Banco Santander S.A. 2019 prudential minimum capital requirements (0816Q)

15 Febrero 2019 - 1:00AM

UK Regulatory

TIDMBNC

RNS Number : 0816Q

Banco Santander S.A.

14 February 2019

Banco Santander, S.A., in compliance with the Securities Market

legislation, hereby communicates the following:

RELEVANT INFORMATION

Banco Santander, S.A. ("Santander") has been informed by the

European Central Bank ("ECB") about its decision regarding the

prudential minimum capital requirements as of 1 March 2019,

following the results of the Supervisory Review and Evaluation

Process (SREP).

The ECB decision requires Santander to maintain a Common Equity

Tier 1 ("CET1") ratio of at least 9.7%(1) on a consolidated basis.

Santander's last reported consolidated fully loaded CET1 ratio, as

of 31 December 2018, was 11.3%(2) .

This CET1 capital requirement of 9.7% includes: the Pillar 1

requirement (4.5%); the Pillar 2 requirement (1.5%); the capital

conservation buffer (2.5%); the requirement deriving from its

consideration as a global systemic financial institution (1%); and

the counter-cyclical buffer (0.2%(3) ).

On an individual basis the ECB requires Santander to maintain a

CET1 ratio of at least 8.6%(1) . Santander's individual fully

loaded CET1 ratio as of 31 December 2018 was 18.2%(2) .

Including the minimum Pillar 1 requirement of Additional Tier 1

(1.5%) and Tier 2 (2%), Santander is required to maintain a total

capital ratio of at least 13.2%(1) on a consolidated basis and

12.1%(1) on an individual level. Santander's last reported total

fully loaded capital ratios, as of 31 December 2018, were 14.8%(2)

and 22.7%(2) on a consolidated and individual basis,

respectively.

Taking into account Santander's consolidated and individual

current capital levels, these capital requirements do not imply any

limitations on distributions in the form of dividends, variable

remuneration or payments to holders of Additional Tier 1

instruments issued by Santander.

Boadilla del Monte (Madrid), February 14, 2019

(1) Note that the applicable transitional periods under

Regulation (EU) 575/2013 have expired and as a consequence that

from the 1 January 2019, the capital requirements criteria commonly

known as fully-loaded and phased-in requirements are the same.

(2) Data calculated applying the IFRS 9 transitional

arrangements.

(3) This requirement comes from the business performed by the

Group in the United Kingdom and the Nordics.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCVZLFFKLFXBBF

(END) Dow Jones Newswires

February 15, 2019 02:00 ET (07:00 GMT)

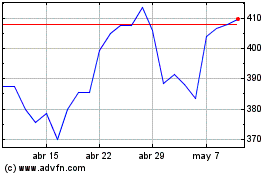

Banco Santander (LSE:BNC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Banco Santander (LSE:BNC)

Gráfica de Acción Histórica

De May 2023 a May 2024