Rio2 Limited (“

Rio2” or the

“

Company”) (TSXV:

RIO; OTCQX:

RIOFF; BVL:

RIO) announces today

that it has closed its previously announced public offering of

97,307,710 common shares of the Company (“

Common

Shares”) at a price of C$0.65 per Common Share for gross

proceeds of approximately C$63 million, including the full exercise

of the agents’ option (the “

Public Offering”).

The Public Offering was conducted pursuant to the terms and

conditions of an agency agreement entered into between the Company

and Raymond James Ltd. and Eight Capital (the “

Co-Lead

Agents”), along with Paradigm Capital Inc. and Pollitt

& Co. Inc. (together with the Co-Lead Agents, the

“

Agents”). In addition to the closing of the

Public Offering, the Company closed its non-brokered private

placement of Common Shares to Wheaton Precious Metals International

Ltd. (“

Wheaton”) for proceeds of C$5 million at

C$0.65 per share (the “

Wheaton Private

Placement”).

The total proceeds of the Public Offering and

the Wheaton Private Placement, together with the US$120 million

financing package (the “Wheaton Financing”) with

Wheaton as previously disclosed on October 21, 2024, is

approximately US$170 million.

Alex Black, the Company’s Executive Chairman

commented, “The closing of the financing package marks a major

achievement for the Company as funding for the construction of

Fenix Gold is now complete. We are grateful for the support we have

received from our stakeholders and look forward to advancing Fenix

Gold into production.”

The Company intends to use the net proceeds from

the Public Offering and the Wheaton Private Placement for the

construction, development, operation, commissioning and ramp-up,

and general working capital for the Project.

The Public Offering and the Wheaton Private

Placement remain subject to certain closing conditions including,

but not limited to, the receipt of all necessary regulatory

approvals including the final listing approval of the TSX Venture

Exchange. The Common Shares issued to Wheaton under the Wheaton

Private Placement are subject to a four month hold period ending on

March 1, 2025.

In connection with the Public Offering, the

Company filed a prospectus supplement (the

“Supplement”) dated October 23, 2024, to the

Company’s short form base shelf prospectus dated October 16, 2024

(the “Base Prospectus”). Copies of the Supplement

and Base Prospectus are available under the Company's profile on

the System for Electronic Data Analysis and Retrieval +

("SEDAR+") at www.sedarplus.ca.

The securities have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S.

state securities laws, and may not be offered or sold in the United

States without registration under the U.S. Securities Act and all

applicable state securities laws or compliance with the

requirements of an applicable exemption therefrom. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation, or sale would be unlawful.

Technical Information

The scientific and technical content of this

news release has been reviewed, approved and verified by Ronoel

Vega, Min. Eng., MMBA, FAusIMM, who is a “qualified person” under

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects. For additional information regarding the Project,

including key parameters, assumptions and risks associated with its

development, see the independent technical report entitled “NI

43-101 Technical Report on the Feasibility Study for the Fenix Gold

Project,” dated October 18, 2023, with an effective date of October

16, 2023, a copy of which document is available under Rio2’s SEDAR+

profile at www.sedarplus.ca.

About Rio2

Rio2 is a mining company with a focus on

development and mining operations with a team that has proven

technical skills as well as successful capital markets track

record. Rio2 is focused on taking its Fenix Gold Project in Chile

to production in the shortest possible timeframe based on a staged

development strategy. Rio2 and its wholly owned subsidiary, Fenix

Gold Limitada, are companies with the highest environmental

standards and responsibility with the firm conviction that it is

possible to develop mining projects that respect the three pillars

(Social, Environment, Economics) of responsible development. As

related companies, we reaffirm our commitment to apply

environmental standards beyond those that are mandated by

regulators, seeking to protect and preserve the environment of the

territories that we operate in.

To learn more about Rio2 Limited, please visit

www.rio2.com or Rio2’s SEDAR+ profile at www.sedarplus.ca.

ON BEHALF OF THE BOARD OF RIO2

LIMITED

Alex BlackExecutive ChairmanEmail:

alex.black@rio2.comTel: +51 99279 4655

Kathryn JohnsonExecutive Vice President, CFO

& Corporate SecretaryEmail: kathryn.johnson@rio2.comTel: +1 604

762 4720

Cautionary Statement on Forward-Looking

Information

This news release contains “forward-looking

statements” and “forward-looking information” within the meaning of

applicable Canadian and U.S. securities laws relating to Rio2’s

planned development of the Fenix Gold Project, the receipt of

regulatory approvals for the Public Offering and the Wheaton

Private Placement; and the use of proceeds from the Public

Offering, Wheaton Private Placement and Wheaton Financing.

All statements included herein, other than

statements of historical fact, may be forward-looking information

and such information involves various risks and uncertainties.

These statements are based on Rio2’s current internal expectations,

estimates, projections, assumptions and beliefs, which may prove to

be incorrect. Some of the forward-looking statements may be

identified by the use of conditional or future tenses or by the use

of such words such as “will”, “expects”, “may”, “should”,

“estimates”, “anticipates”, “believes”, “projects”, “plans”, and

similar expressions, including variations thereof and negative

forms. These statements are not guarantees of future performance

and undue reliance should not be placed on them. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause Rio2’s actual performance

and financial results in future periods to differ materially from

any projections of future performance or results expressed or

implied by such forward-looking statements. A description of

assumptions used to develop such forward-looking information can be

found in Rio2’s disclosure documents on the SEDAR+ website at

www.sedarplus.ca. These risks and uncertainties include but are not

limited to: risks and uncertainties relating to the completion of

the Public Offering and the Wheaton Private Placement as described

herein, and management’s ability to anticipate and manage the

foregoing factors and risks. There can be no assurance that

forward-looking statements will prove to be accurate, and actual

results and future events could differ materially from those

anticipated in such statements. Rio2 undertakes no obligation to

update forward-looking statements if circumstances or management’s

estimates or opinions should change except as required by

applicable securities laws. The reader is cautioned not to place

undue reliance on forward-looking statements. Rio2 disclaims any

intention or obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except to the extent required by securities

legislation.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

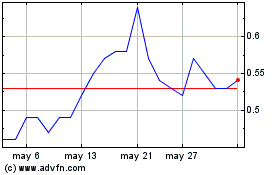

Rio2 (TSXV:RIO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Rio2 (TSXV:RIO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025