S&P 500 Index: Should You Expect a Santa Claus Rally In 2023?

04 Diciembre 2023 - 4:15AM

Finscreener.org

The

S&P 500 saw an

increase of about 1% last week, suggesting a period of bullish

consolidation after the significant rally in November, where the

index climbed 8.9%.

However, itU+02019s premature to

draw firm conclusions. Notably, over the past couple of days, there

has been a noticeable pattern: technology stocks are

underperforming while small caps are excelling.

For instance, on Friday,

the Nasdaq Composite, which has been the top performer among major

indexes year-to-date, recorded the smallest gain (+0.56%), while

the Russell 2000, the lowest performer year-to-date, showed the

highest increase (+2.44%). This shift might indicate a potential

trend towards investing in small caps or value stocks, possibly due

to a belief that thereU+02019s more potential for relative gains in

these undervalued sectors.

One hypothesis for this trend is

that if interest rates decrease and the economy is on track for a

gentle deceleration, the undervalued small caps might be set for a

significant rebound.

However, an opposing view

suggests small caps have been underperforming for valid reasons and

may represent a risky investment. As it stands, itU+02019s a

development worth watching, and time will ultimately reveal the

outcome of these market dynamics.

Will this momentum continue for the S&P 500

index?

Stocks are reaching their daily

highs, coinciding with a notable drop in 10-year yields to their

lowest in two months, now at 4.22%. The decline in yields seems to

be a reaction to comments made late last week by Federal Reserve

Chair Jerome Powell.

Although Powell didnU+02019t

offer any new insights, stating itU+02019s premature to say that

policy settings

are adequately aligned to meet their goals, investors seemed to

latch onto his remark that monetary policy is firmly in restrictive

territory.

Consequently, the SPX, DJI, and

RUT are all poised to close at their highest levels in several

months. The SPX is below the 4,600 resistance level, leaving market

watchers curious if it will surpass the threshold this

week.

Meanwhile, the DJI has already

achieved a 52-week high, with additional gains on Friday, and the

RUT is revitalizing to two-month highs, aligning with the decline

in 10-year yields.

Considering these factors and a

generally bullish market trend typical of this season, the market

may continue to trend upward next week.

However, a couple of

uncertainties linger:

Will the SPXU+02019s struggle to

break past 4,600 dampen the upward momentum in the RUT/DJI?

and

What impact will next

FridayU+02019s Nonfarm Payrolls report have on this trend,

particularly if it shows robust figures?

Remembering that stocks reacted

favorably to last monthU+02019s weaker-than-expected nonfarm

payrolls report (150K vs. the 160K estimate, with unemployment

rising to 3.9%), investors might prefer figures that hint at a

relaxing labor market.

Interest rate hikes on the cards?

BloombergU+02019s data indicates

that the likelihood of the Federal Reserve lowering interest rates

in either their December or January FOMC meeting is currently at

9.2%. This contrasts with a higher 12.8% chance of increased rates,

as noted last Friday.

Observing these week-over-week

probability shifts offers insight into market reactions to recent

economic data and comments from the Fed. According to

BloombergU+02019s forecasts, thereU+02019s a significant chance

(over 65% probability) of a rate cut at the May 2024 FOMC

meeting.

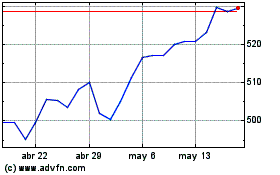

SPDR S&P 500 (AMEX:SPY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SPDR S&P 500 (AMEX:SPY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024