Ethereum On The Move: Dormant ETH Wallets Linked To $4 Billion Scam Awaken

08 Agosto 2024 - 3:00AM

NEWSBTC

On Wednesday, online reports unveiled that hundreds of Ethereum

wallets that had been dormant for over 3 years were moving large

amounts of ETH. The wallets were believed to have moved $2 billion

worth of ETH linked to a $4 billion crypto scam. Investors worried

that another massive dump would affect the market’s recovery.

However, further details revealed that the initial ETH amount

suspected to be moving was considerably smaller. Related Reading:

Solana (SOL) Bounces 30% Amid Market Recovery, Analysts Remain

Bullish 3-Year-Old Dormant Ethereum Wallets Awaken On-chain

tracking firm Lookonchain reported that hundreds of Ethereum

wallets started to move considerable amounts of ETH earlier today.

In a now-deleted post, the firm suggested that the wallets, which

had been dormant for 3.3 years, possibly moved over 700,000 ETH.

Lookonchain tracked the funds back to an address linked to the

PlusToken Ponzi Scheme. In 2020, the Chinese police reported

seizing 833,083 ETH, now worth around $2.11 billion, as part of the

crackdown on the scam crypto trading platform. The now-awaken ETH

wallets’ funds came from an address labeled “Plus Token Ponzi 2.”

This wallet dispersed 789,533 ETH from the seized assets to

thousands of addresses and had not moved since April 2021. The news

sparked a conversation between crypto investors, who feared the

Chinese government would follow the steps of the German and US

governments, adding another wave of selling pressure to Ethereum

and the recovering market. However, newly unveiled details

clarified that the amount of ETH suspected to be moved was

incorrect, which prompted the on-chain data firm to delete its

original report. Is ETH’s Selling Pressure Over? According to

on-chain data analyst EmberCN, the amount of Ether “waiting to be

sold” is significantly smaller. The analyst detailed that most of

the original 789,534 ETH went into crypto exchange Bidesk three

years ago. The tokens were transferred to the now-collapsed

exchange between June and September 2021 via multiple Ethereum

addresses. Per the report, most of the ETH transferred to Bidesk

was transferred into Huobi and sold in 2021. Additionally, the

analyst claimed to have tracked down around 12 Ethereum addresses

to have collected PlusToken-related ETH in the last 30 hours. These

wallets reportedly have 25,757 ETH, worth around $63.1 million.

Some of that amount was not “transferred to Bidesk in 2021; some

was taken out of Bidesk and not transferred to Huobi.” EmberCN

concluded the “current collection” moving was only a small unsold

portion of the PlusToken-related tokens. However, the

second-largest cryptocurrency by market capitalization still took a

6.5% hit in the last four hours. This performance could be

attributed to Jump Trading’s latest sell-off. Related Reading:

Analyst Warns Bitcoin (BTC) Price Could Drop Another 20%

Lookonchain revealed that the Chicago-based trading firm sold

another $29 million worth of ETH today. Jump Trading also redeemed

another $48.2 million in preparation for selling on Wednesday

morning. Per the report, the firm still holds 21,394 wstETH, worth

around $63.6 million. As of this writing, ETH went from hovering

between the $2,500-$2,540 range to trading around the $2,370 mark.

This represents a 6.8% and 28.3% drop in the daily and weekly

timeframes. Featured Image from Unsplash.com, Chart from

TradingView.com

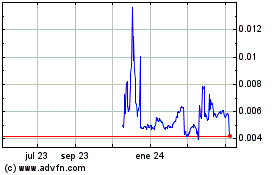

Four (COIN:FOURRUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

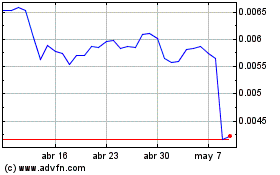

Four (COIN:FOURRUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024