dYdX To Unlock $478M Worth Of Tokens, Will Bears Have A Field Day?

30 Noviembre 2023 - 4:00PM

NEWSBTC

On December 1, dYdX, the layer-2 decentralized exchange,

will unlock 150 million DYDX worth roughly $478 million

to early investors and core team members. This substantial unlock

has raised concerns among investors, who fear the influx of fresh

tokens could substantially increase supply. If this is not matched

by high demand, DYDX prices will likely pull back, reversing recent

gains posted over the past few trading weeks. DYDX Worth $500

Million To Hit The Market According to Bubblemaps data, out of

the $478 million worth of DYDX, over 50% is allocated to venture

capitalists (VCs), including Paradigm and Polychain. Zooming back

and looking at their data, VCs seeded $100 million to the layer-2

decentralized exchange. These tokens were distributed to private

investors through five wallets, including Coinbase Custody,

Investor Distribution, and the Foundation Wallet. Currently trading

at over $3, DYDX is at February 2023 levels and technically

bullish. However, the upcoming token unlock casts a shadow over the

token’s positive momentum. Related Reading: Shiba Inu L2 Shibarium

Crosses 4 Million Transactions As Burn Rate Explodes Notably, dYdX,

postponed its token unlock by ten months. According to data, the

humongous DYDX unlock was initially postponed from February to

December 2023. Following this move, DYDX prices edged higher. Even

so, prices pulled back before consolidating in the better part of

Q2, Q3, and early Q4 2023. There was a pronounced rally in late

October 2023 as DYDX rose, riding the optimism across the crypto

board. At spot rates, DYDX is up 82% from October 2023 highs.

However, looking at price action, bears are retesting the 20-day

moving average of the BB. A break below this level might trigger a

sell-off, pushing prices back to October 2023 highs. Which Way

Could Take The Price Action? While it is likely that prices could

contract ahead or after the unlocking event, the team has devised a

way of mitigating the expected selling pressure. To illustrate, the

initial unlock will release 30% of the total amount. Afterward,

there will be monthly equal releases over the next three

years. For optimists, however, that a significant

portion of these tokens will go to the team, and investors could

end up supporting prices. Team members and venture capitalists

trade less frequently than retail investors, meaning the expected

liquidation pressure, if any, could be limited. Moreover, some team

members and even early investors might consider re-staking DYDX

from their infrastructure, giving them more control. Related

Reading: Bitcoin Alert: $137 Million Moved By Long-Sleeping Whale,

Market Braces For Impact Even with this release, crypto

participants are upbeat, anticipating Bitcoin prices to track

higher ahead of the expected spot Bitcoin ETF approval by the

Securities and Exchange Commission (SEC). More tailwinds could

result from the Bitcoin halving event in early Q2 2024. Feature

image from Canva, chart from TradingView

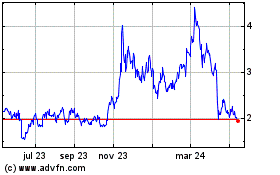

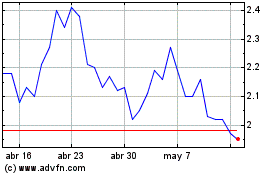

dYdX (COIN:DYDXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

dYdX (COIN:DYDXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024