Hexatronic Group AB (publ) Interim Report January – June 2024

Hexatronic Group AB (publ)

Interim Report

January – June 2024

Continued strong cash flow and modest recovery in Fiber

Solutions

Second quarter (April 1 – June 30,

2024)

- Net sales decreased

by 10 percent to MSEK 2,024 (2,258). Sales decreased organically by

18 percent.

- EBITA decreased by

45 percent to MSEK 222 (405), corresponding to an EBITA margin of

11.0 percent (17.9).

- Operating profit

(EBIT) decreased by 49 percent to MSEK 192 (377), corresponding to

an operating margin of 9.5 percent (16.7).

- Net result decreased

by 66 percent to MSEK 89 (259).

- Earnings per share

after dilution amounted to SEK 0.44 (1.27).

- Our new focus areas,

Harsh Environment and Data Center, continued to improve with strong

organic and acquisition-driven growth in the second

quarter.

- Leverage ratio (net

debt/EBITDA (pro forma), R12) amounted to 2.2x compared to 1.7x as

of December 31, 2023.

- Cash flow from

operating activities amounted to MSEK 221 (348).

Significant events during the quarter

- Hexatronic announced

changes in the company's executive management. Jakob Skov, Head of

focus area Harsh Environment, joined the company's executive

management as of April 2024 and in June 2024 Pernilla Grennfelt

joined Hexatronic as Head of Investor Relations and the company's

executive management.

- The AGM resolved,

for the period until the next Annual General Meeting, to re-elect

Erik Selin, Helena Holmgren and Jaakko Kivinen and to elect Magnus

Nicolin, Diego Anderson, Linda Hernström and Åsa Sundberg as

members of the Board of Directors. Magnus Nicolin was elected as

Chairman of the Board of Directors.

- Hexatronic has been

selected by NOVOS FiBER as a strategic partner in the U.S. market

for Hexatronic's end-to-end fiber-to-the-home (FTTH) solution. The

agreement initially runs for a period of three years and is

expected to generate sales of approximately 400 MSEK.

Significant events since the end of the

quarter

- No significant

events occurred after the end of the quarter.

Comments from the CEO

Continued strong cash flow and modest recovery in Fiber

Solutions

The second quarter saw sequential sales growth for the

Group of 14 percent. This is primarily attributable to a modest

recovery in the market for Fiber Solutions, positive seasonal

effects, and continued good development in our new focus areas.

Despite ongoing price pressure, our profitability improved during

the quarter, rising to 11.0% from 9.4% in the previous quarter.

This improvement is due to higher capacity utilization and the cost

savings program announced in November. Additionally, our business

continued to generate strong operating cash flow, amounting to SEK

221 million in the quarter, which corresponds to a cash conversion

of 115 percent.

Sequentially improved profitability and

growth

The second quarter of 2023 was the company's

historically strongest quarter in terms of both sales and

profitability. Compared to last year, sales decreased by 10 percent

in the second quarter. The EBITA margin for the quarter was 11.0

percent compared to 17.9 percent in the corresponding quarter last

year. However, compared with the previous quarter, sales increased

by 14 percent and EBITA by 33 percent, improving profitability by

just over 1.6 percentage points. The quarter-over-quarter

improvement in profitability was partly driven by higher volumes in

several of our factories and by the previously communicated cost

reduction program, partly offset by continued price pressure during

the quarter.

Marginally improved demand with continued price pressure

in Fiber Solutions

In the US, we saw a slight increase

in demand for both Blue Diamond Industries' duct sales and our

fiber-to-the-home (FTTH) system sales. We signed a contract worth

approximately SEK 400 million over three years with Novus Fiber,

further proving the strength of our FTTH system offering. We saw

increased price pressure for duct sales, which we believe will

continue during the year. Work on the new duct factory in Utah is

currently in the completion phase according to the previously

communicated plan.

In Europe, we saw continued weak demand with price pressure in

most markets. The markets in the UK and Germany remained weak

during the quarter.

Sales in APAC developed favourably, mainly due to a couple of

major projects.

New focus areas continue to develop

strongly

Our new focus areas, Harsh

Environment and Data Center, develop very positively, with strong

organic and acquisition-driven growth in the second quarter.

Together they represent a significant part of the Group – around 27

percent of sales during the second quarter.

Sales in Harsh Environment amounted to SEK 297 million in the

second quarter, up from SEK 153 million in the corresponding

quarter last year. The increase is mainly attributable to the

acquisition of Fibron Cable, although organic growth was also

strong.

Sales in Data Center amounted to SEK 250 million in the second

quarter, compared to SEK 190 million in the corresponding period

last year. The increase is driven by both organic growth and the

acquisition of USNet. During the quarter, we merged USNet with DCS

to form a strong data center company in the US. After the end of

the quarter, a letter of intent was signed to acquire parts of

Icelandic Endor to further broaden our offering in hardware and

services for the data center market, as well as to strengthen our

customer base and presence in Iceland, Sweden and Germany.

As we have previously communicated, our acquisition agenda

primarily focuses on strengthening our offerings and presence in

Harsh Environment and Data Center.

Continued reduction in net debt and good financial

flexibility

We continue to have good financial

flexibility for long-term value creation. Interest-bearing net debt

(i.e. excluding IFRS 16) decreased during the quarter from SEK

2,102 million to SEK 1,996 million. Over the past three quarters,

we have reduced interest-bearing net debt by approximately SEK 500

million.

The ratio of interest-bearing net debt to pro forma EBITDA on a

rolling 12-month basis, which reflects our existing bank covenants,

increased from 1.7 times to 1.9 times during the quarter. Including

IFRS 16, this corresponds to an increase from 2.0 times to 2.2

times during the quarter. The increase is due to lower

profitability in the second quarter compared with the record-strong

second quarter of the previous year.

Outlook for the second half of the year and

beyond

We expect the Harsh Environment and Data

Center markets to remain strong for the rest of the year and for a

long time to come, mainly driven by investments in defense, energy

and AI.

In line with our previous assessment, we expect the market for

Fiber Solutions to remain weak in the third quarter, with a gradual

increase in demand from the latter part of 2024. However, we expect

a return to the pre-pandemic seasonal pattern of lower activity in

the fourth and first quarters.

We continue to see strong underlying structural trends

supporting the continued deployment of fiber optic systems

globally.

The order book as of the end of the second quarter corresponded

to approximately 2.5 months of sales, where we estimate a

normalized order book is 2 to 3 months.

Finally, I would like to welcome our new members to the Board,

who bring increased international weight and important industry

expertise.

Welcome to join us on our growth journey.

Henrik Larsson Lyon

President and CEO Hexatronic Group AB (publ)

Please direct any questions to:

Henrik Larsson Lyon, President and CEO, + 46 (0)70-650 34 00

Pernilla Lindén, CFO, + 46 (0)70-877 58 32

Pernilla Grennfelt, Head of Investor Relations, +46 (0)70 290 99

55

This is information that Hexatronic Group AB (publ) is obliged

to make public pursuant to the Market Abuse Regulation and the

Securities Markets Act. The information was submitted for

publication through the agency of the contact person set out above

on July 16, 2024 at 07.00 CEST.

Hexatronic Group AB (publ) enables non-stop connectivity for

communities worldwide. We partner with customers across four

continents – from telecom operators to network owners – offering

leading-edge fiber technology and solutions for any and all

conditions. Hexatronic Group AB (publ) was founded in 1993 in

Sweden and is listed on Nasdaq Stockholm. Our global product brands

include Viper, Stingray, Raptor, InOne, and Wistom®.

- Hexatronic Group AB (publ) - Interim report Q2, 2024

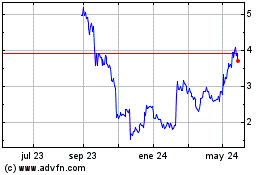

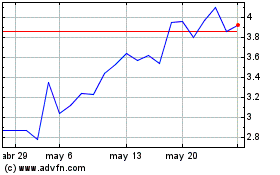

Hexatronic Group AB (TG:02H0)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Hexatronic Group AB (TG:02H0)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024