Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the

“

Company” or “

Ackroo”), a gift

card, loyalty marketing, payments and point-of-sale technology

consolidator and services provider, announces that it has signed a

definitive arrangement agreement (the “

Arrangement

Agreement”), dated December 12th, 2024, with Paystone Inc.

(“

Paystone”). Pursuant to the Arrangement

Agreement, Paystone will acquire (the

“

Transaction”) all of the issued and outstanding

shares of Ackroo (the “

Ackroo Shares”) at a price

of $0.15 per Ackroo Share, and will assume all assets and

liabilities of the Company, including the Company’s existing debt

to BDC Capital Inc. (“

BDC”). The purchase

represents approximately a 25% premium over yesterday’s closing

price and approximately a 36% premium over the 90 days volume

weighted average price. With 115,304,952 Ackroo Shares currently

issued and outstanding, approximately 9,000,000 options that are in

the money, and close to $3,000,000 of debt owed to BDC, which will

be repaid by the Purchaser on the closing of the Transaction, the

enterprise value of the Transaction is approximately $21,000,000.

“I am very happy for our shareholders, employees

and clients,” said Steve Levely, CEO of Ackroo. “The goal at Ackroo

since I took over in May 2014 was to accrue value through market

consolidation until we were consolidated ourselves. Ten years

later, here we are with a business that has scaled by combining

smaller adjacent software and payment organizations into one

combined entity which has delivered both financial and functional

success. While I am proud of what we have done to get to this

point, I am equally excited for what is next for our staff and

valued clients. Paystone has been consolidating the industry as

well, acquiring direct competitors of ours like Datacandy and

integrating payment and value-added software solutions. Bringing

all of these assets and tools together under one organization to

further optimize and scale is an exciting next step for all

involved. I am also happy for our shareholders. Speaking on behalf

of the board, we believed, at this stage of the business, and given

the current state of the capital markets, it was in the best

interest of the company to pursue this Transaction, which creates a

liquidity event for shareholders while positioning Ackroo’s

product, team and clients to be able to benefit from a much larger

private organization.”

Transaction Terms

Pursuant to the terms and conditions of the

Arrangement Agreement, the holders of the issued and outstanding

Ackroo Shares will receive $0.15 cash (the “Offer

Price”) for each Ackroo Share held immediately prior to

closing of the Transaction. In connection with the Transaction,

Ackroo has agreed to accelerate vesting of all of outstanding

incentive stock options, and Paystone has agreed to complete a cash

payment to holders of all outstanding “in-the-money” options upon

closing in an amount equivalent to the difference between the

exercise price of the options and the Offer Price. Upon closing,

all outstanding incentive stock options will be cancelled. The

Transaction will be carried out by way of a court-approved plan of

arrangement under the Canada Business Corporations Act.

Steve Levely, the Chief Executive Officer of

Ackroo, and another arm’s length shareholder (together, the

“Deferring Shareholders”), have agreed to defer

payment of the Offer Price, for any Ackroo Shares they hold, for a

minimum twelve months following closing. The Deferring Shareholders

will receive, in lieu of the cash consideration, the equivalent

principal amount unsecured subordinated promissory note of

Paystone. Upon closing, Mr. Levely has also agreed to assume the

role of Chief Operating Officer of Paystone.

The Arrangement Agreement contains customary

deal-protection provisions including a non-solicitation covenant in

respect of Ackroo, a right of Paystone to match any superior

proposal as defined and described in the Arrangement Agreement.

Under certain circumstances, if the Arrangement Agreement is

terminated, Paystone would be entitled to a termination fee of

$750,000. Full details of the Transaction will be included in a

management information circular to be mailed to Ackroo shareholders

and will be available on SEDAR+ in the coming weeks. In addition, a

copy of the Arrangement Agreement will be filed under Ackroo’s

profile on SEDAR+.

Conditions to Completion

Completion of the Transaction is subject to a

number of terms and conditions, including, without limitation, the

following: (a) approval of the Ackroo shareholders, as described

below; (b) approval of the TSX Venture Exchange; (c) issuance of a

final order by the Ontario Superior Court of Justice; (d) Paystone

obtaining debt financing sufficient to satisfy the Offer Price;

and, other standard conditions of closing for a transaction of this

nature. Furthermore, the Arrangement Agreement may be terminated by

the Company if, prior to 5:00 p.m. (Toronto time) on January 13,

2025, the Purchaser has not obtained a commitment letter in respect

of such debt financing. There can be no assurance that all

necessary approvals will be obtained or that all conditions to

completion of the Transaction will be satisfied.

The Transaction is subject to approval at a

special meeting of Ackroo shareholders (the “Ackroo

Meeting”) and requires: (a) an affirmative vote in favour

from 66.67% of the votes cast by Ackroo shareholders at the Ackroo

Meeting; and (b) a simple majority of votes cast by Ackroo

shareholders, excluding votes held by persons described in items

(a) through (d) of Section 8.1(2) of Multilateral Instrument 61-101

– Protection of Minority Security Holders in Special Transactions.

Paystone does not require shareholder approval of the

Transaction.

Transaction Timeline

Pursuant to the Arrangement Agreement and

subject to satisfying all necessary conditions and receipt of all

required approvals, the parties anticipate completing the

Transaction in February 2025. In connection with completion of the

Transaction, the Ackroo Shares will be de-listed from the TSX

Venture Exchange and following closing, Ackroo will make an

application to cease to be a reporting issuer under Canadian

securities laws.

Recommendation of the Board of Directors

and Fairness Opinion

After consultation with its financial and legal

advisors, and following receipt of the unanimous recommendation by

a Special Committee of Ackroo composed entirely of independent

directors (the “Special Committee”), the board of

directors of Ackroo (the “Ackroo Board”)

unanimously approved the entering into of the Arrangement Agreement

(with interested directors abstaining). The Ackroo Board recommends

that Ackroo shareholders vote in favour of the Transaction.

Paradigm Capital Inc. provided a verbal fairness opinion to the

Ackroo Board, to be confirmed by a written opinion, to the effect

that, as of the date of such opinion and subject to the

assumptions, limitations and qualifications stated in such opinion,

the consideration to be received by Ackroo shareholders (other than

the Deferring Shareholders) pursuant to the Transaction is fair

from a financial point of view, to such Ackroo shareholders.

Voting Supporting

Agreements

In connection with signing of the Arrangement

Agreement, certain directors, officers and shareholders of Ackroo

have entered into voting support agreements with Paystone, agreeing

to vote their Ackroo Shares in favour of the Transaction at the

Ackroo Meeting. An aggregate of 72,669,960 Ackroo Shares,

representing approximately 63.19% of the issued and outstanding

Ackroo Shares are subject to these voting support agreements.

Advisors and Counsel

Paradigm Capital Inc. is acting as financial

advisor to Ackroo and had provided a fairness opinion to the Ackroo

Board. Cassels Brock & Blackwell LLP is acting as legal counsel

to Ackroo, and Miller Thomson LLP is acting as legal counsel to

Paystone.

About Paystone

Paystone is a leading North American payment and

software company redefining the way merchants engage their

customers and grow their businesses. The company's suite of

automated payment processing, customer loyalty programs, gift card

solutions, and reputation marketing software is used at over 35,000

merchant locations across Canada and the United States which

collectively process over 10 billion dollars a year in bankcard

volume. The fintech company employs over 150 employees and serves

as the technology partner of choice for hundreds of partners across

North America.

About Ackroo

As an industry consolidator, Ackroo acquires,

integrates and manages gift card, loyalty marketing, payment and

point-of-sale solutions used by merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale. Ackroo’s

acquisition of payment ISO’s affords Ackroo the ability to resell

payment processing solutions to their growing merchant base through

some of the world’s largest payment technology and service

providers. As a third revenue stream, Ackroo has acquired certain

custom software products including hybrid management and

point-of-sale solutions that help manage and optimize the general

operations for niche industry’s including automotive dealers and

more. All solutions are focused on helping to consolidate, simplify

and improve the merchant marketing, payments and point-of sale

ecosystem for their clients. Ackroo is headquartered in Hamilton,

Ontario, Canada. For more information, visit: www.ackroo.com.

For further information, please contact:

|

Steve LevelyChief Executive Officer | AckrooTel:

416-360-5619 x730Email: slevely@ackroo.com |

|

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

possibility that the Transaction will not be completed on the terms

and conditions or timing currently contemplated, or at all, due to

a failure to obtain, in a timely manner or otherwise, required

shareholder, court and regulatory approvals, the failure to satisfy

other conditions of closing or other circumstances contemplated by

the Arrangement Agreement; the possibility of adverse reactions or

changes in business relationships resulting from the announcement,

completion or termination of the Transaction which could have a

material impact on the Company’s business and financial condition

during the period prior to the closing of the Transaction and upon

any termination of the Transaction; the Company’s ability to raise

enough capital to support the Company’s go forward plans; the

overall global economic environment; the impact of competition and

new technologies; general market, political and economic conditions

in the countries in which the Company operates; projected capital

expenditures and liquidity; changes in the Company’s strategy;

government regulations and approvals; changes in customers’

budgeting priorities; plus other factors that may arise.

Actual results or events could differ materially

from those contemplated in forward-looking statements as a result

of the following: (i) the ability to secure the required

shareholder or court approvals; (ii) the occurrence of a “Material

Adverse Effect” (as defined in the Arrangement Agreement) or the

failure to satisfy any other closing condition in favour of

Paystone provided for in the Arrangement Agreement, which condition

is not waived by Paystone; and (iii) Paystone’s ability to obtain

debt financing sufficient to satisfy the Offer Price.

Forward-looking statements may also include, without limitation,

any statement relating to future events, conditions or

circumstances.

Any forward-looking statements in this press

release are made as of the date hereof, and the Company undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

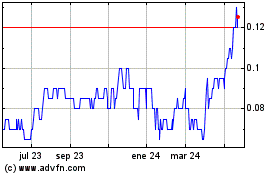

Ackroo (TSXV:AKR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

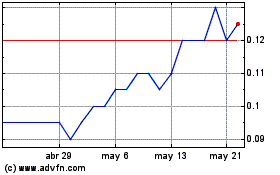

Ackroo (TSXV:AKR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025