Crypto Market Hasn’t Bottomed Yet, Analyst Says – More Pain Ahead?

15 Septiembre 2022 - 5:40AM

NEWSBTC

Notable crypto market analyst Willy Woo has just issued an

appraisal on Bitcoin’s performance in the coming months or maybe

year. His analysis shows that the coin has not bottomed out yet. On

Twitter, he said: “In terms of max pain, the market has not felt

the same pain as prior bottoms. We can see this in the blue line

(supply in profit by @glassnode). We have only reached 52% of coins

being underwater so far. Prior bottoms were 61%, 64%, 57%,” Woo

said on his recent tweet detailing his analysis.” Crypto Market And

Its Correlation With Stocks Bitcoin is highly associated with the

S&P 500 Index which fell after the US Federal Reserve’s CPI

announcement earlier this week. The announcement highlighted the

highest annual inflation rate, which was 8.3 percent. Related

Reading: Solana (SOL) Heats Up 7% In Last 24 Hours As Helium Eyes

Merge Have we bottomed? In terms of max pain, the market has not

felt the same pain as prior bottoms. We can see this in the blue

line (supply in profit by @glassnode). We have only reached 52% of

coins being underwater so far. Prior bottoms were 61%, 64%, 57%.

pic.twitter.com/qx4cvKO7IA — Willy Woo (@woonomic) September 14,

2022 This is greater than the anticipated rate of 8% for the crypto

market. This tragedy has instilled the market with fear and

despair. However, the market turmoil that traders and investors are

experiencing is not the end of it. The central bank enacted

policies that boosted the economy with fresh cash early on in the

global health crisis. This is referred to as quantitative easing.

With inflation soaring, the Fed is reportedly mulling a 1 percent

interest rate increase. As was the case in June, this price

increase will have a negative impact on the entire crypto market.

Following the Fed’s decision to raise interest rates, both the

stock and cryptocurrency markets experienced a string of

liquidations. Chart: Glassnode This sell-off was precipitated by

fears of an impending recession and the increase indicated. And

this may occur again as the Federal Reserve pursues quantitative

tightening strategies to further tackle the persistent inflation

problem. The Small Percentage Matters In Crypto Another 1% rise

might send the larger financial market crashing. As Woo stated,

history does not have to repeat itself. However, it is possible

that it has already begun in one way or another. Related Reading:

Uniswap (UNI) Price Struggles To Overcome $6.8 Resistance The

analyst previously stated that the current low is only at 52

percent, compared to 60+ percent in recent history. If this is the

current bottom, then investor and trader mood is likely to be

strong. As of this writing, the S&P 500 was trading at $3,946.

If the correlation between Bitcoin and the S&P 500 Index

remains, any price movement, favorable or negative, will have an

impact on both the broader stock and crypto markets. Would you say

that 52% is the absolute minimum? Time will tell whether or not the

Feds raise interest rates. If the Federal Reserve decides to hike

interest rates, that will be the absolute low point for the

currency. BTC total market cap at $385 billion on the daily chart |

Source: TradingView.com Featured image from Medium, Chart:

TradingView.com

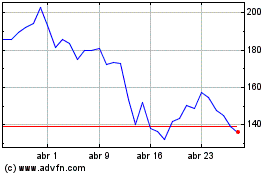

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024