Bulletin from Annual General Meeting in Hexatronic Group AB (publ)

Press release 7 May 2024Hexatronic Group AB

(publ)556168-6360

Bulletin from Annual General Meeting in

Hexatronic Group AB (publ)

The following resolutions, amongst other, were

passed at the Annual General Meeting (the “AGM”)

of Hexatronic Group AB (publ) (“Hexatronic” or the

“Company”) held today on 7 May 2024 in Gothenburg,

Sweden.

Adoption of Income Statement and Balance

Sheet for the Financial Year 2023 and Discharge from

Liability

The AGM adopted the income statements and the

balance sheets, respectively, for the Company and the group for the

financial year 2023 and as of 31 December 2023, respectively. The

members of the Board of Directors and the CEO were discharged from

liability for the financial year 2023.

Allocation of Profits

The AGM resolved, in accordance with the Board

of Directors’ proposal, that no dividend shall be distributed and

that the result shall be carried forward.

Election of Board Members, Auditors, and

Fees to the Board of Directors and Auditors

The AGM resolved that the number of

shareholder-elected members of the Board of Directors shall be

seven without deputies and that the number of auditors shall be one

registered accounting firm without deputy auditors.

The AGM resolved, for the period until the next

Annual General Meeting, to re-elect Erik Selin, Helena Holmgren and

Jaakko Kivinen and to elect Diego Andersson, Linda Hernström,

Magnus Nicolin and Åsa Sundberg as members of the Board of

Directors. Magnus Nicolin was elected as Chairman of the Board of

Directors.

The registered accounting firm Öhrlings

PricewaterhouseCoopers AB was re-elected as the Company’s auditor

for the period until the end of the next Annual General Meeting and

it was noted that Johan Malmqvist will act as auditor in

charge.

The AGM resolved that fees to members of the

Board of Directors shall be paid with SEK 1,000,000 to the

Chairman of the Board of Directors and SEK 365,000 to the other

members of the Board of Directors. It was further resolved that

fees to the Chairman of the Audit Committee shall be paid with SEK

140,000 and SEK 80,000 to member of the Audit Committee.

The AGM resolved, if the Board of Directors

establishes a Remuneration Committee, that fees to the Chairman of

the Remuneration Committee shall be paid with SEK 80,000 and SEK

40,000 to member of the Remuneration Committee, and that the fees

to the auditor shall be paid in accordance with approved statement

of costs.

Principles for the appointment of the

members of the Nomination Committee

The AGM resolved to adopt new principles for the

appointment of the members of the Nomination Committee in

accordance with the Nomination Committee’s proposal.

Approval of the Board of Directors’

remuneration report

The AGM resolved to approve the Remuneration

Report for the financial year 2023.

Adoption of a long-term

performance-based share savings programme

The AGM resolved, in accordance with the Board

of Directors’ proposal, to adopt a long-term performance-based

share savings programme for the group's management team, other

senior executives and other key employees employed in Sweden (LTIP

2024). The AGM further resolved on a directed issue of not more

than 1,343,596 convertible shares of series C, as a result of which

the share capital may increase by a maximum of SEK 13,435.96,

authorisation for the Board of Directors to resolve on repurchases

of all issued redeemable and convertible shares of series C and

approval of transfer of own ordinary shares to participants.

Outstanding rights to shares under previous long-term incentive

programmes and LTIP 2024 amount to approximately 2.91 per cent of

the Company’s total number of outstanding shares upon full

exercise.

Adoption of a long-term incentive

programme for the group’s employees outside of Sweden

The AGM resolved, in accordance with the Board

of Directors' proposal, to adopt a long-term incentive programme

(Warrant Programme 2024) directed to the group's employees outside

of Sweden and on a directed issue free of charge to the subsidiary

Proximion AB of a total of not more than 442,500 warrants with the

right for participants to subscribe for a total of not more than

442,500 shares. Proximion AB shall handle the warrants in

accordance with the terms of the Warrant Programme 2024 and

transfer the warrants to participants free of charge. Based on the

existing number of ordinary shares in the Company, the Warrant

Programme 2024, upon full exercise of all 442,500 warrants, entails

a dilution corresponding to approximately 0.22 per cent of the

capital and votes related to ordinary shares.

Resolution to authorise the Board of

Directors to resolve on the acquisition and transfer of own

shares

The AGM resolved, in accordance with the Board

of Directors' proposal, to authorise the Board of Directors, on one

or several occasions until the end of the next Annual General

Meeting, to resolve to acquire the Company’s own ordinary shares.

Furthermore, the AGM authorised the Board of Directors, for the

period until the end of the next Annual General Meeting, on one or

several occasions, to resolve to transfer the own ordinary shares

held by the Company at the time of the Board of Directors'

resolution on transfer. Ordinary shares may be acquired to the

extent that the Company’s holding of its own shares does not exceed

one tenth of the Company’s total outstanding shares (regardless of

share class).

The purpose of the authorisation is to give the

Board of Directors the opportunity to adapt the Company’s capital

structure to its capital needs and thereby, among other things, be

able to use the repurchased ordinary shares as a means of payment

for the acquisition of companies.

The possibility of deviation from the

shareholders’ preferential rights when transferring own ordinary

shares is justified by the fact that transfer of ordinary shares

over Nasdaq Stockholm or otherwise with deviation from preferential

rights for shareholders can take place with greater speed,

flexibility and is more cost-effective than transfer to all

shareholders.

Resolution to authorise the Board of

Directors to resolve on new issues of shares, warrants and/or

convertibles

The AGM resolved, in accordance with the Board's

proposal, to authorise the Board of Directors, on one or several

occasions and with or without shareholders' preferential rights,

until the end of the next Annual General Meeting, to resolve on new

issues of shares, warrants and/or convertibles of not more than ten

(10) per cent of the registered share capital in the Company at the

time of the issue resolution. An issue may be carried out as a

cash, in kind or set-off issue.

Deviation from the shareholders’ preferential

rights shall only be possible in connection with company

acquisitions. If the Board of Directors resolves on an issue with

deviation from the shareholders’ preferential rights, the rationale

shall be that the Company quickly needs access to capital in the

event of a company acquisition or alternatively needs to pay with

the Company’s shares, warrants and/or convertibles.

Adoption of guidelines for remuneration

to senior executives

The AGM resolved, in accordance with the Board

of Directors’ proposal, to adopt new guidelines for remuneration to

senior executives.

For more information, please

contact:

Henrik Larsson Lyon, CEO Hexatronic Group,

+46 706 50 34 00Pernilla Lindén, CFO Hexatronic Group,

+46 708 77 58 32

The information was submitted for publication,

through the agency of the contact persons set out above, at 19:00

CEST on 7 May 2024.

Hexatronic creates sustainable networks all over

the world. We partner with customers on four continents – from

telecom operators to network owners – and offer leading,

high-quality fiber technology for every conceivable application.

Hexatronic Group (publ.) was founded in Sweden in 1993 and the

Group is listed on Nasdaq OMX Stockholm. Our global brands include

Viper, Stingray, Raptor, InOne, and Wistom®.

- 2024-05-07 Bulletin from Annual General Meeting in Hexatronic

Group AB (publ)

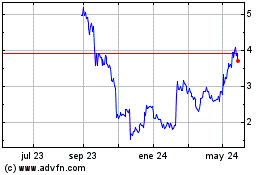

Hexatronic Group AB (TG:02H0)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

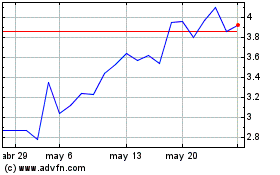

Hexatronic Group AB (TG:02H0)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024