Unitil Corporation (NYSE: UTL) (unitil.com) today announced GAAP

Net Income (Net Income) of $11 thousand, or $0.00 in Earnings Per

Share (EPS), for the third quarter of 2024, a decrease of $1.4

million in Net Income, or $0.09 in EPS, compared to the third

quarter of 2023. The Company’s Net Income was $31.5 million, or

$1.96 in EPS, for the first nine months of 2024, an increase of

$1.8 million in Net Income, or $0.11 in EPS, compared to the first

nine months of 2023. The Company's Adjusted Net Income (a non-GAAP

financial measure1) was $0.4 million, or $0.02 in EPS for the third

quarter of 2024, a decrease of $1.0 million, or $0.07 in EPS,

compared to the third quarter of 2023. The Company's Adjusted Net

Income (a non-GAAP financial measure1) was $32.1 million, or $2.00

in EPS, for the first nine months of 2024, an increase of $2.4

million, or $0.15 in EPS, compared to the first nine months of

2023. The Company’s earnings in the first nine months of 2024

reflect higher rates and customer growth.

______________________

1 The accompanying Supplemental Information more

fully describes the non-GAAP financial measures used in this press

release and includes a reconciliation of the non-GAAP financial

measures to the financial measures that the Company’s management

believes are the most comparable GAAP financial measures. A

discussion of the changes in the most comparable GAAP financial

measures for the periods presented is included in the main body of

this press release.

______________________

“We are pleased with the Company’s strong operational and

financial performance through the first nine months of 2024,” said

Thomas P. Meissner, Jr., Unitil’s Chairman and Chief Executive

Officer. “Regulatory and transition activities for the planned

acquisition of Bangor Natural Gas Company continue as expected and

we recently issued our 2024 Corporate Sustainability and

Responsibility Report, which describes our accomplishments,

initiatives, and commitments related to sustainable practices and

creating long-term sustainable value for stakeholders.”

Electric GAAP Gross Margin was $22.3 million in the three months

ended September 30, 2024, a decrease of $0.3 million compared

to the same period in 2023. Electric GAAP Gross Margin was $60.2

million in the nine months ended September 30, 2024, a

decrease of $0.4 million compared to the same period in 2023. The

three month period reflects higher depreciation and amortization

expense of $0.8 million, partially offset by higher rates and

customer growth of $0.5 million. The decrease in the nine month

period was driven by higher depreciation and amortization expense

of $2.0 million, partially offset by higher rates and customer

growth of $1.6 million.

Electric Adjusted Gross Margin (a non-GAAP financial measure1)

was $29.7 million and $81.7 million in the three and nine months

ended September 30, 2024, respectively, increases of $0.5 million

and $1.6 million, respectively, compared to the same periods in

2023. These increases reflect higher rates and customer growth.

Gas GAAP Gross Margin was $11.8 million in the three months

ended September 30, 2024, a decrease of $0.5 million compared

to the same period in 2023. Gas GAAP Gross Margin was $82.4 million

in the nine months ended September 30, 2024, an increase of

$5.8 million compared to the same period in 2023. The decrease in

the three month period was driven by higher depreciation and

amortization of $1.6 million, partially offset by higher rates and

customer growth of $1.1 million. The increase in the nine month

period was driven by higher rates and customer growth of $9.2

million, partially offset by higher depreciation and amortization

of $3.4 million.

Gas Adjusted Gross Margin (a non-GAAP financial measure1) was

$23.3 million and $115.6 million in the three and nine months ended

September 30, 2024, respectively, increases of $1.1 million and

$9.2 million, respectively, compared to the same periods in 2023.

These increases reflect higher rates and customer growth.

Operation and Maintenance expenses increased $0.7 million and

$1.1 million in the three and nine months ended September 30, 2024,

respectively, compared to the same periods in 2023. The increase in

the three month period reflects higher labor costs of $0.4 million

and higher utility operating costs of $0.3 million. The increase in

the nine month period reflects higher labor costs of $0.9 million

and higher utility operating costs of $0.2 million.

Depreciation and Amortization expense increased $2.3 million and

$5.1 million in the three and nine months ended September 30, 2024,

respectively, compared to the same periods in 2023, reflecting

higher depreciation rates resulting from recent base rate cases,

additional depreciation associated with higher levels of utility

plant in service, and higher amortization of storm costs and other

deferred costs.

Taxes Other Than Income Taxes increased $0.8 million and $1.5

million in the three and nine months ended September 30, 2024,

respectively, compared to the same periods in 2023, reflecting

higher local property taxes on higher utility plant in service and

higher payroll taxes. Interest Expense, Net increased $0.4 million

and $1.0 million in the three and nine months ended September 30,

2024, respectively, compared to the same periods in 2023, primarily

reflecting higher interest expense on short-term borrowings and

higher levels of long-term debt, partially offset by higher

interest income on regulatory assets and other interest income.

Other (Income) Expense, Net decreased $0.3 million in the three

months ended September 30, 2024, compared to the same period in

2023, reflecting lower retirement benefit costs. Other (Income)

Expense, Net increased $0.2 million in the nine months ended

September 30, 2024, respectively, compared to the same period in

2023, reflecting higher retirement benefit costs.

Federal and State Income Taxes for the three and nine months

ended September 30, 2024 decreased $0.9 million and increased $0.1

million, respectively, compared with the same periods in 2023. The

decrease in the three month period reflects lower pre-tax earnings

in the third quarter of 2024. The increase in the nine month period

reflects higher pre-tax earnings in the first nine months of

2024.

At its January 2024, May 2024, July 2024 and October 2024

meetings, the Unitil Corporation Board of Directors declared

quarterly dividends on the Company’s common stock of $0.425 per

share. These quarterly dividends result in a current effective

annualized dividend rate of $1.70 per share, representing an

unbroken record of quarterly dividend payments since trading began

in Unitil’s common stock.

The Company’s earnings historically have been seasonal and

typically have been higher in the first and fourth quarters when

customers use natural gas for heating purposes.

The Company will hold a quarterly conference call to discuss

second quarter 2024 results on Tuesday, November 5, 2024, at 10:00

a.m. Eastern Time. This call is being webcast. This call, financial

and other statistical information contained in the Company’s

presentation on this call, and information required by Regulation G

regarding non-GAAP financial measures can be accessed in the

Investor Relations section of Unitil’s website, unitil.com.

About Unitil Corporation

Unitil Corporation provides energy for life by safely and

reliably delivering electricity and natural gas in New England. We

are committed to the communities we serve and to developing people,

business practices, and technologies that lead to the delivery of

dependable, more efficient energy. Unitil Corporation is a public

utility holding company with operations in Maine, New Hampshire and

Massachusetts. Together, Unitil’s operating utilities serve

approximately 108,500 electric customers and 88,400 natural gas

customers. For more information about our people, technologies, and

community involvement please visit unitil.com.

Forward-Looking Statements

This press release may contain forward-looking statements. All

statements, other than statements of historical fact, included in

this press release are forward-looking statements. Forward-looking

statements include declarations regarding Unitil’s beliefs and

current expectations. These forward-looking statements are subject

to the inherent risks and uncertainties in predicting future

results and conditions that could cause the actual results to

differ materially from those projected in these forward-looking

statements. Some, but not all, of the risks and uncertainties

include the following: Unitil’s regulatory environment (including

regulations relating to climate change, greenhouse gas emissions

and other environmental matters); fluctuations in the supply of,

the demand for, and the prices of, energy commodities and

transmission and transportation capacity and Unitil’s ability to

recover energy commodity costs in its rates; customers’ preferred

energy sources; severe storms and Unitil’s ability to recover storm

costs in its rates; general economic conditions; variations in

weather; long-term global climate change; unforeseen or changing

circumstances, which could adversely affect the reduction of

company-wide direct greenhouse gas emissions; Unitil’s ability to

retain its existing customers and attract new customers; increased

competition; and other risks detailed in Unitil's filings with the

Securities and Exchange Commission. These forward looking

statements speak only as of the date they are made. Unitil

undertakes no obligation, and does not intend, to update these

forward-looking statements except as required by law.

| For more

information please contact: |

|

|

|

| Christopher Goulding –

Investor Relations |

Alec O’Meara – External

Affairs |

| Phone: 603-773-6466 |

Phone: 603-773-6404 |

| |

|

| Email:

gouldingc@unitil.com |

Email: omeara@unitil.com |

| |

|

Supplemental Information; Non-GAAP Financial Measures

The Company's earnings discussion includes Adjusted Net Income,

a non-GAAP financial measure referencing our 2024 GAAP Net Income

less certain transaction costs related to the Company's acquisition

of Bangor Natural Gas Company (Bangor), which it disclosed

previously in 2024. The Company's management believes that the

transaction costs related to the acquisition of Bangor, which are

included in Operation and Maintenance expense on the Consolidated

Statements of Earnings, are not indicative of the Company's ongoing

costs and not directly related to the ongoing operations of the

business and therefore not an indicator of baseline operating

performance.

In the following tables the Company has reconciled Adjusted Net

Income to GAAP Net Income, which we believe to be the most

comparable GAAP financial measure.

| (Millions,

except per share data) |

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

September 30, |

|

September 30, |

|

|

2024 |

|

2023 |

|

|

Amount |

|

Per Share |

|

Amount |

|

Per Share |

|

GAAP Net Income |

$ |

--- |

|

$ |

--- |

|

$ |

1.4 |

|

$ |

0.09 |

|

|

Transaction Costs |

|

0.4 |

|

|

0.02 |

|

|

--- |

|

|

--- |

|

| Adjusted

Net Income |

$ |

0.4 |

|

$ |

0.02 |

|

$ |

1.4 |

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30 |

|

|

2024 |

|

2023 |

|

|

Amount |

|

Per Share |

|

Amount |

|

Per Share |

| GAAP Net

Income |

$ |

31.5 |

|

$ |

1.96 |

|

$ |

29.7 |

|

$ |

1.85 |

|

|

Transaction Costs |

|

0.6 |

|

|

0.04 |

|

|

--- |

|

|

--- |

|

| Adjusted

Net Income |

$ |

32.1 |

|

$ |

2.00 |

|

$ |

29.7 |

|

$ |

1.85 |

|

| |

The Company analyzes operating results using Electric and Gas

Adjusted Gross Margins, which are non-GAAP financial measures.

Electric Adjusted Gross Margin is calculated as Total Electric

Operating Revenue less Cost of Electric Sales. Gas Adjusted Gross

Margin is calculated as Total Gas Operating Revenues less Cost of

Gas Sales. The Company’s management believes Electric and Gas

Adjusted Gross Margins are important financial measures to analyze

revenue from the Company’s ongoing operations because the approved

cost of electric and gas sales are tracked, reconciled and passed

through directly to customers in electric and gas tariff rates,

resulting in an equal and offsetting amount reflected in Total

Electric and Gas Operating Revenue.

In the following tables the Company has reconciled Electric and

Gas Adjusted Gross Margin to GAAP Gross Margin, which we believe to

be the most comparable GAAP financial measure. GAAP Gross Margin is

calculated as Revenue less Cost of Sales, and Depreciation and

Amortization. The Company calculates Electric and Gas Adjusted

Gross Margin as Revenue less Cost of Sales. The Company believes

excluding Depreciation and Amortization, which are period costs and

not related to volumetric sales, is a meaningful measure to inform

investors of the Company’s profitability from electric and gas

sales in the period.

|

Three Months Ended September 30, 2024 ($

millions) |

|

|

|

|

|

|

| |

Electric |

Gas |

Other |

Total |

|

Total Operating Revenue |

$ |

62.5 |

|

$ |

30.4 |

|

$ |

--- |

|

$ |

92.9 |

|

| Less: Cost of Sales |

|

(32.8 |

) |

|

(7.1 |

) |

|

--- |

|

|

(39.9 |

) |

| Less: Depreciation and

Amortization |

|

(7.4 |

) |

|

(11.5 |

) |

|

(0.2 |

) |

|

(19.1 |

) |

|

GAAP Gross Margin |

|

22.3 |

|

|

11.8 |

|

|

(0.2 |

) |

|

33.9 |

|

| Depreciation and

Amortization |

|

7.4 |

|

|

11.5 |

|

|

0.2 |

|

|

19.1 |

|

|

Adjusted Gross Margin |

$ |

29.7 |

|

$ |

23.3 |

|

$ |

--- |

|

$ |

53.0 |

|

|

|

|

Three Months Ended September 30, 2023 ($

millions) |

|

|

|

|

|

|

|

|

Electric |

Gas |

Other |

Total |

|

Total Operating Revenue |

$ |

72.1 |

|

$ |

31.8 |

|

$ |

--- |

|

$ |

103.9 |

|

| Less:

Cost of Sales |

|

(42.9 |

) |

|

(9.6 |

) |

|

--- |

|

|

(52.5 |

) |

| Less:

Depreciation and Amortization |

|

(6.6 |

) |

|

(9.9 |

) |

|

(0.3 |

) |

|

(16.8 |

) |

|

GAAP Gross Margin |

|

22.6 |

|

|

12.3 |

|

|

(0.3 |

) |

|

34.6 |

|

|

Depreciation and Amortization |

|

6.6 |

|

|

9.9 |

|

|

0.3 |

|

|

16.8 |

|

|

Adjusted Gross Margin |

$ |

29.2 |

|

$ |

22.2 |

|

$ |

--- |

|

$ |

51.4 |

|

|

|

|

Nine Months Ended September 30, 2024 ($

millions) |

|

|

|

|

|

|

|

|

Electric |

Gas |

Other |

Total |

|

Total Operating Revenue |

$ |

192.5 |

|

$ |

174.8 |

|

$ |

--- |

|

$ |

367.3 |

|

| Less:

Cost of Sales |

|

(110.8 |

) |

|

(59.2 |

) |

|

--- |

|

|

(170.0 |

) |

| Less:

Depreciation and Amortization |

|

(21.5 |

) |

|

(33.2 |

) |

|

(0.5 |

) |

|

(55.2 |

) |

|

GAAP Gross Margin |

|

60.2 |

|

|

82.4 |

|

|

(0.5 |

) |

|

142.1 |

|

|

Depreciation and Amortization |

|

21.5 |

|

|

33.2 |

|

|

0.5 |

|

|

55.2 |

|

|

Adjusted Gross Margin |

$ |

81.7 |

|

$ |

115.6 |

|

$ |

--- |

|

$ |

197.3 |

|

|

|

|

Nine Months Ended September 30, 2023 ($

millions) |

|

|

|

|

|

|

|

|

Electric |

Gas |

Other |

Total |

|

Total Operating Revenue |

$ |

244.8 |

|

$ |

182.7 |

|

$ |

--- |

|

$ |

427.5 |

|

| Less:

Cost of Sales |

|

(164.7 |

) |

|

(76.3 |

) |

|

--- |

|

|

(241.0 |

) |

| Less:

Depreciation and Amortization |

|

(19.5 |

) |

|

(29.8 |

) |

|

(0.8 |

) |

|

(50.1 |

) |

|

GAAP Gross Margin |

|

60.6 |

|

|

76.6 |

|

|

(0.8 |

) |

|

136.4 |

|

|

Depreciation and Amortization |

|

19.5 |

|

|

29.8 |

|

|

0.8 |

|

|

50.1 |

|

|

Adjusted Gross Margin |

$ |

80.1 |

|

$ |

106.4 |

|

$ |

--- |

|

$ |

186.5 |

|

|

|

Selected financial data for 2024 and 2023 is presented in the

following table:

|

Unitil Corporation – Condensed Consolidated Financial

Data |

|

(Millions, except Per Share data)(Unaudited) |

| |

|

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric kWh Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

|

|

194.6 |

|

|

|

187.0 |

|

|

|

4.1% |

|

|

|

|

515.3 |

|

|

501.7 |

|

|

|

2.7% |

|

|

Commercial/Industrial |

|

|

257.1 |

|

|

|

253.2 |

|

|

|

1.5% |

|

|

|

|

708.9 |

|

|

696.0 |

|

|

|

1.9% |

|

|

Total Electric kWh Sales |

|

|

451.7 |

|

|

|

440.2 |

|

|

|

2.6% |

|

|

|

|

1,224.2 |

|

|

1,197.7 |

|

|

|

2.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Therm Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

|

|

2.5 |

|

|

|

2.5 |

|

|

|

--- |

|

|

|

|

32.3 |

|

|

32.6 |

|

|

|

(0.9% |

) |

|

Commercial/Industrial |

|

|

25.2 |

|

|

|

25.3 |

|

|

|

(0.4% |

) |

|

|

|

131.6 |

|

|

132.1 |

|

|

|

(0.4% |

) |

|

Total Gas Therm Sales |

|

|

27.7 |

|

|

|

27.8 |

|

|

|

(0.4% |

) |

|

|

|

163.9 |

|

|

164.7 |

|

|

|

(0.5% |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric Revenues |

|

$ |

62.5 |

|

|

$ |

72.1 |

|

|

$ |

(9.6 |

) |

|

|

$ |

192.5 |

|

$ |

244.8 |

|

|

$ |

(52.3 |

) |

|

Cost of Electric Sales |

|

|

32.8 |

|

|

|

42.9 |

|

|

|

(10.1 |

) |

|

|

|

110.8 |

|

|

164.7 |

|

|

|

(53.9 |

) |

|

Electric Adjusted Gross Margin(a non-GAAP

financial

measure1): |

|

|

29.7 |

|

|

|

29.2 |

|

|

|

0.5 |

|

|

|

|

81.7 |

|

|

80.1 |

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Revenues |

|

|

30.4 |

|

|

|

31.8 |

|

|

|

(1.4 |

) |

|

|

|

174.8 |

|

|

182.7 |

|

|

|

(7.9 |

) |

|

Cost of Gas Sales |

|

|

7.1 |

|

|

|

9.6 |

|

|

|

(2.5 |

) |

|

|

|

59.2 |

|

|

76.3 |

|

|

|

(17.1 |

) |

|

Gas Adjusted Gross Margin(a non-GAAP

financial

measure1): |

|

|

23.3 |

|

|

|

22.2 |

|

|

|

1.1 |

|

|

|

|

115.6 |

|

|

106.4 |

|

|

|

9.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjusted Gross Margin(a non-GAAP

financial

measure1): |

|

|

53.0 |

|

|

|

51.4 |

|

|

|

1.6 |

|

|

|

|

197.3 |

|

|

186.5 |

|

|

|

10.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operation & Maintenance Expenses |

|

|

20.3 |

|

|

|

19.6 |

|

|

|

0.7 |

|

|

|

|

57.1 |

|

|

56.0 |

|

|

|

1.1 |

|

|

Depreciation & Amortization |

|

|

19.1 |

|

|

|

16.8 |

|

|

|

2.3 |

|

|

|

|

55.2 |

|

|

50.1 |

|

|

|

5.1 |

|

|

Taxes Other Than Income Taxes |

|

|

7.8 |

|

|

|

7.0 |

|

|

|

0.8 |

|

|

|

|

22.6 |

|

|

21.1 |

|

|

|

1.5 |

|

|

Other (Income) Expense, Net |

|

|

(0.3 |

) |

|

|

--- |

|

|

|

(0.3 |

) |

|

|

|

0.1 |

|

|

(0.1 |

) |

|

|

0.2 |

|

|

Interest Expense, Net |

|

|

7.4 |

|

|

|

7.0 |

|

|

|

0.4 |

|

|

|

|

22.1 |

|

|

21.1 |

|

|

|

1.0 |

|

|

Income (Loss) Before Income Taxes |

|

|

(1.3 |

) |

|

|

1.0 |

|

|

|

(2.3 |

) |

|

|

|

40.2 |

|

|

38.3 |

|

|

|

1.9 |

|

|

Provision for Income Taxes |

|

|

(1.3 |

) |

|

|

(0.4 |

) |

|

|

(0.9 |

) |

|

|

|

8.7 |

|

|

8.6 |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

--- |

|

|

$ |

1.4 |

|

|

$ |

(1.4 |

) |

|

|

$ |

31.5 |

|

$ |

29.7 |

|

|

$ |

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share |

|

$ |

--- |

|

|

$ |

0.09 |

|

|

$ |

(0.09 |

) |

|

|

$ |

1.96 |

|

$ |

1.85 |

|

|

$ |

0.11 |

|

|

|

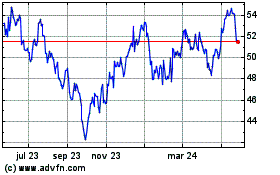

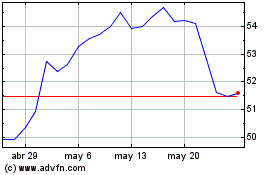

Unitil (NYSE:UTL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Unitil (NYSE:UTL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024