SUI Price Soars 12% In Minutes, Triggering Huge Liquidations: Predictions For The Altcoin

21 Diciembre 2024 - 7:30AM

NEWSBTC

The native token of the decentralized smart contract platform Sui

(SUI) kicked off the week with an all-time high of $4.96, buoyed by

an overall bullish trend in the cryptocurrency market. The momentum

was short-lived, as SUI experienced a significant retracement on

Friday, plummeting nearly 30% to $3.49. However, the token

rebounded swiftly, stabilizing at approximately $4.55, representing

a 12.8% increase from the week’s low and just 8.9% shy of its

record price, SUI Surges Amid Market Volatility In stark contrast,

major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have

continued to experience downward corrections following the US

Federal Reserve’s (Fed)0 recent decision regarding interest rates.

The Fed’s dovish stance has negatively impacted risk assets,

contributing to a generally bearish sentiment in the market that

led the market’s leading crypto, to retrace almost 10% from the

record high of $108,000. The volatility surrounding SUI led to

nearly $14 million in liquidations across both long and short

positions on centralized exchanges, with Binance reporting the

highest liquidation rates within the past 24 hours, according to

data from Coinalyze. Related Reading: Bitcoin Rally Loses

Momentum: Could A Drop To $75,000 Signal The Final Correction?

Notably, recent analysis has indicated that Sui ranks third in net

inflows over the past three months, with close to $1 billion

entering the network, highlighting the growing investor interest in

SUI, further bolstered by a new partnership with Phantom

wallet. Crypto analyst Route 2 FI noted in a recent social

media post on X (formerly Twitter), that the bullish reversal in

SUI’s price indicated strong investor sentiment, culminating in the

token’s record peak at the beginning of the week. Analyst Targets

$6 As Market Momentum Builds Michael van de Poppe, another

respected analyst, pointed out the substantial daily candle

movement in SUI, emphasizing that the price dipped into support

before quickly bouncing back. He expressed optimism that this trend

is far from over, suggesting that SUI could continue its upward

trajectory with a target of $6 in sight. The recent surge in SUI’s

price is also expected to attract Bitcoin liquidity into its

ecosystem, further enhancing the token’s bullish prospects.

Technical analyst Rekt Capital highlighted that SUI has effectively

executed a post-breakout retest from its re-accumulation

range. Rekt also noted that strategic partnerships with

Babylon Labs and Lombard Finance would facilitate the integration

of Bitcoin liquidity, which could significantly benefit the Sui

platform. Related Reading: XRP, Solana Among Altcoins Witnessing TD

Buy Signal, Analyst Reveals The growing interest in SUI raises

questions about its potential performance in 2025. However, crypto

researcher Eyezenhour recently emphasized that while there are

numerous reasons for optimism regarding SUI’s future, the key

factor is attention. The researcher contends that the Sui

Network has started to captivate institutional investors, a trend

attributed to its dominant technology, upcoming integrations with

Phantom and Backpack, and a talented core and executive team.

This is expected to continue throughout the current bullish cycle

and into 2025, adding to the bullish sentiment for the altcoin as

the year draws to a close. Featured image from DALL-E, chart

from TradingView.com

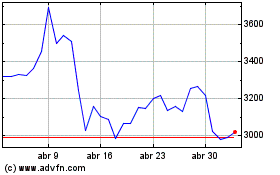

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024