UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04893

THE TAIWAN FUND, INC.

(Exact name of registrant as specified in charter)

C/O STATE STREET BANK AND TRUST COMPANY,

ONE CONGRESS BUILDING

ONE CONGRESS STREET, SUITE 1

BOSTON, MASSACHUSETTS 02114-2016

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) |

Copy to: |

| |

|

| State Street Bank and Trust Company |

Leonard B. Mackey, Jr., Esq. |

| Attention: Brian F. Link |

Clifford Chance US LLP |

| Secretary |

31 West 52nd Street |

| One Congress Building |

New York, New York 10019-6131 |

| One Congress Street, Suite 1 |

|

| Boston, Massachusetts 02114-2016 |

|

Registrant’s telephone number, including area code: 1-800-426-5523

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

Item 1. Report to Stockholders.

| |

Page |

Chairman’s Statement |

2 |

Report of the Investment Manager |

3 |

About the Portfolio Manager |

5 |

Performance |

6 |

Portfolio Snapshot |

7 |

Industry Allocation |

8 |

Schedule of Investments |

9 |

Financial Statements |

11 |

Notes To Financial Statements |

14 |

Report of Independent Registered Public Accounting Firm |

20 |

Other Information |

21 |

Summary of Dividend Reinvestment and Cash Purchase Plan |

24 |

Board Deliberations Regarding Renewal of Investment Advisory Agreement between the Fund and Nomura Asset Management U.S.A. Inc. |

27 |

Investment Objectives and Policies |

30 |

Risk Factors and Special Considerations |

31 |

Directors and Officers |

36 |

Dear Stockholders,

The TAIEX Total Return Index (in U.S. dollar terms) (“TAIEX”) returned 36.67% during the 12 months from September 1, 2023 through August 31, 2024 (the “Period”). The Taiwan equity market was positively impacted by a number of factors, including the expectation of U.S. interest rate cuts, the end of inventory adjustments, and U.S. consumer goods recovery. The Taiwan Fund, Inc.’s (the “Fund”) total return based on its net asset value (“NAV”) for the Period was 37.11%, 2.37% of which consisted of accretion to net asset value from the repurchase of Fund shares at prices less than NAV. The factors impacting the Fund’s performance are detailed in the following “Report of the Investment Manager”.

During the year the Fund made purchases totaling 705,289 shares under its Share Repurchase Program.

On behalf of the Board, I thank you for your continuing support of the Fund.

Sincerely,

William C. Kirby

Chairman

2

Report of the Investment Manager (unaudited) |

Market Review

During the period from September 1, 2023 through August 31, 2024, the TAIEX Total Return Index (the “Benchmark”) rose by 36.67% in U.S. dollar terms, with Real Estate and Information Technology (“IT”) being the best-performing sectors. Real Estate and Real Estate Management & Development were the best-performing industries during the period. The rise in the IT sector was mostly driven by the Semiconductors, and the Semiconductor Equipment industry. During the period, the worst two performing sectors were Energy and Materials.

Fund Review (Attribution Reports)

The Taiwan Fund, Inc.’s (the “Fund”) net asset value rose 37.11% during the period from September 1, 2023 through August 31, 2024, 2.37% of which consisted of accretion to net asset value from the repurchase of Fund share at prices less than net asset value. At an industry group level, stock selection in the Fund’s holdings in the Capital Goods, Materials and Consumer Durables & Apparel sectors were the leading contributors to performance. Conversely, the Fund’s performance was negatively impacted by holdings in the Consumer Durables & Apparel and Consumer Staples Distribution & Retail sectors, and an underweighting in the Real Estate Management & Development sector. At the stock selection level, the largest contributors were Taiwan Semiconductor Manufacturing Co. Ltd, Fortune Electric Co. Ltd, Asia Vital Components Co. Ltd, eMemory Technology Inc., and MediaTek Inc. The largest detractors were Gigabyte Technology Co. Ltd, Visual Photonics Epitaxy Co. Ltd, Asmedia Technology Inc., Sunonwealth Electric Machine Industry Co. Ltd and Global Unichip Corporation.

Key Transactions

The Fund’s total holdings were at 87.10% of total assets on August 31, 2024, a decrease compared to the end of August 2023 (89.50%). The major change to the Fund’s portfolio holdings was in the Semiconductors, Semiconductor Equipment and Technology Hardware, and Equipment industries. The Fund increased its holdings in Visual Photonics Epitaxy Co Ltd., with the expectation that the company will benefit from a continued increase in 5G penetration, inventory normalization and the usage of WiFi-7.

3

The Fund also added to its holdings in Winbond Electronics Corporation, anticipating growth in capacity utilization and profit margins. Additionally, in the Technology Hardware & Equipment sector, the Fund reduced its holdings in Wistron Corporation reflected weaker growth expectations.

Outlook and Strategy

The U.S. Consumer Price Index (“CPI”) declined to 2.9% year-over-year (YoY) in July, down from a 3.0% increase in June. This marks the lowest CPI increase since March of 2021. Additionally, the Federal Open Market Committee (“FOMC”) noted signs of moderation in the labor market, indicating an improved balance between supply and demand conditions. Given the ongoing moderation in both inflation and the job market, we anticipate that the Federal Reserve will begin a rate-cutting cycle in September 2024.

Despite recent global, macro and geopolitical uncertainties, we believe the Artificial Intelligence (“AI”) growth theme remains intact. The competition among cloud service providers (“CSPs”) remains intense. CSPs have been increasingly focused on developing chips to meet their own specific needs, rather than relying on high-end chips from Nvidia. While the share prices of Application-Specific Integrated Circuits (“ASIC”) design firms have declined sharply, following the comments from Jensen Huang at the GPU Technology Conference (“GTC”), demand for ASIC custom chips, continues to rise. ASIC players are expected to outpace GPUs in growth and potentially take up a large percentage of the cloud AI semiconductor market size in the next four to five years.

In addition to the advancement in ASICs, the Apple Worldwide Developers Conference (“WWDC”) emerged as another highlight in the industry. Unlike past years, Apple did not introduce new hardware at the June event. Instead, the company introduced a series of products that position Apple as a central player in the upcoming Internet of Things (IoT) computing cycle. This shift in focus from AI servers, and AI applications to Apple-centric intelligence services marks a notable change in industry dynamics. We anticipate that this development will further enhance the growth potential of Taiwan Semiconductor Manufacturing Co. Ltd., particularly in its advanced processes and advanced packaging. We expect this trend to continue, delivering sustained benefits to Taiwan’s technology supply chains.

4

About the Portfolio Manager (unaudited) |

Nomura Asset Management U.S.A. Inc. (“Nomura”) is a U.S.-based firm registered as an investment adviser with the Securities and Exchange Commission. The firm is a wholly owned subsidiary of Nomura Asset Management Co., Ltd. (“NAM Tokyo”), which is itself wholly owned by Nomura Holdings, Inc., a Japanese public company focused on the financial services industry. As of June 30, 2024, the total assets under management of NAM Tokyo and its investment advisory subsidiaries and affiliates (the “NAM Group”) amounted to US$546 billion. NAM Tokyo’s affiliate, Nomura Asset Management Taiwan Ltd. (“NAM Taiwan”), had total assets under management and distribution on June 30, 2024 of US$21.8 billion including US$7.4 billion invested in Taiwan equity mandates.

Sky Chen

Portfolio Manager

Sky Chen has been a Portfolio Manager at Nomura Asset Management Taiwan Ltd. since 2007 and has worked in the Taiwan investment industry since 1998. Prior to joining Nomura, Sky worked as a Portfolio Manager at First Capital Management and as a sell-side analyst at JihSun Securities. Sky received a B.S. degree in Economics from Chung Hsing University in 1996 and a Master’s degree in Finance from the National Chiao Tung University 1998.

George Hsieh

Deputy Portfolio Manager

George Hsieh is a Portfolio Manager who joined Nomura Asset Management Taiwan Ltd. in 2003 and has worked in the Taiwan investment industry since 2001. Prior to Nomura, George worked as an analyst at Capital AM. George received a B.S. degree in Business Administration from Taiwan University in 1996 and a Master’s degree in International Business from NCCU in 1998.

5

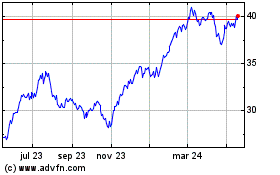

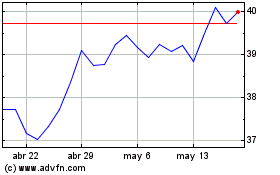

Performance (annualized returns as of August 31, 2024) |

|

1 Year |

5 Year |

10 Year |

Net Asset Value (NAV) |

37.11% |

27.97% |

15.59% |

Market Price |

45.68% |

27.18% |

14.66% |

TAIEX Total Return Index |

36.67% |

19.55% |

12.30% |

Past performance is not indicative of future results. Returns are expressed in U.S. dollars. Returns for the Fund are historical returns that reflect changes in net asset value and market price per share during each period and assume that dividends and capital gains, if any, were reinvested. Net asset value is total assets less total liabilities divided by the number of shares outstanding. NAV performance includes the deduction of management fees and other expenses. NAV and market price returns do not reflect broker sales charges or commissions, which would reduce returns. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

The TAIEX Total Return Index is a stock market index for companies traded on the Taiwan Stock Exchange (TWSE). The index is calculated on a total return basis with net dividends reinvested. An investor may not invest directly in an index.

Growth of an Assumed $10,000 Investment |

Nomura was appointed investment manager of the Fund on September 17, 2022. From June 2019 through September 16, 2022 Allianz Global Investors U.S. LLC was the investment manager. Prior to June 2019, the Fund had different investment management arrangements.

6

Top Ten Equity Holdings |

|

Top Ten Equity Holdings |

Holdings as of August 31, 2024 |

% |

|

Holdings as of August 31, 2023 |

% |

Taiwan Semiconductor Manufacturing Co. Ltd. |

23.6 |

|

Taiwan Semiconductor Manufacturing Co. Ltd. |

18.9 |

eMemory Technology, Inc. |

4.3 |

|

Fortune Electric Co. Ltd. |

4.9 |

Delta Electronics, Inc. |

4.1 |

|

Gigabyte Technology Co. Ltd. |

4.7 |

Quanta Computer, Inc. |

4.0 |

|

Alchip Technologies Ltd. |

4.7 |

Alchip Technologies Ltd. |

4.0 |

|

Quanta Computer, Inc. |

4.5 |

Grand Process Technology Corp. |

3.7 |

|

Asia Vital Components Co. Ltd. |

4.5 |

Jentech Precision Industrial Co. Ltd. |

3.3 |

|

eMemory Technology, Inc. |

4.3 |

Nien Made Enterprise Co. Ltd. |

3.3 |

|

Global Unichip Corp. |

3.7 |

Asia Vital Components Co. Ltd. |

3.2 |

|

Delta Electronics, Inc. |

3.7 |

Century Iron & Steel Industrial Co. Ltd. |

3.0 |

|

Sunonwealth Electric Machine Industry Co. Ltd. |

3.5 |

Top Ten Industry Weightings |

|

Top Ten Industry Weightings |

Weightings as of August 31, 2024 |

% |

|

Weightings as of August 31, 2023 |

% |

Semiconductors & Semiconductor Equipment |

49.2 |

|

Semiconductors & Semiconductor Equipment |

40.7 |

Electronic Equipment, Instruments & Components |

11.4 |

|

Technology Hardware, Storage & Peripherals |

17.7 |

Technology Hardware, Storage & Peripherals |

11.3 |

|

Electrical Equipment |

6.7 |

Household Durables |

3.3 |

|

Electronic Equipment, Instruments & Components |

5.3 |

Metals & Mining |

3.0 |

|

Machinery |

3.7 |

Consumer Staples Distribution & Retail |

2.1 |

|

Consumer Staples Distribution & Retail |

2.5 |

Electrical Equipment |

1.9 |

|

Metals & Mining |

2.5 |

Leisure Products |

1.8 |

|

Textiles, Apparel & Luxury Goods |

2.0 |

Diversified Telecommunication Services |

1.4 |

|

Household Durables |

1.9 |

Textiles, Apparel & Luxury Goods |

1.3 |

|

Leisure Products |

1.6 |

|

*

|

Percentages based on net assets.

|

7

Fund holdings are subject to change and percentages shown above are based on net assets as of August 31, 2024. The pie chart illustrates the allocation of the investments by industry. A complete list of holdings as of August 31, 2024 is contained in the Schedule of Investments included in this report. The most current available data regarding portfolio holdings and industry allocation can be found on our website, www.thetaiwanfund.com. You may also obtain updated holdings by calling 1-800-426-5523.

8

Schedule of Investments/August 31, 2024

(Showing Percentage of Net Assets) |

| |

|

Shares |

|

|

US $

Value

(Note 1) |

|

COMMON STOCKS – 87.1% |

|

|

|

|

|

|

|

|

COMMUNICATION SERVICES — 1.4% |

Diversified Telecommunication Services — 1.4% |

|

|

|

|

Chunghwa Telecom Co. Ltd. |

|

|

1,285,000 |

|

|

$ |

4,980,931 |

|

TOTAL COMMUNICATION SERVICES |

|

|

|

|

|

|

4,980,931 |

|

| |

|

|

|

|

|

|

|

|

CONSUMER DISCRETIONARY — 6.8% |

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure — 0.4% |

|

|

|

|

|

|

|

|

Bafang Yunji International Co. Ltd. |

|

|

17,000 |

|

|

|

80,244 |

|

Gourmet Master Co. Ltd. |

|

|

526,000 |

|

|

|

1,359,806 |

|

| |

|

|

|

|

|

|

1,440,050 |

|

| |

|

|

|

|

|

|

|

|

Household Durables — 3.3% |

|

|

|

|

|

|

|

|

Nien Made Enterprise Co. Ltd. |

|

|

799,000 |

|

|

|

11,738,981 |

|

| |

|

|

|

|

|

|

|

|

Leisure Products — 1.8% |

|

|

|

|

|

|

|

|

Giant Manufacturing Co. Ltd. |

|

|

220,000 |

|

|

|

1,643,639 |

|

Merida Industry Co. Ltd. |

|

|

652,000 |

|

|

|

4,911,910 |

|

| |

|

|

|

|

|

|

6,555,549 |

|

| |

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods — 1.3% |

|

|

|

|

Eclat Textile Co. Ltd. |

|

|

80,000 |

|

|

|

1,340,419 |

|

Feng TAY Enterprise Co. Ltd. |

|

|

324,800 |

|

|

|

1,482,363 |

|

Fulgent Sun International Holding Co. Ltd. (a) |

|

|

505,000 |

|

|

|

1,910,128 |

|

| |

|

|

|

|

|

|

4,732,910 |

|

TOTAL CONSUMER DISCRETIONARY |

|

|

|

|

|

|

24,467,490 |

|

| |

|

|

|

|

|

|

|

|

CONSUMER STAPLES — 2.1% |

|

|

|

|

|

|

|

|

Consumer Staples Distribution & Retail — 2.1% |

|

|

|

|

President Chain Store Corp. |

|

|

869,000 |

|

|

|

7,646,874 |

|

TOTAL CONSUMER STAPLES |

|

|

|

|

|

|

7,646,874 |

|

| |

|

|

|

|

|

|

|

|

INDUSTRIALS — 1.9% |

|

|

|

|

|

|

|

|

Electrical Equipment — 1.9% |

|

|

|

|

|

|

|

|

Fortune Electric Co. Ltd. (a) |

|

|

330,400 |

|

|

|

6,888,928 |

|

TOTAL INDUSTRIALS |

|

|

|

|

|

|

6,888,928 |

|

| |

|

|

|

|

|

|

|

|

INFORMATION TECHNOLOGY — 71.9% |

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components — 11.4% |

All Ring Tech Co. Ltd. |

|

|

84,000 |

|

|

$ |

1,001,750 |

|

Arizon RFID Technology Cayman Co. Ltd. |

|

|

80,000 |

|

|

|

636,449 |

|

Chroma ATE, Inc. |

|

|

184,000 |

|

|

|

1,877,962 |

|

Delta Electronics, Inc. |

|

|

1,189,000 |

|

|

|

14,848,562 |

|

E Ink Holdings, Inc. |

|

|

374,000 |

|

|

|

3,565,802 |

|

Elite Material Co. Ltd. (a) |

|

|

283,000 |

|

|

|

4,113,629 |

|

Fositek Corp. (a) |

|

|

276,000 |

|

|

|

6,910,785 |

|

Hon Hai Precision Industry Co. Ltd. |

|

|

236,000 |

|

|

|

1,361,113 |

|

Lotes Co. Ltd. (a) |

|

|

146,000 |

|

|

|

6,982,807 |

|

| |

|

|

|

|

|

|

41,298,859 |

|

| |

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment — 49.2% |

Alchip Technologies Ltd. |

|

|

175,000 |

|

|

|

14,496,718 |

|

ASMedia Technology, Inc. (a) |

|

|

80,000 |

|

|

|

4,426,383 |

|

ASPEED Technology, Inc. |

|

|

21,000 |

|

|

|

3,236,324 |

|

eMemory Technology, Inc. (a) |

|

|

187,000 |

|

|

|

15,403,095 |

|

Globalwafers Co. Ltd. |

|

|

203,000 |

|

|

|

3,074,508 |

|

Grand Process Technology Corp. (a) |

|

|

219,000 |

|

|

|

13,486,402 |

|

Jentech Precision Industrial Co. Ltd. (a) |

|

|

284,000 |

|

|

|

12,029,384 |

|

MediaTek, Inc. |

|

|

84,000 |

|

|

|

3,256,018 |

|

Phison Electronics Corp. |

|

|

178,000 |

|

|

|

2,960,175 |

|

SDI Corp. (a) |

|

|

716,000 |

|

|

|

3,077,524 |

|

Taiwan Semiconductor Manufacturing Co. Ltd. |

|

|

2,894,000 |

|

|

|

85,399,687 |

|

Visual Photonics Epitaxy Co. Ltd. (a) |

|

|

1,954,000 |

|

|

|

8,673,585 |

|

Winbond Electronics Corp. |

|

|

2,388,000 |

|

|

|

1,795,292 |

|

WinWay Technology Co. Ltd. (a) |

|

|

174,000 |

|

|

|

6,418,256 |

|

| |

|

|

|

|

|

|

177,733,351 |

|

| |

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals — 11.3% |

Asia Vital Components Co. Ltd. (a) |

|

|

607,000 |

|

|

|

11,498,656 |

|

Gigabyte Technology Co. Ltd. |

|

|

250,000 |

|

|

|

2,039,700 |

|

King Slide Works Co. Ltd. (a) |

|

|

200,000 |

|

|

|

7,908,722 |

|

Quanta Computer, Inc. |

|

|

1,735,000 |

|

|

|

14,535,167 |

|

Wiwynn Corp. |

|

|

84,000 |

|

|

|

4,989,059 |

|

| |

|

|

|

|

|

|

40,971,304 |

|

TOTAL INFORMATION TECHNOLOGY |

|

|

|

|

|

|

260,003,514 |

|

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

9

Schedule of Investments/August 31, 2024

(Showing Percentage of Net Assets) (concluded) |

| |

|

Shares |

|

|

US $

Value

(Note 1) |

|

MATERIALS — 3.0% |

|

|

|

|

|

|

|

|

Metals & Mining — 3.0% |

|

|

|

|

|

|

|

|

Century Iron & Steel Industrial Co. Ltd. (a) |

|

|

1,488,000 |

|

|

$ |

11,047,202 |

|

TOTAL MATERIALS |

|

|

|

|

|

|

11,047,202 |

|

TOTAL COMMON STOCKS |

|

|

|

|

|

|

|

|

(Cost — $191,978,857) |

|

|

|

|

|

|

315,034,939 |

|

| |

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS — 87.1% |

|

|

|

|

|

|

|

|

(Cost — $191,978,857) |

|

|

|

|

|

|

315,034,939 |

|

| |

|

|

|

|

|

|

|

|

OTHER ASSETS AND LIABILITIES, NET—12.9% |

|

|

|

|

|

|

46,474,575 |

|

| |

|

|

|

|

|

|

|

|

NET ASSETS—100.0% |

|

|

|

|

|

$ |

361,509,514 |

|

Legend:

US $ – United States dollar

|

(a)

|

All or a portion of the security is on loan. The market value of the securities on loan is $36,397,487, collateralized by non-cash collateral such as U.S. Government securities in the amount of $39,096,816.

|

The accompanying notes are an integral part of the financial statements.

10

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2024 |

Assets: |

|

|

|

|

|

|

|

|

Investments in securities, at value (cost $191,978,857) (Notes 2 and 3) |

|

|

|

|

|

$ |

315,034,939 |

|

Cash |

|

|

|

|

|

|

3,036,497 |

|

Foreign cash (cost $42,890,600) |

|

|

|

|

|

|

43,697,184 |

|

Dividend receivable |

|

|

|

|

|

|

868,102 |

|

Receivable for securities sold |

|

|

|

|

|

|

803,986 |

|

Performance fee receivable |

|

|

|

|

|

|

423,627 |

|

Securities lending receivable |

|

|

|

|

|

|

246,496 |

|

Prepaid expenses |

|

|

|

|

|

|

58,489 |

|

Total assets |

|

|

|

|

|

|

364,169,320 |

|

| |

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

Payable for securities purchased |

|

$ |

1,872,424 |

|

|

|

|

|

Accrued custodian fees |

|

|

204,020 |

|

|

|

|

|

Accrued management fee (Note 4) |

|

|

176,299 |

|

|

|

|

|

Payable for fund shares repurchased |

|

|

113,645 |

|

|

|

|

|

Accrued audit fees |

|

|

66,200 |

|

|

|

|

|

Accrued directors’ and officers’ fees |

|

|

444 |

|

|

|

|

|

Other payables and accrued expenses |

|

|

226,774 |

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

2,659,806 |

|

| |

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

$ |

361,509,514 |

|

| |

|

|

|

|

|

|

|

|

Net Assets Consist of: |

|

|

|

|

|

|

|

|

Paid in capital |

|

|

|

|

|

$ |

234,669,655 |

|

Total distributable earnings (loss) |

|

|

|

|

|

$ |

126,839,859 |

|

| |

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

$ |

361,509,514 |

|

| |

|

|

|

|

|

|

|

|

Net Asset Value, per share ($361,509,514/6,722,275 shares outstanding) |

|

|

|

|

|

$ |

53.78 |

|

STATEMENT OF OPERATIONS

For the Year Ended August 31, 2024 |

Investment Income: |

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

|

$ |

5,337,748 |

|

Securities Lending Income |

|

|

|

|

|

|

1,846,695 |

|

| |

|

|

|

|

|

|

7,184,443 |

|

Less: Taiwan stock dividend tax (Note 2) |

|

|

|

|

|

|

(2,545 |

) |

Taiwan withholding tax (Note 2) |

|

|

|

|

|

|

(1,066,769 |

) |

Total investment income |

|

|

|

|

|

|

6,115,129 |

|

| |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

Management fees (Note 4) |

|

$ |

1,975,334 |

|

|

|

|

|

Performance adjustment |

|

|

(423,627 |

) |

|

|

|

|

Custodian fees |

|

|

316,505 |

|

|

|

|

|

Directors’ fees |

|

|

303,924 |

|

|

|

|

|

Administration and accounting fees |

|

|

233,595 |

|

|

|

|

|

Insurance fees |

|

|

75,815 |

|

|

|

|

|

Legal fees |

|

|

66,570 |

|

|

|

|

|

Audit fees |

|

|

66,200 |

|

|

|

|

|

Compliance services fees |

|

|

66,000 |

|

|

|

|

|

Principal financial officer fees |

|

|

66,000 |

|

|

|

|

|

Tax Guarantor fees |

|

|

57,345 |

|

|

|

|

|

Stockholder communications |

|

|

37,993 |

|

|

|

|

|

Transfer agent fees |

|

|

23,018 |

|

|

|

|

|

Miscellaneous |

|

|

143,959 |

|

|

|

|

|

Total expenses |

|

|

|

|

|

|

3,008,631 |

|

Net Investment Income |

|

|

|

|

|

|

3,106,498 |

|

| |

|

|

|

|

|

|

|

|

Realized and Unrealized Gain (Loss) on: |

|

|

|

|

|

|

|

|

Net realized gain (loss) on: |

|

|

|

|

|

|

|

|

Investments |

|

|

58,122,846 |

|

|

|

|

|

Foreign currency transactions |

|

|

(1,245,259 |

) |

|

|

|

|

| |

|

|

|

|

|

|

56,877,587 |

|

Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

|

|

|

|

Investments |

|

|

36,152,127 |

|

|

|

|

|

Foreign currency translations |

|

|

1,040,585 |

|

|

|

|

|

| |

|

|

|

|

|

|

37,192,712 |

|

Net realized and unrealized gain |

|

|

|

|

|

|

94,070,299 |

|

Net Increase in Net Assets Resulting From Operations |

|

|

|

|

|

$ |

97,176,797 |

|

11

The accompanying notes are an integral part of the financial statements.

Financial Statements (continued)

|

STATEMENTS OF CHANGES IN NET ASSETS

| |

|

Year Ended

August 31, 2024 |

|

|

Year Ended

August 31, 2023 |

|

Increase/(Decrease) in Net Assets |

|

|

|

|

|

|

|

|

Operations: |

|

|

|

|

|

|

|

|

Net investment income |

|

$ |

3,106,498 |

|

|

$ |

3,085,793 |

|

Net realized gain on investments and foreign currency transactions |

|

|

56,877,587 |

|

|

|

5,433,759 |

|

Net change in unrealized appreciation (depreciation) on investments and foreign currency translations |

|

|

37,192,712 |

|

|

|

64,125,816 |

|

Net increase in net assets resulting from operations |

|

|

97,176,797 |

|

|

|

72,645,368 |

|

Distributions to stockholders from: |

|

|

|

|

|

|

|

|

Distributable Income |

|

|

(3,194,849 |

) |

|

|

— |

|

Total distributions to stockholders |

|

|

(3,194,849 |

) |

|

|

— |

|

Capital stock transactions (Note 6): |

|

|

|

|

|

|

|

|

Reinvestment of distributions |

|

|

6,531 |

|

|

|

— |

|

Cost of shares repurchased (Note 5) |

|

|

(27,567,174 |

) |

|

|

(1,372,755 |

) |

Total capital stock transactions |

|

|

(27,560,643 |

) |

|

|

(1,372,755 |

) |

Increase in net assets |

|

|

66,421,305 |

|

|

|

71,272,613 |

|

| |

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

|

|

Beginning of year |

|

|

295,088,209 |

|

|

|

223,815,596 |

|

End of year |

|

$ |

361,509,514 |

|

|

$ |

295,088,209 |

|

The accompanying notes are an integral part of the financial statements.

12

Financial Statements (concluded)

|

FINANCIAL HIGHLIGHTS

Selected data for a share of common stock outstanding for the years indicated

| |

|

Year Ended August 31, |

|

| |

|

2024 |

|

|

2023† |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year |

|

$ |

39.73 |

|

|

$ |

29.96 |

|

|

$ |

42.83 |

|

|

$ |

28.79 |

|

|

$ |

20.80 |

|

Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income(a) |

|

|

0.43 |

|

|

|

0.41 |

(b) |

|

|

0.33 |

|

|

|

0.04 |

|

|

|

0.06 |

|

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

|

|

13.13 |

|

|

|

9.32 |

(c) |

|

|

(10.28 |

) |

|

|

17.31 |

|

|

|

9.54 |

|

Total from investment operations |

|

|

13.56 |

|

|

|

9.73 |

|

|

|

(9.95 |

) |

|

|

17.35 |

|

|

|

9.60 |

|

Less Distributions to Stockholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

— |

|

|

|

— |

|

|

|

(0.48 |

) |

|

|

(0.38 |

) |

|

|

(1.47 |

) |

Net realized gains |

|

|

(0.44 |

) |

|

|

— |

|

|

|

(2.44 |

) |

|

|

(2.93 |

) |

|

|

(0.23 |

) |

Total distributions to stockholders |

|

|

(0.44 |

) |

|

|

— |

|

|

|

(2.92 |

) |

|

|

(3.31 |

) |

|

|

(1.70 |

) |

Capital Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accretion (dilution) to net asset value resulting from share repurchase program, tender offer or issuance of shares for the reinvestment of distributions from net investment income and net realized gains |

|

|

0.93 |

|

|

|

0.04 |

|

|

|

0.00 |

(d) |

|

|

0.00 |

(d) |

|

|

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year |

|

$ |

53.78 |

|

|

$ |

39.73 |

|

|

$ |

29.96 |

|

|

$ |

42.83 |

|

|

$ |

28.79 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market value, end of year |

|

$ |

44.73 |

|

|

$ |

31.10 |

|

|

$ |

25.20 |

|

|

$ |

35.83 |

|

|

$ |

23.65 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share net asset value(e) |

|

|

37.11 |

% |

|

|

32.61 |

%(b)(c) |

|

|

(24.42 |

)% |

|

|

66.88 |

% |

|

|

49.63 |

% |

Per share market value(e) |

|

|

45.68 |

% |

|

|

23.41 |

%(b)(c) |

|

|

(24.01 |

)% |

|

|

69.95 |

% |

|

|

43.31 |

% |

Ratio and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets, end of year (000s) |

|

$ |

361,510 |

|

|

$ |

295,088 |

|

|

$ |

223,816 |

|

|

$ |

319,915 |

|

|

$ |

214,956 |

|

Ratio of expenses before fee waiver |

|

|

0.91 |

% |

|

|

1.47 |

% |

|

|

1.02 |

% |

|

|

1.44 |

% |

|

|

1.70 |

% |

Ratio of expenses after fee waiver |

|

|

0.91 |

% |

|

|

1.40 |

% |

|

|

0.96 |

% |

|

|

1.44 |

% |

|

|

1.70 |

% |

Ratio of net investment income |

|

|

0.94 |

% |

|

|

1.28 |

%(b) |

|

|

0.86 |

% |

|

|

0.12 |

% |

|

|

0.23 |

% |

Portfolio turnover rate |

|

|

54 |

% |

|

|

70 |

% |

|

|

127 |

% |

|

|

242 |

% |

|

|

241 |

% |

|

(a)

|

Based on average shares outstanding during the period.

|

|

(b)

|

The prior investment manager reimbursed the Fund for costs related to the change in investment manager in the amount of $1,018,672. Without this reimbursement the net investment income per share would have been $0.28, the ratio of net investment income would have been 0.86% and the Fund’s net asset value total return would have been 32.15%.

|

|

(c)

|

Nomura reimbursed the Fund for a procedural error in the amount of $26,442. The impact was deemed immaterial to net realized and unrealized gain/loss on investments and the Fund’s total return.

|

|

(d)

|

Amount represents less than $0.005 per share.

|

|

(e)

|

Total investment return at net asset value (“NAV”) is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market value is based on changes in the market price at which the Fund’s shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV.

|

|

†

|

Nomura was appointed investment manager of the Fund on September 17, 2022. From June 2019 through September 16, 2022 Allianz Global Investors U.S. LLC was the investment manager. Prior to June 2019, the Fund had different investment management arrangements.

|

The accompanying notes are an integral part of the financial statements.

13

Notes To Financial Statements

August 31, 2024 |

1. Organization

The Taiwan Fund, Inc. (the “Fund”), a Maryland corporation, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified closed-end management investment fund.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services - Investment Companies.”

The Fund concentrates its investments in the securities listed on the Taiwan Stock Exchange. Because of this concentration, the Fund may be subject to certain additional risks not typically associated with investing in securities of U.S. companies or the U.S. government, including (1) volatility of the Taiwan securities market, (2) restrictions on repatriation of capital invested in Taiwan, (3) fluctuations in the rate of exchange between the New Taiwan Dollar and the U.S. Dollar, and (4) political and economic risks, including tensions and the potential of conflict with the People’s Republic of China. In addition, Republic of China accounting, auditing, financial and other reporting standards are not equivalent to U.S. standards and, therefore, certain material disclosures may not be made, and less information may be available to investors investing in Taiwan than in the United States. There is also generally less regulation by governmental agencies and self-regulatory organizations with respect to the securities industry in Taiwan than there is in the United States.

2.

Significant Accounting Policies

The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Actual results could differ from those estimates. Management has evaluated the impact of all events or transactions occurring after year end through the date these financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure. The following summarizes the significant accounting policies of the Fund:

Security Valuation. All securities, including those traded over-the-counter, for which market quotations are readily available are valued at the last sales price prior to the time of determination of the Fund’s net asset value per share or, if there were no sales on such date, at the closing price quoted for such securities (but if bid and asked quotations are available, at the mean between the last current bid and asked prices, rather than such quoted closing price). These securities are generally categorized as Level 1 securities in the fair value hierarchy. In certain instances where the price determined above may not represent fair market value, the value is determined by Nomura Asset Management U.S.A. Inc. (“Nomura”), acting as the Board of Directors’ (the “Board”) Valuation Designee. Foreign securities may be valued at fair value according to procedures approved by the Board if the closing price is not reflective of current market values due to trading or events occurring in the valuation time of the Fund. In addition, substantial changes in values in the U.S. markets subsequent to the close of a foreign market may also affect the values of securities traded in the foreign market. These securities may be categorized as Level 2 or Level 3 securities in the fair value hierarchy, depending on the valuation inputs. Short-term investments, having a maturity of 60 days or less are valued at amortized cost, which approximates market value, with accrued interest or discount earned included in interest receivable.

14

Notes To Financial Statements (continued)

August 31, 2024 |

2. Significant Accounting Policies – continued

The Fund has adopted fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

|

●

|

Level 1 – quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement.

|

|

●

|

Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers.

|

|

●

|

Level 3 – model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information.

|

Investments

in Securities |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Common Stocks^ |

|

$ |

315,034,939 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

315,034,939 |

|

Total |

|

$ |

315,034,939 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

315,034,939 |

|

|

^

|

See schedule of investments for industry breakout.

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Repurchase Agreements. In connection with transactions in repurchase agreements, it is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. If the seller defaults, and the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited. As of August 31, 2024, the Fund was not participating in any repurchase agreements.

Securities lending. The Fund may lend securities to qualified financial institutions, brokers and dealers. State Street Bank & Trust serves as securities lending agent to the Fund pursuant to a Securities Lending Authorization Agreement. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions. The lending of securities exposes the Fund to risks such as; the borrowers may fail to return the loaned securities or may not be able to provide additional collateral, the Fund may experience delays in recovery of the loaned securities or delays in access to collateral, or the Fund may experience losses related to the investment collateral. To minimize certain risks, loan counterparties pledge securities issued or guaranteed by the U.S. Government or irrevocable letters of credit issued by banks as collateral. The initial collateral received by the Fund is required to have a value of at least 102% of the current value of the loaned securities traded on U.S. exchanges, and a value of at least 105% for all other securities. The lending agent has agreed to indemnify the Fund in the case of default of any securities borrower.

15

Notes To Financial Statements (continued)

August 31, 2024 |

2. Significant Accounting Policies – continued

The Fund receives compensation for lending securities from interest or dividends earned on the U.S. Government securities and irrevocable letters of credit held as collateral (and in some cases fees paid by borrowers), less associated fees and expenses. Such income is reflected in securities lending income within the Statement of Operations.

The value of loaned securities and related non-cash collateral outstanding at August 31, 2024, if any, are shown on a gross basis in a footnote to the Schedule of Investments.

Foreign Currency Translation. The financial accounting records of the Fund are maintained in U.S. Dollars. Investment securities, other assets and liabilities denominated in a foreign currency are translated into U.S. Dollars at the current exchange rate. Purchases and sales of securities, income receipts and expense payments are translated into U.S. Dollars at the exchange rate on the dates of the transactions.

Reported net realized gains and losses on foreign currency transactions represent net gains and losses from disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. Dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities but are included in realized and unrealized gain or loss on investments.

Forward Foreign Currency Transactions. A forward foreign currency contract (“Forward”) is an agreement between two parties to buy or sell currency at a set price on a future date. The Fund may enter into Forwards in order to hedge foreign currency risk or for other risk management purposes. Realized gains or losses on Forwards include net gains or losses on contracts that have matured or which the Fund has terminated by entering into an offsetting closing transaction. Unrealized appreciation or depreciation on Forwards, if any, is included in the Statement of Assets and Liabilities. The portfolio could be exposed to risk of loss if the counterparty is unable to meet the terms of the contract or if the value of the currency changes unfavorably. As of August 31, 2024 the Fund had no open Forwards.

Indemnification Obligations. Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

Taxes. As a qualified Regulated Investment Company under Subchapter M of the Internal Revenue Code, the Fund is not subject to income taxes to the extent that it distributes all of its investment company taxable income and net realized capital gains for its fiscal year. In addition to federal income tax for which the Fund is liable on undistributed amounts, the Fund is subject to federal excise tax on undistributed investment company taxable income and net realized capital gains. Also, the Fund is currently subject to a Taiwan security transaction tax of 0.3% on sales of equities and 0.1% on sales of mutual fund shares based on the transaction amount. Security transaction tax is embedded in the cost basis of each security and contributes to the realized gain or loss for the Fund. Security transaction taxes are not accrued until the tax becomes payable.

The Fund’s functional currency for tax reporting purposes is the New Taiwan Dollar.

16

Notes To Financial Statements (continued)

August 31, 2024 |

2. Significant Accounting Policies – continued

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for prior three fiscal years. The Fund identifies its major tax jurisdictions as U.S. Federal, Maryland and Taiwan where the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Investment Income. Dividend income is recorded on the ex-dividend date; except, where the ex-dividend date may have passed, certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date.

Taiwanese companies typically declare dividends in the Fund’s third fiscal quarter of each year. As a result, the Fund receives substantially less dividend income in the first half of its year. Interest income, which includes accretion of original discount, is accrued as earned.

Dividend and interest income generated in Taiwan is subject to a 21% withholding tax. Stock dividends received (except those which have resulted from capitalization of capital surplus) are taxable at 21% of the par value of the stock dividends received.

Distributions to Stockholders. The Fund distributes to stockholders at least annually, substantially all of its taxable ordinary income and expects to distribute its taxable net realized gains. Certain foreign currency gains (losses) are taxable as ordinary income and, therefore, increase (decrease) taxable ordinary income available for distribution. Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”), stockholders may elect to have all cash distributions automatically reinvested in Fund shares. (See the summary of the Plan described later.) Unless the Board elects to make a distribution in shares of the Fund’s common stock, stockholders who do not participate in the Plan will receive all distributions in cash paid by check in U.S. dollars. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expired.

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. Book and tax basis differences, if any, are primarily due to differing treatments for foreign currency transactions, net operating loss and post October capital and late year ordinary loss deferrals.

Permanent book and tax basis differences relating to stockholder distributions will result in reclassifications between components of net assets. Accordingly, for the year ended August 31, 2024, the effects of certain differences were reclassified. The Fund decreased distributable earnings by $23,724,199, and increased paid in capital by $23,724,199.

Security Transactions. Security transactions are accounted as of the trade date. Gains and losses on securities sold are determined on the basis of identified cost.

3. Purchases and Sales of Securities

For the year ended August 31, 2024, purchases and sales of securities, other than short-term securities, aggregated $157,979,193 and $201,313,750, respectively.

17

Notes To Financial Statements (continued)

August 31, 2024 |

4. Management Fees and Other Service Providers

Management Fee. Effective September 17, 2022, the Fund entered into an Investment Management Agreement (the “Agreement”) with Nomura. Under the terms of the Agreement, Nomura receives a fee for its services, computed daily and payable monthly in U.S. dollars, at the annual rate of 0.60% of the Fund’s average daily net assets (“Base Fee”) with a performance adjustment (“Performance Adjustment”) of up to +/-0.25% (25 basis points) of the Fund’s average daily net assets, which would occur when the performance of the Fund’s shares exceeds, or is exceeded by, the performance of the Index by 5 percentage points (500 basis points) for the Performance Period.

For the period September 1, 2023, through August 31, 2024, the management fee was equivalent to an annual rate of 0.47% of the Fund’s average daily net assets which reflected a -0.13% Performance Adjustment.

Administration Fees. State Street Bank and Trust Company (“State Street”) provides or arranges for the provision of certain administrative and accounting services for the Fund, including maintaining the books and records of the Fund, and preparing certain reports and other documents required by federal and/or state laws and regulations. State Street also provides certain legal administrative services, including corporate secretarial services and preparing regulatory filings. State Street also serves as the custodian (the “Custodian”) to the Fund. For these services, the Fund pays State Street both fixed fees and asset based fees that vary according to the number of positions and transactions and out of pocket expenses.

Director’s and Officer’s Fees and Expenses. The Fund pays each of its directors who is not an “interested person” of the Fund, as the term is defined in the 1940 Act, an annual fee of $30,000 ($40,000 for the Chairman of the Board and the Chairman of the Audit Committee) plus a fee of $6,000 for attending the quarterly Board and Committee meetings. The Fund will pay each Director $2,000 for meetings held on days separate from the quarterly Board meeting.

Other Service Providers. Pursuant to a Compliance Services Agreement, Foreside Fund Officer Services, LLC (‘‘FFOS’’) provides the Fund with a Chief Compliance Officer. FFOS is paid customary fees for its services. Foreside Management Services, LLC (“FMS”) provides the Fund with a Treasurer. Neither FFOS, FMS, nor their employees that serve as officers of the Fund, have a role in determining the investment policies or which securities are purchased or sold by the Fund.

General. Certain officers of the Fund may also be employees of the aforementioned companies that provide services to the Fund, and during their terms of office, receive no compensation from the Fund.

5. Discount Management Policy / Conditional Tender Offer Policy

The Board has approved a Discount Management Program (the “Program”) which authorizes management to make open market purchases in an aggregate amount up to 10% of the Fund’s outstanding shares. These repurchases may be commenced or suspended at any time or from time to time without any notice. The Fund will report repurchase activity on the Fund’s website on a weekly basis.

During the year ended August 31, 2024 the Fund repurchased 705,289 shares at an average price of $39.09 per share including brokerage commissions at an average discount of 19.69%. These repurchases had a total cost of $27,567,174, resulting in a per share accretion of $0.93 to the Fund’s net asset value.

On December 16, 2020, the Board announced that it has adopted a conditional tender offer policy (the “Policy”). Under the Policy, the Fund will conduct a tender offer to purchase up to 25% of its outstanding shares at 98% of NAV if the Fund’s NAV performance for the five-year

18

Notes To Financial Statements (concluded)

August 31, 2024 |

5. Discount Management Policy / Conditional Tender Offer Policy – continued

period ending December 31, 2025 were exceeded by the performance of the Fund’s benchmark (the Taiex Total Return Index) over that period.

The Board regularly reviews the discount at which the Fund’s shares trade below its NAV.

6. Fund Shares

At August 31, 2024, there were 100,000,000 shares of $0.01 par value capital stock authorized, of which 6,722,275 were issued and outstanding.

| |

|

For the

Year Ended

August 31, 2024 |

|

|

For the

Year Ended

August 31, 2023 |

|

Shares outstanding at beginning of year |

|

|

7,427,371 |

|

|

|

7,470,494 |

|

Shares issued from reinvestment of distributions |

|

|

193 |

|

|

|

— |

|

Shares repurchased |

|

|

(705,289 |

) |

|

|

(43,123 |

) |

Shares outstanding at end of year |

|

|

6,722,275 |

|

|

|

7,427,371 |

|

7. Federal Tax Information

There were no distributions made by the Fund during the year ended August 31, 2023. The tax character of the distribution paid by the Fund during the year ended August 31. 2024.

| |

|

Year Ended

August 31, 2024 |

|

Capital Gains |

|

$ |

3,194,849 |

|

Ordinary Income |

|

$ |

— |

|

Distribution in excess of Ordinary Income |

|

$ |

— |

|

Total |

|

$ |

3,194,849 |

|

As of August 31, 2024, the tax components of accumulated net earnings (losses) were $123,834,370 of unrealized appreciation, $43,173,386 of undistributed long term capital gains and $40,167,897 late-year ordinary loss deferral. Net capital losses incurred after October 31 and within the taxable year, are deemed to arise on the first day of the Fund’s next taxable year. Net late-year ordinary losses incurred after December 31 and within the taxable year, and net late-year specified losses incurred after October 31 and within the taxable year, are deemed to arise on the first day of the Fund’s next taxable year.

The difference between book basis and tax basis unrealized appreciation and depreciation is attributable primarily to the tax deferral of losses on wash sales. At August 31, 2024, the aggregate cost basis of the Fund’s investment securities for income tax purposes was $192,016,152. Net unrealized appreciation of the Fund’s investment securities was $123,018,787 of which $129,543,505 was related to appreciated investment securities and $6,524,718 was related to depreciated investment securities.

19

Report of Independent Registered Public Accounting Firm

|

To the Board of Directors and

Stockholders of The Taiwan Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The Taiwan Fund, Inc. (the “Fund”), including the schedule of investments, as of August 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2007.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of August 31, 2024 by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

| |

|

| |

TAIT, WELLER & BAKER LLP |

Philadelphia, Pennsylvania

October 25, 2024

20

Other Information (unaudited)

|

The Annual Meeting of Stockholders was held on April 16, 2024 (the “Annual Stockholder Meeting”). The voting results for the proposal considered at the Annual Stockholder Meeting are as follows:

1. Election of Directors. The stockholders of the Fund elected William C. Kirby, Shelley E. Rigger, Anthony S. Clark and Warren J. Olsen to the Board of Directors to serve for a one year term expiring on the date of which the annual meeting of stockholders is held in 2025 or until their successors are elected and qualified.

Director |

Votes cast “for” |

Votes “against/withheld” |

William C. Kirby |

5,667,775 |

685,111 |

Shelley E. Rigger |

5,812,512 |

540,374 |

Anthony S. Clark |

5,805,836 |

547,050 |

Warren J. Olsen |

5,814,611 |

538,275 |

Federal Tax Information. The Fund has made an election under Internal Revenue Code Section 853 to pass through foreign taxes paid by the Fund to its stockholders. For the year ended August 31, 2024, the total amount of foreign taxes paid that was passed through to its stockholders for information reporting purposes was $1,076,031 (representing taxes withheld plus taxes on stock dividends).

In addition, for the year ended August 31, 2024, the Fund paid distributions of $3,194,849 which were designated as long term capital gains dividends.

Privacy Policy

Privacy Notice

The Taiwan Fund, Inc. collects non-public personal information about its stockholders from the following sources:

[ ] Information it receives from stockholders on applications or other forms;

[ ] Information about stockholder transactions with the Fund, its affiliates, or others; and

[ ] Information it receives from a consumer reporting agency.

The Fund’s policy is to not disclose nonpublic personal information about its stockholders to nonaffiliated third parties (other than disclosures permitted by law).

The Fund restricts access to nonpublic personal information about its stockholders to those agents of the Fund who need to know that information to provide products or services to stockholders. The Fund maintains physical, electronic, and procedural safeguards that comply with federal standards to guard it stockholders’ nonpublic personal information. |

21

Other Information (unaudited) (continued)

|

Proxy Voting Policies and Procedures

A description of the policies and procedures that are used by Nomura, the Fund’s Investment Manager, to vote proxies relating to the Fund’s portfolio securities is available (1) without charge, upon request, by calling 1-800-426-5523; and (2) as an exhibit to the Fund’s annual report on Form N-CSR which is available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information regarding how the investment manager voted these proxies during the most recent 12-month period ended June 30 is available without charge, upon request, by calling the same number or by accessing the Commission’s website.

Quarterly Portfolio of Investments

The Fund files its complete Schedule of Investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov. The quarterly Schedule of Investments will be made available without charge, upon request, by calling 1-800-426-5223, or on the Fund’s website at www.thetaiwanfund.com.

22

Other Information (unaudited) (concluded)

|

Certifications

The Fund’s chief executive officer has certified to the New York Stock Exchange that, as of April 17, 2024, he was not aware of any violation by the Fund of applicable New York Stock Exchange corporate governance listing standards. The Fund also has included the certifications of the Fund’s chief executive officer and chief financial officer required by Section 302 and Section 906 of the Sarbanes-Oxley Act of 2002 in the Fund’s Form N-CSR filed with the Commission, for the period of this report.

23

Summary of Dividend Reinvestment and

Cash Purchase Plan (unaudited) |

What is the Dividend Reinvestment and Cash Purchase Plan?

The Dividend Reinvestment and Cash Purchase Plan (the “Plan”) offers stockholders of the Fund, a prompt and simple way to reinvest their dividends and capital gains distributions in shares of the Fund. The Fund will distribute to stockholders, at least annually, substantially all of its net income and expects to distribute annually its net realized capital gains. Computershare Trust Company, N.A. (the “Plan Administrator”), acts as Plan Administrator for stockholders in administering the Plan. The Plan also allows you to make optional cash investments in Fund shares through the Plan Administrator.

Who Can Participate in the Plan?

If you own shares in your own name, you can elect to participate directly in the Plan. If you own shares that are held in the name of a brokerage firm, bank, or other nominee, you should contact your nominee to arrange for them to participate on your behalf.

What Does the Plan Offer?

The Plan has two components; reinvestment of dividends and capital gains distributions, and a voluntary cash purchase feature.

Reinvestment of dividends and capital gains distributions

If you choose to participate in the Plan, your dividends and capital gains distributions will be promptly invested for you, automatically increasing your holdings in the Fund. If the Fund declares a dividend or capital gains distribution payable in cash, you will automatically receive shares purchased by the Plan Administrator on the open market. You will be charged a per share fee (currently $0.05) incurred with respect to the Plan Administrator’s open market purchases. If a distribution is declared which is payable in shares or cash at the option of the stockholder and if on the valuation date (generally the payable date) the market price of shares is equal to or exceeds their net asset value, the Fund will issue new shares to you at the greater of the following: (a) net asset value per share or (b) 95% of the market price per share. If the market price per share on the valuation date is less than the net asset value per share, the Fund will issue new shares to you at the market price per share on the valuation date.

All reinvestments are in full and fractional shares, carried to six decimal places. In the case of foreign (non-U.S.) stockholders, reinvestment will be made net of applicable withholding tax.

The Plan will not operate if a distribution is declared in shares only, subject to an election by the stockholders to receive cash.

24

Summary of Dividend Reinvestment and

Cash Purchase Plan (unaudited) (continued) |

Voluntary cash purchase option

Plan participants have the option of making investments in Fund shares through the Plan Administrator. You may invest any amount from $100 to $3,000 semi-annually. The Plan Administrator will purchase shares for you on the New York Stock Exchange or otherwise on the open market on or about February 15 and August 15. If you hold shares in your own name, you should deal directly with the Plan Administrator. Checks in U.S. dollars and drawn in U.S. banks should be made payable to “Computershare”. The Plan Administrator will not accept cash, traveler’s checks, money orders, or third party checks. The Plan Administrator will wait up to three business days after receipt of a check to ensure it receives good funds and will then seek to purchase shares for optional cash investments on the next applicable investment date. We suggest you send your check, along with a completed transaction form which is attached to each statement you receive, to the following address to be received at least three business days before the investment date:

Computershare, c/o The Taiwan Fund, Inc. at P.O. Box 43006, Providence, RI 02940-3006. The Plan Administrator will return any cash payments received more than thirty-five days prior to February 15 or August 15, and you will not receive interest on uninvested cash payments. If you own shares that are held in the name of a brokerage firm, bank, or other nominee, you should contact your nominee to arrange for them to participate in the cash purchase option on your behalf. If your check is returned unpaid for any reason, the Plan Administrator will consider the request for investment of such funds null and void, and will immediately remove these shares from your account. The Plan Administrator will be entitled to sell shares to satisfy any uncollected amount plus any applicable fees. If the net proceeds of the sale are insufficient to satisfy the balance of any uncollected amounts, the Plan Administrator will be entitled to sell such additional shares from your account as may be necessary to satisfy the uncollected balance.

Is There a Cost to Participate?

For purchases from the reinvestment of dividends and capital gains distributions, you will also be charged a per share fee (currently $0.05) incurred with respect to the Plan Administrator’s open market purchases in connection with the reinvestment of dividends and capital gains distributions. The Plan Administrator’s service fees for handling capital gains distributions or income dividends will be paid by the Fund. For purchases from voluntary cash payments, participants are charged a service fee (currently $0.75 per investment) and a per share fee (currently $0.05) for each voluntary cash investment. Per share fees include any brokerage commissions the Plan Administrator is required to pay. Per share fees and service fees, if any, will be deducted from amounts to be invested.

What Are the Tax Implications for Participants?

You will receive tax information annually for your personal records and to help you prepare your federal income tax return.