Bitcoin Price Flashes Major Buy Signal On The 4-Hour TD Sequential Chart, Where To Enter?

23 Diciembre 2024 - 11:00AM

NEWSBTC

A crypto analyst has shared a TD Sequential chart indicating that

the Bitcoin price is flashing a major buy signal in the 4-hour time

frame. This signal suggests that Bitcoin’s bearish momentum could

be waning, making this a potentially critical moment to consider

entering the market. Bitcoin Price TD Sequential Flashes Buy Signal

A TD Sequential is a unique technical indicator that identifies

trend exhaustion and price reversals and indicates buy or sell

signals. According to an X (formerly Twitter) post by crypto

analyst Ali Martinez, Bitcoin’s 4-hour chart showcases a green “9”

candle, signaling a potential buying opportunity. Related

Reading: Dogecoin Price Above $10: Historical Data Shows How High

DOGE Will Go This Bull Cycle Typically, in a downtrend, the green 9

candle is interpreted as a buy signal, indicating that bearish

momentum might be reaching exhaustion and prices could be getting

ready for a rebound. Martinez also shows an ”A13” marker on the TD

Sequential chart, which represents a countdown phase that tracks 13

additional candles and identifies a stronger trend

exhaustion. During a downtrend, the appearance of a TD

Sequential A13 often signals a potential decline in a

cryptocurrency’s sell-off phase, reinforcing the possibility of a

price reversal. Bitcoin’s current buy signal emerged as its price

exceeded $94,000. This buy signal suggests an optimal time to enter

the market, with the $94,915 price point highlighted as a potential

entry for traders aiming to capitalize on a possible Bitcoin price

rebound. Although the TD Sequential is an indicator used to

identify buy and sell signals, market participants can exercise

caution by considering additional factors like volatility, broader

market sentiment, and more. If the current buy signal holds,

Martinez has predicted that a price rebound can be expected.

However, a failure to maintain its current price could lead to

further downsides, potentially pushing Bitcoin to its next critical

support level. BTC Market Top Set At $168,500 In another more

recent X post, Martinez presented a chart of Bitcoin’s price

movements, predicting a market top above $168,500 based on the

Mayer Multiple. The chart shows Bitcoin price performance based on

the Mayer Multiple, which compares BTC to the 200-day Moving

Average (MA). Related Reading: Bitcoin Price Above $100,000

Again? Why $99,800 Is An Important Resistance To Break The red

line, as seen on the chart, indicates the Mayer MultipLe (MM) at

2.4, while the green line showcases MM at 0.8. Additionally, the

blue line is the Oscillator, which tracks the Mayer Multiple over

time. Historically, the Bitcoin price tops have

coincided with the Mayer Multiple reaching the 2.4 level or higher.

Currently, Bitcoin’s Multiple Mayer sits at 1.3845 in the chart.

However, if its price continues to rise and the MM reaches 2.4

again, Martinez predicts a market top above $168,500 for

Bitcoin. As of writing, Bitcoin’s price is $94,692, meaning a surge

to $168,500 would require a significant 78% increase from its

present market value. Featured image created with Dall.E,

chart from Tradingview.com

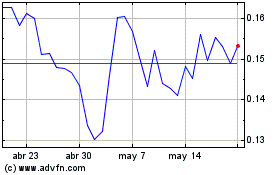

Dogecoin (COIN:DOGEUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Dogecoin (COIN:DOGEUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024