Aura Amends Dividend Policy to Quarterly Payments, and Declares Dividend of US$0.24 Per Share Based on Q3 2024 Results; BDR holders will receive R$ 0.08 per BDR

04 Noviembre 2024 - 5:48PM

Aura Minerals Inc. (TSX: ORA, B3: AURA33 and OTCQX: ORAAF)

(“Aura” or the “Company”) has approved an amendment to its

dividend policy (“

Dividend Policy”), with the

intention of declaring and paying dividends on a quarterly basis.

Under the Dividend Policy, the Company will determine quarterly

cash dividends in an aggregate amount equal to 20% of its reported

Adjusted EBITDA¹ for the relevant three months less sustaining

capital expenditures and exploration capital expenditures for the

same period.

Dividends are expected to be declared four times

per year, starting in Q4 2024, based on the reported results and

capital expenditures for the applicable three-month period, with a

record date that is no less than seven business day after the date

of the press release announcing the financial statements and

Management's Discussion and Analysis (“MD&A”)

of each calendar quarter. Dividends are expected to be declared

four times per year, starting in being declared in Q4 2024,

according to the Q3 2024 results, based on the reported results and

capital expenditures for the applicable three-month period, with a

record date that is no less than seven business day after the date

of the press release announcing the financial statements and

Management's Discussion and Analysis (“MD&A”)

of each calendar quarter. As such, any dividend payable under the

Dividend Policy will be declared together or soon after the press

release announcing the financial statements and MD&A of each

calendar quarter¹.

In addition to the amended Dividend Policy, the

Board has declared and approved the payment of a dividend (the

“Dividend”) of US$0.24 per common share

(approximately US$17.4 million in total). The Dividend is in

respect of and is based on Aura’s financial results for the three

months ending September 30, 2024. This payment is above the minimum

foreseen in the Company’s Dividend Policy.

The Dividend will be paid in US dollars on

December 2, 2024, to shareholders of record as of the close of

business on November 15, 2024 (“Record Date”).

Holders of the Company’s Brazilian Depositary

Receipts as of Record Date will receive US$0.08 per BDR (since 1

Aura share is equivalent to 3 BDRs) and are expected to receive

payment by December 18, 2024, and will receive the Brazilian Reais

equivalent of the Dividend, based on a market exchange rate to be

disclosed in a future Press Release, in advance of its payment

date.

The Dividend is not subject to withholding taxes

at the time of payment by the Company.

Rodrigo Barbosa, President & CEO commented,

"We are excited to announce another dividend following strong Q3

results, underscoring our commitment to delivering consistent and

sustainable returns to our shareholders while actively growing our

business. The transition to a quarterly dividend policy highlights

our confidence in Aura's long-term growth and operational strength,

enabling us to reward shareholders regularly. With a demonstrated

track record of paying sector leading dividends upon strong

execution, Aura stands out as a Company that prioritizes

shareholder value. With this move, we remain dedicated to

maximizing returns through regular dividends and strategic share

buybacks, while we invest on production and resources growth. We

remain dedicated to maximizing returns through regular dividends

and strategic share buybacks, while we invest to increase our

production and mineral resources and reserves.”

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on the development and operation of gold and base

metal projects in the Americas. The Company’s four producing assets

include the San Andres gold mine in Honduras, the EPP and Almas

gold mines in Brazil and the Aranzazu copper-gold-silver mine in

Mexico. In addition, the Company has the Tolda Fria gold project in

Colombia and four projects in Brazil: the Borborema and Matupá gold

projects, which are in development the São Francisco gold project,

which is on care and maintenance, and the Serra da Estrela copper

project in Brazil, Carajás region, which is at the exploration

stage.

For further information, please visit Aura’s website at

www.auraminerals.com or contact:Investor

Relationsri@auraminerals.com

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which include, but are not limited to,

statements with respect to the activities, events or developments

that the Company expects or anticipates will or may occur in the

future, including the expected timing of the Dividend; expected

production levels in Q2 2024 and metal prices received in respect

thereof; the Company’s sustaining capital expenditures and

exploration capital expenditures for Q2 2024; the further potential

of the Company’s properties; and the ability of the Company to

achieve its short and long term outlook and the anticipated timing

and results thereof.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Specific reference is

made to the most recent Annual Information Form on file with

certain Canadian provincial securities regulatory authorities for a

discussion of some of the factors underlying forward-looking

statements, which include, without limitation, the ability of the

Company to achieve its short-term and longer-term outlook and the

anticipated timing and results thereof, the ability to lower costs

and increase production, the ability of the Company to successfully

achieve business objectives, copper and gold or certain other

commodity price volatility, changes in debt and equity markets, the

uncertainties involved in interpreting geological data, increases

in costs, environmental compliance and changes in environmental

legislation and regulation, interest rate and exchange rate

fluctuations, general economic conditions and other risks involved

in the mineral exploration and development industry. Readers are

cautioned that the foregoing list of factors is not exhaustive of

the factors that may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

|

¹ The declaration of dividends under the Dividend Policy is

subject to the discretion of the Company’s board of directors,

having regard to the best interests of the Company and the

limitations imposed by the solvency tests contained in the

Company’s memorandum of association and articles of association and

other requirements of applicable corporate law. Nothing in the

Dividend Policy shall restrict the discretion of the Company’s

board of directors from authorizing sustaining capital expenditures

or exploration capital expenditures that the board of directors

deems to be in the best interests of the Company. These

expenditures may limit future amounts of dividends payable under

the Dividend Policy. |

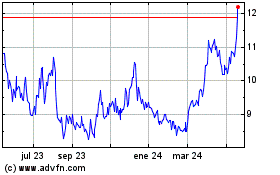

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

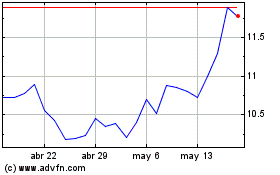

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024