Magna International Inc. (TSX: MG; NYSE: MGA) today reported

financial results for the first quarter ended March 31, 2023.

Please click HERE for full first

quarter MD&A and Financial Statements.

|

|

|

THREE MONTHS ENDED |

|

|

|

March 31, 2023 |

|

March 31, 2022 |

|

Reported |

|

|

|

|

|

Sales |

|

$ |

10,673 |

|

$ |

9,642 |

| Income from operations before

income taxes |

|

$ |

275 |

|

$ |

420 |

| Net income attributable to Magna

International Inc. |

|

$ |

209 |

|

$ |

364 |

| Diluted earnings per share |

|

$ |

0.73 |

|

$ |

1.22 |

|

Non-GAAP Financial Measures(1)Adjusted EBIT |

|

$ |

437 |

|

$ |

507 |

|

|

|

|

|

|

| Adjusted diluted earnings per

share |

|

$ |

1.11 |

|

$ |

1.28 |

|

|

|

|

|

|

| All results

are reported in millions of U.S. dollars, except per share figures,

which are in U.S. dollars |

| |

|

(1) Adjusted EBIT and Adjusted diluted earnings per share are

Non-GAAP financial measures that have no standardized meaning under

U.S. GAAP, and as a result may not be comparable to the calculation

of similar measures by other companies. A reconciliation of these

Non-GAAP financial measures is included in the back of this press

release. |

A photo of Swamy Kotagiri, Magna’s Chief

Executive Officer is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/dd51ddac-f8f4-4964-88a6-1f4436f0463f

THREE MONTHS ENDED MARCH 31, 2023

We posted sales of $10.7 billion for the first

quarter of 2023, an increase of 11% from the first quarter of 2022,

which compares to a 3% increase in global light vehicle production,

including 8% and 7% higher production in our two largest markets,

North America and Europe, respectively. In addition to higher

global production, our sales benefitted from higher volumes at our

complete vehicles assembly segment, and the launch of new programs,

while the net weakening of foreign currencies against the U.S.

dollar negatively impacted sales.

Adjusted EBIT decreased to $437 million in the

first quarter of 2023 compared to $507 million in the first quarter

of 2022. The decrease mainly reflected higher net production input

costs, operating inefficiencies at a facility in Europe, higher net

engineering costs including spending relating to our

electrification and ADAS businesses, lower net favourable

commercial resolutions and higher net warranty costs. These

declines were partially offset by earnings on higher sales and

lower employee profit sharing and incentive compensation.

Income from operations before income taxes was

$275 million for the first quarter of 2023 compared to $420 million

in the first quarter of 2022, which includes Other expense, net(2)

of $142 million and $61 million, respectively. Excluding Other

expense, net from both periods, income from operations before

income taxes decreased $64 million in the first quarter of 2023

compared to the first quarter of 2022.

Net income attributable to Magna International

Inc. was $209 million for the first quarter of 2023 compared to

$364 million in the first quarter of 2022, which includes after tax

Other expense, net(2) of $110 million and $48 million, respectively

and Adjustments to Deferred Tax Valuation Allowances of $29 million

in the first quarter of 2022. Excluding Other expense, net, after

tax and Deferred Tax Valuation Allowances from both periods, net

income attributable to Magna International Inc. decreased $64

million in the first quarter of 2023 compared to the first quarter

of 2022.

Diluted earnings per share decreased to $0.73 in

the first quarter of 2023, compared to $1.22 in the first quarter

of 2022, and Adjusted diluted earnings per share decreased to $1.11

compared to $1.28.

In the first quarter of 2023, we generated cash

from operations before changes in operating assets and liabilities

of $568 million and used $341 million in operating assets and

liabilities. Investment activities for the first quarter of 2023

included $424 million in fixed asset additions and a $101 million

increase in investments, other assets and intangible assets.

RETURN OF CAPITAL TO SHAREHOLDERS

During the three months ended March 31, 2023, we

paid dividends of $132 million.

Our Board of Directors declared a first quarter

dividend of $0.46 per Common Share, payable on June 2, 2023 to

shareholders of record as of the close of business on May 19,

2023.

(2) Other expense, net is comprised

of restructuring and impairments costs and net losses on the

revaluation of certain public company warrants and equity

investments. In addition, Net Income in 2022 includes a $29 million

benefit related to Adjustments to Deferred Tax Valuation

Allowances. A reconciliation of these Non-GAAP financial measures

is included in the back of this press release.

SEGMENT SUMMARY

| ($Millions) |

For the three months ended March 31, |

|

Sales |

|

Adjusted EBIT |

|

|

2023 |

|

2022 |

|

Change |

|

|

2023 |

|

2022 |

Change |

|

|

Body Exteriors & Structures |

$ |

4,439 |

|

$ |

4,077 |

|

$ |

362 |

|

|

$ |

270 |

|

$ |

229 |

$ |

41 |

|

| Power & Vision |

|

3,323 |

|

|

3,046 |

|

|

277 |

|

|

|

84 |

|

|

154 |

|

(70 |

) |

| Seating Systems |

|

1,486 |

|

|

1,376 |

|

|

110 |

|

|

|

36 |

|

|

49 |

|

(13 |

) |

| Complete Vehicles |

|

1,626 |

|

|

1,275 |

|

|

351 |

|

|

|

52 |

|

|

50 |

|

2 |

|

|

Corporate and Other |

|

(201 |

) |

|

(132 |

) |

|

(69 |

) |

|

|

(5 |

) |

|

25 |

|

(30 |

) |

|

Total Reportable Segments |

$ |

10,673 |

|

$ |

9,642 |

|

$ |

1,031 |

|

|

$ |

437 |

|

$ |

507 |

$ |

(70 |

) |

| |

|

For the three months ended March 31, |

|

|

Adjusted EBIT as a percentage of

sales |

|

|

|

2023 |

|

2022 |

|

Change |

|

|

Body Exteriors & Structures |

|

6.1 |

% |

5.6 |

% |

0.5 |

% |

| Power & Vision |

|

2.5 |

% |

5.1 |

% |

(2.6 |

)% |

| Seating Systems |

|

2.4 |

% |

3.6 |

% |

(1.2 |

)% |

|

Complete Vehicles |

|

3.2 |

% |

3.9 |

% |

(0.7 |

)% |

|

Consolidated Average |

|

4.1 |

% |

5.3 |

% |

(1.2 |

)% |

For further details on our segment results,

please see our Management’s Discussion and Analysis of Results of

Operations and Financial Position and our Interim Financial

Statements.

2023 OUTLOOK

We disclose a full-year Outlook annually in

February with quarterly updates. The following Outlook is an update

to our previous Outlook in February 2023.

Updated 2023 Outlook

Assumptions

|

|

|

Current |

|

Previous |

| Light Vehicle Production

(millions of units) |

|

|

|

|

|

North AmericaEuropeChina |

|

15.016.326.2 |

|

14.916.226.2 |

| |

|

|

|

|

| Average Foreign exchange rates:1

Canadian dollar equals1 euro equals |

|

U.S. $0.748U.S. $1.086 |

|

U.S. $0.750U.S. $1.070 |

Updated 2023 Outlook

|

|

|

Current |

|

Previous |

| Segment Sales |

|

|

|

|

|

Body Exteriors & StructuresPower & VisionSeating

SystemsComplete Vehicles |

|

$16.8 - $17.4 billion$13.0 - $13.4 billion$5.6 - $5.9 billion$5.3 -

$5.6 billion |

|

$16.7 - $17.3 billion$13.0 - $13.4 billion$5.5 - $5.8 billion$4.9 -

$5.2 billion |

| Total Sales |

|

$40.2 - $41.8 billion |

|

$39.6 - $41.2 billion |

| |

|

|

|

|

| Adjusted EBIT Margin(3) |

|

4.7% - 5.1% |

|

4.1% - 5.1% |

| |

|

|

|

|

| Equity Income (included in

EBIT) |

|

$95 - $125 million |

|

$95 - $125 million |

| |

|

|

|

|

| Interest Expense, net |

|

Approximately $150 million |

|

Approximately $150 million |

| |

|

|

|

|

| Income Tax Rate(4) |

|

Approximately 21% |

|

Approximately 21% |

| |

|

|

|

|

| Net Income attributable to

Magna(5) |

|

$1.3 - $1.5 billion |

|

$1.1 - $1.4 billion |

| |

|

|

|

|

| Capital Spending |

|

Approximately $2.4 billion |

|

Approximately $2.4 billion |

|

|

|

|

|

|

|

Notes:(3) Adjusted EBIT Margin is the ratio of Adjusted EBIT

to Total Sales(4) The Income Tax Rate has been calculated

using Adjusted EBIT and is based on current tax

legislation(5) Net Income attributable to Magna represents Net

Income excluding Other expense, net |

Our Outlook is intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Although considered reasonable by

Magna as of the date of this document, the 2023 Outlook above and

the underlying assumptions may prove to be inaccurate. Accordingly,

our actual results could differ materially from our expectations as

set forth herein. The risks identified in the “Forward-Looking

Statements” section below represent the primary factors which we

believe could cause actual results to differ materially from our

expectations.

Key Drivers of Our Business

Our operating results are primarily dependent on

the levels of North American, European and Chinese car and light

truck production by our customers. While we supply systems and

components to every major original equipment manufacturer (“OEM”),

we do not supply systems and components for every vehicle, nor is

the value of our content consistent from one vehicle to the next.

As a result, customer and program mix relative to market trends, as

well as the value of our content on specific vehicle production

programs, are also important drivers of our results.

OEM production volumes are generally aligned

with vehicle sales levels and thus affected by changes in such

levels. Aside from vehicle sales levels, production volumes are

typically impacted by a range of factors, including: general

economic and political conditions; labour disruptions; free trade

arrangements; tariffs; relative currency values; commodities

prices; supply chains and infrastructure; availability and relative

cost of skilled labour; regulatory considerations, including those

related to environmental emissions and safety standards; and other

factors. Additionally, COVID-19 can impact vehicle production

volumes, including through: mandatory stay-at-home orders which

restrict production; elevated employee absenteeism; and supply

chain disruptions.

Overall vehicle sales levels are significantly

affected by changes in consumer confidence levels, which may in

turn be impacted by consumer perceptions and general trends related

to the job, housing and stock markets, as well as other

macroeconomic and political factors. Other factors which typically

impact vehicle sales levels and thus production volumes include:

interest rates and/or availability of credit; fuel and energy

prices; relative currency values; regulatory restrictions on use of

vehicles in certain megacities; and other factors. Additionally,

COVID-19 can impact vehicle sales, including through mandatory

stay-at-home orders which restrict operations of car dealerships,

as well as through a deterioration in consumer confidence.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

|

The reconciliation of Non-GAAP financial measures is as

follows:Adjusted EBIT |

|

|

|

|

|

For the three months ended March 31, |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

Net Income |

$ |

217 |

|

|

$ |

379 |

|

|

Add: |

|

|

|

|

Interest expense, net |

|

20 |

|

|

|

26 |

|

|

Other expense, net |

|

142 |

|

|

|

61 |

|

|

Income taxes |

|

58 |

|

|

|

41 |

|

|

Adjusted EBIT |

$ |

437 |

|

|

$ |

507 |

|

|

|

|

|

|

|

Adjusted EBIT as a percentage of sales (“Adjusted EBIT

margin”) |

|

|

|

|

|

For the three months ended March 31, |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

Sales |

$ |

10,673 |

|

|

$ |

9,642 |

|

|

Adjusted EBIT |

$ |

437 |

|

|

$ |

507 |

|

|

Adjusted EBIT as a percentage of sales |

|

4.1% |

|

|

|

5.3% |

|

|

|

|

|

|

|

Adjusted diluted earnings per share |

|

|

|

|

|

For the three months ended March 31, |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

Net income attributable to Magna International Inc. |

$ |

209 |

|

|

$ |

364 |

|

|

Add (deduct): |

|

|

|

|

Other expense, net |

|

142 |

|

|

|

61 |

|

|

Tax effect on Other expense, net |

|

(32 |

) |

|

|

(13 |

) |

|

Adjustments to Deferred Tax Valuation Allowances |

|

— |

|

|

|

(29 |

) |

|

Adjusted net income attributable to Magna International Inc. |

$ |

319 |

|

|

$ |

383 |

|

|

Diluted weighted average number of Common Shares outstanding during

the period (millions): |

|

286.6 |

|

|

|

298.1 |

|

|

Adjusted diluted earnings per share |

$ |

1.11 |

|

|

$ |

1.28 |

|

Certain of the forward-looking financial

measures above are provided on a Non-GAAP basis. We do not provide

a reconciliation of such forward-looking measures to the most

directly comparable financial measures calculated and presented in

accordance with U.S. GAAP. To do so would be potentially misleading

and not practical given the difficulty of projecting items that are

not reflective of on-going operations in any future period. The

magnitude of these items, however, may be significant.

This press release together with our

Management’s Discussion and Analysis of Results of Operations and

Financial Position and our Interim Financial Statements are

available in the Investor Relations section of our website at

www.magna.com/company/investors and filed electronically through

the System for Electronic Document Analysis and Retrieval (SEDAR)

which can be accessed at www.sedar.com as well as on the United

States Securities and Exchange Commission’s Electronic Data

Gathering, Analysis and Retrieval System (EDGAR), which can be

accessed at www.sec.gov.

We will hold a conference call for interested

analysts and shareholders to discuss our first quarter ended March

31, 2023 results on Friday, May 5, 2023 at 8:00 a.m. ET. The

conference call will be chaired by Swamy Kotagiri, Chief Executive

Officer. The number to use for this call from North America

is 1-800-584-0405. International callers should use

1-416-981-9017. Please call in at least 10 minutes prior to the

call start time. We will also webcast the conference call at

www.magna.com. The slide presentation accompanying the conference

call as well as our financial review summary will be available on

our website Friday prior to the call.

TAGSQuarterly earnings, financial results,

vehicle production

INVESTOR CONTACTLouis Tonelli, Vice-President,

Investor Relations louis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT Tracy Fuerst, Vice-President,

Corporate Communications & PR tracy.fuerst@magna.com │

248.761.7004

TELECONFERENCE CONTACTNancy Hansford, Executive

Assistant, Investor Relations nancy.hansford@magna.com │

905.726.7108

OUR BUSINESS(6)

Magna is more than one of the world’s largest

suppliers in the automotive space. We are a mobility technology

company with a global, entrepreneurial-minded team of 171,000(7)

employees and an organizational structure designed to innovate like

a startup. With 65+ years of expertise, and a systems approach to

design, engineering and manufacturing that touches nearly every

aspect of the vehicle, we are positioned to support advancing

mobility in a transforming industry. Our global network includes

341 manufacturing operations and 88 product development,

engineering and sales centres spanning 29 countries.

For further information about Magna (NYSE:MGA; TSX:MG), please

visit www.magna.com or follow us on Twitter

@MagnaInt.

(6) Manufacturing operations, product

development, engineering and sales centres include certain

operations accounted for under the equity method.(7) Number of

employees includes over 160,000 employees at our wholly owned or

controlled entities and over 11,000 employees at certain operations

accounted for under the equity method.FORWARD-LOOKING

STATEMENTSCertain statements in this press release

constitute "forward-looking information" or "forward-looking

statements" (collectively, "forward-looking statements"). Any such

forward-looking statements are intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Forward-looking statements may

include financial and other projections, as well as statements

regarding our future plans, strategic objectives or economic

performance, or the assumptions underlying any of the foregoing,

and other statements that are not recitations of historical fact.

We use words such as "may", "would", "could", "should", "will",

"likely", "expect", "anticipate", "believe", "intend", "plan",

"aim", "forecast", "outlook", "project", "estimate", "target" and

similar expressions suggesting future outcomes or events to

identify forward-looking statements. The following table identifies

the material forward-looking statements contained in this document,

together with the material potential risks that we currently

believe could cause actual results to differ materially from such

forward-looking statements. Readers should also consider all of the

risk factors which follow below the table:

|

Material Forward-Looking Statement |

Material Potential Risks Related to Applicable

Forward-Looking Statement |

|

Light Vehicle Production |

- Light vehicle sales levels

- Supply disruptions

- Production allocation decisions by

OEMs

|

|

Total SalesSegment Sales |

- The impact of elevated interest

rates and availability of credit on consumer confidence and in turn

vehicle sales and production

- Potential supply disruptions

- The impact of the Russian invasion

of Ukraine on global economic growth and industry production

volumes

- The impact of rising interest rates

and availability of credit on consumer confidence and, in turn,

vehicle sales and production

- The impact of deteriorating vehicle

affordability on consumer demand, and in turn vehicle sales and

production

- Concentration of sales with six

customers

- Shifts in market shares among

vehicles or vehicle segments

- Shifts in consumer “take rates” for

products we sell

|

|

Adjusted EBIT Margin Net Income Attributable to Magna |

- Same risks as for Total Sales and

Segment Sales above

- Successful execution of critical

program launches, including complete vehicle manufacturing of the

Fisker Ocean SUV

- Operational underperformance

- Production inefficiencies in our

operations due to volatile vehicle production allocation decisions

by OEMs

- Higher costs incurred to mitigate

the risk of supply disruptions

- Inflationary pressures

- Our ability to secure cost

recoveries from customers and/or otherwise offset higher input

costs

- Price concessions

- Commodity cost volatility

- Scrap steel price volatility

- Higher labour costs

- Tax risks

|

|

Equity Income |

- Same risks as Adjusted EBIT Margin

and Net Income Attributable to Magna

- Risks related to conducting

business through joint ventures

|

Forward-looking statements are based on

information currently available to us and are based on assumptions

and analyses made by us in light of our experience and our

perception of historical trends, current conditions and expected

future developments, as well as other factors we believe are

appropriate in the circumstances. While we believe we have a

reasonable basis for making any such forward-looking statements,

they are not a guarantee of future performance or outcomes. In

addition to the factors in the table above, whether actual results

and developments conform to our expectations and predictions is

subject to a number of risks, assumptions and uncertainties, many

of which are beyond our control, and the effects of which can be

difficult to predict, including, without limitation:

Macroeconomic, Geopolitical and Other Risks

- impact of the Russian invasion of Ukraine;

- inflationary pressures;

- interest rate levels;

- risks related to COVID-19;

Risks Related to the Automotive Industry

- economic cyclicality;

- regional production volume declines;

- deteriorating vehicle affordability;

- potential consumer hesitancy with respect to Electric Vehicles

(“EVs”);

- intense competition;

Strategic Risks

- alignment of our product mix with the “Car of the Future”;

- our ability to consistently develop and commercialize

innovative products or processes;

- our investments in mobility and technology companies;

- our changing business risk profile as a result of increased

investment in electrification and autonomous/assisted driving,

including: higher R&D and engineering costs, and challenges in

quoting for profitable returns on products for which we may not

have significant quoting experience;

Customer- Related Risks

- concentration of sales with six customers;

- inability to significantly grow our business with Asian

customers;

- emergence of potentially disruptive EV OEMs, including risks

related to limited revenues/operating history of new OEM

entrants;

- Evolving counterparty risk profile;

- dependence on outsourcing;

- OEM consolidation and cooperation;

- shifts in market shares among vehicles or vehicle

segments;

- shifts in consumer "take rates" for products we sell;

- quarterly sales fluctuations;

- potential loss of any material purchase orders;

- potential OEM production-related disruptions;

Supply Chain Risks

- semiconductor chip supply disruptions and price increases, and

the impact on customer production volumes and on the efficiency of

our operations;

- supply disruptions and applicable costs related to supply

disruption mitigation initiatives;

- regional energy shortages/disruptions and pricing;

- a deterioration of the financial condition of our supply

base;

Manufacturing/Operational Risks

- product and new facility launch risks;

- operational underperformance;

- restructuring costs;

- impairment charges;

- labour disruptions;

- skilled labour attraction/retention;

- leadership expertise and succession;

|

|

IT Security/Cybersecurity Risk

- IT/Cybersecurity breach;

- product Cybersecurity breach;

Pricing Risks

- pricing risks between time of quote and start of

production;

- price concessions;

- commodity price volatility;

- declines in scrap steel/aluminum prices;

Warranty / Recall Risks

- costs related to repair or replacement of defective products,

including due to a recall;

- warranty or recall costs that exceed warranty provision or

insurance coverage limits;

- product liability claims;

Climate Change Risks

- transition risks and physical risks;

- strategic and other risks related to the transition to

electromobility;

Acquisition Risks

- competition for strategic acquisition targets;

- inherent merger and acquisition risks;

- acquisition integration risk;

Other Business Risks

- risks related to conducting business through joint

ventures;

- intellectual property risks;

- risks of conducting business in foreign markets;

- fluctuations in relative currency values;

- an increase in pension funding obligations;

- tax risks;

- reduced financial flexibility as a result of an economic

shock;

- inability to achieve future investment returns that equal or

exceed past returns;

- changes in credit ratings assigned to us;

- the unpredictability of, and fluctuation in, the trading price

of our Common Shares;

- a reduction of suspension of our dividend;

Legal, Regulatory and Other Risks

- antitrust risk;

- legal claims and/or regulatory actions against us;

- changes in laws and regulations, including those related to

vehicle emissions, taxation, or made as a result of the COVID-19

pandemic.

- potential restrictions on free trade;

- trade disputes/tariffs; and

- environmental compliance costs.

|

In evaluating forward-looking statements or

forward-looking information, we caution readers not to place undue

reliance on any forward-looking statement. Additionally, readers

should specifically consider the various factors which could cause

actual events or results to differ materially from those indicated

by such forward-looking statements, including the risks,

assumptions and uncertainties above which are:

- discussed under the “Industry

Trends and Risks” heading of our Management’s Discussion and

Analysis; and

- set out in our revised Annual

Information Form filed with securities commissions in Canada, our

annual report on Form 40-F / 40-F/A filed with the United States

Securities and Exchange commission, and subsequent filings.

Readers should also consider discussion of our

risk mitigation activities with respect to certain risk factors,

which can be also found in our Annual Information Form.

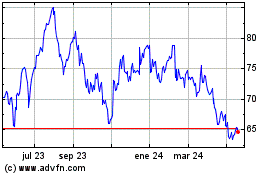

Magna (TSX:MG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

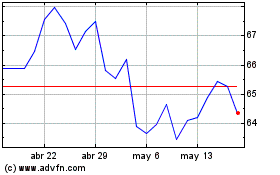

Magna (TSX:MG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025