Time to Sell This Commodity ETF? - ETF News And Commentary

25 Marzo 2013 - 10:00AM

Zacks

Although some commodities have had a strong start to 2013, many

have seen severe weakness to open up the year. This has been

especially true in the beaten down base metal space, in products

such as aluminum, zinc, and copper.

These metals have been victims of relatively sluggish conditions

in some key emerging markets like China, as well as worries over

continued dollar strength. This currency issue has been especially

bad this year as the U.S. dollar has appreciated significantly,

reversing a long trend in the space.

In fact, not only has the dollar been strong, but it has

actually been surging against a wide range of other global

currencies. The dollar has recently broken out above long-term

moving averages, and thanks to ongoing issues in Europe, Japan, and

Great Britain, the rise of the dollar could continue for quite some

time.

If this situation holds firm, the bad news could continue for

the volatile and dollar driven base metal ETF, the

PowerShares DB Base Metals Fund (DBB). This ETF

has slumped significantly thanks to the trends outlined above, and

there is little hope for a reversal in the near term.

Consider the following chart of the base metal ETF against the

dollar ETF, UUP:

As you can see, there is a pretty significant inverse

correlation between the dollar and this base metal ETF. This trend

is also apparent over longer time periods as well, suggesting that

investors who want to delve into this space should pay close

attention to the dollar’s movements.

And given how uncertain the euro has been trading with all of

the Cyprus issues, the dollar could continue to gain. This may be

especially true if investors add in the threat of a triple dip

recession in the UK, and a focused effort by Japan to weaken their

currency against the greenback.

This situation is further reflected by the chart of DBB on its

own. The fund recently saw its 15 day SMA break below its

longer-term 200 day SMA, implying further bearishness ahead.

For these reasons, we currently assign DBB a Zacks ETF Rank of 4

or ‘Sell’. This means that we are looking for further weakness in

this ETF over the course of the next year.

If recent history is any guide, this could definitely be the

case, as several key currencies are expected to have down years in

2013 as well. This is extremely important for the base metal space,

and along with relatively sluggish demand, it could keep DBB and

other base metal ETFs in check throughout the year.

Other Options

Instead of this troubled base metal ETF, investors could look to

other commodities which could be better poised to take advantage of

the current market trends. One such segment is definitely in the

precious metal market.

However, we aren’t talking about gold here, as some of the key

white metals—specifically platinum and palladium—look to be top

performers in 2013. These look to be well-positioned to take

advantage of rising demand thanks to a strong car market, while

they also have solid industrial applications beyond the automotive

space as well.

While it is true that these two may be hurt by a strong dollar

as well, they can easily overcome this thanks to some significant

supply concerns. Investors are starting to worry about these

supplies meeting demand so this could help to mitigate many of the

worries that are currently afflicting the base metal ETF

market.

Furthermore both of these metals can easily be accessed via

ETFs, specifically with PPLT and PALL. Both of

these funds are currently ranked as ‘buys’ by the Zacks ETF Ranking

system, so they look to be better positioned than many of their

other counterparts in the space going forward.

Bottom Line

Base metals are probably a space to avoid, but that doesn’t mean

that all commodities are looking weak. Some key products in the

precious metal space, such as PALL and PPLT could be better

positioned and be solid value plays for some investors, especially

when compared to base metal ETFs at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Author is long PPLT

PWRSH-DB B METL (DBB): ETF Research Reports

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

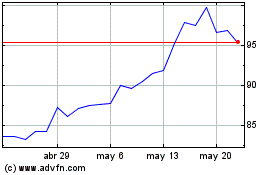

Abrdn Palladium ETF (AMEX:PPLT)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

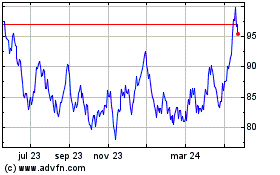

Abrdn Palladium ETF (AMEX:PPLT)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024