Element Fleet Management Corp. (TSX:EFN) (“Element” or the

“Company”), the largest publicly traded, pure-play automotive fleet

manager in the world, today announced strong financial and

operating results for the three months ended June 30, 2024.

The following table presents Element's selected

financial results in U.S. dollars unless otherwise noted.

|

|

Q2 20241 |

Q1 20241,2 |

Q2 2023 |

QoQ |

YoY |

|

In US$ millions, except percentages and per share

amount and unless otherwise noted |

US$ |

US$ |

US$ |

% |

% |

|

Selected financial results - as reported: |

|

|

|

|

|

|

Net revenue |

274.6 |

|

262.5 |

|

240.6 |

|

4.6 |

% |

14.1 |

% |

| Pre-tax income |

135.2 |

|

123.0 |

|

118.9 |

|

9.9 |

% |

13.7 |

% |

| Pre-tax income margin |

49.2 |

% |

46.9 |

% |

49.4 |

% |

230 bps |

-20 bps |

| Earnings per share (EPS)

[basic] |

0.26 |

|

0.23 |

|

0.22 |

|

0.03 |

|

0.04 |

|

|

Earnings per share (EPS) [basic] [$CAD] |

0.35 |

|

0.31 |

|

0.29 |

|

0.04 |

|

0.06 |

|

|

Adjusted results (excludes one-time strategic

project costs in 2024)1 |

|

|

|

|

|

| Adjusted net revenue3 |

274.6 |

|

262.5 |

|

240.6 |

|

4.6 |

% |

14.1 |

% |

| Adjusted operating income

(AOI)3 |

152.9 |

|

143.6 |

|

132.7 |

|

6.4 |

% |

15.2 |

% |

| Adjusted operating

margin3 |

55.7 |

% |

54.7 |

% |

55.1 |

% |

+100 bps |

+60 bps |

| Adjusted EPS3 [basic] |

0.29 |

|

0.27 |

|

0.25 |

|

0.02 |

|

0.04 |

|

|

Adjusted EPS3 [basic] [$CAD] |

0.39 |

|

0.36 |

|

0.33 |

|

0.03 |

|

0.06 |

|

|

Other highlights: |

|

|

|

|

|

| Adjusted free cash flow per

share3 (FCF/sh) |

0.38 |

|

0.35 |

|

0.34 |

|

0.03 |

|

0.04 |

|

|

Adjusted free cash flow per share3 (FCF/sh) [$CAD] |

0.52 |

|

0.47 |

|

0.46 |

|

0.05 |

|

0.06 |

|

|

Originations (excluding Armada) |

1,976 |

|

1,542 |

|

1,889 |

|

28.2 |

% |

4.6 |

% |

- Q2 2024 and Q1 2024 included US$2.4

million and US$2.1 million, respectively, in one-time strategic

project costs.

- Q1 2024 revenue benefitted from

US$7.0 million in certain services revenue items which are

unlikely to repeat in 2024.

- Adjusted results are non-GAAP or

supplemental financial measures, which do not have any standard

meaning prescribed by GAAP under IFRS and are therefore unlikely to

be comparable to similar measures presented by other issuers. For

further information, please see the "IFRS to Non-GAAP

Reconciliations" section in this earnings release. The Company uses

“Adjusted Results” because it believes that they provide useful

information to investors regarding its performance and results of

operations.

"Our robust growth was driven by our continued

commercial success," said Laura Dottori-Attanasio, Chief Executive

Officer of Element. "Driven by our aspiration to take Element to

new heights, we are delighted to unveil our very first Purpose

Statement "Move the World Through Intelligent Mobility." We

developed this brand promise with the collaboration of our team

members. It is a reflection of our unwavering commitment to putting

our clients first and embodies our dedication to intelligent,

seamless mobility."

Net revenue growth

Element grew Q2 2024 net revenue 14.1% over Q2

2023 (“year-over-year”) to US$274.6 million led largely by robust

growth across all revenue line items. Net revenue increased US$12.1

million or 4.6% from Q1 2024 ("quarter-over-quarter").

Net financing revenue

Q2 2024 net financing revenue grew

US$16.7 million or 15.8% from Q2 2023 and grew

US$15.2 million or 14.2% quarter-over-quarter. Year-over-year

growth was largely as a result of higher net earning assets

associated with higher originations in the U.S., Canada, and ANZ

regions. These increases were partly offset by higher funding costs

year-over-year.

Gain on sale ("GOS") was largely unchanged

year-over-year as higher GOS in Mexico was mostly offset by lower

GOS in ANZ as prices continue to moderate but remain well above

historic levels. Higher volume of vehicles available for sale in

Mexico continue to mitigate used vehicle pricing headwinds.

Service revenue

Element's largely unlevered services revenue is

the key pillar of its capital-light business model, which also

improves the Company's return on equity profile.

Q2 2024 services revenue grew 10.8%

year-over-year to US$140.1 million driven primarily by higher

origination volumes, and higher penetration rates of our service

offerings from existing clients. Also contributing to the

year-over-year increase was growth in both Mexico and ANZ.

Q1 2024 services revenue benefitted from

US$7.0 million in certain services revenue items that we do

not anticipate to recur in 2024 (as previously disclosed).

Excluding these amounts, services revenue was largely unchanged

quarter-over-quarter.

Syndication volume

The Company syndicated a record

US$955.2 million of assets in Q2 2024 - US$440.8 million

or 85.7% more volume than Q2 last year and more than double that of

Q1 2024. These increases are attributed to record originations and

our ongoing focus on our capital lighter model. The Company

expanded the number of names it syndicated, impacting the Company's

syndication mix. Overall, pricing in the syndication market has

improved from Q1 and client demand remains robust.

Q2 2024 syndication revenue grew

US$3.6 million or 41.9% year-over-year and US$3.8 million

or 46.4% quarter-over-quarter largely due to record volumes this

quarter.

Adjusted operating income and adjusted

operating margins

AOI was US$152.9 million this quarter, an

increase of US$20.2 million or 15.2% year-over-year —

amounting to adjusted EPS of US$0.29 for Q2 2024, which is a

4 cent increase year-over-year. Q2 2024 adjusted operating

margin was 55.7%, representing margin expansion of 60 basis points

year-over-year. This expansion is driven largely by positive

operating leverage (i.e. net revenue growth outpacing growth in

adjusted operating expenses). Adjusted operating margin expanded

100 basis points quarter-over-quarter.

Element expanded adjusted pre-tax return on

common equity by 140 basis points year-over-year to 19.6% in Q2

2024.

Originations

Element originated US$2.0 billion of assets

in Q2 2024 (excluding Armada), which is a US$87.2 million or

4.6% increase year-over-year and a US$434.1 million or 28.2%

increase quarter-over-quarter.

The table below sets out the geographic

distribution of originations (excluding Armada) for the three-month

periods indicated.

|

(in U.S.$000’s) |

June 30, 2024 |

June 30, 2023 |

Variance to Q2 2023 |

|

(Excluding Armada) |

US$ |

% |

US$ |

% |

US$ |

% |

|

United States and Canada |

1,599,955 |

81.0 |

1,522,241 |

80.6 |

77,714 |

|

5.1 |

% |

| Mexico |

252,573 |

12.8 |

255,453 |

13.5 |

(2,880 |

) |

(1.1 |

)% |

|

Australia and New Zealand |

123,486 |

6.2 |

111,123 |

5.9 |

12,363 |

|

11.1 |

% |

|

Total |

1,976,014 |

100.0 |

1,888,817 |

100.0 |

87,197 |

|

4.6 |

% |

Growing adjusted free cash flow per

share and return of capital to shareholders

On an adjusted basis, Element generated US$0.38

of adjusted free cash flow ("FCF") per share in Q2 2024 – 4 cents

more year-over-year driven primarily by an increase in net revenues

and higher originations, while investing US$17.4 million in total

capital investments this quarter.

Element returned US$37.7 million and US$75.9

million of cash to common shareholders through dividends and

buybacks of common shares in Q2 2024 and first half 2024,

respectively.

Full-year 2024 guidance

As a result of its robust first-half performance

and positive outlook for the remainder of the year, Element is

raising its full-year guidance on most metrics.

|

In US$ unless otherwise noted |

FY 2023 - U.S. Dollars |

Prior 2024 Guidance - U.S. Dollars |

New 2024 Guidance - U.S. Dollars |

|

Net revenue |

$959.1 million |

$1.020 - 1.040 billion |

$1.060 - $1.080 billion |

|

Implied YoY Growth |

|

6-8% |

11-13% |

| Adjusted operating margin |

55.3% |

55.0% - 55.5% |

55.0% - 55.5% |

| Adjusted operating income |

$530.6 million |

$560 – 575 million |

$575 - 595 million |

|

Implied YoY Growth |

|

6-8% |

8-12% |

| Adjusted EPS [basic] |

$0.98 |

$1.05 - 1.09 |

$1.07 - $1.11 |

|

Implied YoY Growth |

|

7-11% |

9-13% |

| Adjusted free cash flow per

share |

$1.24 |

$1.31 - 1.34 |

$1.32 - 1.36 |

|

Implied YoY Growth |

|

6-8% |

6-10% |

| Originations (excl

Armada) |

$6.3 billion |

$7.0 - 7.4 billion |

$7.0 - 7.4 billion |

|

Implied YoY Growth |

|

11-17% |

11-17% |

Certain implied year-over-year growth amounts

shown in this table may not calculate exactly due to rounding.

Element’s full-year 2023 results and 2024

guidance exclude non-recurring setup costs associated with its

previously announced strategic initiatives, non-recurring costs

associated with the acquisition of Autofleet, and also prior to any

material changes in foreign exchange.

Acquisition of Autofleet

Today, the Company announced it has entered into

a definitive agreement to acquire Autofleet, an innovator in fleet

and mobility solutions. Autofleet has a robust and highly scalable

fleet optimization technology platform alongside optimized mobility

solutions tailored for the fleet industry.

“Having previously worked with Autofleet and

witnessed the common culture, commitment to clients, and focus on

delivering impactful results that our two companies share, we are

thrilled to welcome them to the Element organization as an integral

part of our business," commented Dottori-Attanasio. "We are

confident their expertise will enable us to fast-track the

modernization of our digital capabilities, enhance our ability to

scale our core business more quickly, and ultimately deliver

increased value to our clients and shareholders."

Founded in 2018, the firm boasts a skilled team

of approximately 70 professionals including developers, engineers,

and data scientists. Element anticipates that the combination of

its own scale, market leadership, and comprehensive fulfillment

capabilities with Autofleet's digital, data, and cloud

capabilities, will advance its purpose to Move the World Through

Intelligent Mobility and unlock new revenue streams for both

companies.

“This partnership represents a powerful

alignment of two companies with shared aspiration and cultures, and

enables us to leverage Element’s commercial organization and

leadership to accelerate new growth areas for the business,” stated

Kobi Eisenberg, Chief Executive Officer of Autofleet. “We are

incredibly proud to join forces with Element, a company that shares

our commitment to advancing intelligent solutions within the fleet

and mobility industries.”

The completion of the acquisition is subject to

customary closing conditions, and the terms of the transaction

remain undisclosed. The Company expects the transaction to close in

early Q4 2024.

Strategic initiatives

update

As previously disclosed, the Company plans to

optimize its business further by centralizing accountability for

its U.S. and Canadian leasing operations and establishing a

strategic sourcing presence in Asia. The Company continues to

expect these initiatives to generate between US$30 - $45 million

(CAD $40 - $60 million) of run-rate net revenue, and between US$22

- $37 million (CAD $30 - $50 million) of run-rate adjusted

operating income (“AOI”), by full-year 2028. The above initiatives

require approximately US$22 million (total) (CAD $30 million) in

non-recurring setup costs, of which US$2.4 million and

US$2.1 million were incurred in Q2 2024 and Q1 2024,

respectively (H1 2023 - nil). In 2023, the Company incurred US$13.7

million, in aggregate, in such costs. The remaining and final costs

of approximately US$3.8 million will likely be recorded in Q3

2024.

In August, the Company commenced operations in

Dublin, creating a global standard for leasing excellence. This

Dublin-based team is currently comprised of 50 cross-functional

professionals, growing to approximately 80 later this year. As

previously communicated, centralizing our U.S. and Canadian leasing

functions in Ireland provides the following benefits:

- Enhancing our consistent, superior

client leasing experience to grow market-leading offerings across

leasing lifecycle;

- Greater control over a broader

leasing functions to better asses performance and optimize capital

allocations;

- Aligning commercial sales and

strategic alliances to leasing strategy; and

- A more disciplined pricing

strategy.

In April 2024, the Company commenced operations

in Singapore, marking a significant milestone in its ongoing

strategic initiative to enhance its global procurement capabilities

and strategic sourcing relationships in Asia. Concurrently, the

Company entered into its first collaboration agreement with a

strategic sourcing supplier.

The expected payback period from the Company's

investments is anticipated to be less than 2.5 years.

The Company also remains focused on prioritizing

digitization and automation initiatives to enable future growth,

drive operational efficiencies and position itself as a leading

industry player in the rapidly evolving mobility and vehicle

connectivity landscape.

Capital structure

Redemption of all outstanding 6.21% Cumulative

5-Year Rate Reset Preferred Shares Series C

On June 30, 2024, the Company redeemed all of

its 5,126,400 issued and outstanding 6.21% Cumulative 5-Year Rate

Reset Preferred Shares Series C (the “Series C Shares”) at a price

of CAD$25.00 per Series C Share for an aggregate total amount of

approximately US$91.2 million (CAD$128 million), together with all

accrued and unpaid dividends up to but excluding the Share

Redemption Date (the “Redemption Price”), less any tax required to

be deducted and withheld by the Company.

Intention to redeem all its outstanding 5.903%

Cumulative 5-Year Rate Reset Preferred Shares Series E

To further optimize the Company’s balance sheet

and mature its capital structure, the Company announced today its

intention to redeem - in accordance with the terms of the 5.903%

Cumulative 5-Year Rate Reset Preferred Shares Series E (the "Series

E Shares") as set out in the Company's articles - all of its

5,321,900 issued and outstanding Series E Shares on September 30,

2024 (the "Share Redemption Date") for a redemption price equal to

CAD$25.00 per Series E Share for a an aggregate total amount of

approximately US$92.4 million (CAD$133 million), together with all

accrued and unpaid dividends up to but excluding the Share

Redemption Date (the "Redemption Price"), less any tax required to

be deducted and withheld by the Company.

The Company has provided notice today of the

Redemption Price and the Share Redemption Date to the sole

registered holder of the Series E Shares in accordance with the

terms of the Series E Shares as set out in the Company’s articles.

Non-registered holders of Series E Shares should contact their

broker or other intermediary for information regarding the

redemption process for the Series E Shares in which they hold a

beneficial interest. The Company’s transfer agent for the Series E

Shares is Computershare Investor Services Inc. ("Computershare

Investor Services"). Questions regarding the redemption process may

be directed to Computershare Investor Services at 1-800-564-6253 or

by email to corporateactions@computershare.com.

Following their redemption on September 30,

2024, the Series E Shares will be de-listed from and no longer

trade on the Toronto Stock Exchange ("TSX").

4.25% Convertible Unsecured Subordinated

Debentures Exchanged for Common Shares

On June 26, 2024, the Company redeemed all of

its remaining outstanding 4.25% Convertible Unsecured Subordinated

Debentures (the "Debentures") due June 30, 2024 (the "Redemption

Date"). Prior to the Redemption Date, beneficial holders of the

Debentures exercised their right to exchange an aggregate principal

amount of approximately CAD$172.0 million for consideration of

approximately 14.6 million Common Shares, issued from Treasury

and delivered to beneficial holders. The Debentures were converted

into Common Shares at a conversion price of CAD$11.77391 per Common

Share. As a result, the Debentures were delisted from and no longer

trade on the TSX (previous ticker TSX: EFN.DB.B).

As at June 30, 2024, total Common Shares issued

and outstanding were 403.6 million.

Conference call and webcast

A conference call to discuss these results will

be held on Wednesday, August 14, 2024 at 8:00 a.m. Eastern

Time.

The conference call and webcast can be accessed

as follows:

|

Webcast: |

|

https://services.choruscall.ca/links/elementfleet2024q2.html |

| |

|

|

| Telephone: |

|

Click here to join the call most efficiently, |

| |

|

or dial one of the following numbers to speak with an

operator: |

| |

|

|

| |

|

Canada/USA toll-free: 1-844-763-8274 |

| |

|

|

| |

|

International: +1-647-484-8814 |

| |

|

|

A taped recording of the conference call may be

accessed through September 14, 2024 by dialing 1-855-669-9658

(Canada Toll Free), 1-877-344-7529 (U.S. Toll Free) or

1-412-317-0088 (International Toll) and entering the access code

2637551.

Dividends declared

The Company's Board has authorized and declared

a quarterly dividend of CAD$0.12 per outstanding common share of

Element for the third quarter of 2024. The dividend will be paid on

October 15, 2024 to shareholders of record as at the close of

business on September 27, 2024.

Element’s Board of Directors also declared the

following dividends on Element’s preferred shares:

|

Series |

TSX Ticker |

Amount (CAD$) |

Record Date |

Payment Date |

|

Series E |

EFN.PR.E |

$0.3689380 |

September 13, 2024 |

September 27, 2024 |

|

|

|

|

|

|

Note: This will be the final quarterly dividend

payment on the Series E Shares prior to their planned redemption on

September 30, 2024 as disclosed earlier in this press release.

Holders will receive on the Redemption Date of the Series E Shares

all accrued and unpaid dividends up to but excluding the Redemption

Date.

The Company’s common and preferred share

dividends are designated to be eligible dividends for purposes of

section 89(1) of the Income Tax Act (Canada).

Normal course issuer bid

On November 13, 2023, the TSX approved the

Company’s intention to renew its normal course issuer bid (the

“2023 NCIB”). Under the 2023 NCIB, the Company has approval from

the TSX to purchase up to 38,852,159 common shares during the

period from November 15, 2023, to November 14, 2024. There cannot

be any assurance as to how many common shares will ultimately be

purchased pursuant to the 2023 NCIB.

During the first six months of 2024, we

purchased 455,300 common shares for cancellation, for an aggregate

amount of approximately US$7.3 million (CAD$10.0 million) at a

volume weighted average price of CAD$21.95 per Common Share.

Element applies trade date accounting in

determining the date on which the share repurchase is reflected in

the consolidated financial statements. Trade date accounting is the

date on which the Company commits itself to purchase the

shares.

IFRS to

Non-GAAP Reconciliations ,

Non-GAAP Measures and Supplemental Information

The Company's audited consolidated financial

statements have been prepared in accordance with IFRS as issued by

the IASB and the accounting policies we adopted in accordance with

IFRS. These audited consolidated financial statements reflect all

adjustments that are, in the opinion of management, necessary to

present fairly our financial position as at June 30, 2024 and

June 30, 2023, the results of operations, comprehensive income

and cash flows for the three-month periods-ended June 30, 2024

and June 30, 2023.

Non-GAAP and IFRS key annualized operating

ratios and per share information of the operations of the

Company:

|

|

|

As at and for the three-month period

ended |

| (in

US$000’s except ratios and per share amounts or unless otherwise

noted) |

|

June 30,2024 |

March 31,2024 |

June 30,2023 |

| |

|

|

|

|

| Key annualized

operating ratios |

|

|

|

|

| |

|

|

|

|

| Leverage

ratios |

|

|

|

|

|

Financial leverage ratio |

P/(P+R) |

|

74.8 |

% |

|

75.5 |

% |

|

72.1 |

% |

| Tangible leverage ratio |

P/(R-K) |

|

6.50 |

|

|

6.68 |

|

|

5.61 |

|

| Average financial leverage

ratio |

Q/(Q+V) |

|

74.9 |

% |

|

73.8 |

% |

|

71.4 |

% |

| Average tangible leverage

ratio |

Q/(V-L) |

|

6.49 |

|

|

6.15 |

|

|

5.50 |

|

| |

|

|

|

|

| Other key operating

ratios |

|

|

|

|

|

Allowance for credit losses as a % of total finance receivables

before allowance |

F/E |

|

0.07 |

% |

|

0.08 |

% |

|

0.10 |

% |

|

Adjusted operating income on average net earning assets |

B/J |

|

7.47 |

% |

|

7.34 |

% |

|

7.80 |

% |

|

Adjusted operating income on average tangible total equity of

Element |

D/(V-L) |

|

34.22 |

% |

|

32.37 |

% |

|

30.28 |

% |

| |

|

|

|

|

| Per share

information |

|

|

|

|

|

Number of shares outstanding |

W |

|

403,609 |

|

|

388,926 |

|

|

389,703 |

|

|

Weighted average number of shares outstanding [basic] |

X |

|

390,013 |

|

|

389,161 |

|

|

390,385 |

|

|

Pro forma diluted average number of shares outstanding |

Y |

|

390,163 |

|

|

404,118 |

|

|

405,505 |

|

|

Cumulative preferred share dividends during the period |

Z |

|

2,869 |

|

|

2,919 |

|

|

4,475 |

|

|

Other effects of dilution on an adjusted operating income

basis |

AA |

$ |

— |

|

$ |

1,222 |

|

$ |

1,219 |

|

| Net income per share

[basic] |

(A-Z)/X |

$ |

0.26 |

|

$ |

0.23 |

|

$ |

0.22 |

|

| Net income per share

[diluted] |

|

$ |

0.26 |

|

$ |

0.23 |

|

$ |

0.21 |

|

|

|

|

|

|

|

| Adjusted EPS

[basic] |

(D1)/X |

$ |

0.29 |

|

$ |

0.27 |

|

$ |

0.25 |

|

|

Adjusted EPS [diluted] |

(D1+AA)/Y |

$ |

0.29 |

|

$ |

0.26 |

|

$ |

0.24 |

|

Management also uses a variety of both IFRS and

non-GAAP and Supplemental Measures, and non-GAAP ratios to monitor

and assess their operating performance. The Company uses these

non-GAAP and Supplemental Financial Measures because they believe

that they may provide useful information to investors regarding

their performance and results of operations.

The following table provides a reconciliation of

certain IFRS to non-GAAP measures related to the operations of the

Company and other supplemental information.

|

|

|

For the three-month period ended |

|

(in US$000’s except per share amounts or unless otherwise

noted) |

|

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

Reported results |

|

US$ |

US$ |

US$ |

|

Services income, net |

|

140,123 |

|

147,053 |

|

126,433 |

|

|

Net financing revenue |

|

122,409 |

|

107,178 |

|

105,698 |

|

|

Syndication revenue, net |

|

12,045 |

|

8,226 |

|

8,491 |

|

| Net

revenue |

|

274,577 |

|

262,457 |

|

240,622 |

|

| Operating

expenses |

|

131,581 |

|

132,499 |

|

115,233 |

|

| Operating

income |

|

142,996 |

|

129,958 |

|

125,389 |

|

| Operating

margin |

|

52.1 |

% |

49.5 |

% |

52.1 |

% |

| Total

expenses |

|

139,393 |

|

139,478 |

|

121,692 |

|

| Income before income

taxes |

|

135,184 |

|

122,979 |

|

118,930 |

|

| Net

income |

|

102,698 |

|

93,817 |

|

89,374 |

|

| EPS

[basic] |

|

0.26 |

|

0.23 |

|

0.22 |

|

|

EPS [diluted] |

|

0.26 |

|

0.23 |

|

0.21 |

|

|

Adjusting items |

|

|

|

|

| Impact of adjusting items on

operating expenses: |

|

|

|

|

|

Strategic initiatives costs – Salaries, wages, and benefits |

|

475 |

|

485 |

|

— |

|

|

Strategic initiatives costs – General and administrative

expenses |

|

1,883 |

|

1,640 |

|

— |

|

|

Share-based compensation |

|

6,775 |

|

10,731 |

|

6,534 |

|

|

Amortization of convertible debenture discount |

|

724 |

|

793 |

|

756 |

|

| Total impact of adjusting

items on operating expenses |

|

9,857 |

|

13,649 |

|

7,290 |

|

| Total pre-tax impact of

adjusting items |

|

9,857 |

|

13,649 |

|

7,290 |

|

| Total after-tax impact of

adjusting items |

|

7,442 |

|

10,305 |

|

5,504 |

|

| Total impact of adjusting

items on EPS [basic] |

|

0.02 |

|

0.03 |

|

0.01 |

|

| Total

impact of adjusting items on EPS [diluted] |

|

0.02 |

|

0.03 |

|

0.01 |

|

|

|

|

For the three-month period ended |

|

(in US$000’s except per share amounts or unless otherwise

noted) |

|

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

Adjusted results |

|

US$ |

US$ |

US$ |

|

Adjusted net revenue |

|

274,577 |

|

262,457 |

|

240,622 |

|

| Adjusted operating

expenses |

|

121,724 |

|

118,850 |

|

107,943 |

|

| Adjusted operating

income |

|

152,853 |

|

143,607 |

|

132,679 |

|

| Adjusted operating

margin |

|

55.7 |

% |

54.7 |

% |

55.1 |

% |

| Provision for income

taxes |

|

32,486 |

|

29,162 |

|

29,556 |

|

| Adjustments: |

|

|

|

|

| Pre-tax income |

|

5,381 |

|

5,390 |

|

3,533 |

|

| Foreign tax rate differential

and other |

|

(418 |

) |

632 |

|

(584 |

) |

| Provision for taxes

applicable to adjusted results |

|

37,449 |

|

35,184 |

|

32,505 |

|

|

Adjusted net income |

|

115,404 |

|

108,423 |

|

100,174 |

|

|

Adjusted EPS [basic] |

|

0.29 |

|

0.27 |

|

0.25 |

|

|

Adjusted EPS [diluted] |

|

0.29 |

|

0.26 |

|

0.24 |

|

The following table summarizes key statement of

financial position amounts for the periods presented.

|

Selected statement of financial position

amounts |

|

For the three-month period ended |

|

(in US$000’s unless otherwise noted) |

|

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

|

|

US$ |

US$ |

US$ |

|

Total Finance receivables, before allowance for credit losses |

E |

7,775,035 |

|

7,478,974 |

|

7,005,218 |

|

|

Allowance for credit losses |

F |

5,351 |

|

5,794 |

|

7,613 |

|

|

Net investment in finance receivable |

G |

5,525,306 |

|

5,349,038 |

|

4,680,188 |

|

|

Equipment under operating leases |

H |

2,589,411 |

|

2,685,015 |

|

2,383,189 |

|

|

Net earning assets |

I=G+H |

8,114,717 |

|

8,034,053 |

|

7,063,377 |

|

|

Average net earning assets |

J |

8,186,031 |

|

7,825,155 |

|

6,801,141 |

|

| Goodwill and intangible

assets |

K |

1,583,634 |

|

1,587,465 |

|

1,591,966 |

|

|

Average goodwill and intangible assets |

L |

1,584,972 |

|

1,588,981 |

|

1,589,673 |

|

|

Borrowings |

M |

8,711,416 |

|

9,021,567 |

|

7,587,282 |

|

| Unsecured convertible

debentures |

N |

— |

|

126,108 |

|

125,653 |

|

| Less: continuing involvement

liability |

O |

(101,075 |

) |

(87,199 |

) |

(56,390 |

) |

| Total

debt |

P=M+N-O |

8,610,341 |

|

9,060,476 |

|

7,656,545 |

|

|

Average debt |

Q |

8,757,365 |

|

8,239,147 |

|

7,274,728 |

|

| Total shareholders'

equity |

R |

2,908,420 |

|

2,944,588 |

|

2,956,533 |

|

|

Preferred shares |

S |

92,404 |

|

181,077 |

|

263,380 |

|

|

Common shareholders' equity |

T=R-S |

2,816,016 |

|

2,763,511 |

|

2,693,153 |

|

|

Average common shareholders' equity |

U |

2,782,534 |

|

2,747,716 |

|

2,646,122 |

|

|

Average total shareholders' equity |

V |

2,934,053 |

|

2,928,793 |

|

2,909,503 |

|

Throughout this press release, management uses

the following terms and ratios which do not have a standardized

meaning under IFRS and are unlikely to be comparable to similar

measures presented by other organizations. Non-GAAP measures are

reported in addition to, and should not be considered alternatives

to, measures of performance according to IFRS.

Adjusted operating expenses

Adjusted operating expenses are equal to

salaries, wages and benefits, general and administrative expenses,

and depreciation and amortization less adjusting items impacting

operating expenses. The following table reconciles the Company's

reported expenses to adjusted operating expenses.

|

|

For the three-month period ended |

|

(in US$000’s except per share amounts or unless otherwise

noted) |

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

|

US$ |

US$ |

US$ |

|

Reported Expenses |

139,393 |

139,478 |

121,692 |

|

| Less: |

|

|

|

|

Amortization of intangible assets from acquisitions |

6,966 |

6,979 |

6,982 |

|

|

Loss (gain) on investments |

846 |

— |

(523 |

) |

|

Operating expenses |

131,581 |

132,499 |

115,233 |

|

| Less: |

|

|

|

|

Amortization of convertible debenture discount |

724 |

793 |

756 |

|

|

Share-based compensation |

6,775 |

10,731 |

6,534 |

|

|

Strategic initiatives costs - Salaries, wages and benefits |

475 |

485 |

— |

|

|

Strategic initiatives costs - General and administrative

expenses |

1,883 |

1,640 |

— |

|

|

Total adjustments |

9,857 |

13,649 |

7,290 |

|

|

Adjusted operating expenses |

121,724 |

118,850 |

107,943 |

|

Adjusted operating income or Pre-tax

adjusted operating income

Adjusted operating income reflects net income or

loss for the period adjusted for the amortization of debenture

discount, share-based compensation, amortization of intangible

assets from acquisitions, provision for or recovery of income

taxes, loss or income on investments, and adjusting items from the

table below.

The following tables reconciles income before

taxes to adjusted operating income.

|

|

For the three-month period ended |

|

(in US$000’s except per share amounts or unless otherwise

noted) |

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

|

US$ |

US$ |

US$ |

|

Income before income taxes |

135,184 |

122,979 |

118,930 |

|

|

Adjustments: |

|

|

|

|

Amortization of convertible debenture discount |

724 |

793 |

756 |

|

|

Share-based compensation |

6,775 |

10,731 |

6,534 |

|

|

Amortization of intangible assets from acquisition |

6,966 |

6,979 |

6,982 |

|

|

Loss (gain) on investments |

846 |

— |

(523 |

) |

| Adjusting

Items: |

|

|

|

| Strategic initiatives costs -

Salaries, wages and benefits |

475 |

485 |

— |

|

| Strategic initiatives costs -

General and administrative expenses |

1,883 |

1,640 |

— |

|

| Total pre-tax impact

of adjusting items |

2,358 |

2,125 |

— |

|

|

Adjusted operating income |

152,853 |

143,607 |

132,679 |

|

Adjusted operating margin

Adjusted operating margin is the adjusted

operating income before taxes for the period divided by the net

revenue for the period.

After-tax adjusted operating

income

After-tax adjusted operating income reflects the

adjusted operating income after the application of the Company’s

effective tax rates.

Adjusted net income

Adjusted net income reflects reported net income

less the after-tax impacts of adjusting items. The following table

reconciles reported net income to adjusted net income.

|

|

For the three-month period ended |

|

(in US$000’s except per share amounts or unless otherwise

noted) |

June 30,2024 |

March 31,2024 |

June 30,2023 |

|

|

US$ |

US$ |

US$ |

|

Net income |

102,698 |

|

93,817 |

|

89,374 |

|

|

Amortization of convertible debenture discount |

724 |

|

793 |

|

756 |

|

|

Share-based compensation |

6,775 |

|

10,731 |

|

6,534 |

|

|

Amortization of intangible assets from acquisition |

6,966 |

|

6,979 |

|

6,982 |

|

|

Loss (gain) on investments |

846 |

|

— |

|

(523 |

) |

|

Strategic initiatives costs - Salaries, wages and benefits |

475 |

|

485 |

|

— |

|

|

Strategic initiatives costs - General and administrative

expenses |

1,883 |

|

1,640 |

|

— |

|

|

Provision for income taxes |

32,486 |

|

29,162 |

|

29,556 |

|

|

Provision for taxes applicable to adjusted results |

(37,449 |

) |

(35,184 |

) |

(32,505 |

) |

|

Adjusted net income |

115,404 |

|

108,423 |

|

100,174 |

|

After-tax adjusted operating income

attributable to common shareholders

After-tax adjusted operating income attributable

to common shareholders is computed as after-tax adjusted operating

income less the cumulative preferred share dividends for the

period.

About Element Fleet

Management

Element Fleet Management (TSX: EFN) is the

largest publicly traded pure-play automotive fleet manager in the

world, providing the full range of fleet services and solutions to

a growing base of loyal, world-class clients – corporations,

governments, and not-for-profits – across North America, Australia,

and New Zealand. Element’s services address every aspect of

clients’ fleet requirements, from vehicle acquisition, maintenance,

accidents and remarketing, to integrating EVs and managing the

complexity of gradual fleet electrification. Clients benefit from

Element’s expertise as one of the largest fleet solutions providers

in its markets, offering economies of scale and insight used to

reduce fleet operating costs and improve productivity and

performance. For more information,

visit elementfleet.com/investor-relations.

This press release includes forward-looking

statements regarding Element and its business. Such statements are

based on management’s current expectations and views of future

events. In some cases the forward-looking statements can be

identified by words or phrases such as “may”, “will”, “expect”,

“plan”, “anticipate”, “intend”, “potential”, “estimate”, “believe”

or the negative of these terms, or other similar expressions

intended to identify forward-looking statements, including, among

others, statements regarding Element’s financial performance,

enhancements to clients’ service experience and service levels;

improvements to client retention trends; reduction of operating

expenses; increases in efficiency; Element’s ability to achieve its

sustainability objectives; the ability to satisfy all closing

conditions related to the Autofleet acquisition; Element achieving

its digital platform ambitions; the Autofleet acquisition enabling

the Company to scale its business more quickly, achieve operational

efficiencies, increase client and shareholder value and unlock new

revenues streams; EV strategy and capabilities; global EV adoption

rates; dividend policy and the payment of future dividends;

Element’s expectation and ability to redeem its preferred shares

and convertible debentures; the costs and benefits of strategic

initiatives; creation of value for all stakeholders; expectations

regarding syndication; growth prospects and expected revenue

growth; level of workforce engagement; improvements to magnitude

and quality of earnings; executive hiring and retention; focus and

discipline in investing; balance sheet management and plans with

respect to leverage ratios; and Element’s proposed share purchases,

including the number of common shares to be repurchased, the timing

thereof and TSX acceptance of the NCIB and any renewal thereof. No

forward-looking statement can be guaranteed. Forward-looking

statements and information by their nature are based on assumptions

and involve known and unknown risks, uncertainties and other

factors which may cause Element’s actual results, performance or

achievements, or industry results, to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statement or information.

Accordingly, readers should not place undue reliance on any

forward-looking statements or information. Such risks and

uncertainties include those regarding the fleet management and

finance industries, economic factors, regulatory landscape and many

other factors beyond the control of Element. A discussion of the

material risks and assumptions associated with this outlook can be

found in Element’s annual MD&A, and Annual Information Form for

the year ended December 31, 2023, each of which has been filed on

SEDAR+ and can be accessed at www.sedarplus.ca. Except as required

by applicable securities laws, forward-looking statements speak

only as of the date on which they are made and Element undertakes

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

Contact:

Rocco Colella

Director, Investor Relations

(437) 349-3796

rcolella@elementcorp.com

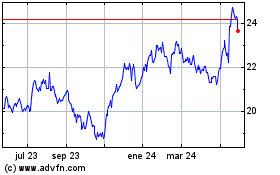

Element Fleet Management (TSX:EFN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

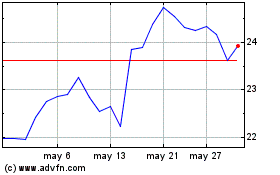

Element Fleet Management (TSX:EFN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024