Fingerprints announces final terms for the partially guaranteed

rights issue

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY

OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, AUSTRALIA, BELARUS, HONG KONG, JAPAN, CANADA, NEW ZEALAND,

RUSSIA, SINGAPORE, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

THE RELEASE, DISTRIBUTION OR PUBLICATION WOULD BE UNLAWFUL. PLEASE

SEE "IMPORTANT INFORMATION" AT THE END OF THIS PRESS

RELEASE.

On 26 April 2024, the Board of Directors of Fingerprint Cards AB

(publ) (“Fingerprints” or the “Company”) announced that the Board

of Directors resolved to, subject to subsequent approval by the

annual general meeting on 28 May 2024, carry out a partially

guaranteed issue of new shares of series B (“B-shares”) of up to

approximately SEK 310 million with preferential rights for its

existing shareholders (the “Rights Issue”). Today, Fingerprints’

Board of Directors announce the final terms of the Rights Issue,

including the subscription price and the maximum number of shares

to be issued. The subscription price has been set to SEK 0.09 per

new B-share and shareholders in Fingerprints will receive one (1)

subscription right for each existing share held on the record date,

whereby three (3) subscription rights entitles to subscription of

seventeen (17) new B-shares in the Rights Issue.

Summary

- Shareholders in Fingerprints as of

the record date 30 May 2024 will receive one (1) subscription right

for each existing share held on the record date, whereby three (3)

subscription rights entitles to subscription of seventeen (17) new

B-shares in the Rights Issue.

- A maximum of 3,471,579,078 B-shares

will be issued, entailing an increase of the total number of

B-shares in the Company from 604,756,603 B-shares to up to

4,076,335,681 B-shares.

- The subscription price is SEK 0.09

per new B-share, corresponding to total issue proceeds of up to

approximately SEK 312.4 million before transaction costs.

- The subscription price of SEK 0.09

per share corresponds to a discount of approximately 37.5 percent

compared to the theoretical price after separation of subscription

rights, based on the closing share price of Fingerprints’ B-share

on Nasdaq Stockholm on 22 May 2024.

- The record date for the Rights Issue

is 30 May 2024 and the subscription period runs from and including

3 June 2024 up to and including 17 June 2024.

- The last day of trading in B-shares

including the right to participate in the Rights Issue is 28 May

2024.

- The Rights Issue is subject to the

approval by the annual general meeting to be held on 28 May

2024.

- The Rights Issue is subject to

subscription undertakings and guarantee commitments in a total

amount of up to SEK 275 million.

"The Rights Issue is an important part of our transformation

plan, which enables focused investments in profitable business

areas and new, fast-growing segments within the biometrics market.

We are also pleased to see HCM’s belief in Fingerprints,

demonstrated by their guarantee commitment of up to SEK 150 million

in the Rights Issue. Their approach of providing flexible and

permanent capital to high-growth companies aligns with our vision,

and their commitment underscores their confidence in our innovative

potential and long-term value. We appreciate their support as we

continue to drive sustained growth and success with a stable and

supportive partnership.” commented Adam Philpott, President &

CEO of Fingerprints.

Terms of the Rights Issue

Shareholders which on the record date 30 May 2024 are registered

as shareholders in Fingerprints in the share register maintained by

Euroclear Sweden AB, have preferential rights to subscribe for

B-shares in relation to the number of shares held on the record

date. Shareholders will receive one (1) subscription right for each

share held on the record date, whereby three (3) subscription

rights entitles to subscription of seventeen (17) new B-shares. A

total of up to 3,471,579,078 B-shares will be issued, entailing an

increase of the total number of B-shares in the Company from

604,756,603 B-shares to up to 4,076,335,681 B-shares and an

increase in the Company’s share capital from SEK 26,675,515.69 to

up to SEK 177,836,770.99. The subscription price is SEK 0.09 per

new B-share, corresponding to total issue proceeds of up to SEK

312,442,117 before deduction of transaction costs related to the

Rights Issue, assuming that the Rights Issue is fully

subscribed.

In the event that not all B-shares are subscribed for by

exercising subscription rights, the Company’s Board of Directors

shall, within the maximum amount of the Rights Issue, decide on the

allotment of B-shares subscribed for without subscription rights.

In such cases, allotment of new B-shares shall be carried out in

accordance with the following:

- Firstly, allotment of B-shares shall

be granted to those who have subscribed for B-shares by exercising

subscription rights, regardless if the subscriber were registered

as shareholder on the record date on 30 May 2024 or not and, in the

event of over-subscription, pro rata in relation to their

subscription by exercising subscription rights, and, to the extent

this is not possible, by drawing lots.

- Secondly, allotment of B-shares

shall be granted to others who have subscribed for B-shares without

exercising subscription rights, and in the event of

over-subscription, pro rata in relation to the subscribed amount,

and to the extent this is not possible, by drawing lots.

- Thirdly, allotment of B-shares, that

does not constitute FDI Shares (as defined below), shall as

applicable be granted to a party who have guaranteed part of the

Rights Issue with allotment before other guarantors in accordance

with separate agreement with the Company (“Primary Subscription

Guarantee”).

- Fourthly, allotment of B-shares,

that does not constitute FDI Shares (as defined below), shall as

applicable be granted to the parties who, subordinated to the

Primary Subscription Guarantee, guarantees part of the Rights

Issue, pro rata in relation to such guarantee commitments in

accordance with separate agreement with the Company.

- Ultimately, as applicable, allotment

of B-shares that constitutes FDI Shares (as defined below) shall be

granted to the relevant party who guarantees part of the Rights

Issue if and when that guarantor has obtained a positive FDI

Decision (as defined below).

Allotment of B-shares in the Rights Issue that would entail that

a party who guarantees part of the Rights Issue gains control of

ten (10) per cent or more of the votes in the Company following the

Rights Issue requires a prior decision from the Inspectorate of

Strategic Products (“ISP”) in accordance with the Screening of

Foreign Direct Investment Act (the “Swedish FDI Act”) (Sw. lag

(2023:560) om granskning av utländska direktinvesteringar), and, if

applicable, any other equivalent body pursuant to legislation in

any other jurisdiction, to approve the investment or leave the

application therefore without remark (“FDI Decision”). Such

B-shares in the Rights Issue which, if granted to a party who

guarantees part of the Right Issue, would require a FDI Decision

and such FDI Decision has not been obtained at the time of granting

are referred to as “FDI Shares”.

Some of the Company’s shareholders (including members of the

Board of Directors and executive management) have undertaken to

subscribe for new B-shares for a total amount of approximately SEK

1.5 million in the Rights Issue. Furthermore, in a display of

continued support of the Company, an entity managed by Heights

Capital Management, Inc. (“HCM”) have entered into a guarantee

commitment consisting of a so-called top guarantee in an amount of

up to SEK 50 million and, subordinated to HCM’s top guarantee, a

so-called bottom guarantee in an amount of up to SEK 100 million.

In addition, certain other external investors have, subordinated to

HCM’s top guarantee, entered into bottom guarantee commitments

which together with HCM’s bottom guarantee amounts to up to

approximately SEK 225 million. If the Rights Issue is subscribed

and paid for in an amount between SEK 225 million and SEK 275

million, the top guarantee covers the subscription and payment of

B-shares in the Rights Issue up to SEK 275 million and if the

Rights Issue is subscribed and paid for in an amount under SEK 225

million, the bottom guarantees covers the subscription of and

payment for B-shares in the Rights Issue up to SEK 225 million. No

guarantee commitment covers the subscription of and payment for

B-shares in the Rights Issue in excess of SEK 275 million.

Accordingly, the Rights Issue is covered by subscription

undertakings and guarantee commitments in an aggregate amount of up

to SEK 275 million.

The record date for determining which shareholders are entitled

to subscribe for new B-shares is 30 May 2024. The B-shares are

traded including right to participate in the Rights Issue up to and

including 28 May 2024. The subscription period is expected to run

from and including 3 June 2024 up to and including 17 June 2024. In

the event that any guarantee commitment will require the

subscription and payment of FDI Shares, there will be a separate

and longer subscription and payment period in respect of such FDI

Shares which may run up until 31 August 2024. Trading in

subscription rights is expected to take place on Nasdaq Stockholm

from and including 3 June 2024 up to and including 12 June 2024,

and trading in paid subscribed B-shares (Sw. betald tecknad aktie

“BTA”) is expected to occur from and including 3 June 2024 up to

and including 27 June 2024.

The Company’s Board of Directors will apply for admission to

trading of the new B-shares on Nasdaq Stockholm. First day of

trading is expected to occur on or about 3 July 2024.

Shareholders not participating in the Rights Issue will be

subject to a dilutive effect corresponding to approximately 85.0

percent of the number of shares and approximately 83.6 percent of

the number of votes upon full subscription in the Rights Issue.

However, the shareholders have the possibility to fully or partly

compensate themselves financially for this dilutive effect by

selling their subscription rights.

Further and as announced by way of press release on 26 April

2024, the Swedish Securities Council (Sw. Aktiemarknadsnämnden)

granted one of the external guarantors, HCM, an exemption from the

mandatory bid obligations under the Swedish Act on Public Takeovers

on the Stock Market (Sw. lagen (2006:451) om offentliga

uppköpserbjudanden på aktiemarknaden). The exemption is however

conditional upon that (i) the Company’s shareholders prior to the

annual general meeting, are informed about the total holding of

shares and votes that HCM may receive as a result of its guarantee

commitment (if fully utilised) and (ii) the Rights Issue is

approved by the annual general meeting with at least two thirds of

both the votes cast and shares represented at the meeting,

excluding any shares held and represented by HCM. Against the above

and in accordance with the final terms of the Rights Issue, HCM may

receive a total of 1,666,666,666 shares and votes in Fingerprints

if their guarantee commitment is fully utilised, which if the

Rights Issue is fully subscribed corresponds to 40.8 percent of the

number of shares in the Company and 40.1 percent of the number of

votes in the Company following the completion of the Rights

Issue.1

The Rights Issue is subject to the approval by the annual

general meeting to be held on 28 May 2024. The notice to the annual

general meeting is available at Fingerprints’ website,

fingerprints.com/agm2024.

Preliminary timetable

|

Annual general meeting |

28 May 2024 |

|

Last day of trading in shares including right to receive

subscription rights |

28 May 2024 |

|

Planned publishing date of the prospectus |

29 May 2024 |

|

First day of trading in shares excluding right to receive

subscription rights |

29 May 2024 |

|

Record date for the Rights Issue |

30 May 2024 |

|

Trading in subscription rights |

3 June – 12 June 2024 |

|

Subscription period |

3 June – 17 June 2024 |

|

Trading in paid subscribed B-shares (BTA) |

3 June – 27 June 2024 |

|

Expected announcement of the outcome in the Rights Issue |

18 June 2024 |

Prospectus

A prospectus regarding the Rights Issue will be published prior

to the record date for the Rights Issue on Fingerprints’ website,

fingerprints.com and on Pareto Securities AB’s website,

www.paretosec.com.

Advisers

Pareto Securities acts as Sole Manager and Bookrunner in

connection with the Rights Issue. Gernandt & Danielsson

Advokatbyrå KB acts as legal advisor to the Company in connection

with the Rights Issue.

For more information, please contact: Adam

Philpott, CEO

Investor Relations:+46(0)10-172 00

10investrel@fingerprints.com

Press:+46(0)10-172 00 20press@fingerprints.com

This is the type of information that Fingerprint Cards AB (publ)

is obligated to disclose pursuant to the EU’s Market Abuse

Regulation. The information was submitted for publication, through

the agency of the contact person set out above, on 23 May 2024 at

07:30 am CEST.

Important information

This press release does not contain and does not constitute an

offer to acquire, subscribe or otherwise trade in shares,

subscription rights, BTAs, convertibles or other securities in

Fingerprints. The offer to relevant persons regarding the

subscription of shares in Fingerprints will only be made through

the prospectus that Fingerprints will publish on its website after

approval and registration with the Swedish Financial Supervisory

Authority (Sw. Finansinspektionen).

The information in this press release may not be disclosed,

published or distributed, directly or indirectly, in or into the

United States (including its territories and possessions),

Australia, Japan, Canada, Hong Kong, New Zealand, Singapore or

South Africa or any other jurisdiction where distribution or

publication would be illegal or require registration or other

measures than those that follow from Swedish law. Actions that

violate these restrictions may constitute a violation of applicable

securities laws.

No shares, warrants, BTAs, convertibles or other securities have

been registered, and no shares, warrants, BTAs, convertibles or

other securities will be registered under the United States

Securities Act of 1933 as currently amended (“Securities Act”) or

the securities legislation of any state or other jurisdiction of

the United States and no shares, warrants, BTAs, convertibles or

other securities may be offered, sold, or otherwise transferred,

directly or indirectly, within or into the United States, except

under an available exemption from, or in a transaction not subject

to, the registration requirements under the Securities Act and in

compliance with the securities legislation in the relevant state or

any other jurisdiction of the United States.

In all EEA Member States ("EEA"), other than Sweden, Denmark,

Finland and Norway, this press release is intended for and is

directed only to qualified investors in the relevant Member State

as defined in the Regulation (EU) 2017/1129 (together with

associated delegated regulations and implementing regulations, the

“Prospectus Regulation”), i.e. only to those investors who can

receive the offer without an approved prospectus in such EEA Member

State.

In the United Kingdom, this press release is directed and

communicated only to persons who are qualified investors as defined

in Article 2(e) of the Prospectus Regulation (as incorporated into

domestic law in the United Kingdom) who are (i) persons who fall

within the definition of “professional investors” in Article 19(5)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (as amended) (“the Regulation”), or (ii)

persons covered by Article 49(2)(a) - (d) in the Regulation, or

(iii) persons to whom the information may otherwise lawfully be

communicated (all such persons referred to in (i), (ii) and (iii)

above are collectively referred to as “Relevant Persons”).

Securities in the Company are only available to, and any

invitation, offer or agreement to subscribe, purchase or otherwise

acquire such securities will only be processed in respect of

Relevant Persons. Persons who are not Relevant Persons should not

act based on or rely on the information contained in this press

release.

The Company considers that it carries out protection-worthy

activities under the Foreign Direct Investment Screening Act (the

“Swedish FDI Act”) (Sw. lag (2023:560) om granskning av utländska

direktinvesteringar). According to the Swedish FDI Act, the Company

must inform presumptive investors that the Company’s activities may

fall under the regulation and that the investment may be subject to

mandatory filing. If an investment is subject to mandatory filing,

it must prior to its completion, be filed with the Inspectorate of

Strategic Products (the “ISP”). An investment may be subject to

mandatory filing if i) the investor, a member of the investor’s

ownership structure or a person on whose behalf the investor is

acting would, after the completion of the investment, hold votes in

the Company equal to, or exceeding any of the thresholds of 10, 20,

30, 50, 65 or 90 per cent of the total number of votes in the

Company, ii) the investor would, as a result of the investment,

acquire the Company, and the investor, a member of the investor’s

ownership structure or a person on whose behalf the investor is

acting, would, directly or indirectly, hold 10 per cent or more of

the total number of votes in the Company, or iii) the investor, a

member of the investor’s ownership structure or a person on whose

behalf the investor is acting, would acquire, as a result of the

investment, direct or indirect influence on the management of the

Company. The investor may be imposed an administrative sanction if

an investment that is subject to mandatory filing is carried out

before the ISP has either i) decided to take no action, or ii)

authorised the investment. The investor may be imposed an

administrative sanction charge if a mandatory filing investment is

carried out before the ISP either i) decided to leave the

notification without action or ii) approved the investment. Each

shareholder should consult an independent legal adviser on the

possible application of the Swedish FDI Act in relation to the

Rights Issue for the individual shareholder.

This announcement does not constitute an investment

recommendation. The price and value of securities and any income

from them can go down as well as up and you could lose your entire

investment. Past performance is not a guide to future performance.

Information in this announcement cannot be relied upon as a guide

to future performance.

Forward-looking statements

Matters discussed in this press release may contain

forward-looking statements. Such statements are all statements that

are not historical facts and contain expressions such as

“believes”, “expects”, “anticipates”, “intends”, “estimates”,

“will", “may”, “continues”, “should” and other similar expressions.

The forward-looking statements in this press release are based on

various assumptions, which in several cases are based on additional

assumptions. Although Fingerprints believes these assumptions were

reasonable when made, such forward-looking statements are subject

to known and unknown risks, uncertainties, contingencies and other

material factors that are difficult or impossible to predict and

beyond its control. Such risks, uncertainties, contingencies and

material factors could cause actual results to differ materially

from those expressed or implied in this communication through the

forward-looking statements. The information, perceptions and

forward-looking statements contained in press release speak only as

at its date, and are subject to change without notice. Fingerprints

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or other circumstances, except for when it is required by law or

other regulations. Accordingly, investors are cautioned not to

place undue reliance on any of these forward-looking

statements.

Information to distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended (“MiFID II”); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the “MiFID

II Product Governance Requirements”), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any “manufacturer” (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the shares in Fingerprints have been subject to a product approval

process, which has determined that such shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the “Target Market Assessment”). Notwithstanding the

Target Market Assessment, Distributors should note that: the price

of the shares in Fingerprints may decline and investors could lose

all or part of their investment; the shares in Fingerprints offer

no guaranteed income and no capital protection; and an investment

in the shares in Fingerprints is compatible only with investors who

do not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Rights

Issue.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the shares in

Fingerprints.

Each distributor is responsible for undertaking its own target

market assessment in respect of the shares in Fingerprints and

determining appropriate distribution channels.

About Fingerprints Fingerprint Cards AB

(Fingerprints) – the world’s leading biometrics company, with its

roots in Sweden. We believe in a secure and seamless universe,

where you are the key to everything. Our solutions are found in

hundreds of millions of devices and applications, and are used

billions of times every day, providing safe and convenient

identification and authentication with a human touch. For more

information visit our website, read our blog, and follow

us on Twitter. Fingerprints is listed on Nasdaq Stockholm

(FING B).

1 Based on HCM’s shareholding as of 22 May 2024 and the maximum

number of shares that HCM may receive as a result of its guarantee

commitment (if fully utilised).

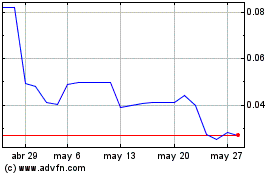

Fingerprint Cards AB (TG:FPQ1)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

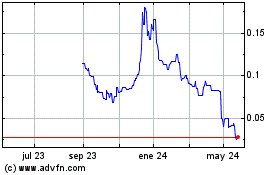

Fingerprint Cards AB (TG:FPQ1)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024