Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”), informs its shareholders and the

market in general that its Subsidiary, Aura Almas Mineração S.A.

(“Almas”), within the scope of the public offering of 1,000,000

(one million) simple debentures, not convertible into shares, in a

single series, of the secured type, with additional personal

guarantee, with a unit face value of R$1,000.00 (one thousand

reais) on the Issue Date, that is, October 2, 2024, totaling

R$1,000,000,000.00 (one billion reais) on the Issue Date

("Debentures"), concludes on this date the “Bookbuilding

Procedure”.

On the Unit Face Value or balance of the Unit

Face Value of the Debentures, as the case may be, interest will be

charged corresponding to the accumulated variation of 100% (one

hundred percent) of the average daily rates of the DI – Interbank

Deposit of one day, "over extra-group", expressed as a percentage

per year, based on 252 (two hundred and fifty-two) Business Days,

plus a spread (surcharge) of 1.60% (one point sixty percent) per

year, based on 252 (two hundred and fifty-two) Business Days, in

accordance with Annex I.

ANNEX I

THE RESULTS OF THE

BOOKBUILDING PROCEDURE OF THE PUBLIC

OFFERING OF DISTRIBUTION, UNDER THE RITE OF AUTOMATIC REGISTRATION,

OF SIMPLE DEBENTURES, NOT CONVERTIBLE INTO SHARES,

OF THE SECURED TYPE, WITH ADDITIONAL PERSONAL

GUARANTEE, IN A SINGLE SERIES, OF

THE 2ND (SECOND) ISSUE OF THE

AURA ALMAS MINERAÇÃO

S.A.Publicly-held corporation, category "B"CNPJ

No. 08.213.823/0001-07Fazenda Mateus Lopes, S/N, Zona Rural, CEP

77310-000 City of Almas, State of Tocantins

in the total amount ofR$

1,000,000,000.00 (one billion reais)

ISIN CODE: BRAALMDBS017

1. SECURITIES AND ISSUER

Pursuant to the provisions of article 61,

paragraph 4, of the Resolution of the Brazilian Securities and

Exchange Commission ("CVM") No. 160, of July 13, 2022, as in force

("CVM Resolution 160"), and CVM Resolution No. 44, of August 23,

2021, as in force, AURA ALMAS MINERAÇÃO S.A., a

publicly-held corporation, category "B", before the Brazilian

Securities and Exchange Commission ("CVM"), in the operational

phase, headquartered in Cidade de Almas, State of Tocantins, at

Fazenda Mateus Lopes, S/N, Zona Rural, CEP 77310-000, registered in

the National Registry of Legal Entities of the Ministry of Finance

("CNPJ")") under No. 08.213.823/0001-07, with its articles of

incorporation registered with the Board of Trade of the State of

Tocantins ("JUCETINS") under NIRE 17.300.009.423 ("Issuer"),

together with ITAÚ BBA ASSESSORIA FINANCEIRA S.A.,

an institution that is part of the securities distribution system,

headquartered in the City of São Paulo, State of São Paulo, at

Avenida Brigadeiro Faria Lima, No. 3,500, 1st, 2nd, 3rd (part), 4th

and 5th floors, registered with the CNPJ under No.

04,845,753/0001-59 ("Lead Coordinator"), within the scope of the

public offering of 1,000,000 (one million) simple debentures, not

convertible into shares, in a single series, of the secured type,

with additional personal guarantee, with a unit face value of

R$1,000.00 (one thousand reais) on the Issue Date, that is, October

2, 2024 ("Issue Date"), totaling R$1,000,000,000.00 (one billion

reais) on the Issue Date ("Debentures"), to be carried out pursuant

to CVM Resolution No. 160, of July 13, 2022, as in force ("CVM

Resolution 160"), intended exclusively for professional investors,

as defined pursuant to articles 11 and 13 of CVM Resolution No. 30,

of May 11, 2021, as in force ("Offering"), hereby make public, by

means of this notice to the market ("Notice to the Market") INFORM

that on October 15, 2024, the conclusion of the “Bookbuilding

Procedure”, as defined in the "Private Deed of the 2nd (Second)

Issue of Simple Debentures, Non-Convertible into Shares, of the

Secured Type, with Additional Personal Guarantee, in a Single

Series, for Public Distribution, Registered under the Automatic

Rite, of Aura Alma Mineração S.A.", entered into on September 08,

2024, between the Issuer, OLIVEIRA TRUST

DISTRIBUIDORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A.,

registered with the CNPJ/MF under No. 36.113.876/0004-34, as the

fiduciary agent and AURA MATUPÁ MINERAÇÃO LTDA.,

registered with the CNPJ/MF under No. 17.708.824/0001-13, as

guarantor, as amended ("Indenture").

The terms beginning in capital letters and used

in this Notice to the Market that are not defined herein, will have

the meaning attributed to them in the Indenture.

For more information on the Bookbuilding Procedure, see

the Indenture.

2. RESULT OF THE

BOOKBUILDING PROCEDURE

After the conclusion of the Bookbuilding Procedure, the

following was defined:

|

Interest of the Debentures |

On the Unit Face Value or balance of the Unit Face Value of the

Debentures, as the case may be, interest will be charged

corresponding to the accumulated variation of 100% (one hundred

percent) of the average daily rates of the DI – Interbank Deposit

of one day, "over extra-group", expressed as a percentage per year,

based on 252 (two hundred and fifty-two) Business Days, calculated

and disclosed daily by B3, in the daily newsletter available on its

website (http://www.b3.com.br) ("DI Rate"), plus a spread

(surcharge) of 1.60% (one point sixty percent) per year, based on

252 (two hundred and fifty-two) Business Days ("Interest")The

Interest will be calculated exponentially and cumulatively pro rata

temporis by elapsed Business Days, incident on the Unit Face Value

of the Debentures or on the balance of the Unit Face Value of the

Debentures, as the case may be, since the Profitability Start Date,

or the Interest Payment Date (as defined below) immediately

preceding (inclusive), as applicable, until the Interest Payment

Date in question, the date of payment as a result of the early

maturity of the obligations arising from the Debentures, pursuant

to the Indenture, the date of payment of the redemption of all the

Debentures resulting from the Early Redemption Offer, the Optional

Early Redemption and the Optional Acquisition, with total

cancellation of the Debentures, whichever comes first. The Interest

will be calculated according to the formula provided for in the

Indenture. |

3. ADDITIONAL

INFORMATIONThis Notice to the Market, any rectification

announcements and any and all other notices or notices related to

the Offering have been or will be, as the case may be, made

available, until the closing of the Offering, pursuant to Article

13 of CVM Resolution 160, on the pages of the Issuer, the Lead

Coordinator and/or with the CVM.

THIS NOTICE TO THE MARKET IS FOR INFORMATION PURPOSES

ONLY, AND IS NOT AN OFFER TO SELL SECURITIES.

THE DISCLOSURE OF THE PROSPECTUS AND

SHEET FOR THE REALIZATION OF THIS OFFERING WAS WAIVED, CONSIDERING

THAT THE TARGET AUDIENCE OF THE OFFERING IS COMPOSED EXCLUSIVELY OF

PROFESSIONAL INVESTORS, AS PROVIDED FOR IN ITEM I OF ARTICLE 9 AND

PARAGRAPH 1 OF ARTICLE 23, BOTH OF CVM RESOLUTION 160.

CONSIDERING THAT THE OFFERING IS

INTENDED EXCLUSIVELY FOR PROFESSIONAL INVESTORS, PURSUANT TO

ARTICLE 26, ITEM V, PARAGRAPH (A), OF CVM RESOLUTION 160, AND IS,

THEREFORE, SUBJECT TO THE RITE OF AUTOMATIC REGISTRATION OF

DISTRIBUTION, THE REGISTRATION OF THE OFFERING DOES NOT REQUIRE

PRIOR ANALYSIS BY THE CVM. IN THIS SENSE, THE DOCUMENTS RELATED TO

THE DEBENTURES AND THE OFFERING HAVE NOT BEEN AND WILL NOT BE

SUBJECT TO REVIEW BY THE CVM.

THE REGISTRATION OF THIS OFFERING DOES

NOT IMPLY, ON THE PART OF THE CVM, A GUARANTEE OF THE VERACITY OF

THE INFORMATION PROVIDED OR A JUDGMENT ON THE QUALITY OF THE

ISSUER, AS WELL AS ON THE DEBENTURES TO BE

DISTRIBUTED.

CONSIDERING THAT THE OFFERING IS INTENDED EXCLUSIVELY

FOR PROFESSIONAL INVESTORS, PURSUANT TO ARTICLE 26, ITEM V,

PARAGRAPH A, OF CVM RESOLUTION 160, AND IS, THEREFORE, SUBJECT TO

THE AUTOMATIC REGISTRATION OF DISTRIBUTION RITE PROVIDED FOR IN CVM

RESOLUTION 160, THE DEBENTURES WILL BE SUBJECT TO RESTRICTIONS ON

RESALE, AS INDICATED IN ARTICLE 86, ITEM II, OF CVM RESOLUTION

160.

THE OFFERING IS IRREVOCABLE, BUT MAY BE SUBJECT TO

PREVIOUSLY INDICATED CONDITIONS THAT CORRESPOND TO A LEGITIMATE

INTEREST OF THE COMPANY AND WHOSE IMPLEMENTATION DOES NOT DEPEND ON

THE DIRECT OR INDIRECT ACTION OF THE COMPANY OR PERSONS RELATED TO

IT, PURSUANT TO ARTICLE 58 OF CVM RESOLUTION 160.

CAREFULLY READ THE TERMS AND CONDITIONS

OF THE INDENTURE AND THE SUMMARY OF DEBENTURES BEFORE MAKING YOUR

INVESTMENT DECISION, ESPECIALLY THE "RISK FACTORS"

SECTION.

MORE INFORMATION ABOUT THE DISTRIBUTION CAN BE OBTAINED

FROM THE LEAD COORDINATOR OR CVM.

São Paulo, October 15, 2024.

For more information, please contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

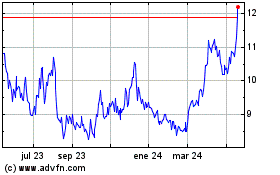

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

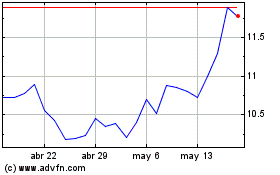

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025