Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the

“Company”) is pleased to announce that, further to its news

releases dated April 26, 2024 and April 25, 2024, due to higher

demand, the Company and PI Financial Corp. as sole underwriter and

bookrunner (the “Underwriter”) have increased the size of the

Company’s previously announced marketed offering (the “Offering”)

from to $2 million to $3.024 million.

In connection with the Offering, the Company

entered into an underwriting agreement dated April 30, 2024 (the

“Underwriting Agreement”) with the Underwriter, pursuant to which

the Company will issue 7,200,000 units of the Company (“Units”) at

a price of $0.42 per Unit for aggregate gross proceeds to the

Company of approximately $3,024,000. Each Unit will consist of one

ordinary share of the Company (a “Common Share”) and one ordinary

share purchase warrant (each, a “Warrant”). Each Warrant will

entitle the holder to acquire one Common Share (each a “Warrant

Share”) at an exercise price of $0.55 per Warrant Share for a

period of 4 years following the closing of the Offering, subject to

adjustment in certain events.

The Units will be offered under the amended and

restated base shelf prospectus of the Company receipted on January

10, 2024 (the “Base Shelf Prospectus”), as supplemented by a

prospectus supplement (the “Supplement”) to be prepared and filed

in each of the provinces and territories of Canada other than

Quebec (collectively, the “Jurisdictions”) and in the United States

pursuant to available exemptions from the registration requirements

under applicable United States securities laws, and in such other

jurisdictions outside of Canada and the United States which are

agreed to by the Company and the Underwriter.

Pursuant to the Underwriting Agreement, the

Company has granted the Underwriter an option (the “Over-Allotment

Option”) to cover over-allotments and for market stabilization

purposes. The Over-Allotment Option may be exercised at any time up

to 30 days subsequent to the closing of the Offering to purchase up

to an additional 15.0% of the Units sold under the Offering on the

same terms and conditions of the Offering. The Over-Allotment

Option is exercisable to acquire Units, Common Shares and/or

Warrants (or any combination thereof) at the discretion of the

Underwriter.

The net proceeds of the Offering are expected to

be used primarily to strengthen the Company's financial position

and provide liquidity to finance ongoing operations, including, in

particular, the Company’s expenses incurred, and expected to be

incurred, in connection with the Company’s research and

development objectives, and for working capital and general

corporate purposes.

The closing of the Offering is expected to occur

on or about May 7, 2024 (the “Closing Date”) and is subject to

certain conditions including, but not limited to, the receipt of

all necessary approvals, including the approval of the TSX Venture

Exchange (the “TSXV”).

Access to the Base Shelf Prospectus, the

Supplement, and any amendment to the documents is provided in

accordance with securities legislation relating to procedures for

providing access to a shelf prospectus supplement, a base shelf

prospectus and any amendment. The Base Shelf Prospectus is, and the

Supplement will be, accessible on SEDAR+ at www.sedarplus.ca.

An electronic or paper copy of the Base Shelf

Prospectus, the Supplement (when filed), and any amendment to the

documents may be obtained, without charge, from PI Financial Corp,

3401 – 40 King St Street, Toronto, ON, Canada, M5H 3Y2, by email

to syndication@pifinancial.com attention: PI Syndication and by

providing the contact with an email address or address, as

applicable. The Base Shelf Prospectus contains and the Supplement

will contain, important detailed information about the Company and

the proposed Offering. Prospective investors should read the

Supplement (when filed) and the Base Shelf Prospectus and the other

documents the Company has filed on SEDAR+ before making an

investment decision.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

United States Securities Act of 1933, as amended, and applicable

state securities laws.

About GMG

GMG is a clean-technology company which seeks to

offer energy saving and energy storage solutions, enabled by

graphene, including that manufactured in-house via a proprietary

production process. GMG has developed a proprietary production

process to decompose natural gas (i.e. methane) into its elements,

carbon (as graphene), hydrogen and some residual hydrocarbon gases.

This process produces high quality, low cost, scalable, ‘tuneable’

and low/no contaminant graphene suitable for use in

clean-technology and other applications.

The Company’s present focus is to de-risk and

develop commercial scale-up capabilities, and secure market

applications. In the energy savings segment, GMG has focused on

graphene enhanced heating, ventilation and air conditioning

(“HVAC-R”) coating (or energy-saving coating), lubricants and

fluids.

In the energy storage segment, GMG and the

University of Queensland are working collaboratively with financial

support from the Australian Government to progress R&D and

commercialization of graphene aluminium-ion batteries (“G+AI

Batteries”).

GMG’s 4 critical business objectives are:

- Produce Graphene and improve/scale cell production

processes

- Build Revenue from Energy Savings Products

- Develop Next-Generation Battery

- Develop Supply Chain, Partners

& Project Execution Capability

For further information please contact:

- Craig Nicol, Chief Executive Officer and Managing Director of

the Company at craig.nicol@graphenemg.com, +61 415 445 223

- Leo Karabelas at Focus Communications Investor Relations,

leo@fcir.ca, +1 647 689 6041

www.graphenemg.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes certain statements

and information that may constitute forward-looking information

within the meaning of applicable Canadian securities laws.

Forward-looking statements relate to future events or future

performance and reflect the expectations or beliefs of management

of the Company regarding future events. Generally, forward-looking

statements and information can be identified by the use of

forward-looking terminology such as “intends”, “expects” or

“anticipates”, or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“should”, “would” or will “potentially” or “likely” occur. This

information and these statements, referred to herein as

“forward‐looking statements”, are not historical facts, are made as

of the date of this news release and include without limitation,

the Company's intention to complete the Offering on the terms, the

expected Closing Date of the Offering, the use of the net proceeds

of the Offering, the receipt of all necessary approvals, including

the approval of the TSXV, and the Company’s objectives, goals or

future plans.

Such forward-looking statements are based on a

number of assumptions of management, including, without limitation,

assumptions regarding the ability of the Company to obtain all

necessary approvals for the Offering, the Underwriting Agreement

and the expectation that it will not be terminated early, the

ability of the Company to achieve the expected results of its

products in research and development, that the Company will be able

to research, develop and produce certain products as anticipated,

that the Company will be able to engage third parties and develop

relationships to assist in the development, that the Company and

the University of Queensland will continue to progress research and

development of the G+AI Batteries, distribution and sale of its

products, and assumptions regarding the completion of the Offering

and the timing thereof. Additionally, forward-looking information

involve a variety of known and unknown risks, uncertainties and

other factors which may cause the actual plans, intentions,

activities, results, performance or achievements of GMG to be

materially different from any future plans, intentions, activities,

results, performance or achievements expressed or implied by such

forward-looking statements. Such risks include, without limitation:

the Offering will not be completed on the timetable anticipated or

at all, the use of proceeds from the Offering will differ from

management’s current expectations, the engagement of the

Underwriter in connection with the Offering will not continue as

expected, the Company will not obtain all necessary approvals,

including the approval of the TSXV, the Company will not be able to

use its products as expected or the performance, safety profile and

production and maintenance requirements of the Company’s products

will not be consistent with management’s expectations, the impact

of the Company’s products will not be consistent with management’s

expectations, the Company will not be able to research, develop and

produce certain products, that the Company’s collaboration with the

University of Queensland will not continue as currently expected by

management, the Company will not be successful in engaging third

parties and developing relationships to assist in the development,

distribution and sale its products, public health crises may

adversely impact the Company’s business and the ability of the

Company to develop its products, risks relating to the extent and

duration of the conflict in the Middle-East and Eastern Europe and

its impact on global markets, the volatility of global capital

markets, political instability, the failure of the Company to

attract and retain skilled personnel, unexpected development and

production challenges, unanticipated costs and the risk factors set

out under the heading “Risk Factors” in the Company’s annual

information form dated October 12, 2023 available for review on the

Company’s profile at www.sedarplus.com.

Although management of the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements and forward-looking information. Readers are cautioned

that reliance on such information may not be appropriate for other

purposes. The Company does not undertake to update any

forward-looking statement, forward-looking information or financial

out-look that are incorporated by reference herein, except in

accordance with applicable securities laws. We seek safe

harbor.

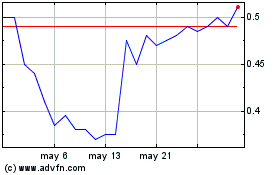

Graphene Manufacturing (TSXV:GMG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Graphene Manufacturing (TSXV:GMG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025