Aura Minerals Announces Updated San Andres Mine NI 43-101 Showing

an Increase in Mineral Reserve and Mineral Resource Estimates

TORONTO, ONTARIO--(Marketwired - May 27, 2014) - Aura Minerals

Inc. (the "Company") (TSX:ORA) announces updated NI 43-101

compliant Mineral Reserve and Mineral Resource estimates for its

wholly-owned San Andres Mine located in the Department of Copan,

Honduras.

Highlights

- a 44% increase in total Proven and Probable Mineral Reserves to

1,129 thousand ounces ('koz") of contained gold at a cut-off of

0.28 grams per tonne ("g/t") for oxide material and 0.37 g/t for

mixed material

- a 1.7% increase in Measured and Indicated Mineral Resources to

1,660 koz of contained gold at a cut-off of 0.23 g/t for oxide

material and 0.30 g/t for mixed material

- planned tonnage increase going forward to approximately 7 Mt of

processed material per year

- current and anticipated reduction in operating costs.

Mineral Reserves as at December 31, 2013

|

Reserve Category |

|

Tonnes (000) |

|

Gold Grade (g/t) |

|

Contained Gold Ounces (000) |

|

Proven |

|

14,714 |

|

0.50 |

|

237 |

|

Probable |

|

53,388 |

|

0.52 |

|

892 |

|

Proven and Probable |

|

68,102 |

|

0.52 |

|

1,129 |

- The mineral reserve estimates are based on an optimized pit,

which has been made operational, using $1,300/oz gold.

- The cut-off grade used was 0.28 g/t for oxide material and 0.37

g/t for mixed material.

- Contained metal figures may not add due to rounding.

- Surface topography as of December 31, 2013.

The 1,129 koz of contained gold in total Proven and Probable

Mineral Reserves represents a 44% increase - before taking account

of depletion from mining activities in the 2012 and 2013 years - as

compared to the previously reported total Proven and Probable

Mineral Reserves as of December 31, 2011 of 45.7 million tonnes

("Mt") grading 0.53 g/t gold which contained 784 koz of gold.

Mineral Resources as at December 31, 2013

|

Resource Category |

|

Tonnes (000) |

|

Gold Grade (g/t) |

|

Contained Gold Ounces (000) |

|

Measured |

|

16,238 |

|

0.48 |

|

252 |

|

Indicated |

|

88,603 |

|

0.49 |

|

1,407 |

|

Measured & Indicated |

|

104,841 |

|

0.49 |

|

1,660 |

|

Inferred |

|

4,348 |

|

0.49 |

|

69 |

- The Mineral Resource estimate is based on an optimized shell

using $1,600/oz gold.

- The cut-off grade used was 0.23 g/t for oxide material and 0.30

g/t for mixed material.

- Contained metal figures may not add due to rounding.

- Surface topography as of December 31, 2013, and a 200m river

offset restriction have been imposed.

- Mineral Resources are inclusive of Mineral Reserves.

- The estimate of Mineral Resources may be materially affected by

environmental, permitting, legal, marketing, or other relevant

issues.

- The Mineral Resources in this news release were estimated using

the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council.

The 1,660 koz of gold in total Measured and Indicated Mineral

Resources as of December 31, 2013 represents a 1.7% increase -

before taking account of depletion from mining activities in the

2012 and 2013 years - as compared to the Company's previously

reported Measured and Indicated Mineral Resources, as of December

31, 2011, of 98.9 Mt grading 0.51 g/t gold which contained 1,631

koz of gold.

Additional Highlights

In updating the Mineral Resource and Mineral Reserve estimates,

the Company reinterpreted its geological models, updated the

geological database and updated the mine design parameters. During

the course of 2012 and 2013 resource delineation drilling,

geological mapping and data quality programmes of the Cerro Cortez,

Cerro Cemetery, Twin Hills and East Ledge areas have significantly

improved the size and confidence in the oxidation horizons,

mineralization controls and data density for the Mineral Resource

model estimation. Two key changes to the previous Mineral Resource

model estimation were to the geological models and the inclusion of

production blast hole samples into the Mineral Resource. The use of

the production blast holes has been supported by a detailed

reconciliation of the resource models and significantly helps with

short range local variability. Appropriate validations were

undertaken to ensure that the block model adequately represents the

informing composite data.

The updated Mineral Resource and Mineral Reserve estimates

included infill and step-out drilling of an additional 273 holes

consisting of 23,963 metres of drilling, changes in operating cost

estimates and updated metal prices originally included in the San

Andres technical report dated March 28, 2012 (effective as of

December 31, 2011).

Negotiations have been ongoing with the surrounding communities

and an agreement reached with the local community to relocate a

cemetery has also enabled San Andres to include additional Mineral

Reserves, which had previously been classified as Mineral

Resources.

In addition to the above, the Company has implemented a small,

but effective capital expansion programme. The crushing system at

San Andres was upgraded to enable increased efficiency, stable

throughput and product quality, and the Company expects to realize

the benefits of this throughout the remainder of 2014 and into the

future. Previous to the upgrade, nominal yearly throughput was

approximately 5 Mt, whereas planned tonnage going forward is 7 Mt

of processed material per year. Due to the higher feed rate, there

is a reduction in operating costs.

Qualified Persons and NI 43-101 Technical Report

The Mineral Resource and Mineral Reserve estimates were prepared

by or under the supervision of Bruce Butcher, P. Eng., the

Company's VP Technical Services and Ben Bartlett, FAusimm., the

Company's Manager, Mineral Resources, both Qualified Persons as

that term is defined in NI 43-101. Each of the Qualified Persons

have reviewed and approved the written disclosure contained in this

news release including any sampling, analytical and test data

underlying the information contained in this news release.

The Company will file a NI 43-101 compliant technical report in

respect of the updated Mineral Resource and Mineral Reserve

estimate on SEDAR and on the Company's website within 45 days of

this news release.

About Aura Minerals

Aura Minerals is a Canadian mid-tier gold and copper production

company focused on the development and operation of gold and base

metal projects in the Americas. The Company's producing assets

include the copper-gold-silver Aranzazu mine in Mexico, the San

Andres gold mine in Honduras and the Sao Francisco and Sao Vicente

gold mines in Brazil. The Company's core development asset is the

copper-gold-iron Serrote project in Brazil. Recent achievements on

the Serrote project include: completion of basic engineering;

significant progress on land acquisitions and community

resettlement, with approximately 70% of the project area now

acquired; and engineering-only award of long lead equipment.

Detailed negotiations for debt and equity financing of the project

are continuing.

Contact Information

For further information, please visit Aura Minerals' web site at

www.auraminerals.com.

Forward-Looking Information

This news release contains "forward-looking information" and

"forward-looking statements", as defined in applicable securities

laws (collectively, "forward-looking statements") which may

include, but is not limited to, statements with respect to the

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including, without

limitation, test work and confirming results from work performed to

date, estimation of Mineral Resources and Mineral Reserves and the

realization of the expected economics of the San Andres Mine.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as "plans," "expects," "is

expected," "budget," "scheduled," "estimates," "forecasts,"

"intends," "anticipates," or "believes" or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results "may," "could," "would," "might"

or "will" be taken, occur or be achieved.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

the Company, are inherently subject to significant business,

economic and competitive uncertainties and contingencies.

Forward-looking statements in this news release are based upon,

without limitation, the following estimates and assumptions: the

presence of and continuity of metals at San Andres at modeled

grades; the capacities of various machinery and equipment; the

availability of personnel, machinery and equipment at estimated

prices; exchange rates; metals and minerals sales prices;

appropriate discount rates; tax rates and royalty rates applicable

to the mining operations; cash costs; anticipated mining losses and

dilution; metals recovery rates, reasonable contingency

requirements; political stability in Honduras; future negotiations

with unions; and receipt of regulatory approvals on acceptable

terms.

Known and unknown risks, uncertainties and other factors, many

of which are beyond the Company's ability to predict or control

could cause actual results to differ materially from those

contained in the forward-looking statements. Specific reference is

made to the most recent Annual Information Form on file with

certain Canadian provincial securities regulatory authorities for a

discussion of some of the factors underlying forward-looking

statements, which include, without limitation, gold and copper or

certain other commodity price volatility, changes in debt and

equity markets, the uncertainties involved in interpreting

geological data, increases in costs, environmental compliance and

changes in environmental legislation and regulation, interest rate

and exchange rate fluctuations, general economic conditions and

other risks involved in the mineral exploration and development

industry. Readers are cautioned that the foregoing list of factors

is not exhaustive of the factors that may affect the

forward-looking statements.

All forward-looking statements herein are qualified by this

cautionary statement. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Aura Minerals Inc.Joshua PerelmanSr. Financial Analyst(416)

649-1056(416) 649-1044info@auraminerals.comwww.auraminerals.com

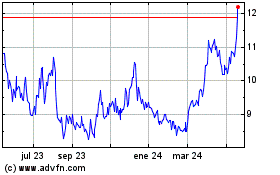

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

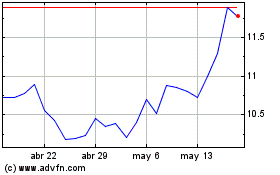

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025