This press release contains forward-looking

information that is based upon assumptions and is subject to risks

and uncertainties as indicated in the cautionary note contained

within this press release.

Dream Unlimited Corp. (TSX: DRM) (“Dream”, “the Company” or

“we”) today announced its financial results for the three and

twelve months ended December 31, 2021 (“fourth quarter”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220222006088/en/

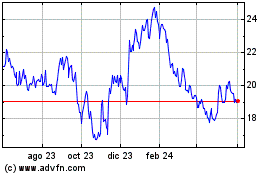

Breakdown of Assets Under Management by

Asset Class and Geography (Graphic: Business Wire)

“2021 has been an exceptional year for Dream across all lines of

business,” said Michael Cooper, Chief Responsible Officer. “Our

western Canada land and housing business had a very profitable year

and 2022 has significant pre-sales leading to the expectation of

another good year, our development team is making great progress on

our developments and anticipated profits are as planned, and with

our innovative impact focus, we are accessing more opportunities

and working closely with the government on some of their highest

priorities. Our asset management business also had an outstanding

year with the introduction of our private asset management

business, which now manages about $1.4 billion of equity from

institutions and high net worth individuals. We have also seen

significant growth across our public vehicles, with Dream

Industrial REIT’s robust acquisition and development pipelines and

Dream Impact Trust’s acquisitions of impact investments. With

various developments nearing completion over the next two years,

including portions of our impact investments at Zibi and the West

Don Lands, we enter 2022 well-positioned to continue developing and

acquiring best in class assets in great markets.”

As of December 31, 2021, assets under management(1) were $15

billion, up $5 billion since 2020, with fee earning assets under

management(1) of $9 billion as of year end, up from $5 billion at

the end of 2020. We have significantly expanded our assets under

management in the past two years, increasing our geographic

diversification outside of Canada from 7% in 2019 to 29% in 2021

while expanding our investments in the industrial and residential

rental asset classes from 31% to 59% over the same period. A

breakdown of assets under management by asset class and geography

as of December 31, 2021, 2020 and 2019 is included above.

As at December 31, 2021 our debt to total assets ratio(1) was

37% and we ended the year with $275.6 million in available

liquidity(2).

A summary of our consolidated results for the three and twelve

months ended December 31, 2021 is included in the table below.

For the three months ended

December 31,

For the twelve months ended

December 31,

(in thousands of Canadian dollars, except

per share

amounts)

2021

2020

2021

2020

Revenue

$

150,122

$

48,639

$

325,922

$

347,623

Net margin

$

34,685

$

5,245

$

60,566

$

72,320

Net margin (%)(1)

23.1%

$

10.8%

18.6%

20.8%

Earnings (loss) before income taxes

$

95,349

$

(31,181)

$

125,875

$

197,620

Earnings (loss) for the period(3)

$

80,317

$

(32,315)

$

110,661

$

159,638

Basic earnings (loss) per share(3)

$

1.87

$

(0.70)

$

2.52

$

3.37

Diluted earnings (loss) per share

$

1.81

$

(0.70)

$

2.46

$

3.31

December 31, 2021

December 31, 2020

Total assets

$

3,488,674

$

2,844,373

Total liabilities

$

2,066,461

$

1,437,761

Shareholders’ equity (excluding

non-controlling interest)(4)

$

1,422,213

$

1,391,646

Total issued and outstanding shares

42,836,031

45,011,928

Earnings before income taxes after adjusting for fair value

adjustments taken on Dream Impact Trust units held by other

unitholders(1) for the three months ended December 31, 2021 was

$99.1 million, an increase of $70.2 million relative to the prior

year. The change is primarily due to higher lot sales in Western

Canada, fair value gains on the Company’s investment properties

portfolio and increased fees earned from our growing asset

management platform. Higher earnings were also driven by the growth

of our GTA multi-family rental portfolio, with 1,140 units (at

100%) acquired in the second half of 2021.

Earnings before income taxes after adjusting for fair value

adjustments taken on Dream Impact Trust units held by other

unitholders(1) for the twelve months ended December 31, 2021 was

$150.9 million, up from $119.9 million in the prior year. Current

year pre-tax earnings were primarily driven by the gains across our

multi-family rental portfolio, higher earnings from the Company’s

equity accounted investments, including Dream Office REIT,

increased earnings from our asset management platform and improved

results from Arapahoe Basin. The comparative year results include

the gain on sale of our renewable power portfolio, the sale of 480

acres at Glacier Ridge and occupancies at our Canary Block,

Riverside Square, BT Towns and Zibi developments, with limited

comparable activity in 2021.

Earnings before income taxes for the three and twelve months

ended December 31, 2021 was $95.3 million and $125.9 million,

respectively due to the aforementioned operational results in

addition to the fair value changes in Dream Impact Trust units held

by other unitholders.

Highlights: Recurring Income

- In the fourth quarter, revenue and net operating income(1)

derived from recurring income sources increased to $35.9 million

and $10.0 million, respectively, due to higher earnings from our

asset management platform, Toronto investment properties and our

recreational properties portfolio. Included in results for the

quarter is $2.4 million in net operating income(1) from seven

multi-family rental properties in the GTA acquired in 2021.

- In the year ended December 31, 2021, our recurring income

segment generated revenue and net operating income(1) of $116.8

million and $40.4 million, respectively, up by $24.5 million and

$13.2 million over the prior year, primarily due to increased

earnings from our asset management platform and Toronto investment

properties, in addition to increased visitors and a full year of

operations at Arapahoe Basin.

- Included in revenue for the year ended December 31, 2021 was

$22.7 million in fees earned from Dream Industrial REIT, up from

$11.3 million in the prior year, largely driven by $2.4 billion in

acquisitions in 2021, which generated acquisition fees and higher

base fees for the Company. Dream Industrial REIT has an additional

$400 million in acquisitions closed, under contract or in exclusive

negotiations in 2022. In 2021, Dream Industrial REIT raised over

$2.2 billion in capital through equity issues and unsecured

debentures. We have also raised nearly $1.4 billion in capital to

date for our private asset management business, inclusive of Dream

Impact Fund, a U.S. apartment portfolio with a buy/fix/sell

strategy, and our U.S. industrial fund. Our asset management team

remains focused on sourcing, managing and growing both our public

and private platform through 2022 and our target is to raise an

additional $1 billion in private equity this year.

- In the year ended December 31, 2021, Arapahoe Basin generated

Adjusted EBITDA(1) of $10.7 million, up from $2.3 million in the

prior year, largely due to reduced social distancing measures and

our investment in summer activities including the Aerial Adventure

Park, the Via Ferrata climbing course, various hiking and biking

trails, disc golf, events and specialty dining. Similarly, in the

year ended December 31, 2021, Arapahoe Basin generated net earnings

of $6.5 million, an increase of $8.3 million over 2020.

- Results for 2021 include $62.1 million in equity earnings on

our 33% interest in Dream Office REIT, up from $36.2 million over

the comparative period. Improved results were driven by fair value

gains at Dream Office REIT and through the REIT’s 10.5% interest in

Dream Industrial REIT, in addition to increased operating income at

Dream Industrial REIT from recent acquisitions. As at February 18,

2022, the Company had a 29% interest in Dream Impact Trust and a

35% interest in Dream Office REIT, inclusive of interests held by

Dream’s Chief Responsible Officer.

- Across the Dream group platform, which includes assets held

through the Company, Dream Impact Trust, Dream Impact Fund and

Dream Office REIT, we have nearly 5,300 units and 11.5 million sf

of gross leasable area (“GLA”) in stabilized rental, retail and

commercial properties, in addition to our recreational properties.

Over the next four years, we expect to add an additional 2,500

units and 2.4 million sf of rental, retail and commercial GLA to

our recurring income portfolio, including West Don Lands Blocks 8

and 3/4/7, Canary Block 10, and several buildings at Zibi.

Highlights: Development

- In the three months ended December 31, 2021, we generated

revenue and net margin of $114.2 million and $26.7 million,

respectively, compared to revenue of $28.9 million and net margin

of $0.6 million in the comparative period. The improved results

were driven by higher lot sales in Western Canada, including our

first sales at Alpine Park in Calgary, our most valuable land

holding in Western Canada.

- Year-to-date, revenue and net margin for the development

segment was $209.2 million and $27.1 million, respectively, down by

$46.2 million and $24.6 million from 2020, which included the sale

of 480 acres at Glacier Ridge and condominium occupancies at

Riverside Square, BT Towns and Kanaal at Zibi.

- We achieved 959 lot sales and 119 housing occupancies in 2021,

up from 335 lot sales and 107 housing occupancies in 2020. As of

February 18, 2022, we have secured commitments for 794 lots, 19

acres and 69 houses across our communities in Saskatchewan and

Alberta that we expect to contribute to earnings in 2022.

- Across the Dream group platform, we have approximately 4.0

million sf of GLA in retail or commercial properties and over

20,000 condominium or purpose-built rental units (at the project

level) in our development pipeline. For further details on our

development pipeline, refer to the “Summary of Dream’s Assets &

Holdings” section of our MD&A.

Highlights: Impact Investing

- Dream has developed a well-defined impact strategy that can be

applied not only to Dream Impact Trust and Dream Impact Fund, but

across our various business lines and our REITs. Dream released its

inaugural impact report and disclosure statement as a signatory to

the Operating Principles for Impact Management in May 2021. On

December 1, 2021, we have made a public commitment to achieving net

zero greenhouse gas emissions by 2035, 15 years in advance of the

Paris Agreement, with Arapahoe Basin targeting net zero by 2025.

Both Dream Impact Trust and Dream Office REIT received five-star

GRESB ratings this year, and 87% of Dream Office REIT’s portfolio

is WELL Health-Safety certified. We also announced our Social

Procurement Program on November 8, 2021, with quantifiable supply

chain targets to be met by 2025.

- To support our net zero targets, Dream has pursued creative

financing arrangements across our platform, including a $136.6

million commitment from the Canada Infrastructure Bank to retrofit

19 buildings in Ontario and Saskatchewan, two green bond closings

by Dream Industrial REIT raising $650 million to finance eligible

green projects, $189 million in green loans relating to Canary

Block 10 (Dream’s interest in the Indigenous Hub in Toronto), a $30

million convertible debenture offering by Dream Impact Trust used

to finance impact investments, and a $23 million in financing for

Zibi Community Utility secured through the Federation of Canadian

Municipalities Green Municipal Fund.

- On December 1, 2021, Canada Housing Mortgage Corporation

(“CMHC”) announced the MLI Select program, which is designed to

preserve and create affordable, climate-compatible multi-unit

residential housing. Through collaborative engagement, Dream

supported CMHC as they designed this innovative insured financing

product.

- On January 22, 2022, the National Capital Commissions (“NCC”)

announced in partnership with CMHC that Dream was selected to

develop the first phase of the Building LeBreton project in Ottawa,

Ontario. Dream LeBreton will be Canada’s largest residential

zero-carbon project with 601 residential rental units, 40% of which

will be affordable and 31% will be accessible. The site is adjacent

to a light-rail station, various pedestrian pathways and our

34-acre Zibi development.

- On February 15, 2022, Waterfront Toronto announced that Dream

and Great Gulf Group were selected to develop the Quayside site in

downtown Toronto. Quayside is a 3.4 million sf all-electric, zero

carbon community which will include over 800 affordable housing

units, a two acre forested green space, and a significant urban

farm atop one of Canada’s largest residential mass timber

buildings.

- To further our commitment to impact in our communities, we

recently announced the Dream Community Foundation that will offer

and support the creation of affordable housing and invest in

programs and services aimed at supporting our most vulnerable

residents. The foundation will initially be funded by the Cooper

family, through a pledge of $25 million over 5 years, with third

party donations and/or government subsidies to be assessed in the

future. The foundation aims to provide programming and donations to

build community amongst tenants and local neighbourhoods while

allowing our public vehicles to earn market returns on their impact

investments.

Share Capital & Return to Shareholders

- In the year ended December 31, 2021, 2.4 million Subordinate

Voting Shares were purchased for cancellation by the Company at an

average price of $25.29 under a normal course issuer bid ("NCIB")

for total proceeds of $61.4 million (year ended December 31, 2020 -

7.7 million Subordinate Voting Shares at an average price of

$22.07, inclusive of 5.0 million Subordinate Voting Shares

purchased for cancellation under a substantial issuer bid).

Subsequent to year end, 0.3 million Subordinate Voting Shares were

purchased for cancellation by the Company under the NCIB at an

average price of $39.31.

- Dividends of $4.3 million and $13.5 million were declared and

paid on its Subordinate Voting Shares and Class B Shares in the

three and twelve months ended December 31, 2021, respectively

(three and twelve months ended December 31, 2020 - $2.7 million and

$11.2 million, respectively).

Select financial operating metrics for Dream’s segments for the

three and twelve months ended December 31, 2021 are summarized in

the table below.

Three months ended December

31, 2021

(in thousands of dollars except

outstanding share and per share amounts)

Recurring income

Development

Corporate and other

Total

Revenue

$

35,883

$

114,239

$

—

$

150,122

% of total revenue

23.9%

76.1%

—%

100.0%

Net margin

$

7,996

$

26,689

$

—

$

34,685

Net margin (%)(1)

22.3%

23.4%

n/a

23.1%

Twelve months ended December

31, 2021

(in thousands of dollars except

outstanding share and per share amounts)

Recurring income

Development

Corporate and other

Total

Revenue

$

116,766

$

209,156

$

—

$

325,922

% of total revenue

35.8%

64.2%

—%

100.0%

Net margin

$

33,502

$

27,064

$

—

$

60,566

Net margin (%)(1)

28.7%

12.9%

n/a

18.6%

As at December 31,

2021

Segment assets

$

1,885,019

$

1,575,453

$

28,202

$

3,488,674

Segment liabilities

$

739,363

$

558,870

$

768,228

$

2,066,461

Segment shareholders’ equity

$

1,145,656

$

1,016,583

$

(740,026)

$

1,422,213

Shareholders’ equity per share(5)

$

26.75

$

23.73

$

(17.28)

$

33.20

Three months ended December 31,

2020

(in thousands of dollars except

outstanding share and per share amounts)

Recurring income

Development

Corporate and other

Total

Revenue

$

19,758

$

28,881

$

—

$

48,639

% of total revenue

40.6%

59.4%

—%

100.0%

Net margin

$

4,597

$

648

$

—

$

5,245

Net margin (%)(1)

23.3%

2.2%

n/a

10.8%

Twelve months ended December 31,

2020

(in thousands of dollars except

outstanding share and per share amounts)

Recurring income

Development

Corporate and other

Total

Revenue

$

92,229

$

255,394

$

—

$

347,623

% of total revenue

26.5%

73.5%

—%

100.0%

Net margin

$

20,637

$

51,683

$

—

$

72,320

Net margin (%)(1)

22.4%

20.2%

n/a

20.8%

As at December 31, 2020

Segment assets

$

1,118,871

$

1,560,924

$

164,578

$

2,844,373

Segment liabilities

$

313,274

$

452,100

$

672,387

$

1,437,761

Segment shareholders’ equity

$

805,597

$

1,093,858

$

(507,809)

$

1,391,646

Shareholders’ equity per share(5)

$

17.90

$

24.30

$

(11.28)

$

30.92

Other Information

Information appearing in this press release is a select summary

of results. The financial statements and MD&A for the Company

are available at www.dream.ca and on www.sedar.com.

Conference Call

Senior management will host a conference call on February 23,

2022 at 8:00 am (ET). To access the call, please dial

1-888-465-5079 in Canada or 416- 216-4169 elsewhere and use

passcode 9643 707#. To access the conference call via webcast,

please go to Dream’s website at www.dream.ca and click on Calendar

of Events in the News and Events section. A taped replay of the

conference call and the webcast will be available for 90 days.

About Dream Unlimited Corp.

Dream is a leading developer of exceptional office and

residential assets in Toronto, owns stabilized income generating

assets in both Canada and the U.S., and has an established and

successful asset management business, inclusive of $15 billion of

assets under management across three Toronto Stock Exchange ("TSX")

listed trusts, our private asset management business and numerous

partnerships. We also develop land and residential assets in

Western Canada. Dream expects to generate more recurring income in

the future as its urban development properties are completed and

held for the long term. Dream has a proven track record for being

innovative and for our ability to source, structure and execute on

compelling investment opportunities. A comprehensive overview of

our holdings is included in the "Summary of Dream's Assets and

Holdings" section of our MD&A.

Non-GAAP Measures and Other Disclosures

In addition to using financial measures determined in accordance

with IFRS, we believe that important measures of operating

performance include certain financial measures that are not defined

under IFRS. Throughout this press release, there are references to

certain non-GAAP financial measures and other specified financial

measures, including those described below, which management

believes are relevant in assessing the economics of the business of

Dream. These performance and other measures are not standardized

financial measures under IFRS, and may not be comparable to similar

measures disclosed by other issuers. However, we believe that they

are informative and provide further insight as supplementary

measures of financial performance, financial position or cash flow,

or our objectives and policies, as applicable.

Non-GAAP Financial Measures

“Adjusted EBITDA” represents net income for the period

adjusted for interest expense on debt; amortization and

depreciation; share of earnings from equity accounted investments;

and net current and deferred income tax expense (recovery). This

non-IFRS measure is an important measure used by the Company in

evaluating the performance of divisions within our recurring income

segment.

Year ended December 31,

2021

Asset management

Stabilized properties

Arapahoe Basin

Dream Impact Trust &

consolidation and fair value adjustments(1)

Total recurring income

Net earnings

$

92,946

$

17,054

$

6,452

$

20,671

$

137,123

Less: Interest expense

(135)

(8,345)

(120)

(3,514)

(12,114)

Less: Taxes

-

-

-

-

-

Less: Depreciation and amortization

-

(1,068)

(4,111)

-

(5,179)

Less: Share of earnings from equity

accounted investments

75,791

5,994

(46)

1,173

82,912

Adjusted EBITDA

$

17,290

$

20,473

$

10,729

$

23,012

$

71,504

Year ended December 31, 2020

Asset management

Stabilized properties and

renewables

Arapahoe Basin

Dream Impact Trust &

consolidation and fair value adjustments(1)

Total recurring income

Net earnings

$

40,529

$

25,235

$

(1,853)

$

10,281

$

74,282

Less: Interest expense

(126)

(6,294)

(191)

(3,095)

(9,706)

Less: Taxes

-

-

-

-

-

Less: Depreciation and amortization

-

(1,134)

(3,916)

-

(5,050)

Less: Share of earnings from equity

accounted investments

31,944

34,048

(48)

(143)

65,801

Adjusted EBITDA

$

8,711

$

(1,295)

$

2,302

$

13,519

$

23,237

"Consolidation and fair value adjustments" represents

certain IFRS adjustments required to reconcile Dream standalone and

Dream Impact Trust results to the consolidated results as at and

for the years ended December 31, 2021 and 2020. Consolidation and

fair value adjustments relate to business combination adjustments

on acquisition of Dream Impact Trust on January 1, 2018 and related

amortization, elimination of intercompany balances including the

investment in Dream Impact Trust units, adjustments for co-owned

projects, fair value adjustments to the Dream Impact Trust units

held by other unitholders, and deferred income taxes.

"Earnings before income taxes after adjusting for fair value

on Dream Impact Trust units held by other unitholders"

represents the Company's pre-tax earnings excluding the impact from

the volatility of Dream Impact Trust's share price.

For the three months ended

December 31,

For the year ended December

31,

2021

2020

2021

2020

Earnings before income taxes

$

95,349

$

(31,181)

$

125,875

$

197,620

Less: Adjustments related to Dream Impact

Trust units

(3,782)

(60,130)

(25,019)

77,764

Earnings before income taxes after

adjusting for fair value on Dream Impact Trust units held by other

unitholders

$

99,131

$

28,949

$

150,894

$

119,856

“Net operating income" represents revenue less direct

operating costs and is equal to gross margin as per Note 36 of the

consolidated financial statements. Net operating income excludes

general, administrative and overhead expenses, and amortization,

which are included in net margin per Note 36 of the consolidated

financial statements. This non-GAAP measure is an important measure

used to assess the profitability of the Company’s recurring income

segment. Net operating income for the recurring income segment for

the year ended December 31, 2021 and 2020 is calculated as

follows:

For the three months ended

December 31,

For the year ended December

31,

2021

2020

2021

2020

Revenue

$

35,883

$

19,758

$

116,766

$

92,229

Less: Direct operating costs

(25,921)

(13,491)

(76,351)

(65,007)

Less: Selling, marketing, depreciation and

other indirect costs

(1,966)

(1,670)

(6,913)

(6,585)

Net margin

$

7,996

$

4,597

$

33,502

$

20,637

Add: Depreciation

1,380

1,159

4,907

3,544

Add: General and administrative

expenses

586

511

2,006

3,041

Net operating income

$

9,962

$

6,267

$

40,415

$

27,222

Supplementary and Other Financial

Measures

"Assets under management (“AUM”)" is the respective

carrying value of gross assets managed by the Company on behalf of

its clients, investors or partners under asset management

agreements, development management agreements and/or management

services agreements at 100% of the client's total assets. All other

investments are reflected at the Company's proportionate share of

the investment's total assets without duplication. Assets under

management is a measure of success against the competition and

consists of growth or decline due to asset appreciation, changes in

fair market value, acquisitions and dispositions, operations gains

and losses, and inflows and outflows of capital.

"Available liquidity" represents Dream's standalone

corporate cash and debt facilities to cover the Company’s capital

requirements including acquisitions. This financial measure is used

by the Company to forecast and plan to hold adequate amounts of

available liquidity allow for the Company to settle obligations as

they come due.

December 31, 2021

December 31, 2020

Dream standalone corporate level cash

$

2,135

$

42,010

Operating line availability

163,498

252,830

Margin loan availability

110,000

110,000

Housing facilities availability

-

21,296

Available liquidity

$

275,633

$

426,136

"Debt to total assets ratio" represents the Company's

financial leverage and is calculated as debt as a percentage of

total assets per the consolidated financial statements.

“Fee earning assets under management” represents assets

under management that are managed under contractual arrangements

that entitle the Company to earn asset management revenue

calculated as the total of: (i) 100% of the purchase price of

client properties, assets and/or indirect investments subject to

asset management agreements; (ii) 100% of the carrying value of

gross assets of the underlying development project subject to

development management agreements; and (iii) 100% of the carrying

value of specific Dream Office REIT redevelopment properties

subject to a development management addendum under the shared

services agreement with Dream Office REIT, without duplication.

“Net margin %” is an important measure of operating

earnings in each business segment of Dream and represents net

margin as a percentage of revenue.

Forward-Looking Information

This press release may contain forward-looking information

within the meaning of applicable securities legislation, including,

but not limited to, statements regarding our objectives and

strategies to achieve those objectives; our beliefs, plans,

estimates, projections and intentions, and similar statements

concerning anticipated future events, future growth, expected net

proceeds from sales or transactions, results of operations,

performance, business prospects and opportunities, acquisitions or

divestitures, tenant base, future maintenance and development plans

and costs, capital investments, financing, the availability of

financing sources, income taxes, vacancy and leasing assumptions,

litigation and the real estate industry in general; as well as

specific statements in respect of our development plans and

proposals for current and future projects, including projected

sizes, density, timelines, uses and tenants; anticipated current

and future unit sales and occupancies and resulting revenue; our

acquisition and development pipeline; the expansion and growth of

our asset management business and private asset management

division; expectations regarding raising private equity funds in

2022; our achievement of supply chain targets by 2025 in line with

our social procurement program; expectations regarding the sale of

assets; the expectation that our income generating assets will grow

over time; expectations regarding our sustainability targets,

including in respect of Dream LeBreton becoming Canada’s largest

residential zero-carbon project; expectations regarding our

reduction of greenhouse gas emissions, including in respect of our

commitment to achieve net zero greenhouse gas emissions by 2035;

expectations regarding the Dream Community Foundation’s activities

and funding; and our overall financial performance, profitability

and liquidity for future periods and years. Forward-looking

information is based on a number of assumptions and is subject to a

number of risks and uncertainties, many of which are beyond Dream’s

control, which could cause actual results to differ materially from

those that are disclosed in or implied by such forward-looking

information. These assumptions include, but are not limited to: the

nature of development lands held and the development potential of

such lands, our ability to bring new developments to market,

anticipated positive general economic and business conditions,

including low unemployment and interest rates, positive net

migration, oil and gas commodity prices, our business strategy,

including geographic focus, anticipated sales volumes, performance

of our underlying business segments and conditions in the Western

Canada land and housing markets. Risks and uncertainties include,

but are not limited to, general and local economic and business

conditions, the impact of the COVID-19 pandemic on the Company and

uncertainties surrounding the COVID-19 pandemic, including

government measures to contain the COVID-19 pandemic employment

levels, regulatory risks, mortgage rates and regulations,

environmental risks, consumer confidence, seasonality, adverse

weather conditions, reliance on key clients and personnel and

competition. All forward-looking information in this press release

speaks as of February 22, 2022. Dream does not undertake to update

any such forward-looking information whether as a result of new

information, future events or otherwise, except as required by law.

Additional information about these assumptions and risks and

uncertainties is disclosed in filings with securities regulators

filed on SEDAR (www.sedar.com).

Endnotes:

(1)

For the definition of the following specified financial

measures: assets under management, fee earning assets under

management, net margin (%), net operating income, debt to total

assets ratio, earnings before income taxes after adjusting for fair

value losses taken on Dream Impact Trust units held by other

unitholders, adjusted EBITDA, consolidation and fair value

adjustments, refer to the “Non-GAAP Measures and Other Disclosures”

section of this press release.

(2)

For the definition of the following capital management

measure: available liquidity, refer to the “Non-GAAP Measures and

Other Disclosures” section of this press release.

(3)

Earnings (loss) for the three and twelve months ended

December 31, 2021 includes a loss of $3.8 million and a loss of

$25.0 million, respectively, on Dream Impact Trust units held by

other unitholders (three and twelve months ended December 31, 2020

– loss of $60.1 million and a gain of $77.8 million, respectively).

Refer to the “Additional Information – Consolidated Dream” section

of our MD&A for results on a Dream standalone basis.

(4)

Shareholders’ equity (excluding non-controlling interest)

excludes $15.0 million of non-controlling interest as at December

31, 2020.

(5)

Shareholders’ equity per share represents shareholders’

equity divided by total number of shares outstanding at period end.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220222006088/en/

Dream Unlimited Corp. Deb Starkman Chief Financial

Officer (416) 365-4124 dstarkman@dream.ca Kim Lefever Director,

Investor Relations (416) 365-6339 klefever@dream.ca

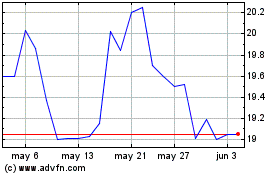

DREAM Unlimited (TSX:DRM)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

DREAM Unlimited (TSX:DRM)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025