TIDMPHAR

RNS Number : 5086N

Pharos Energy PLC

20 May 2020

Pharos Energy plc

("Pharos" or the "Company" or, together with its subsidiaries,

the "Group")

RESULTS OF ANNUAL GENERAL MEETING

The Company announces that at its Annual General Meeting ("AGM")

held today, all resolutions put before the meeting were duly

passed.

In accordance with LR 9.6.2, copies of resolutions concerning

items other than ordinary business are being submitted to the

National Storage Mechanism and will shortly be available for

inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism.

On the date of the meeting, Pharos' issued share capital

consisted of 406,637,952 ordinary shares of GBP0.05 each with

voting rights; 9,122,268 shares were in Treasury and therefore, the

total number of voting rights was 397,515,684.

Voting was conducted on a poll, the results of which are shown

in the table below and will shortly be available on the Company's

website, www.pharos.energy .

Resolution Votes in Total

Favour % Votes % Votes Votes

(Including Against (excluding Withheld

Discretionary) votes

withheld)

1. To receive

the Annual

Report

and Accounts

for the

financial

year ended 31

December 2019. 234,737,202 99.91% 216,436 0.09% 234,953,638 182,319

======================= ====== ================== ====== ===================== ===================

2. To approve

the

Remuneration

Policy

included in

the Annual

Report and

Accounts for

the

financial year

ended 31

December

2019. 217,778,159 92.62% 17,354,025 7.38% 235,132,184 3,773

======================= ====== ================== ====== ===================== ===================

3. To approve

the Directors'

Remuneration

Report

included

in the Annual

Report and

Accounts

for the

financial year

ended

31 December

2019. 186,249,683 79.21% 48,882,501 20.79% 235,132,184 3,773

======================= ====== ================== ====== ===================== ===================

4. To reappoint

John E Martin,

who is Chair

of the

Nominations

and ESG

Committees, as

a Director. 234,196,158 99.63% 869,802 0.37% 235,065,960 69,997

======================= ====== ================== ====== ===================== ===================

5. To reappoint

Edward T

Story,

who is a

member of the

Nominations

and ESG

Committees, as

a Director. 233,355,107 99.27% 1,710,853 0.73% 235,065,960 69,997

======================= ====== ================== ====== ===================== ===================

6. To reappoint

Janice M

Brown,

who is a

member of the

ESG

Committee, as

a Director. 233,753,041 99.44% 1,324,924 0.56% 235,077,965 57,992

======================= ====== ================== ====== ===================== ===================

7. To reappoint

Dr Michael

J Watts as a

Director. 234,098,337 99.58% 979,628 0.42% 235,077,965 57,992

======================= ====== ================== ====== ===================== ===================

8. To reappoint

Robert G Gray,

who is Chair

of the

Remuneration

Committee and

a member of

the

Audit and

Risk,

Nominations

and ESG

Committees, as

a Director. 219,168,950 93.22% 15,938,068 6.78% 235,107,018 28,939

======================= ====== ================== ====== ===================== ===================

9. To reappoint

Marianne

Daryabegui,

who is a

member of the

Audit

and Risk,

Remuneration

and

Nominations

Committees, as

a Director. 225,043,278 95.72% 10,055,440 4.28% 235,098,718 37,239

======================= ====== ================== ====== ===================== ===================

10. To

reappoint Lisa

Mitchell,

who is Chair

of the Audit

and

Risk Committee

and a member

of the

Nominations

and ESG

Committees, as

a Director. 234,595,656 99.81% 444,587 0.19% 235,040,243 95,714

======================= ====== ================== ====== ===================== ===================

11. To

reappoint

Deloitte LLP

as Auditors to

hold office

until the

conclusion of

the

next Annual

General

Meeting

at which

accounts are

laid

before the

Company. 234,886,619 99.92% 182,621 0.08% 235,069,240 66,717

======================= ====== ================== ====== ===================== ===================

12. To

authorise the

Audit

and Risk

Committee, for

and

on behalf of

the Directors,

to agree the

Auditors'

remuneration. 234,320,643 99.68% 743,828 0.32% 235,064,471 71,486

======================= ====== ================== ====== ===================== ===================

13. To

authorise the

Directors

to allot

securities

(s.551

of the

Companies Act

2006). 233,946,000 99.61% 924,981 0.39% 234,870,981 264,976

======================= ====== ================== ====== ===================== ===================

14. To disapply

pre-emption

rights (s.570

and s.573 of

the Companies

Act 2006) 232,817,740 99.13% 2,041,608 0.87% 234,859,348 276,609

======================= ====== ================== ====== ===================== ===================

15. To disapply

pre-emption

rights (s.570

and s.573 of

the Companies

Act 2006) up

to a further

5% for

acquisitions

or specified

capital

investments. 234,556,190 99.87% 303,158 0.13% 234,859,348 276,609

======================= ====== ================== ====== ===================== ===================

16. To

authorise the

Company

to repurchase

its own Shares

(s.701 of the

Companies Act

2006). 225,537,069 96.03% 9,328,837 3.97% 234,865,906 270,051

======================= ====== ================== ====== ===================== ===================

17. To

authorise the

Directors

to call

general

meetings of

the Company

(other than an

annual general

meeting) on

not less than

14 clear days'

notice. 233,193,832 99.29% 1,676,418 0.71% 234,870,250 265,707

======================= ====== ================== ====== ===================== ===================

The Board thanks all investors for their support through

participation in the AGM votes and is pleased that resolutions 1-2

and 4-17, including the Company's Remuneration Policy, were

approved by shareholders representing over 90% of the share capital

voted. The Remuneration Policy followed consultation with investors

and is intended to be applied over the next three years.

In the context of approval of its Remuneration Policy, and the

Director salary and fee reductions announced on 12 May, the Company

is disappointed at the vote of 20.79% against resolution 3, the

advisory vote on the Directors' Remuneration Report. The

Remuneration Committee intends to consider the position again once

the market has normalised. In accordance with provision 4 of the

Corporate Governance Code, the Company will publish an update on

views received from shareholders, and actions taken, within six

months of the AGM. It will also publish a final summary together

with any further steps in the next annual report.

For further information, please contact:

Pharos Energy plc Tel: 0207 603 1515

Tony Hunter, Company Secretary

Notes to editors

Pharos Energy is an independent oil and gas exploration and

production company with a focus on sustainable growth and returns

to stakeholders, headquartered in London and listed on the London

Stock Exchange.

Pharos has production, development and exploration interests in

Egypt, Israel and Vietnam.

In Egypt, Pharos holds a 100% working interest in the El Fayum

oil concession in the low-cost and highly prolific Western Desert,

one of Egypt's most established and prolific hydrocarbon basins.

The concession produces from 10 fields and is located 80 km south

west of Cairo and close to local energy infrastructure. It is

operated by Petrosilah a 50/50 JV between Pharos and Egyptian

General Petroleum Corporation (EGPC). Pharos is also an operator

with 100% working interest in the North Beni Suef (NBS) Concession

which is located immediately south of the El Fayum concession.

In Israel, Pharos together with Cairn Energy plc and Israel's

Ratio Oil Exploration, were successful in their bid for eight

blocks in the second offshore bid round in Israel. Each party has

an equal working interest and Cairn is the operator.

In Vietnam, Pharos holds a 30.5% working interest in the Te Giac

Trang (TGT) Field in Block 16-1, which is operated by the Hoang

Long Joint Operating Company. Block 16-1 is located in the shallow

water Cuu Long Basin, offshore southern Vietnam and a 25% working

interest in the Ca Ngu Vang (CVN) Field in Block 9-2, which is

operated by the Hoan Vu Joint Operating Company. Block 9-2 is

located in the shallow water Cuu Long Basin, offshore southern

Vietnam. Pharos also holds a 70% interest in and is designated

operator of Blocks 125 & 126, located in the moderate to deep

water Phu Khanh Basin, north east of the Cuu Long Basin, offshore

central Vietnam.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RAGAMMBTMTITBAM

(END) Dow Jones Newswires

May 20, 2020 07:46 ET (11:46 GMT)

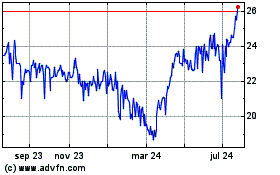

Pharos Energy (LSE:PHAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

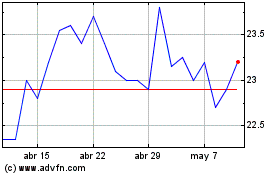

Pharos Energy (LSE:PHAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024