TIDMFDBK

RNS Number : 8886P

Feedback PLC

15 June 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 ("MAR"). IN ADDITION, MARKET

SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN RESPECT OF CERTAIN OF

THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION, AS

PERMITTED BY MAR. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND

SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE

INFORMATION.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM THE

UNITED STATES, CANADA, AUSTRALIA, JAPAN, NEW ZEALAND, THE REPUBLIC

OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BREACH ANY APPLICABLE LAW OR REGULATION. PLEASE SEE THE IMPORTANT

NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NEITHER THIS

ANNOUNCEMENT NOR ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF,

OR BE RELIED UPON IN CONNECTION WITH, ANY OFFER OR COMMITMENT

WHATSOEVER IN ANY JURISDICTION. ANY DECISION TO PURCHASE, SUBSCRIBE

FOR, OTHERWISE ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY SECURITIES

REFERRED TO IN THIS ANNOUNCEMENT MUST BE MADE SOLELY ON THE BASIS

OF THE INFORMATION THAT IS CONTAINED IN AND INCORPORATED BY

REFERENCE INTO THE PROSPECTUS TO BE PUBLISHED BY THE COMPANY IN DUE

COURSE.

Feedback plc

Placing to raise GBP5.05 million, Open Offer to raise up to

GBP0.54 million and Notice of General Meeting

London, 15 June 2020: Feedback plc (AIM: FDBK, "Feedback" or the

"Company"), the specialist medical imaging technology company,

announces that, it has conditionally raised GBP5.05 million,

through the issue of 505,000,000 new ordinary shares of 0.25 pence

each in the Company (the "Placing Shares") at a price of 1 penny

per share ("Issue Price"), the ("Placing").

In addition to the Placing, the Company intends to provide all

qualifying shareholders with the opportunity to subscribe for an

aggregate of up to 53,994,991 new ordinary shares (the "Open Offer

Shares") at the Issue Price, to raise up to approximately GBP0.54

million (before expenses), on the basis of 1 New Ordinary Share for

every 10 Existing Ordinary Shares held on the Record Date (the

"Open Offer" together with the Placing, the "Fundraising").

Shareholders subscribing for their full entitlement under the Open

Offer may also request additional Open Offer Shares through the

Excess Application Facility, as detailed below. The Fundraising is

conditional on shareholder approval at a general meeting of the

Company (the "General Meeting"), further details of which are set

out below.

Fundraising highlights

- The Company today confirms it has conditionally raised GBP5.05

million (before expenses) through a conditional placing of

505,000,000 New Ordinary Shares at a price of 1 penny per share. An

additional 53,994,991 New Ordinary Shares have been made available

for subscription by qualifying shareholders, to raise a maximum of

approximately GBP540,000, also at 1 penny per share.

- An Open Offer to Qualifying Shareholders on the basis of 1 New

Ordinary Share for every 10 Existing Ordinary Shares held on the

Record Date.

- Proceeds of the Placing and the Open Offer will be used to

develop the Company's flagship product, Bleepa(R), an innovative

app based on Feedback's Cadran technology, which allows medical

staff to securely view and discuss high quality medical grade

images on mobile devices. Funds will be applied to:

o Direct sales - engaging and converting NHS trusts to paying

customers of Bleepa(R)

o Indirect sales - develop growth opportunities and 'go to

market' strategies with key strategic partners

o Product development - extend and develop the functionality of

Bleepa(R), including for non-healthcare applications

o Territory expansion - to explore opportunities for

international expansion, via direct and indirect sales

- The Issue Price represents a discount of approximately 9.1 per

cent. to the closing mid-market share price of an Existing Ordinary

Share on 12 June 2020, the Business Day prior to this

announcement.

- The Fundraising is subject to shareholder approval at the

General Meeting on 1 July 2020. If approved, the Placing Shares and

Open Offer Shares are expected to be admitted to trading on AIM on

3 July 2020.

- Stanford Capital Partners Limited acted as sole Bookrunner in

respect of the Placing. Neither the Placing nor the Open Offer has

been underwritten.

- The Directors believe that the Placing Shares and the Open

Offer Shares will rank as 'eligible shares' for the purposes of EIS

and will be capable of being a 'qualifying holding' for the

purposes of investment by VCTs.

Tom Oakley, Chief Executive Officer of Feedback, commented:

"At this key moment for our company we are delighted to have

generated the support of some of London's leading institutional

investors for our vision of Bleepa(R). Feedback is now a very

different company to the one I joined just over a year ago; we now

have a singular focus to deliver an exciting clinical product which

leverages the best of our longstanding imaging heritage, repurposed

to meet the future challenges of the clinical frontline.

We have taken Bleepa(R) from concept to fully certified medical

device in less than a year and gained traction with two NHS sites.

This is a remarkable achievement, but it is only the beginning.

Having established Bleepa(R) we now have ambitious plans to scale

Bleepa(R) and get it out to clinicians across the UK and

internationally. This funding will enable us to take Bleepa(R)

forward at the pace required and we are excited to get started.

This funding marks a new start for Feedback, as we pivot away

from our heritage product lines towards Bleepa(R), and at this time

the Company wants to ensure that we reach out to our many loyal,

longstanding shareholders, who have supported the Company

throughout our journey so far. It is our desire to ensure that all

shareholders have the opportunity to participate in this fundraise

and buy in afresh to the Company's new vision. The Board has sought

to recognise the extraordinary support and longstanding commitment

of our shareholders through provision of an open offer.

Although this is a large raise relative to our current market

capitalisation, the Board has worked closely with its broker,

Stanford Capital, to minimise dilution for shareholders. A

fundraise of this level is both essential to allow us to grow at

the pace required but is also a validation and endorsement of the

vision and opportunity before us. With the support of the City and

our shareholders we look forward to taking the Company forward into

a new phase of opportunity."

Notice of General Meeting and Shareholder Circular

The Placing and the Open Offer are conditional, inter alia, on

the approval by shareholders of resolutions to be proposed at the

General Meeting to provide authority to the Directors to allot the

New Ordinary Shares otherwise than on a pre-emptive basis.

The General Meeting will be held at the offices of Trowers &

Hamlins LLP, 3 Bunhill Row London, EC1Y 8YZ at 10.00 a.m. on 1 July

2020. The Circular containing the Notice of General Meeting will be

posted to shareholders later today and will be made available

shortly on the Company's website at https://fbkmed.com/feedback-plc

.

In light of the COVID-19 pandemic Shareholders are urged to

exercise their votes by submitting their Form of Proxy and

appointing the Chairman of the General Meeting as their proxy.

Shareholders and their proxies will not be allowed to attend the

meeting in person, as to do so would be inconsistent with current

government guidelines relating to COVID-19 (as published as at the

date of this circular), in particular the advice for people to

avoid public gatherings, all non-essential travel and social

contact. Any Shareholder seeking to attend the General Meeting in

person will be refused entry. The Company is actively following

developments and will issue further information through a

Regulatory Information Service and/or on its website

(www.fbkmed.com/feedback-plc) if it becomes necessary or

appropriate to make any alternative arrangements for the General

Meeting. The General Meeting will be purely functional in format to

comply with the relevant legal requirements.

The above should be read in conjunction with the full text of

this announcement and the Circular, extracts from which are set out

below. All capitalised terms used throughout this announcement

shall have the meanings given to such terms in the Definitions

section of this announcement and as defined in the Circular.

Enquiries:

Feedback plc +44 (0) 20 8126 6798

Tom Oakley, CEO IR@fbk.com

Lindsay Melvin, CFO

Allenby Capital Limited (Nominated Adviser)

David Worlidge / Asha Chotai +44 (0)20 3328 5656

Stanford Capital Partners Limited (Joint

Broker)

Patrick Claridge / John Howes / Bob Pountney +44 20 3815 8880

Peterhouse Capital Limited (Joint Broker)

Lucy Williams / Duncan Vasey +44 (0)20 7469 0936

Instinctif Partners +44 (0)20 7457 2020

Melanie Toyne-Sewell / Phillip Marriage +44 7890 022 814

feedbackplc@instinctif.com

Notes to editors

About Bleepa(R)

Bleepa(R) provides instant and remote access to clinical grade

medical images through a zero footprint application. The majority

of patient cases require medical imaging which can be seamlessly

shared to the entire clinical team through Bleepa(R). Cases can be

discussed through its secure instant messaging and image

annotation, allowing comments and treatment decisions to be

communicated instantly between team members. Bleepa(R) can be

accessed from any internet connected device including phones,

tablets, laptops and desktops; clinicians can use their own devices

and therefore no additional hardware is required.

About Feedback plc - www.fbk.com

Feedback plc (AIM: FDBK) is a specialist medical imaging

technology company providing innovative software and systems,

through its wholly-owned trading subsidiary, Feedback Medical

Limited. Its products advance the work of radiologists, clinicians

and medical researchers by improving workflows and giving unique

insights into diseases, particularly cancer.

Feedback has launched Bleepa(R) , a new secure, encrypted

medical communication app for clinicians accessible through

smartphones, tablets and desktops that facilitates rapid clinical

messaging and review of medical grade imaging for all members of a

clinical team, directly from a hospital Picture Archiving and

Communications System

(PACS). For more information on Bleepa (R) , see www.bleepa.com .

IMPORTANT NOTICES

The total consideration under the Open Offer to Qualifying

Shareholders will be less than EUR8 million (or an equivalent

amount) in aggregate and it is therefore an exempt offer to the

public for the purposes of section 86(1)(e) of FSMA and the Placing

Shares will only be available to qualified investors for the

purposes of the Prospectus Regulation or otherwise in circumstances

not resulting in an offer of transferable securities to the public

under section 102B of FSMA. Neither the Placing nor the Open Offer

constitutes an offer to the public requiring an approved prospectus

under section 85(1) of FSMA and accordingly this document does not

constitute a prospectus for the purposes of the Prospectus Rules

made by the Financial Conduct Authority of the United Kingdom

("FCA") pursuant to sections 73A(1) and (4) of FSMA and has not

been pre-approved by the FCA pursuant to sections 85 and 87 of

FSMA, the London Stock Exchange, any securities commission or any

other authority or regulatory body. In addition, this document does

not constitute an admission document drawn up in accordance with

the AIM Rules for Companies. This document has not been approved

for issue by any person for the purposes of section 21 of FSMA.

Allenby Capital Limited, which is authorised and regulated by

the FCA in the United Kingdom, is acting as nominated adviser to

the Company for the purposes of the AIM Rules for Companies in

connection with the Fundraising and, as such, its responsibilities

are owed solely to the London Stock Exchange and are not owed to

the Company and the Directors or to any other person or entity.

Allenby Capital Limited will not be responsible to any person other

than the Company for providing the protections afforded to clients

of Allenby Capital Limited or for providing advice to any other

person in connection with the Fundraising or any acquisition of

shares in the Company. Allenby Capital Limited is not making any

representation or warranty, express or implied, as to the contents

of this document. Allenby Capital Limited has not authorised the

contents of, or any part of, this document, and no liability

whatsoever is accepted by Allenby Capital Limited for the accuracy

of any information or opinions contained in this document or for

the omission of any material information.

Stanford Capital Partners Limited, which is authorised and

regulated by the FCA in the United Kingdom, is acting as broker to

the Company in connection with the Placing. Stanford Capital

Partners Limited will not be responsible to any person other than

the Company for providing the protections afforded to clients of

Stanford Capital Partners Limited or for providing advice to any

other person in connection with the Placing or any acquisition of

shares in the Company. Stanford Capital Partners Limited is not

making any representation or warranty, express or implied, as to

the contents of this document. Stanford Capital Partners Limited

has not authorised the contents of, or any part of, this document,

and no liability whatsoever is accepted by Stanford Capital

Partners Limited for the accuracy of any information or opinions

contained in this document or for the omission of any material

information.

This announcement does not constitute or form part of any offer

or invitation to buy, subscribe for, or sell Ordinary Shares in any

jurisdiction in which such offer or solicitation is unlawful. In

particular, the New Ordinary Shares have not been, and will not be,

registered under the United States Securities Act of 1933 as

amended (the "Securities Act") or qualified for sale under the laws

of any state of the United States or under the applicable laws of

any of Canada, Australia, Japan, New Zealand or the Republic of

South Africa, and, subject to certain exceptions, may not be

offered or sold in the United States or to, or for the account or

benefit of, US persons (as such term is defined in Regulation S

under the Securities Act) or to any national, resident or citizen

of Canada, Australia, Japan, New Zealand or the Republic of South

Africa. The distribution or transmission of this announcement in

jurisdictions other than the UK may be restricted by law and,

therefore, persons into whose possession this document comes should

inform themselves about and observe such restrictions. Any failure

to comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction. In particular, this

announcement may not be distributed, directly or indirectly, in or

into the United States, Canada, Australia, Japan, New Zealand or

the Republic of South Africa. Overseas Shareholders and any person

(including, without limitation, nominees and trustees), who have a

contractual or other legal obligation to forward this announcement

to a jurisdiction outside the UK should seek appropriate advice

before taking any action.

No person has been authorised to give any information or make

any representation in relation to the Proposals and, if given or

made, such information or representation must not be relied upon as

having been so authorised by the Company, the Directors, Allenby

Capital Limited or Stanford Capital Partners Limited.

This announcement includes "forward-looking statements" which

includes all statements other than statements of historical fact,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Group to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. These forward-looking statements speak

only as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statements are based unless required to do so by

applicable law or the AIM Rules for Companies.

Extracts from the Circular

(References to pages or paragraphs below refer to the relevant

pages or paragraphs of the Circular. References to 'this document'

refer to the Circular.)

1. INTRODUCTION

The Company has today announced that it has conditionally raised

a total of up to approximately GBP5.59 million (before expenses),

comprising a Placing to raise GBP5.05 million and an Open Offer to

raise up to an additional GBP0.54 million. The Open Offer provides

Qualifying Shareholders with an opportunity to participate in the

proposed issue of New Ordinary Shares on the same terms as the

Placees.

The issue price of 1 penny per New Ordinary Share represents an

approximate 9.1 per cent. discount to the closing middle market

price of 1.1 pence per Existing Ordinary Share on 12 June 2020, the

last Business Day before the announcement of the Proposals.

The Fundraising is conditional, inter alia, on the passing of

the Resolutions by the Shareholders at the General Meeting, which

has been convened for 10.00 a.m. on 1 July 2020. If the Resolutions

are passed, the New Ordinary Shares are expected to be allotted

immediately after the General Meeting, conditional on Admission,

which is expected to occur at 8.00 a.m. on 3 July 2020. Should

Shareholder approval not be obtained at the General Meeting,

neither the Placing nor the Open Offer will proceed. Neither the

Placing nor the Open Offer has been underwritten.

The purpose of this document is to explain the background to the

Fundraising, to set out the reasons why the Board believes that the

Proposals are in the best interests of the Company and its

Shareholders and to seek Shareholder approval of the Resolutions at

the forthcoming General Meeting, which will be held at the of ces

of Trowers & Hamlins LLP, 3 Bunhill Row London, EC1Y 8YZ at

10.00 a.m. on 1 July 2020.

2. BACKGROUND TO AND REASONS FOR THE FUNDRAISING

Background

In September 2019, the Company launched its flagship product,

Bleepa(R) at the NHS Expo in Manchester. Bleepa(R) is an innovative

app based on Feedback's Cadran technology, which allows medical

staff to securely view and discuss high quality medical grade

images on mobile devices. The app displays images directly from the

hospital's Picture Archive Communication System (PACS). Bleepa(R)

is able to display images including X-rays, CTs, MRIs and

ultrasound studies allowing users to easily scroll through image

slices and annotate areas of interest, as well as enabling

discussion on the go.

Importantly, Bleepa(R) has been manufactured using a QMS

(quality management system) compliant with ISO 13485 and bears a CE

mark as a certified Class 1 Medical Device, which sets Bleepa(R)

apart from other medical imaging products currently available in

the UK. In addition, Bleepa(R) is a zero footprint application

meaning that no patient data is stored locally on the device being

used to access the app; Bleepa(R) complies with the NHS Data

Security and Protection Toolkit and the Cyber Essentials

accreditation used by the NHS.

In December 2019, the Company initiated a Bleepa(R) pilot study

with the Pennine Acute Hospitals NHS Trust, whereby a team of

healthcare professionals used the product, whilst handling

respiratory requests for specialist review of inpatients from other

clinical teams. The Company announced on 18 February 2020, that

early indications from a small cohort in the pilot study

demonstrated that Bleepa(R) more than halved the average referral

time and enabled 60 per cent. of cases to be dealt with entirely

through Bleepa(R) without the need for the clinical team to take

any action other than to discuss each case through Bleepa(R).

As announced on 26 March 2020, following the Covid-19 outbreak

(the "Outbreak"), owing to the immense critical care demands facing

the clinical frontline, Feedback and Pennine NHS Trust elected to

pause the Bleepa(R) pilot, which was focusing on evaluating

specific clinical workflow applications of Bleepa(R), to evaluate

options for a wider rollout to support the local COVID-19 response

within the Trust. On 20 April 2020, the Company further announced

that Bleepa(R) was to be rolled-out across the Pennine Acute

Hospitals NHS Trust with immediate effect as a key patient

management tool to assist its coronavirus response. New features

were developed at pace within a two-week period by the Feedback

team, and over 200 frontline clinicians within the Acute Medical

Team were enrolled on Bleepa(R). Importantly, during the Outbreak,

Bleepa(R) has enabled case reviews by clinicians who are

self-isolating, or by clinicians at other hospitals where

multi-site communication is required.

On 21 May 2020, the Company announced a further NHS trust would

be using Bleepa(R), with Royal Papworth Hospital NHS Foundation

Trust renewing its contract for clinical PACS (picture archiving

and communication system) services. The contract, set for a term of

14 months, relates to Feedback's Cadran PACS which has provided

core medical imaging services to the Trust since 2001. The contract

includes the use of Bleepa(R) as an upgrade to Cadran Web Viewer

and will see Bleepa(R) made available to all clinicians at the

Trust.

On 1 June 2020, the Company announced that, in compliance with

the Medical Device Directive ("MD Directive") and having met the

stringent criteria associated with the manufacture of a medical

device, it had affixed a CE Mark to Bleepa(R). All clinical

communication platforms that display digital images of patients for

the purpose of diagnosis are classed as medical devices under the

MD Directive guidelines and require a CE mark.

The Directors of Feedback believe that Bleepa(R) is the only

communication platform to address the UK market that has met MD

Directive certification requirements. As such, the Board considers

that having a CE mark is a major step forward for the Bleepa(R)

product since the use of a non-CE marked product may

inappropriately put individual clinicians and Trusts at risk of

civil claims for damages arising from misuse of that product.

Reasons for the Fundraising

The Board's vision is for Bleepa(R) to become the imaging

solution of the clinical frontline. As Feedback was initially set

up as an imaging company rather than a messaging company, the image

display is CE marked and of clinical quality.

The Board believes, there are an estimated 10-15 million

doctors, globally, who need to be able to communicate about

patients' treatment. Healthcare systems are now beginning to

consider the need for improved digital communication systems as the

market begins to mature. As medical imaging is no longer the remit

of radiologists alone, but a key diagnosis tool for most

clinicians, there is an increasing need for frontline clinicians to

review medical imaging as part of their work.

In addition to the NHS and healthcare systems, the Company

believes Bleepa(R) can be deployed in parallel market segments such

as inter-hospital image transfer/communication and community

imaging providing the Company with far more revenue streams than

other communication platforms which do not focus on imaging.

The Company has therefore conducted the Fundraising, conditional

on shareholder approval at the General Meeting, amongst other

things, to ensure it is funded to increase the use and rollout of

Bleepa(R), for use both within NHS and healthcare systems within

other territories and to explore other potential uses of

Bleepa(R).

3. USE OF PROCEEDS

In addition to providing general working capital, the total net

proceeds of the Fundraising of up to approximately GBP5.28 million,

will principally be used to fund growth in the following areas:

1. Direct sales

The Company will seek to engage new NHS trusts and sites to

convert to paying customers of Bleepa(R). To assist with this, the

Company will look to grow its UK sales team and increase the

marketing spend associated with Bleepa(R).

2. Indirect sales

In conjunction with growing direct sales, the Company will also

apply funds to develop growth opportunities and 'go to market'

strategies with key strategic partners with a view to accelerating

adoption of Bleepa(R) whilst reducing customer acquisition

costs.

3. Product development

The Company intends to extend and develop the functionality of

Bleepa(R) which may include positioning the platform for Artificial

Intelligence tool deployment, and Internet-of-Things integration.

The Company will also consider the non-healthcare applications of

Bleepa(R) including within the veterinary sector.

4. Territory expansion

The Board will utilise funds raised to continue to explore

opportunities for international expansion of the Bleepa(R)

platform. To enable this international growth, investment will be

made to support direct and indirect sales in identified territories

and it is likely that Feedback's regulatory team will be expanded

to meet the local regulatory requirements in new territories.

4. DETAILS OF THE FUNDRAISING

The Company has conditionally raised a total of up to

approximately GBP5.59 million (before expenses), comprising: i) a

Placing to raise GBP5.05 million (before expenses) through a

placing of 505,000,000 New Ordinary Shares at 1 penny per share

with institutional and other investors; and ii) an Open Offer to

raise up to an additional approximately GBP540,000 (before

expenses) through an Open Offer of up to 53,994,991 New Ordinary

Shares at 1 penny per share with Qualifying Shareholders.

The Fundraising has not been underwritten and is conditional,

inter alia, upon:

a) the passing of resolutions 1 and 3 of the Resolutions;

b) the Placing Agreement becoming unconditional in all respects

(other than Admission) and not having been terminated in accordance

with its terms; and

c) Admission occurring by not later than 8.00 a.m. 3 July 2020

(or such later time and/or date as the Company, Stanford and

Allenby Capital may agree, not being later than 8.00 a.m. on 17

July 2020).

Accordingly, if any of the conditions are not satisfied or

waived (where capable of waiver), the Fundraising will not proceed,

the New Ordinary Shares will not be issued and all monies received

by Stanford, the Receiving Agents or the Company (as the case may

be) will be returned to the applicants (at the applicants' risk and

without interest) as soon as possible thereafter.

The Directors believe that the New Ordinary Shares to be issued

pursuant to the Placing and Open Offer will rank as 'eligible

shares' for the purposes of EIS and will be capable of being a

'qualifying holding' for the purposes of investment by VCTs.

Details of the Placing

Under the terms of the Placing Agreement, Stanford has agreed to

use its reasonable endeavours to procure subscribers for the

Placing Shares at the Issue Price. The Placing Agreement contains

certain warranties and indemnities from the Company in favour of

Stanford and Allenby Capital. Stanford or Allenby Capital may

terminate the Placing Agreement in certain circumstances.

Details of the Open Offer

In recognition of their continued support to the Company, the

Board believes that the Open Offer provides the Company's

longstanding and supportive Shareholders with an opportunity to

participate in the Fundraising.

The Company is providing all Qualifying Shareholders with the

opportunity to subscribe, at the Issue Price, for an aggregate of

53,994,991 Open Offer Shares, raising gross proceeds of up to

approximately GBP540,000.

Qualifying Shareholders may apply for Open Offer Shares under

the Open Offer at the Issue Price on the following basis:

1 Open Offer Share for every 10 Existing Ordinary Shares

and so in proportion for any number of Existing Ordinary Shares

held on the Record Date.

Entitlements of Qualifying Shareholders will be rounded down to

the nearest whole number of Ordinary Shares. Fractional

entitlements which would otherwise arise will not be issued to the

Qualifying Shareholders but will be made available under the Excess

Application Facility. The Excess Application Facility enables

Qualifying Shareholders to apply for Excess Shares in excess of

their Open Offer Entitlement. Not all Shareholders will be

Qualifying Shareholders. Shareholders who are located in, or are

citizens of, or have a registered office in certain overseas

jurisdictions will not qualify to participate in the Open

Offer.

Valid applications by Qualifying Shareholders will be satisfied

in full up to their Open Offer Entitlements. Qualifying

Shareholders can apply for less or more than their Open Offer

Entitlements but the Company cannot guarantee that any application

for Excess Shares under the Excess Application Facility will be

satisfied as this will depend in part on the extent to which other

Qualifying Shareholders apply for less than or more than their own

Open Offer Entitlements. The Company may satisfy valid applications

for Excess Shares in whole or in part but reserves the right at its

sole discretion not to satisfy, or to scale back, applications made

in excess of Open Offer Entitlements.

Application has been made for the Open Offer Entitlements and

Excess CREST Open Offer Entitlements for Qualifying CREST

Shareholders to be admitted to CREST. It is expected that the Open

Offer Entitlements and the Excess CREST Open Offer Entitlements

will be admitted to CREST on 16 June 2020. Applications through the

CREST system may only be made by the Qualifying Shareholder

originally entitled or by a person entitled by virtue of a bona

fide market claim.

The Open Offer Shares must be paid in full on application. The

latest time and date for receipt of completed Application Forms or

CREST applications and payment in respect of the Open Offer is

11.00 a.m. on 30 June 2020.

Qualifying Shareholders should note that the Open Offer is not a

rights issue and therefore the Open Offer Shares which are not

applied for by Qualifying Shareholders will not be sold in the

market for the benefit of the Qualifying Shareholders who do not

apply under the Open Offer. The Application Form is not a document

of title and cannot be traded or otherwise transferred.

Rights of the New Ordinary Shares and application for

Admission

The New Ordinary Shares will, when issued, be credited as fully

paid up and will be issued subject to the Company's articles of

association and rank pari passu in all respects with the Existing

Ordinary Shares, including the right to receive all dividends and

other distributions declared, made or paid on or in respect of the

Ordinary Shares after the date of issue of the New Ordinary Shares,

and will on issue be free of all claims, liens, charges,

encumbrances and equities.

Application will be made to the London Stock Exchange for the

Admission of the New Ordinary Shares to trading on AIM. It is

expected that Admission of the New Ordinary Shares will occur on or

around 8.00 a.m. (London time) on 3 July 2020 (or such later time

and/or date as Stanford and Allenby Capital may agree with the

Company, not being later than 8.00 a.m. on 17 July 2020).

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for entitlements under the Open 6.00 p.m. on 11 June

Offer 2020

Announcement of the Fundraising 7.00 a.m. on 15 June

2020

Publication and posting of this document, 15 June 2020

the Form of Proxy and (to Qualifying Non-CREST

Shareholders only) the Application Form

Ex-entitlement Date for the Open Offer 8.00 a.m. on 15 June

2020

Open Offer Entitlements and Excess CREST As soon as practical

Open Offer Entitlements credited to stock after 8.00 a.m. on 16

accounts of Qualifying CREST Shareholders June 2020

in CREST

Latest recommended time and date for requesting 4.30 p.m. on 24 June

withdrawal of Open Offer Entitlements and 2020

Excess CREST Open Offer Entitlements from

CREST

Latest time and date for depositing Open 3.00 p.m. on 25 June

Offer Entitlements and Excess CREST Open 2020

Offer Entitlements into CREST

Latest time and date for splitting Application 3.00 p.m. on 26 June

Forms (to satisfy bona fide market claims 2020

only)

Latest time and date for receipt of completed 10.00 a.m. on 29 June

Forms of Proxy and receipt of electronic 2020

proxy appointments via the CREST system

Latest time and date for receipt of the 11:00 a.m. on 30 June

completed Application Form and appropriate 2020

payment in respect of Open Offer Shares

or settlement of relevant CREST instruction

General Meeting 10.00 a.m. on 1 July

2020

Announcement of result of General Meeting 1 July 2020

and Open Offer

Admission and commencement of dealings in 8.00 a.m. on 3 July 2020

the New Ordinary Shares on AIM

CREST members' accounts credited in respect from 8.00 a.m. on 3 July

of New Ordinary Shares in uncertificated 2020

form

Despatch of definitive share certificates by 14 July 2020

for New Ordinary Shares in certificated

form

If any of the details contained in the timetable above should

change, the revised times and dates will be notified to

Shareholders by means of an announcement through a Regulatory

Information Service.

KEY STATISTICS

Number of Existing Ordinary Shares 539,949,917

Number of Placing Shares 505,000,000

Maximum number of Open Offer Shares 53,994,991

Issue Price 1 penny

Open Offer Entitlements under the Open Offer 1 New Ordinary

Share for every

10 Existing Ordinary

Shares

Percentage of the Enlarged Share Capital represented

by the New Ordinary Shares(1) 104 per cent.

Gross proceeds of the Placing GBP5.05 million

Maximum gross proceeds of the Open Offer Approximately

GBP540,000

Estimated net proceeds of the Fundraising(1)

GBP5.28 million

Enlarged Share Capital immediately following the

Fundraising(1) 1,098,944,908

Market capitalisation of the Company immediately

following the Fundraising at the Issue Price(1) GBP10.99 million

Note: (1) Assuming all the Open Offer Shares are taken up

pursuant to the Open Offer.

DEFINITIONS

The following de nitions apply throughout this document unless

the context otherwise requires:

"Act" the Companies Act 2006 (as amended);

"Admission" admission of the New Ordinary Shares to

trading on AIM becoming effective in accordance

with the AIM Rules for Companies;

"AIM" the market of that name operated by the

London Stock Exchange;

"AIM Rules for Companies" the AIM Rules for Companies, as published

and amended from time to time by the London

Stock Exchange;

"Allenby Capital" Allenby Capital Limited, a private limited

company incorporated in England and Wales

under registered number 06706681 and having

its registered office at 5 St. Helen's Place,

London EC3A 6AB, the Company's nominated

adviser and corporate finance adviser for

the purposes of the Fundraising;

"Application Form" the application form enclosed with this

document on which Qualifying Non-CREST Shareholders

may apply for Open Offer Shares under the

Open Offer;

"Board" or "Directors" the directors of the Company as at the date

of this document;

"Business Day" any day (excluding Saturdays and Sundays)

on which banks are open in London for normal

banking business and the London Stock Exchange

is open for trading;

"certificated" or "in where an Ordinary Share is not in uncertificated

certificated form" form (i.e. not in CREST);

"Chairman" the chairman of the Board;

"Company" or "Feedback" Feedback plc, a company registered in England

and Wales with registered number 00598696;

"CREST" the relevant system for the paperless settlement

of trades and the holding of uncerti cated

securities operated by Euroclear UK & Ireland

Limited in accordance with the CREST Regulations;

"CREST Manual" the CREST Manual referred to in agreements

entered into by Euroclear and available

at www.euroclear.com;

"CREST member" a person who has been admitted to CREST

as a system-member (as defined in the CREST

Regulations);

"CREST member account the identification code or number attached

ID" to a member account in CREST;

"CREST participant" a person who is, in relation to CREST, a

system-participant (as defined in the CREST

Regulations);

"CREST participant ID" shall have the meaning given in the CREST

Manual;

"CREST payment" shall have the meaning given in the CREST

Manual;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755) including any enactment

or subordinate legislation which amends

or supersedes those regulations and any

applicable rules made under those regulations

or any such enactment or subordinate legislation

for the time being in force;

"CREST sponsor" a CREST participant admitted to CREST as

a CREST sponsor;

"CREST sponsored member" a CREST member admitted to CREST as a CREST

sponsored member;

"EIS" Enterprise Investment Scheme under the provisions

of Part 5 of the UK Income Tax Act 2007

(as amended);

"Enlarged Share Capital" the entire issued share capital of the Company

on Admission following completion of the

Fundraising;

"Euroclear" Euroclear UK & Ireland Limited;

"Excess Application the arrangement pursuant to which Qualifying

Facility" Shareholders may apply for additional Open

Offer Shares in excess of their Open Offer

Entitlement in accordance with the terms

and conditions of the Open Offer;

"Excess CREST Open Offer in respect of each Qualifying CREST Shareholder,

Entitlement" their entitlement (in addition to their

Open Offer Entitlement) to apply for Open

Offer Shares pursuant to the Excess Application

Facility, which is conditional on them taking

up their Open Offer

Entitlement in full;

"Excess Shares" Ordinary Shares applied for by Qualifying

Shareholders under the Excess Application

Facility;

"Ex-entitlement Date" the date on which the Existing Ordinary

Shares are marked "ex" for entitlement under

the Open Offer, being 15 June 2020;

"Existing Ordinary Shares" the 539,949,917 Ordinary Shares in issue

at the date of this document;

"FCA" the Financial Conduct Authority of the United

Kingdom;

"Form of Proxy" the form of proxy for use by Shareholders

in relation to the General Meeting, enclosed

with this document;

"FSMA" the Financial Services and Markets Act 2000

(as amended);

"Fundraising" the Placing and the Open Offer;

"General Meeting" or the General Meeting of the Company convened

"GM" for 10.00 a.m. on 1 July 2020 or any adjournment

thereof, notice of which is set out at the

end of this document;

"Group" the Company and its subsidiaries (as defined

in the Act);

"Issue Price" 1 penny per New Ordinary Share;

"London Stock Exchange" London Stock Exchange plc;

"Money Laundering Regulations" the money laundering and terrorist financing

provisions of the Criminal Justice Act 1993,

the Terrorism Act 2000, the Proceeds of

Crime Act 2002, the Terrorism Act 2006 and

the Money Laundering Regulations 2007, the

Money Laundering, Terrorist Financing and

Transfer of Funds (Information on the Payer)

Regulations 2017;

"New Ordinary Shares" together, the Placing Shares and the Open

Offer Shares;

"Notice of General Meeting" the notice convening the General Meeting

as set out at the end of this document;

"Open Offer Shares" 53,994,991 new Ordinary Shares being made

available to Qualifying Shareholders pursuant

to the Open Offer;

"Open Offer" the conditional invitation made to Qualifying

Shareholders to apply to subscribe for Open

Offer Shares at the Issue Price on the terms

and subject to the conditions set out in

Part III of this document and, where relevant,

in the Application Form;

"Open Offer Entitlement" the pro rata entitlement of a Qualifying

Shareholder, pursuant to the Open Offer,

to subscribe for 1 Open Offer Share for

every 10 Existing Ordinary Shares registered

in their name as at the Record Date;

"Official List" the Official List of the FCA;

"Ordinary Shares" the ordinary shares of 0.25 pence each in

the capital of the Company in issue from

time to time;

"Overseas Shareholder" a Shareholder with a registered address

outside the United Kingdom;

"Placees" subscribers for the Placing Shares;

"Placing Agreement" the conditional placing agreement entered

into between the Company, Allenby Capital

and Stanford in respect of the Placing,

dated 15 June 2020, as described in this

document;

"Placing" the proposed placing by Stanford (as agent

for the Company) of the Placing Shares with

certain institutional investors and existing

Shareholders, otherwise than on a pre-emptive

basis, at the Issue Price on the terms of

the Placing Agreement;

"Placing Shares" 505,000,000 new Ordinary Shares the subject

of the Placing;

"Proposals" the Placing and the Open Offer and other

matters contained in this document;

"Prospectus Regulation" EU Prospectus Regulation 2107/1129;

"Prospectus Rules" the rules made by the FCA under Part VI

of FSMA in relation to offers of transferable

securities to the public and admission of

transferable securities to trading on a

regulated market;

"Qualifying CREST Shareholders" Qualifying Shareholders holding Existing

Ordinary Shares in a CREST account;

"Qualifying Non-CREST Qualifying Shareholders holding Existing

Shareholders" Ordinary Shares in certificated form;

"Qualifying Shareholders" holders of Existing Ordinary Shares on the

register of members of the Company at the

Record Date (but excluding any Overseas

Shareholder who has a registered address

in the United States of America or any other

Restricted Jurisdiction);

"Receiving Agents", Share Registrars Limited, a private limited

"Registrar" or "Share company incorporated in England and Wales

Registrars" under registered number 04715037 and having

its registered office at 27-28 Eastcastle

Street, London, W1W 8DH, the Company's registrar

and receiving agent;

"Record Date" 6.00 p.m. on 11 June 2020 being the latest

time by which transfers of Existing Ordinary

Shares must be received for registration

by the Company in order to allow transferees

to be recognised as Qualifying Shareholders;

"Regulatory Information has the meaning given to it in the AIM Rules;

Service"

"Resolutions" the resolutions to be proposed at the General

Meeting, the full text of which are set

out in the Notice of General Meeting;

"Restricted Jurisdiction" United States of America, Canada, Australia,

Japan, New Zealand and the Republic of South

Africa and any other jurisdiction where

the extension or availability of the Fundraising

would breach any applicable law;

"Securities Act" US Securities Act of 1933 (as amended);

"Shareholders" the holders of Existing Ordinary Shares,

and the term "Shareholder" shall be construed

accordingly;

"Stanford" Stanford Capital Partners Limited, a private

limited company incorporated in England

and Wales under registered number 11192616

and having its registered office at Warden

House, 37 Manor Road, Colchester, Essex,

United Kingdom, CO3 3LX, the Company's broker

for the purposes of the Placing and Admission;

"stock account" an account within a member account in CREST

to which a holding of a particular share

or other security in CREST is credited;

"uncerti cated" or "uncerti means recorded on the relevant register

cated form" or other record of the share or other security

concerned as being held in uncerti cated

form in CREST, and title to which, by virtue

of the CREST Regulations, may be transferred

by means of CREST;

"United Kingdom" or the United Kingdom of Great Britain and

"UK" Northern Ireland;

"USE" Unmatched Stock Event instructions;

"VCT" a company which is, or which is seeking

to become, approved as a venture capital

trust under the provisions of Part 6 of

the Income Tax Act 2007; and

"GBP" or "Pounds" UK pounds sterling, being the lawful currency

of the United Kingdom.

Certain of the events in the above timetable are conditional

upon, inter alia, the approval of the Resolutions to be proposed at

the General Meeting.

All references to time and dates in this document are to time

and dates in London.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGPUCGQUPUGBC

(END) Dow Jones Newswires

June 15, 2020 02:00 ET (06:00 GMT)

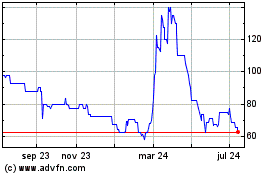

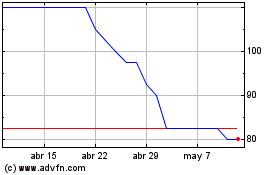

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024