Japanese Yen Rebounds From BoJ-led Decline

16 Junio 2022 - 10:30PM

RTTF2

In the Asian session on Friday, the Japanese yen that weakened

against its key counterparts following the Bank of Japan's decision

to keep its ultra-expansionary policy stance unchanged erased its

losses in a short while.

The central bank left the policy rate unchanged at -0.10 percent

as expected and reaffirmed that it will purchase a necessary amount

of Japanese government bonds (JGBs) without setting an upper limit

so that 10-year JGB yields will remain at around zero percent.

The BoJ board voted 8-1 to retain the policy rate and the

10-year JGB yield target.

The BoJ also retained its forward guidance to purchase 10-year

JGBs at 0.25 percent every business day through fixed-rate purchase

operations, unless it is highly likely that no bids will be

submitted.

The bank reiterated that it will continue with quantitative and

qualitative monetary easing with yield curve control, with an

intention to achieve the inflation target of 2 percent, as long as

it is necessary for maintaining the target in a stable manner.

The bank also decided to continue with the expansion of the

monetary base until the annual inflation exceeds 2 percent and

stays above the target in a stable manner.

The bank repeatedly said that it will not hesitate to take

additional easing measures if required and expects short- and

long-term policy interest rates to remain at their present or lower

levels.

The yen rebounded to 139.43 against the euro and 163.03 against

the pound, from its early 4-day lows of 141.73 and 165.74,

respectively. The yen is seen finding resistance around 137.00

against the euro and 159.00 against the pound.

The yen recovered to 132.35 against the greenback and 136.65

against the franc, after falling to 134.63 and a 7-1/2-year low of

138.70, respectively in early deals. The yen is likely to test

resistance around 118.00 against the greenback and 130.00 against

the franc.

The yen rose back to 93.01 against the aussie and 84.01 against

the kiwi, off its early 4-day lows of 94.57 and 85.40,

respectively. Next key resistance for the yen is seen around 90.00

against the aussie and 79.00 against the kiwi.

The yen bounced off to 102.24 against the loonie, from a low of

103.97 it touched at 10:45 pm ET. The yen traded at 102.12 per

loonie at yesterday's close. If the yen rises further, 99.00 is

likely seen as its next resistance level.

Looking ahead, Eurozone final CPI for May is set for release in

the European session.

Canada industrial product and raw materials price indexes and

U.S. industrial production and leading index, all for May, will be

published in the New York session.

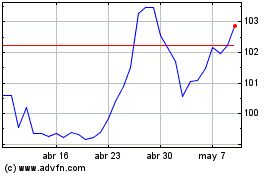

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024