In accordance with the Listing Rules, please see the transcript

below relating to the above, for release to the market.

This announcement was approved and authorised for release by

Woodside’s Disclosure Committee.

Forward looking statements

Disclaimer and important notice

This announcement may contain forward-looking statements with

respect to Woodside’s business and operations, market conditions,

results of operations and financial condition which reflect

Woodside’s views held as at the date of this announcement. All

statements, other than statements of historical or present facts,

are forward-looking statements and generally may be identified by

the use of forward-looking words such as ‘guidance’, ‘foresee’,

‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’,

‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’, ‘project’,

‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or

expressions.

Forward-looking statements are not guarantees of future

performance and are subject to inherent known and unknown risks,

uncertainties, assumptions and other factors, many of which are

beyond the control of Woodside, its related bodies corporate and

their respective officers, directors, employees, advisers or

representatives. Details of the key risks relating to Woodside and

its business can be found in the “Risk” sections of Woodside’s most

recent Annual Report released to the Australian Securities

Exchange, Woodside’s Climate Transition Action Plan and 2023

Progress Report, and in Woodside’s filings with the U.S. Securities

and Exchange Commission, including Woodside’s Annual Report on Form

20-F. You should review and have regard to these risks when

considering the information contained in this announcement.

Investors are strongly cautioned not to place undue reliance on

any forward-looking statements. Actual results or performance may

vary materially from those expressed in, or implied by, any

forward-looking statements.

Woodside Energy Group Ltd

2024 Annual General Meeting

Wednesday, 24 April 2024

Chair Richard Goyder

Good morning everyone, and welcome to Woodside’s 2024 Annual

General Meeting. I’m Richard Goyder, Woodside’s Chair, and on

behalf of our company I’d like to thank everyone attending, whether

in person or online.

We sincerely appreciate your interest in our business.

If you’re here in the room, please familiarise yourself with the

evacuation procedures on the screen, which would apply in the event

of an emergency.

I am informed that a quorum is present and formally declare the

meeting open.

Today is a historic day for Woodside. It is our 70th AGM, and

almost the 30th since we moved our company headquarters to Perth in

1996.

Our history here is proud, but it is very short when compared to

the many thousands of years the Whadjuk people of the Noongar

nation have lived here and cared for this country. I would like to

thank them for this enduring contribution and I pay my respects to

their Elders past and present.

I also recognise the many traditional custodians of the areas

where Woodside operates, in particular, the Ngarda-Ngarli people as

the collective custodians of Murujuga, where we have worked for

more than 40 years.

Australia remains on a journey towards reconciliation and at

Woodside our support for this vital goal is unwavering.

Today’s event is a valuable opportunity for our Board and

company leadership to hear directly from our shareholders, so I ask

that you keep questions brief and avoid repeating issues that have

already been covered. Could you please ask no more than two

questions at a time to give as many shareholders as possible an

opportunity to be heard. I remind shareholders that questions must

relate to the item of business under consideration, and as in

previous years, no speeches, please.

There will be an opportunity for questions during formal

business, so if you’re a shareholder joining online please start

submitting any questions now. You can do this using the same

platform you’re watching the webcast on.

There are instructions on the slide and I’ll run through them

now: To submit a question, you need to tap the messaging tab, type

your question in the chat box at the top of the screen and hit

send. Confirmation your message has been received will then

appear.

Shareholders who wish to ask questions from the floor will need

to register the questions at the question registration desk at the

back of the meeting room. You will then be called to ask your

question at the microphone stand at the back of the room at the

appropriate time. This year we have two microphone stands for

shareholders to use to ask questions. This makes it easier for

shareholders participating online as well as me and Meg to see you

and hear your question.

If you have not already registered a question you wish to ask,

please go to the question registration desk now and give your name

and a brief description of your question. You may return to the

question registration desk at any time during the meeting to

register further questions.

If you have any mobility issues, please raise your hand for

assistance with your question registration. Staff will then bring a

microphone to you for you to ask your question from your seat at

the appropriate time.

The process for submitting audio questions online is on the

right-hand side of the slide. To do so you must first click on the

‘Request to speak’ button at the bottom of the broadcast window,

enter the requested details, click ‘Submit Request’, and follow the

audio prompts to connect. You will continue to hear the meeting

while you wait to ask your question.

I’m joined on stage this morning by our Chief Executive Officer

and Managing Director, Meg O’Neill, and Company Secretary, Warren

Baillie. Also here with us in Perth are directors Larry Archibald,

Ashok Belani, Arnaud Breuillac, Frank Cooper, Swee Chen Goh, Angela

Minas, Ian Macfarlane, Ann Pickard and Ben Wyatt.

In January, Frank Cooper and Gene Tilbrook announced they would

be retiring as Directors of Woodside. Gene stepped down from his

position in February and Frank will do so at the end of today’s

meeting, at which time Ben Wyatt will take over as the Chair of

Woodside’s Audit & Risk Committee. I would like to thank Frank

and Gene for their exceptional service to the Board, and the

contributions they have made to Woodside’s success.

I would also like to warmly welcome Ashok to the Board,

following his appointment in January. Ashok brings extensive

experience in new energy, technology and petroleum sector

decarbonisation. He will stand for election as a non-executive

Director at today’s meeting.

Nick Henry and Anthony Hodge, representing our auditors

PricewaterhouseCoopers, are also present today.

Our Executive Leadership Team along with the Board, will be

available after the meeting to catch up with our shareholders

attending in person over light refreshments.

Voting today will be conducted by poll. Each shareholder present

in person or by proxy has one vote for every ordinary share owned.

Lisa Ahwan, from the company’s share registry Computershare, has

agreed to act as Returning Officer for the poll. I will open the

poll now for voting on all items of business, so that shareholders

who aren’t able to stay for the full meeting can still cast their

votes on all items of business.

For shareholders attending in person, we are using electronic

keypads instead of paper poll cards. This means we will be able to

share the provisional voting results with you towards the end of

the meeting. Instructions for using the handsets and submitting

your votes on each item are now on the screen, please take a moment

to familiarise yourselves with these.

At the time of registration, shareholders who are eligible to

vote would have been given a white plastic smartcard and a handset.

Proxy holders would also have been given a handset and a summary of

their voting instructions. Following the discussion on items of

business, I will prompt those shareholders who are physically

present today to vote on those items and, at that time, your

handset will activate and voting instructions will appear on your

screen.

If you require assistance now or during the voting, please

simply raise your hand and someone from the Computershare team will

assist you. For shareholders requiring assistance online, please

follow the instructions on the online platform to access assistance

on voting.

Voting will remain open during the discussion of the items of

business. I will let you know when the poll is about to close.

Shortly after the close of the poll, the provisional poll results

will appear on the screen behind me. The final results of the poll

will be announced after the meeting to the Australian Securities

Exchange and will also be available on Woodside’s website.

I am holding open proxies in my capacity as Chair of the meeting

and I will vote all available proxies in favour of each

resolution.

Please remember we report our results in US dollars, and any

reference to dollars this morning will be in US currency unless

stated otherwise.

During today’s meeting, we may also make forward-looking

statements about our business and operations. Investors are

cautioned not to place undue reliance on any forward-looking

statements. Please refer to the cautionary statement and disclaimer

wording included in our ASX announcement released earlier today and

our annual report and other filings with the ASX, LSE and SEC.

As the opening video highlighted, Woodside is marking several

milestones this year: Our company was founded in the small

Victorian town of Woodside in 1954 and we are celebrating our 70th

birthday. We are also marking 40 years of providing energy to local

homes and businesses in Western Australia from the North West

Shelf, and it is 35 years since our first LNG ship departed for

Tokyo Bay, marking the birth of the LNG industry in Australia.

Reflecting on this long history of achievement, I feel privileged

to be Chair of this great Australian company and tremendously proud

of the value we continue to return to our shareholders and indeed

all our stakeholders, our employees, suppliers and the communities

in which we operate.

Before I reflect on our performance in 2023, I’d like to state

very clearly that we are committed to conducting our business

sustainably. This means responding to climate change. And it means

ensuring everyone who works at Woodside goes home safely. Sadly,

our safety performance, including the tragic death of a colleague

at the North Rankin Complex, meant we did not achieve this in 2023.

Please be assured that we are steadfast in our commitment to

learning from this incident. There is nothing more important to us

in 2024 than improving safety.

Looking at our broader performance, 2023 further established

Woodside as a global energy supplier. We delivered record

production from our expanded portfolio and achieved excellent LNG

reliability.

Amid normalised oil and gas prices coming off 2022’s record

highs we recorded an annual net profit after tax of US $1.7 billion

and an underlying net profit after tax of US $3.3 billion. Based on

this, the Board determined a fully-franked final dividend of 60 US

cents per share, resulting in a total full-year dividend of 140 US

cents per share fully-franked.

We are committed to returning value to our shareholders, as well

as the communities we operate in and in 2023, Woodside paid a

record A$5 billion to the Australian Government in tax and royalty

payments.

We are delivering these strong returns while also laying the

foundations for future growth. Meg will give more detailed updates

on our major growth projects which are progressing well. We expect

first oil from Sangomar in mid-2024 and Scarborough is targeting

first LNG cargo in 2026. We also took a final investment decision

in June last year to develop the large, high-quality, Trion

resource in Mexico.

We are aiming to reduce our net equity Scope 1 and 2 greenhouse

gas emissions 15% by 2025 and 30% by 2030. This is compared to our

2016 to 2020 gross emissions, with certain adjustments and we are

on track to meet these goals. We have also launched our Climate

Transition Action Plan and announced a new, complementary, Scope 3

emissions abatement target. For the Board and executive leadership

of Woodside, we view our response to climate change not only as a

responsibility, but a great opportunity. Our strategy is to thrive

through the energy transition, for the benefit of our shareholders,

our employees, our communities and the environment.

I would like to thank our shareholders, for investing and

placing trust in Woodside. In particular, may I thank those who

have engaged with us on our climate plans. I believe that all plans

and ideas are improved when they are subject to scrutiny and

constructive feedback, and this has been the case for Woodside over

the past 12 months. In 2023 I held 43 meetings on climate change

with investors and our investor relations team held 70, and since

the beginning of this year I have held more than 40 meetings. We

will continue to engage our shareholders on this important topic

and take action accordingly.

I also recognise that Directors of public companies are under

increasing investor, media and stakeholder scrutiny for the

responsibilities they discharge on behalf of shareholders.

This has certainly been my experience in recent times, but I can

assure you that I have never been more energised and excited to

serve as Chair of Woodside. The complexities of chairing an energy

company as the world strives to decarbonise are many, but I firmly

believe that Woodside’s track record during my time as Chair –

delivering strong operational and financial performance, laying the

foundations for future growth, while continuing to return value to

shareholders – speaks to the quality of our company’s current

leadership and strategy.

On this note I would like to thank the Board, the Woodside team,

and particularly our Chief Executive Officer, Meg O’Neill, for

their work this year. Meg is inclusive, capable and highly

intelligent. She is the right leader to seize the opportunities the

energy transition brings and work through its challenges.

In closing, I’d like to share a reflection about this being

Woodside’s 70th AGM. What would our first chair, Percival McKenzie,

make of the company Woodside is today? I can’t imagine that in 1954

he could ever have conceived we would have thousands of employees

working in offices and at operations around the world, or how great

our contribution to supplying energy to households and businesses

at home and abroad would be, but I believe he would be proud that

we have maintained the enterprising Australian spirit of innovation

and determination that saw Woodside established all those years

ago.

It is a legacy we intend to build on for many decades to

come.

I’ll now hand over to Meg.

Thank you.

CEO and Managing Director Meg

O’Neill

Thank you, Richard and thank you to everyone attending in person

and on-line. It is a great privilege to lead Woodside during this

transformative period for our company.

I am proud to report that we continue to invest and create value

on your behalf while delivering reliable energy to homes and

businesses here in Australia and overseas.

However, when I look back on 2023 I will always think of our

colleague who lost his life while working at our North Rankin

Complex. His death continues to affect many of us, and I again

offer my deepest condolences to his family and friends. Safety is

our number one priority at Woodside and we must improve. We have

commissioned an external review of our safety systems and this will

guide our efforts to improve safety performance.

Our strategy is to thrive through the energy transition. The

heart of this strategy recognises that the world must respond to

the challenge of climate change by changing our energy system – and

we intend to be part of the solution. It is underpinned by three

priorities: providing energy the world needs today and into the

future, creating and returning value, and conducting our business

sustainably – and we are delivering on all three.

As Richard highlighted, in 2023 we achieved record full-year

production of more than 187 million barrels of oil equivalent. This

record demonstrates a clear benefit of our merger with BHP’s

petroleum business, with production now more than double pre-merger

levels.

Our outstanding result of 98% LNG reliability for our operated

LNG plants at Pluto and North West Shelf contributed to this record

overall production and was achieved while successfully delivering

planned turnarounds.

Operating revenue for 2023 was $14 billion, leading to an annual

reported net profit after tax of $1.7 billion and an underlying net

profit after tax of $3.3 billion. With a full-year dividend value

of 140 cents per share we returned more than $2.6 billion to

shareholders, which was 80% of our underlying Net Profit After Tax.

I am tremendously proud that we have delivered value of this

magnitude amid inflationary pressures and lower oil and gas prices,

relative to 2022.

We remain on track to meet our target of reducing our net equity

Scope 1 and 2 emissions 15 per cent below our starting base by

2025. In 2023 we reduced our net equity emissions to 12.5 % below

our starting base. We achieved this by designing and operating out

emissions and using carbon credits as offsets. We aspire to achieve

net zero equity Scope 1 and 2 emissions by 2050 or sooner. And we

have now completed asset decarbonisation planning, identifying a

potential pathway to achieving this goal, with a clear emphasis on

design-out and operate-out solutions.

A great example of this work is the modifications we have made

to receive power from the proposed Woodside Solar project. In 2021,

we set a Scope 3 investment target aiming to invest $5 billion in

new energy products and lower carbon services by 2030. At the end

of 2023, we had cumulatively spent more than $335 million towards

this target, meaning expenditure was up 135% compared to the year

before.

In February, we announced a new, complementary Scope 3 target to

track the potential impact of our new energy products and lower

carbon services in helping customers reduce their emissions. The

new emissions abatement target is to take final investment

decisions on new energy opportunities by 2030, with total abatement

capacity of five million tonnes per annum of CO2 equivalent.

In 2023 we bedded down our transition to a larger, more global

energy company, following the merger with BHP’s petroleum business.

We are now working as one team across multiple locations, with

additional operating assets in the Gulf of Mexico and Trinidad

& Tobago. And we have a range of new energy opportunities in

the United States, complementing our portfolio in the

Asia-Pacific.

We are also making good progress on our key growth projects

Sangomar, Scarborough and Trion. Sangomar, off Senegal, was 96%

complete at the end of the first quarter, with 19 of 23 wells

drilled and completed. The floating production storage and

offloading facility has safely arrived in the waters off Senegal.

We are targeting first oil by the middle of this year.

By the end of Q1, our Scarborough Energy Project was more than

62% complete and on track for first LNG cargo in 2026. A

Scarborough milestone was marked during the quarter with the

arrival on site of the first modules for Pluto Train 2 and at the

end of the quarter, 13 modules were in place. If you visit

Karratha, which I do often, you’ll see site works at Pluto Train 2

are well progressed. Key environmental approvals were accepted in

late 2023 and following this our seismic program was successfully

completed. Offshore works including trunkline installation and

drilling of the wells have also commenced.

These milestones could not have been achieved without meaningful

engagements, and support from First Nations groups, which have been

occurring since 2018.

Another key 2023 achievement was our sale and purchase agreement

with LNG Japan, for the sale of a 10% equity interest in the

Scarborough Joint Venture. I’m pleased to report the transaction is

now complete. In February this year we also signed a sale and

purchase agreement with JERA for a 15.1% equity interest in the

Scarborough Joint Venture. The LNG Japan and JERA deals are strong

evidence of market confidence in Scarborough. In addition, we are

in discussions with both companies for the sale of LNG. The equity

agreements and the LNG supply discussions underline the long-term

value our co-venturers see in the asset, as well as LNG’s place in

a decarbonising world.

Our third major project is Trion in the Gulf of Mexico. We took

a final investment decision on Trion last year and the project is

targeting first oil in 2028. Engineering, procurement, and

contracting activities for Trion are progressing, including the

award of the subsea marine installation contract.

In 2023 we took steps to further increase our capacity to supply

our customers in line with forecasted ongoing global demand for LNG

during the energy transition. We signed an offtake deal with Mexico

Pacific, subject to the company taking a final investment decision

on the proposed third train at the Saguaro Energia LNG Project.

This strengthens our position as a portfolio player, supplying our

own LNG, as well as third party volumes, to our customers.

In our new energy portfolio, we took a final investment decision

on the Hydrogen Refueller @H2Perth. The refueller is a hydrogen

production, storage and refuelling station. This project is

targeting supply of hydrogen to West Australian domestic trucking

customers in 2025. It is modest in scale but is intended to

stimulate demand and demonstrate capability.

Progress is also being made on our proposed H2OK hydrogen

project in Oklahoma as well as the proposed Woodside Solar project

near Karratha. We also continue to advance several carbon capture

and storage opportunities, including the proposed Angel CCS

opportunity. Angel’s foundation project could abate up to five

million tonnes per annum of CO2 equivalent.

As Woodside’s global presence increases, our sustainability

performance becomes ever more important. In 2023 we updated our

Sustainability Strategy, further embedding sustainability

performance into everything we do.

We are committed to supporting community development and

investments that are important to our host communities. In 2023 we

invested A$33.3 million globally in strategic partnerships,

philanthropic programs, employee volunteering, and mandatory

contributions. We strive to maintain real and meaningful

partnerships in the communities where we operate and make them

better places to live.

We are proud of the role our LNG is playing in supporting

decarbonisation and economic growth in Asia. When used to generate

electricity, gas typically produces half the life cycle emissions

of coal. LNG is one of Australia’s most important commodity exports

to key trading partners in our region.

But we are also immensely proud of the contribution we have made

to providing safe and reliable energy to homes and businesses here

in Western Australia since the first North Rankin gas arrived

onshore in 1984. In 2023, Woodside’s WA assets produced 76

petajoules of domestic gas, representing approximately 19% of the

State’s domestic gas supply.

As part of our ongoing and steadfast commitment to WA, earlier

this month we began marketing extra gas to the local market. In

total we will make roughly 32 petajoules of additional gas

available to the WA market by the end of next year.

On the east coast of Australia, 100 per cent of our gas, which

comes from the Bass Strait Project, operated by Esso Australia,

goes to the domestic market. And I am pleased to report Woodside

Bass Strait has initiated an expression of interest process for 50

petajoules of gas across 2025 and 2026.

We aim to keep building on our record of reliable domestic gas

supply, as we work to deliver the projects needed for ongoing

energy security and economic prosperity through the energy

transition.

Before I close, I want to speak plainly about climate change.

There are many views on how our industry should address this urgent

challenge. Recently we’ve seen some of our global peers walk back

from climate goals they now realise were too ambitious amid the

uncertainty of the energy transition.

At Woodside, we are determined to play our role in addressing

climate change. But we won’t make promises that we can’t deliver.

So I give you our commitment that we will set goals and make

decisions informed by the available science, in line with our

capital allocation framework, and with our commitment to energy

security front of mind.

We will also keep listening and responding to you, our

investors, as we continue to develop our strategy to thrive through

the energy transition. I would like to thank all shareholders for

the trust you continue to place in Woodside.

May I echo Richard’s thanks to Gene Tilbrook and Frank Cooper

for their wise counsel and wonderful service to the Woodside

Board.

I’d also like to thank the Woodside team. Our people are

skilled, diverse and values-driven, and they are working hard to

deliver our strategy. I am extremely proud to be leading them, in

this, our 70th year.

Safe, reliable and affordable energy transforms lives.

We must keep this front of mind as we work to contribute to a

stable energy transition.

Thank you.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423870223/en/

INVESTORS Marcela Louzada M: +61 456 994 243 E:

investor@woodside.com

MEDIA Christine Forster M: +61 484 112 469 E:

christine.forster@woodside.com

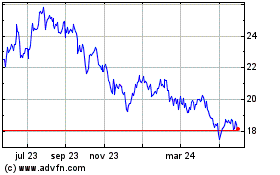

Woodside Energy (NYSE:WDS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

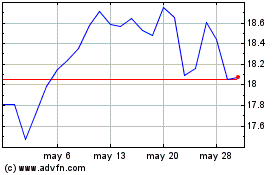

Woodside Energy (NYSE:WDS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024