Coach, Kors Owners Find Building a Luxury Conglomerate Is Hard to Do

06 Noviembre 2019 - 11:13AM

Noticias Dow Jones

By Allison Prang

The owners of Coach and Michael Kors have tried to expand beyond

their core handbag brands, but their strategy to build U.S. luxury

conglomerates has yet to bear fruit.

Capri Holdings Ltd., which acquired Versace and Jimmy Choo to

accompany Kors, reported lower profits in its latest quarter.

Executives put much of the blame on the turmoil in Hong Kong, a key

market for luxury sellers.

Coach owner Tapestry Inc., which bought rival Kate Spade and

boot maker Stuart Weitzman, posted lower quarterly sales and

profits on Tuesday, due in large part to problems at its acquired

brands.

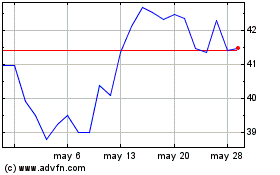

Shares of Capri fell 1.8% Wednesday morning and are down 12%

year to date. Shares of Tapestry dropped 3.7%, and have declined

23% in 2019.

Executives at both companies defended their strategies to

diversify, despite the lackluster latest results. They said they

are on track to revamp their operations and reaffirmed their

revenue and earnings forecasts for the full year.

"We believe the power of our three fashion luxury houses keep us

on track to accelerate growth over the long term," Capri Chief

Executive Officer Jon Idol said on the company's call

Wednesday.

Capri reported a profit of $73 million, down by almost half from

the comparable quarter a year earlier. The company's earnings per

share missed Capri's own expectations as a result of higher costs

and challenges in Hong Kong.

The Michael Kors division reported a slight increase in

comparable sales adjusting for moves in currency. Comparable sales

-- an important measure of sales growth in the retail industry that

looks at performance at stores usually open at least a year -- were

flat at Versace and fell for Jimmy Choo, both after adjusting for

moves in currency.

Michael Kors brings in most of Capri's revenue, but revenue from

the brand fell in the most recent quarter. Capri's total revenue

was $1.44 billion, up 15%, reflecting the addition of Versace,

which had $228 million in quarterly sales.

Versace sales in China were also hurt by controversy over a

Versace T-shirt that listed Hong Kong as both a city and a country.

It sparked a backlash on Chinese social media. The company and

designer Donatella Versace issued public apologies in August.

"We're slowly seeing that subside," Mr. Idol said, but the company

lowered its forecast for Versace sales in China for the balance of

the year.

Tapestry, a day earlier, reported $20 million in quarterly

profit, down from just over $122 million a year earlier. Net sales

fell and selling, general and administrative costs rose.

At Tapestry, only the Coach brand increased sales, which

increased 1% to $966 million for the period that ended Sept. 28.

Sales at Kate Spade and Stuart Wetizman fell 6% and 8%

respectively.

Tapestry CEO Jide Zeitlin said he still believes in owning

multiple brands. Mr. Zeitlin, who serves as the company's chairman,

replaced Victor Luis as CEO in September.

"One of the things that clearly we're very focused on is how to

unlock even further benefits of our multibrand model," Mr. Zeitlin

said on the company's call. "I very much believe that our brands

are stronger together."

The U.S. companies have been building holding companies to

mirror European luxury houses like LVMH. But they have so far

struggled to show that owning multiple brands pays off. LVMH,

meanwhile, has made a bid for Tiffany & Co., looking to add a

U.S. brand to its portfolio.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

November 06, 2019 11:58 ET (16:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

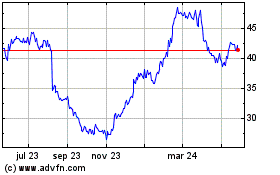

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024