Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF)

(“Company” or

“Aura”) in continuation

to the Press Releases disclosed by the Company on September 8th and

September 25th, 2024, informs its shareholders and the market in

general that its subsidiary, Aura Almas Mineração S.A. (“Almas”),

has settled and closed the public offering of its 2nd (second)

issuance of simple debentures, non-convertible into shares, secured

and with additional surety guarantee, in a single series, for

public distribution under the automatic registration procedure,

approved at the Company's Extraordinary General Meeting held on

September 8th, 2024 (“Debentures”)., in the amount of BRL 1.0

billion (~ US$ 175MM),

On the same date, Almas entered into a swap

agreement (“Swap”) with Banco Itaú S.A. to fully hedge the

Debentures. Under the terms of the Swap, the Company will take an

active position of BRL 1.0 billion (~ US$ 175MM), receiving

compensatory interest corresponding to 100% (one hundred percent)

of the accumulated variation of the DI Rate, plus an exponential

surcharge of 1.60% (one point six zero percent) per annum, and will

pay the exchange rate variation of Brazilian Reais vs. U.S.

Dollars, plus a fixed linear rate of 6.975% per annum. The Swap

transaction has a principal and interest amortization schedule

identical to the principal and interest amortization schedule of

the Debentures.

Rodrigo Barbosa, Aura's CEO commented: “We are

glad to share the results of our recent debenture issuance.

Initially set at BRL 500 million (~ US$ 88MM) with an anticipated

cost of CDI + 1.75% per annum (approximately 7.13% in USD), we

concluded the transaction with a BRL 1 billion (~ US$ 175MM) at a

reduced rate of CDI + 1.60% per annum (6.975% in USD), reflecting

an oversubscribed order book.

This achievement is a result of the excellence

that Aura pursues. It is a testament to the hard work and

dedication of our team under the Aura 360 culture”.

Transaction Highlights:

- Total

Debentures Issued, Subscribed and Paid-In: 1,000,000 (one

million).

- Total Amount:

BRL 1,000,000,000.00 (one billion Brazilian reais), approximately

US$ 175 million

- Maturity Term:

6 (six) years.

- Remuneration:

100% of the accumulated variation of the DI Rate – Interbank

Deposits, plus a surcharge of 1.60% (one point six zero percent)

per annum, based on 252 (two hundred and fifty-two) Business

Days.

- Swap Structure

(pre-fixed): 6.975%

The net funds raised by the Issuer through the

Issuance will be allocated to (i) strengthen cash position and for

the ordinary management of the Issuer’s business; (ii) the early

redemption of all debentures issued by the Issuer under the First

Issuance of the Issuer, as provided for in the Indenture of the

First Issuance, within 30 (thirty) days from the Start Date of

Profitability; and (iii) the full payment and settlement of other

debts of the Issuer (Aura Almas).

Debentures are debt securities issued by

companies with the purpose of raising funds in the Brazilian

market. These securities operate similarly to bonds in the

international market.

The details of the other terms and conditions of

the Issue and Offering are described in the aforementioned minutes

of the Company's Extraordinary General Meeting and in the

Indenture, of September 8th, 2024, as amended, which are available

at the Company's headquarters and on the CVM (www.cvm.gov.br) and

Company (https://www.auraminerals.com/investidores/) websites.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the

Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San

Andres) gold mine in Honduras. The Company’s development projects

include Borborema and Matupá both in Brazil. Aura has unmatched

exploration potential owning over 630,000 hectares of mineral

rights and is currently advancing multiple near-mine and regional

targets along with the Aura Carajas copper project in the prolific

Carajás region of Brazil.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as “plans,” “expects,” “is

expected,” “budget,” “scheduled,” “estimates,” “forecasts,”

“intends,” “anticipates,” or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to the most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

For more information, please contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

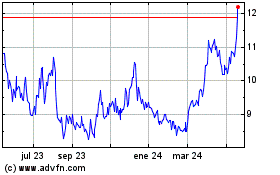

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

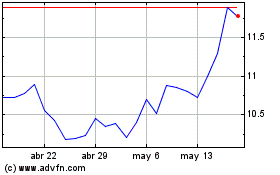

Aura Minerals (TSX:ORA)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025