UPDATE - Ackroo Provides Update on Recent Acquisition

05 Marzo 2024 - 10:42AM

Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a gift card,

loyalty marketing, payments and point-of-sale technology

consolidator and services provider, is pleased to provide an update

on their recent acquisition of Simpliconnect. On January 1st 2023,

Ackroo acquired all of the assets related to Simpliconnect, a US

based loyalty marketing provider focused on the convenience and

petroleum merchant segment. The Company wishes to provide investors

with an update on their progress integrating, operating and

optimizing that business.

The Company has managed to streamline operations

from a vendor management, client pricing, support and employee

standpoint resulting in operational efficiencies and profitability.

Ackroo is also building product parity between the Simpliconnect

platform and their Ackroo Anywhere platform and has already begun

migrating clients over to Ackroo’s core marketing product. This

work, both product parity and migration, is expected to be

completed by the end of April 2024 which will allow acquired

merchants to begin benefiting from the ongoing advancements within

the Ackroo platform while also allow current and prospective Ackroo

merchants the ability to take advantage of the many features and

integrations added via the Simpliconnect product parity work. Once

complete the legacy platform will be decommissioned driving greater

focus for sales and marketing, saving Ackroo hosting costs, and

allowing engineering and support staff to be re-directed to focus

on supporting the core Ackroo platform and the recent acquisition

of GiftFly.

The Company has also achieved financial gain

from the acquisition in its first year of contribution, delivering

$1,234,108 of annual revenue and adding $202,698 of net income

representing a strong 16% profit margin. As of January 1st, 2024,

through continued normalization, Ackroo is now generating a 60% +

profit margin from this business which they expect will continue

through migration and beyond.

From a return on invested capital standpoint,

the final consideration from Ackroo was just under $1,800,000 CAD

plus 5,625,000 shares after an amendment was made in the spring of

2023, with Ackroo expecting to see the cash investment paid back

within 39 months of closing based on the past and current margins

being generated. Over the last year, the Company has also bought

back 6,068,681 shares via a Normal Course Issuer Bid at an average

price of $0.087 per share effectively cancelling out the shares

issued to Simpliconnect earlier in the year. At $0.087 a share the

5,625,000 shares cost Ackroo approximately $489,375 which equates

to about 8 months of future earnings from this business for a total

expected payback time of about 47 months. This falls within the

Company’s payback model and positions Ackroo for another successful

accretive acquisition.

“We are very happy with the continued progress

we have made integrating and optimizing the Simpliconnect

business,” said Steve Levely, CEO of Ackroo. “The Simpliconnect

business was a bit more complex than we originally thought from

both a technical and operational standpoint. Ackroo being very

self-serve technology focused versus Simpliconnect being more

services support focused created early support challenges. The

Simpliconnect engineering team was also outsourced versus Ackroo’s

in-house development team so managing those outsourced

relationships and gaining internal control created initial

challenges. While normalization and migration is expected to take

16 months versus our 12 month model, there were plenty of great

wins for the business operationally, technically and certainly

financially that we are ultimately very happy at this stage. This

acquisition is pushing our technology forward, is helping us expand

further into the US market, helping reinforce our specialization in

areas like convenience and petroleum, and financially contributing

to our growing earnings. All very positive things for Ackroo and

our investors.”

The Company cautions that figures for revenue

have not been audited and are based upon calculations prepared by

management. Actual results may differ from those reported in this

release once these figures have been audited. The Company expects

to complete its 2023 audit in April to confirm revenue figures,

along with other financial results.

About Ackroo

As an industry consolidator, Ackroo acquires,

integrates and manages gift card, loyalty marketing, payment and

point-of-sale solutions used by merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale. Ackroo’s

acquisition of payment ISO’s affords Ackroo the ability to resell

payment processing solutions to their growing merchant base through

some of the world’s largest payment technology and service

providers. As a third revenue stream, Ackroo has acquired certain

custom software products including hybrid management and

point-of-sale solutions that help manage and optimize the general

operations for niche industry’s including automotive dealers and

more. All solutions are focused on helping to consolidate, simplify

and improve the merchant marketing, payments and point-of sale

ecosystem for their clients. Ackroo is headquartered in Hamilton,

Ontario, Canada. For more information, visit: www.ackroo.com.

For further information, please contact:

|

Steve LevelyChief Executive Officer | AckrooTel:

416-360-5619 x730Email: slevely@ackroo.com |

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

Company’s ability to raise enough capital to support the Company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

Company operates; projected capital expenditures and liquidity;

changes in the Company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

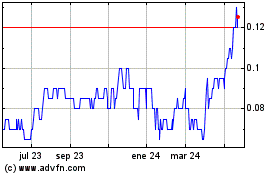

Ackroo (TSXV:AKR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

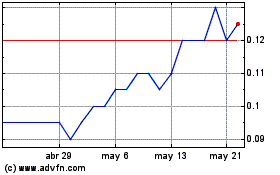

Ackroo (TSXV:AKR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025