Kinaxis® Inc. (“Kinaxis” or the “Company”) (TSX:

KXS) is pleased to announce that the Toronto Stock Exchange (the

“Exchange” or “TSX”) has accepted a notice (the

“Notice”) filed by the Company of its intention to make a

normal course issuer bid (the “NCIB”). In connection with

the NCIB, the Company has entered into an automatic share purchase

plan (an “ASPP”) with its designated broker to allow for

purchases of its common shares (the “Shares”).

The Notice provides that the Company may, during the 12-month

period commencing November 6, 2024 and ending November 5, 2025, or

on such earlier date as Kinaxis completes its purchases or provides

notice of termination, purchase up to 1,404,639 Shares in total,

representing approximately 5% of the issued and outstanding Shares

as at October 23, 2024. As of the close of business on October 23,

2024, the Company had 28,092,786 Shares issued and outstanding.

Except for block purchases permitted under the rules of the TSX,

the number of Shares to be purchased per day will not exceed

15,500, which represents 25% of the average daily trading volume of

the Shares on the TSX for the most recently completed six calendar

months ended September 30, 2024 (being 62,000 Shares) prior to the

TSX’s acceptance of the Notice. The actual number of Shares which

may be purchased under the NCIB and the timing of any such

purchases will be determined by management of the Company, subject

to applicable law and the rules of the TSX.

Subject to any required regulatory approvals, all purchases of

Shares under the NCIB will be conducted through the facilities of

the TSX and/or alternative Canadian trading systems at prevailing

market prices, or by such other means as may be permitted by the

applicable securities regulators. All Shares purchased under the

NCIB will be cancelled.

Kinaxis has entered into an ASPP with RBC Dominion Securities

Inc. (“RBC DS”) to allow for the purchase of Shares under

the NCIB at times when the Company would ordinarily not be

permitted to purchase Shares due to regulatory restrictions or

self-imposed blackout periods.

Pursuant to the ASPP, prior to entering into a blackout period,

Kinaxis may, but is not required to, instruct RBC DS to make

purchases under the NCIB in accordance with the terms of the ASPP.

Such purchases will be determined by RBC DS in its sole discretion

based on parameters established by Kinaxis prior to the blackout

period in accordance with the rules of the TSX, applicable

securities laws and the terms of the ASPP. The ASPP has been

pre-cleared by the TSX concurrently with the initiation of the

NCIB.

The board of directors of the Company (the “Board”)

believes that, from time to time, the market price of the Shares

may not fully reflect the underlying value of the Company’s

business. As a result, depending upon future price movements and

other factors, the Board believes that the purchase of the Shares

would be a desirable use of corporate funds in the best interests

of the Company. Furthermore, the purchases are expected to benefit

all persons who continue to hold Shares by increasing their equity

interest in the Company when such repurchased Shares are

cancelled.

To the knowledge of the Company, no director, senior officer or

other insider of the Company or any of their associates currently

intends to sell any Shares under the NCIB, however sales by such

persons through the facilities of the Exchange or any other

available market or alternative trading system may occur if the

personal circumstances of any such persons change or if any such

persons make a decision unrelated to these normal course purchases.

The benefits to any such person whose Shares are purchased would be

the same as the benefits available to all other holders whose

Shares are purchased.

Under Kinaxis’s normal course issuer bid expiring on November 5,

2024 (the “Expiring NCIB”), the Company received approval from the

TSX to purchase for cancellation up to a maximum of 1,424,790

Shares, representing approximately 5% of Kinaxis’ issued and

outstanding Shares as at October 23, 2023. As of the date hereof,

the Company has repurchased and cancelled 1,052,958 Shares under

the Expiring NCIB, at a weighted average purchase price of

approximately $148.64 per Share (including commissions).

About Kinaxis

Kinaxis is a global leader in modern supply chain orchestration,

powering complex global supply chains and supporting the people who

manage them, in service of humanity. Our powerful, AI-infused

supply chain orchestration platform, Maestro™, combines proprietary

technologies and techniques that provide full transparency and

agility across the entire supply chain — from multi-year strategic

planning to last-mile delivery. We are trusted by renowned global

brands to provide the agility and predictability needed to navigate

today’s volatility and disruption. For more news and information,

please visit kinaxis.com or follow us on LinkedIn.

Cautionary Note and Forward-Looking Information

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Kinaxis and reflects management’s expectations or beliefs

regarding such future events. In certain cases, statements that

contain forward-looking information can be identified by the use of

words such as “plans”, “expects”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”,

“believes” or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might”, or “will be taken”, “occur” or “be achieved” or the

negative of these words or comparable terminology. Forward-looking

information in this press release includes statements with respect

to the anticipated benefits of the NCIB and the number of Shares

that may be purchased under the NCIB. By its very nature

forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual performance

of Kinaxis to be materially different from any anticipated

performance expressed or implied by such forward-looking

information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading “Risk

Factors” in the Company’s annual information form dated March 25,

2024 for its fiscal year ended December 31, 2023 and other risks

identified in the Company’s filings with Canadian securities

regulators, which filings are available on SEDAR+ at

https://www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company’s forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company’s actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company’s statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

SOURCE: Kinaxis Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031676695/en/

Media Relations Jaime Cook | Kinaxis jcook@kinaxis.com

289-552-4640

Investor Relations Rick Wadsworth | Kinaxis

rwadsworth@kinaxis.com 613-907-7613

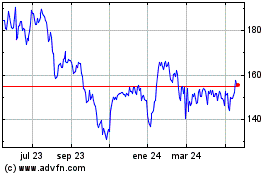

Kinaxis (TSX:KXS)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

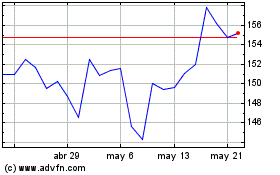

Kinaxis (TSX:KXS)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025