TIDM3IN

RNS Number : 8596Y

3i Infrastructure PLC

10 May 2023

10 May 2023

Results for the year to 31 March 2023

3i Infrastructure plc ('3i Infrastructure' or the 'Company')

today announces a 14.7% return for the year, delivery of the FY23

dividend target of 11.15 pence and a 6.7% increase in the target

dividend for FY24 to 11.90 pence per share.

Richard Laing, Chair of 3i Infrastructure plc, said:

"3i Infrastructure continues to deliver long-term sustainable

returns. I am delighted to report that we achieved another year of

outperformance, with a total return of 14.7% in the year ended 31

March 2023, well ahead of our target. We have increased the

dividend per share in every year of the Company's existence ."

Scott Moseley and Bernardo Sottomayor, Managing Partners,

Co-Heads of European Infrastructure, 3i Investments plc, added:

"This was another strong year for the Company, materially

exceeding its target return. We have carefully selected our

portfolio, identifying infrastructure companies that benefit from

long-term structural growth trends in their underlying markets. 3i

Infrastructure is well positioned to continue to deliver attractive

shareholder returns."

Performance highlights

Well ahead of our target return of 8-10% 14.7%

p.a. Total return on opening NAV

GBP394m

Total return for the year

GBP3,101m

NAV

336.2p

NAV per share

Delivered FY23 dividend target, fully 11.15p

covered Full year dividend per share for

FY23

Setting higher target for FY24 dividend,

up 6.7% year-on-year

11.90p

Target dividend per share for FY24

------------------------------------

For further information, please contact:

Richard Laing, Chair, 3i Infrastructure Tel: 037 1664 0445

plc

Thomas Fodor, investor enquiries Tel: 020 7975 3469

Kathryn van der Kroft, press Tel: 020 7975 3021

enquiries

For further information regarding the announcement of the

results for 3i Infrastructure plc, please visit

www.3i-infrastructure.com. A recording of the analyst presentation

will be made available on this website during the day.

Notes to the preliminary announcement

Note 1

The statutory accounts for the year to 31 March 2023 have not

yet been delivered to the Jersey Financial Services Commission. The

statutory accounts for the year to 31 March 2022 have been

delivered to the Jersey Financial Services Commission. The

auditor's reports on the statutory accounts for these years are

unqualified. This announcement does not constitute statutory

accounts. The preliminary announcement is prepared on the same

basis as set out in the statutory accounts for the year to 31 March

2022.

Note 2

Subject to shareholder approval, the proposed final dividend is

expected to be paid on 10 July 2023 to holders of ordinary shares

on the register on 16 June 2023. The ex-dividend date for the final

dividend will be on 15 June 2023.

Note 3

This report contains Alternative Performance Measures ('APMs'),

which are financial measures not defined in International Financial

Reporting Standards ('IFRS'). More information relating to APMs,

including why we use them and the relevant definitions, can be

found in the Company's 2023 Annual report and accounts and in the

Financial review section.

Note 4

The preliminary announcement has been extracted from the Annual

report and accounts 2023. The Annual report and accounts 2023 will

be available on the Company's website today. Printed copies of the

Annual report and accounts 2023 will be distributed to shareholders

who have elected to receive printed copy communications on or soon

after 22 May 2023.

Notes to editors

About 3i Infrastructure plc

3i Infrastructure plc is a Jersey-incorporated, closed-ended

investment company, an approved UK Investment Trust, listed on the

London Stock Exchange and regulated by the Jersey Financial

Services Commission. The Company's purpose is to invest responsibly

in infrastructure, delivering long-term sustainable returns to

shareholders and having a positive influence on our portfolio

companies and their stakeholders.

3i Investments plc, a wholly-owned subsidiary of 3i Group plc,

is authorised and regulated in the UK by the Financial Conduct

Authority and is the investment manager of 3i Infrastructure

plc.

This statement has been prepared solely to provide information

to shareholders. It should not be relied on by any other party or

for any other purpose. It and the Company's Annual report and

accounts may contain statements about the future, including certain

statements about the future outlook for 3i Infrastructure plc.

These are not guarantees of future performance and will not be

updated. Although we believe our expectations are based on

reasonable assumptions, any statements about the future outlook are

subject to a number of risks and uncertainties and could change.

Factors which could cause or contribute to such differences

include, but are not limited to, general economic and market

conditions and specific factors affecting the financial prospects

or performance of individual investments within the portfolio of 3i

Infrastructure plc.

This press release is not for distribution (directly or

indirectly) in or to the United States, Canada, Australia or Japan

and is not an offer of securities for sale in or into the United

States, Canada, Australia or Japan. Securities may not be offered

or sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the "Securities Act"), or an

exemption from registration under the Securities Act. Any public

offering to be made in the United States will be made by means of a

prospectus that may be obtained from the issuer or selling security

holder and will contain detailed information about 3i Group plc, 3i

Infrastructure plc and management, as applicable, as well as

financial statements. No public offering in the United States is

currently contemplated.

Our purpose

We invest responsibly in infrastructure, delivering long-term

sustainable returns to shareholders and having a positive influence

on our portfolio companies and their stakeholders.

Chair's statement

"Another excellent year, with confidence in the future."

Richard Laing

Chair, 3i Infrastructure

3i Infrastructure continues to deliver long-term sustainable

returns, with another year of outperformance.

I am delighted to report that we achieved another year of

outperformance, with a total return of 14.7% in the year ended 31

March 2023. That return is well ahead of our target to provide

shareholders with a total return of 8% to 10% per annum, to be

achieved over the medium term. Our total return for the three years

since March 2020, the Covid-19 and post-Covid period, was an

impressive 13.7% per annum.

We have built a unique portfolio, which benefits from inflation

linkage and is aligned with long-term megatrends. Our companies,

supported by the engaged asset management approach of 3i, our

Investment Manager, are generating attractive and accretive growth

investment opportunities.

We made another step forward with our sustainability objectives

this year, supported by the establishment of a dedicated

environmental, social and governance ('ESG') team at the Investment

Manager bringing greater focus and increased engagement with our

portfolio companies.

I am grateful to shareholders and the Board of Directors for

their support during the year, including during our equity raise in

February 2023, as well as to the Investment Manager's team for

their continued hard work under the leadership of Scott Moseley and

Bernardo Sottomayor.

Our purpose

Our purpose, is to invest responsibly in infrastructure,

delivering long-term sustainable returns to shareholders and having

a positive influence on our portfolio companies and their

stakeholders.

We invest across a broad range of infrastructure investment

themes and highlight the strong growth prospects of our portfolio

companies in this report. Our portfolio companies invest in,

develop and actively manage essential infrastructure. Examples of

how our portfolio companies have a positive influence are included

in the Sustainability report in the Annual report and accounts

2023.

Performance

The Company generated a total return of GBP394 million in the

year ended 31 March 2023, or 14.7% on opening NAV, ahead of our

target of 8% to 10% per annum to be achieved over the medium term.

This is discussed in more detail in the Review from the Managing

Partners.

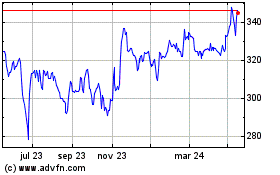

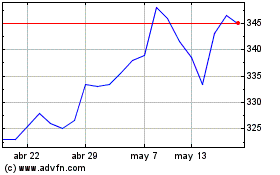

The NAV per share increased to 336.2 pence. Our share price has

not kept pace with the growth in our NAV, which resulted in a Total

Shareholder Return ('TSR') of negative 6.9% in the year, ahead of

the FTSE 250, which returned negative 7.9% in the same period.

Since IPO, the Company's annualised TSR is 11.7%, comparing

favourably with the broader market (FTSE 250: 6.1% annualised over

the same period).

Dividend

Following the payment of the interim dividend of 5.575 pence per

share in January 2023, the Board is recommending a final dividend

for the year of 5.575 pence per share, meeting our target for the

year of 11.15 pence per share, 6.7% above last year's total

dividend. We expect the final dividend to be paid on 10 July

2023.

Consistent with our progressive dividend policy, we are

announcing a total dividend target for the year ending 31 March

2024 of 11.90 pence per share, representing an increase of

6.7%.

Corporate governance

The Company's 2022 Annual General Meeting ('AGM') was held on 7

July 2022. All resolutions were approved by shareholders, including

the re-election of the existing Directors.

This year's AGM will be held on 6 July 2023. Further details are

provided in the Notice of Meeting and on the Company's website,

www.3i-infrastructure.com. In September, we were delighted to

welcome Stephanie Hazell as a non-executive Director. Stephanie

brings a broad strategic experience in the infrastructure sector

from her previous roles at National Grid, Orange and Virgin

Group.

Directors' duties

The Directors have a duty to act honestly and in good faith with

a view to the best interests of the Company and to exercise the

care, diligence and skill that a reasonably prudent person would

exercise in comparable circumstances.

In accordance with the AIC Code of Corporate Governance 2019

(the 'AIC Code'), the Board does this through understanding the

views of the Company's key stakeholders and carefully considering

how their interests and the matters set out in section 172 of the

Companies Act 2006 of England and Wales have been considered in

Board discussions and decision making. More detail can be found in

the Directors' duties and Section 172 statement sections later in

this document.

Capital raise and liquidity

We were pleased with the results of our capital raise and would

like to thank our shareholders for their continued support. The

equity raise proceeds of GBP100 million were used to pay down part

of the drawings on the revolving credit facility ('RCF') and partly

used to fund the GBP28 million acquisition of Future Biogas. This

provides additional flexibility to fund attractive discretionary

growth opportunities in our portfolio.

We manage our balance sheet actively, seeking efficiency through

low levels of uninvested cash with a range of funding options

available to the Company for further investment as described in the

Financial review.

Outlook

The past year has seen significant volatility in both equity and

credit markets and in energy and power prices. Against this

backdrop, the Company has remained disciplined in its investment

approach, maintaining adequate liquidity and an appropriate level

of gearing in the Company's portfolio.

Our portfolio consists of resilient businesses providing

essential services to their customers and the communities they

serve, often benefitting from long-term sustainable trends. These

businesses are generating discretionary growth opportunities that

are accretive to our investment cases, leaving us well positioned

to continue to build on our strong performance.

Richard Laing

Chair, 3i Infrastructure plc

9 May 2023

2007 to 2023

In the 16 years since the initial

public offering ('IPO')

the Company has delivered a total

shareholder return of

11.7%

per annum

Review from the Managing Partners

"The Company's top quartile track record is the result of our

deliberate strategy."

Scott Moseley and Bernardo Sottomayor

Managing Partners, Co-Heads of European Infrastructure

3i Investments plc

This was another strong year for the Company, materially

exceeding its target return.

We delivered another strong total return of 14.7% this year.

Since 2015, when we adopted our current strategy of focusing on

core-plus infrastructure investments, NAV per share including

dividends has grown by 19% per annum. Since 3iN's inception in

2007, we have grown NAV per share including dividends by 14% per

annum.

The Company's top quartile track record is the result of our

deliberate strategy.

We have carefully selected our portfolio, identifying

infrastructure companies that benefit from long-term structural

growth trends in their underlying markets.

We work actively with the management teams at our portfolio

companies to define and execute plans to capitalise on those growth

dynamics. Growing markets provide the catalyst for us to continue

to reinvest in our portfolio companies at returns that are likely

to outperform 3iN's portfolio target.

Our portfolio companies' earnings are also typically positively

correlated to inflation, as well as growing in real terms.

The resulting compounding growth dynamics, together with the

resilience that our portfolio companies have displayed throughout

the cycle, including during the recent Covid-19 pandemic,

demonstrate that the Company offers shareholders very high quality

risk-adjusted returns.

Our active management approach also ensured that we locked in

attractive debt financing across the portfolio before the recent

increases in financing costs. The average level of gearing within

our portfolio companies is a relatively modest 33% of enterprise

value and there are no material refinancing requirements within the

portfolio before 2026.

These conservative levels of gearing within our portfolio

companies, combined with strong operational cash generation,

available credit in the RCF and the recent GBP100 million equity

raise, ensures that our portfolio companies are well placed to

finance these growth investment opportunities as they arise.

Sustainability

The importance of sustainability and meeting ESG standards

continues to increase. This year we created a new team to lead ESG

and sustainability initiatives across the portfolio. The additional

focus that this new team brings helps us to engage on ESG topics in

a more meaningful way, to maintain appropriate oversight over new

and developing ESG legislation and to collate relevant data

regarding the performance of the portfolio companies against

certain sustainability indicators. Our companies are now reporting

Scope 1 and 2 greenhouse gas ('GHG') emissions and considering

opportunities to reduce these.

In the year ahead we plan to build on this progress by working

with portfolio companies to measure Scope 3 GHG emissions, further

develop Paris-aligned decarbonisation plans and where possible set

science-based targets.

Investment and divestment activity

During the year we completed a number of transactions as shown

in the table below:

Date Activity

May 2022 Syndication of a 17% stake in ESVAGT for proceeds of GBP87 million

----------------------------------------------------------------------------------------------

June 2022 Sale of the European Projects portfolio for GBP106 million

----------------------------------------------------------------------------------------------

September 2022 Closing of the acquisition of c.100% stake in GCX for GBP318 million

----------------------------------------------------------------------------------------------

October 2022 Further investment in TCR, acquiring the 48% stake owned by funds managed by DWS for GBP338

million

----------------------------------------------------------------------------------------------

November 2022 Syndication of 28% of 3iN's stake in TCR for proceeds of GBP190 million

----------------------------------------------------------------------------------------------

December 2022 Investment of a further GBP15 million to fund DNS:NET's fibre roll-out programme

----------------------------------------------------------------------------------------------

February 2023 Investment of GBP28 million to acquire Future Biogas

----------------------------------------------------------------------------------------------

March 2023 Investment of a further GBP30 million in Infinis to fund the development of its solar roll-out

programme

----------------------------------------------------------------------------------------------

Outlook

Our portfolio is generating strong earnings growth which we are

confident is set to continue. Additionally, we continue to see

strong demand for high quality infrastructure investments, such as

those held by 3iN, amongst private market investors. Our active

management strategy includes planning selectively to divest our

portfolio companies at an optimal moment in time. The scarcity

value of our assets and favourable growth positioning provide

confidence in the outlook for continued value creation.

Scott Moseley and Bernardo Sottomayor

Managing Partners and Co-Heads of European Infrastructure, 3i

Investments plc

9 May 2023

Our business model

An active investor

Unique offering for shareholders

The Company remains unique, providing public market investors

with access to private infrastructure businesses across a variety

of megatrends, sectors and geographies.

Origination approach

We remain a disciplined investor and, where possible, seek

opportunities to transact off-market, only participating in

competitive processes where we believe we have a distinct

advantage.

We have a large and focused investment team, with a broad

network and access across the geographies in which we invest. Our

reputation, local presence and the relationships we develop with

management teams provide us with competitive advantages. This

allowed us to be successful in signing our new investment this year

in Future Biogas on attractive terms.

Asset management

We maintain a significant focus on active asset management and

investment stewardship. We identify high calibre management teams

and look to implement a clear business strategy. We help identify

accretive growth opportunities to the portfolio companies, and

actively help them to convert those, including executing add-on

M&A opportunities and putting in place adequate capital

structures and capex facilities to fund the associated

investments.

We actively look to enhance the infrastructure characteristics

of the businesses we acquire, ensuring that, where possible, capex

is focused on immediate contracted revenue-generating assets,

improving the infrastructure characteristics of the business to

attract competitive financing, adding elements of service that

create customer stickiness, and often implementing operational

efficiency programmes to optimise EBITDA margins. All of this helps

us position our businesses into the core infrastructure space, thus

maximising the potential exit value.

We execute all of the above through ownership control, effective

board presence and governance and by being involved directly in the

companies' key workstreams.

Competition for new investment primarily comes from private

infrastructure funds. Most other UK listed infrastructure funds

typically target smaller investments in finite life contracted

assets like operational and greenfield Public Private Partnership

('PPP') projects or operational renewable portfolios, which are

outside our investment focus.

Our primary investment focus remains mid-market core-plus

infrastructure with controlling majority or significant minority

positions and strong governance rights, whilst adhering to a set of

core investment characteristics and risk factors. More information

on our business model can be found below.

We invest responsibly in infrastructure to create long-term

value for stakeholders.

Enablers Investment characteristics How we create Value created

value

Financial Non-financial

================== ========================

Investment Asset-intensive Buy well 14.7% 2

Manager's business Total return Further investments

team on time-weighted in portfolio companies

Asset bases that Strong governance opening net asset to fund growth

3i Group network are value +9%

hard to replicate Increase in installed

Engaged asset Optimise strategy 11.15p renewable energy

management Provide essential Ordinary dividend capacity

services per share 12

Reputation Execute plan Portfolio companies

and brand Established market 19% reporting on greenhouse

position Asset IRR gas emissions

High ESG Realisation (since inception)

standards Good visibility

of future

Robust policies cash flows

and procedures

An acceptable

Efficient element of demand

balance or market risk

sheet

Opportunities

for

further growth

Sustainability

========================== ================== ================== ========================

Characteristics we look for in new investments

----------------------------------------------------------------------------------------------------------------------

We look to build and maintain a diversified portfolio of assets, across a range of geographies

and sectors, whilst adhering to a set of core investment characteristics and risk factors.

The Investment Manager has a rigorous process for identifying, screening and selecting investments

to pursue. We look for businesses that combine a base of strong cash flow resilience (eg.

contracted revenues) with high through-cycle underlying market growth fundamentals and operational

improvements and M&A opportunities, which allows us to deliver above target returns. Although

investments may be made into a range of sectors, the Investment Manager typically focuses

on identifying investments that meet most or all of the following criteria and are aligned

with identified megatrends:

----------------------------------------------------------------------------------------------------------------------

Asset-intensive business Good visibility of future cash flows

Owning or having exclusive access under long-term Long-term contracts or sustainable demand that allow us to

contracts to assets that are essential forecast future performance with

to deliver the service a reasonable degree of confidence

---------------------------------------------------------- ----------------------------------------------------------

Asset bases that are hard to replicate An acceptable element of demand or market risk

Assets that require time and significant capital or Businesses that have downside protection, but the

technical expertise to develop, with opportunity for outperformance

low risk of technological disruption

---------------------------------------------------------- ----------------------------------------------------------

Provide essential services Opportunities for further growth

Services that are an integral part of a customer's Opportunities to grow or to develop the business into new

business or operating requirements, or markets, either organically or

are essential to everyday life through targeted M&A

---------------------------------------------------------- ----------------------------------------------------------

Established market position Sustainability

Businesses that have a long-standing position, reputation Businesses that meet our Responsible Investing criteria,

and relationship with their customers with opportunities to improve sustainability

- leading to high renewal and retention rates and ESG standards

---------------------------------------------------------- ----------------------------------------------------------

How we create value

We have a rigorous approach to identify the best investment

opportunities and then actively manage our portfolio companies to

drive sustainable growth and value creation.

Buy well Strong governance Optimise strategy

* Effective use of 3i's network * Make immediate improvements * Agree strategic direction

* Comprehensive due diligence * Appropriate board representation and composition * Develop action plan

* Consistent with return/yield targets * Incentivised and align management teams * Right capital structure to fund growth plan

* Fits risk appetite

---------------------------------------------------------- -------------------------------------------------

What we do is framed

Execute plan Realisation by our strategic priorities

---------------------------------------------------------- =================================================

* Ongoing support * (Re)position business and enhance infrastructure

characteristics to maximise exit value

* Monitor performance

* Long-term view but will sell to maximise shareholder

value

* Review further investment opportunities

* Facilitate and execute M&A

============================================= ========================================================== =================================================

What enables us to create value

Investment Manager's team

The Company is managed by an experienced and well-resourced

team. The European infrastructure team was established by 3i Group

plc ('3i Group') in 2005 and now comprises over 50 people,

including over 30 investment professionals.

This is one of the largest and most experienced groups of

infrastructure investment professionals in Europe, supported by

dedicated nance, tax, legal, operations, sustainability and

strategy teams.

3i Group's network

3i Group has a network of of ces, advisers and business

relationships across Europe. The investment management team

leverages this network to identify, access and assess opportunities

to invest in businesses, on a bilateral basis where possible, and

to position the Company favourably in auction processes.

Engaged asset management

We create value from our investments through the Investment

Manager's engaged asset management approach. Through this approach,

the Investment Manager partners with our portfolio companies'

management teams to develop and execute a strategy to create

long-term value in a sustainable way. Examples of this partnership

include developing strategies that support investment in the

portfolio company's asset base over the long term; continued

improvements in operational performance; and establishing

governance models that promote an alignment of interests between

management and stakeholders.

We develop and supplement management teams, often bringing in a

non-executive chair early in our ownership.

Examples of this engaged asset management approach can be found

on our website, www.3i-infrastructure.com.

Strengthen portfolio company Invest in and develop Grow our platform businesses

management teams companies to support a through further investments

sustainable future

Reputation and brand

The Investment Manager and the Company have built a strong

reputation and track record as investors by investing responsibly,

managing their business and portfolio sustainably, and by carrying

out activities according to high standards of conduct and

behaviour. This has been achieved through upholding the highest

standards of governance, at the Investment Manager, the Company and

in investee companies. This in turn has earned the trust of

shareholders, other investors and investee companies, and has

enabled the Investment Manager to recruit and develop employees who

share those values and ambitions for the future.

The Board seeks to maintain this strong reputation through a

transparent approach to corporate reporting, including on our

progress on driving sustainability through our operations and

portfolio. We are committed to communicating in a clear, open and

comprehensive manner and to maintaining an open dialogue with

stakeholders.

Dedicated ESG team

In FY23, the Investment Manager created a new team to lead ESG

and sustainability initiatives across the portfolio. This will

enable an acceleration of the delivery of the Company's ambitions

around sustainability.

The new team's role is to ensure the Company's approach is right

for the portfolio and to drive genuine ambition and progress at

portfolio company level. Dedicated ESG resource enables us to

identify, monitor and realise the value creation opportunities

linked to sustainability for each portfolio company more

effectively.

The team supports each portfolio company on its respective

sustainability journey and consideration of the Company's

objectives at portfolio company level. The team also leads ESG

reporting for the Company and delivers the annual ESG review of the

portfolio.

By interfacing with the Company's strategy, the team supports

the Board to set the Sustainability strategy and objectives for the

Company, and aligns with key stakeholders such as 3i Group,

particularly on climate-related risks and opportunities.

Sustainability and ESG standards are discussed throughout this

report. Please refer to Our approach, the Sustainability report in

the Annual report and accounts 2023 and the Risk report.

"There is a strong link between companies that have high ESG

standards and those that are able to achieve long-term sustainable

business growth."

Anna Dellis

Partner, 3i Investments plc

Robust policies and procedures

Established investment and asset management processes are

supported by the Investment Manager's comprehensive set of best

practice policies, including governance, conduct, cyber security

and anti-bribery.

Efficient balance sheet

The Company's flexible funding model seeks to maintain an

efficient balance sheet with sufficient liquidity to make new

investments. In order to capitalise on discretionary growth

opportunities in the portfolio, during the year we raised new

equity of GBP100 million.

Since FY15 the Company has raised equity three times and

returned capital to shareholders twice following successful

realisations.

Our approach

The infrastructure market

Competitive landscape

2022 was another very strong year for fundraising in the

unlisted infrastructure space, with over US$300 billion raised in

the core, core-plus and value added segments. Fundraising has

become more concentrated around successful managers, with fewer

funds being raised but the average fund size rising. This makes

competition for suitable larger equity investments more

intense.

Macro environment

The past year has seen a structural shift in the macroeconomic

environment with significant inflation, increases in interest rates

and volatile equity markets. This has slowed down M&A activity

and impacted stock market performance.

In this environment, demand for infrastructure assets typically

increases due to the essential nature of the services they provide

and downside protection as they can act as a hedge with revenues

directly or indirectly linked to inflation.

Our portfolio companies benefit from direct contract indexation

and strong market positions providing pricing power. This is

partially offset by the increase in operational costs experienced

by a number of those companies.

Central banks raised interest rates in response to rising

inflation. The impact on our portfolio has been limited, with over

95% of our portfolio company debt either fixed rate or hedged at 31

March 2023, and with no material refinancing due before 2026.

These trends, and our response to them, are discussed in more

detail within the Risk report.

Interest rates Credit Inflation Power prices

* Over 95% of portfolio company debt is fixed rate or * No material near-term refinancing risk in the * Portfolio returns positively correlated to inflation * Energy generating assets benefitted from the high and

hedged at 31 March 2023 portfolio volatile power price environment

* Balanced mix of direct indexation and strong market

* Nearly 90% of portfolio company debt matures beyond positions provide pricing power

the next three financial years

--------------------------------------------------------- ---------------------------------------------------------- -----------------------------------------------------------

Megatrends

Megatrends are shaping the world around us, influencing decision

making and changing the demands placed on our economy and services.

Identifying the potential for change is a key driver of our

investment decision making - from the businesses, sectors and

countries we invest in, to the way we go about finding

opportunities.

As the Company's portfolio continues to grow, we seek to

diversify our investments across a range of megatrends that will

provide a supportive environment for long-term sustainable returns

to shareholders. We also continually assess underlying risk

factors, both when considering new investment opportunities and in

managing the existing portfolio and its exposure to certain risks,

such as commodity prices and foreseeable technological

disruptions.

Investment themes

Renewable energy generation

There is increasing demand for energy generated from renewable

sources such as wind and solar to support the energy transition.

Our investments in Infinis, Attero, and Valorem all generate energy

from a variety of renewable sources and their combined installed

capacity has grown significantly during our ownership.

Electrification/energy transition

The transition towards a low-carbon economy is gathering pace.

Rising electricity consumption is increasing the demand for related

equipment and services such as those provided by Joulz, which has

expanded its offering to include solar and EV charging

products.

Shared resources

Developed economies are experiencing a shift towards a shared

resources model. This can lead to significant cost savings for

users of capital intensive assets and also reduce overall GHG

emissions. In the case of TCR, which provides pooled ground support

equipment at airports, this has reduced the amount of equipment

required.

Waste treatment and recycling

There is a trend towards increasing levels of recycling driven

by regulatory requirements and consumer preferences. Attero is one

of the largest waste treatment and disposal companies in the

Netherlands and is benefitting from this increased demand for its

services.

Automation, digital operations and increasing connectivity

Technology is developing rapidly, changing operating models and

digitalising industrial processes. Business is increasingly mobile

and data driven, which requires increasing levels of connectivity

through digital infrastructure. Our communications infrastructure

investments, Tampnet, GCX and DNS:NET, are benefitting from this

increased demand.

Demand for healthcare

Increasing life expectancy and an ageing population are

increasing the demand for healthcare-related services and

infrastructure. Our investment in Ionisos, which provides cold

sterilisation services to the medical and pharmaceutical

industries, is aligned to this trend.

Global trade and transport

Businesses are seeking to increase supply resilience and achieve

long-term price stability by establishing deeper, more diversified

supplier bases for goods and services. This can help mitigate

disruptions from extreme weather events and other localised

situations. Advario Singapore (Oystercatcher) supports its

customers storing and blending the gasoline used to transport these

goods.

Urbanisation and smart cities

Technology is increasingly being used to enhance the efficiency

and safety of urban areas. SRL's products allow for greater control

of traffic flows, which in turn reduces congestion around roadworks

and improves safety.

We have a positive influence on our portfolio companies.

Our influence

As active owners we seek to ensure that our investee companies

are run responsibly and that they can make a positive contribution

to their employees, customers, suppliers and the local communities

in which they operate. This includes supporting and empowering

management teams to develop resilient business strategies.

We create a culture at our portfolio companies where the

Company's expectation that management teams embed sustainability

into their strategy is well known.

We facilitate and encourage the exchange of best practices by

portfolio companies by connecting companies that are more advanced

in certain sustainability initiatives with others who can benefit

from their expertise.

We seek to manage material ESG risks and opportunities during

the period of the Company's investment. This includes enhancing

portfolio companies' corporate governance and reporting, and

encouraging them to improve their performance over time on

sustainability issues that are material to them, with a particular

focus on health and safety, and climate change.

We require all our portfolio companies to measure their GHG

emissions. We encourage them to identify decarbonisation

strategies. This year, we asked an initial subset of our portfolio

companies to develop GHG emission reduction targets that are

aligned with the objectives of the Paris Agreement.

Our portfolio

Many infrastructure businesses have sustainability at their

core, providing or enabling the provision of essential services to

society, interconnectivity and the appropriate management of

resources.

Whilst the Company does not pursue a sustainability-driven

investment strategy, it does use its influence in the investments

it makes, where appropriate, to seek to contribute positively to

environmental and social sustainability objectives, such as

transitioning to a low carbon and circular economy, enabling a

healthy and safe society and fostering inclusive growth.

We believe such contributions, alongside good ESG performance of

our portfolio, can protect and potentially enhance value for the

Company's shareholders.

Sustainability in action

Examples of our portfolio companies' sustainability

strategies

Contributing to a low-carbon future

-- Invest in the production of clean energy

-- Engage with suppliers on low-carbon innovation

-- Support customers to decarbonise their operations

-- Develop GHG emissions reduction strategies

Supporting safety and good health

-- Adhere to high health and safety standards that protect

employees

-- Enable safe operations for customers

-- Embed a safety culture across the organisation

-- Contribute to high quality healthcare through Ionisos

Fostering inclusive growth

-- Adhere to high governance and ethical work standards

-- Be an employer of choice supported by a diverse and inclusive

culture

-- Create job opportunities and engage with local

communities

-- Support local and international connectivity through our

telecommunication businesses

Our strategy

Our strategy is to maintain a balanced portfolio of

infrastructure investments delivering an attractive mix of income

yield and capital appreciation for shareholders.

Strategic priorities

Maintaining a balanced portfolio Delivering an attractive mix of income 15%

yield and capital growth for Largest single investment by value

shareholders.

Investing in a diversified portfolio

in developed markets, with a focus on

the UK and Europe.

Disciplined approach to new investment Focusing selectively on investments GBP452m

that are value-enhancing to the New investments less amounts

Company's portfolio and syndicated in the financial year

with returns consistent with our

objectives.

-------------------------------------- --------------------------------------

Managing the portfolio intensively Driving value from our portfolio 2

through our engaged asset-management Follow-on investments in portfolio

approach. companies

Delivering growth through platform 2

investments. Portfolio companies refinanced

-------------------------------------- --------------------------------------

Maintaining an efficient Minimising return dilution to GBP404m

balance sheet shareholders from holding excessive Total liquidity

cash, while retaining a

good level of liquidity for future

investment.

-------------------------------------- --------------------------------------

Sustainability a key Ensuring that our investment decisions 979MW, +9%

driver of performance and asset-management approach consider Installed renewable energy capacity,

both the risks increase in year

and opportunities presented by

sustainability.

-------------------------------------- --------------------------------------

Our objectives and KPIs

Our Our KPIs Rationale and definition Performance over

objectives * Total return is how we measure the overall financial the year

are to performance of the Company * Total return of GBP394 million in the year, or 14.7%

provide on time-weighted opening NAV and equity issued

shareholders

with: * Total return comprises the investment return from the

portfolio and income from any cash balances, net of * The portfolio showed good resilience overall with

management and performance fees and operating and strong performance in particular from TCR, Infinis

finance costs. It also includes foreign exchange and Tampnet

movement and movement in the fair value of

derivatives and taxes

* The hedging programme continues to reduce the

volatility in NAV from exchange rate movements

* Total return, measured as a percentage, is calculated

against the opening NAV, net of the final dividend

for the previous year, and adjusted (on a * Costs were managed in line with expectations

time-weighted average basis) to take into account any

equity issued and capital returned in the year

Total return (% on

opening NAV)

----------------------------------

a total

return

of 8% to 10%

per annum,

to be

achieved

over the

medium

term 2019 15.4%

--------- ---------

2020 11.4%

----------------------- ---------

2021 9.2%

----------------------- ---------

2022 17.2%

----------------------- ---------

2023 14.7%

----------------------- ---------

Target 8-10%

----------------------- ---------

Target

To provide shareholders

with a total return

of 8% to 10% per annum,

to be achieved over

the medium term.

Met or exceeded target

for 2023 and every prior

year shown

----------------------------------

a progressive Annual distribution Rationale and definition Performance over

annual (pence per share) * This measure re ects the dividends distributed to the year

dividend shareholders each year * Proposed total dividend of 11.15 pence per share, or

per share GBP101 million, is in line with the target set at the

beginning of the year

* The Company's business model is to generate returns

from portfolio income and capital returns (through

value growth and realised capital profits). Income, * Income generated from the portfolio and cash deposits,

other portfolio company cash distributions and including non-income cash distributions and other

realised capital profits generated are used to meet income from portfolio companies, totalled GBP202

the operating costs of the Company and to make million for the year

distributions to shareholders

* Operating costs and finance costs used to assess

* The dividend is measured on a pence per share basis, dividend coverage totalled GBP66 million in the year

and is targeted to be progressive

* The dividend was fully covered for the year

* Setting a total dividend target for FY24 of 11.90

pence per share, 6.7% higher than for FY23

-------------------- =========================================================== ============================================================

2019 8.65p

----------------------- --------- =========================================================== ============================================================

2020 9.20p

----------------------- ---------

2021 9.80p

----------------------- ---------

2022 10.45p

----------------------- ---------

2023 11.15p

----------------------- ---------

2024 Target 11.90p

----------------------- ---------

Target

Progressive dividend

per share policy.

FY24 dividend target

of 11.90 pence per share.

Dividend per share increased

every year since IPO

================================== =========================================================== ============================================================

Our portfolio

New investment

Future Biogas

Investment rationale

-- Future Biogas is one of the largest anaerobic digestion

('AD') plant developers and biogas producers in the UK, operating

11 AD plants on behalf of institutional investors under long-term

contracts

-- There is strong political support and growing corporate

demand for domestically-produced biomethane, which, as a direct

substitute for fossil natural gas, has an essential role to play in

decarbonising some of the UK's gas-dependent sectors such as heat,

transport and manufacturing

-- On a national scale, the use of biomethane (vs. natural gas)

allows the existing gas infrastructure to help meet the UK

government's net zero and energy security targets without any

change to the existing system

-- Future Biogas will develop a new generation of unsubsidised

AD plants and sell the resulting biomethane under long-term offtake

agreements to corporate buyers

-- In the longer term, Future Biogas intends to enter the

nascent but high potential voluntary carbon offset market through

carbon capture and storage

-- Future Biogas has a highly experienced management team with a

strong track record in the sector

Characteristics

Essential role in the UK's decarbonisation agenda

Biomethane from AD is a ready-to-use and commercially viable solution for hard to decarbonise

industrial sectors. It does not require any upgrade to the existing UK gas infrastructure.

Energy produced by AD plants is carbon neutral, as the CO(2) released during the process matches

the CO(2) absorbed from the atmosphere by the feedstock. In the future, carbon capture and

storage could be introduced to make the process carbon negative.

---------------------------------------------------------------------------------------------------

Established market position

Future Biogas is one of the largest producers of biomethane in the nascent UK market and

a highly experienced developer and operator of AD plants, with full-service capabilities in

development, construction and operations.

---------------------------------------------------------------------------------------------------

Supply/demand of biomethane

The challenge to decarbonise industrial and manufacturing sectors, and the disparity in biomethane

supply and demand, is expected to sustain a very strong market for green gas in the long term.

---------------------------------------------------------------------------------------------------

Acceptable element of gas price risk

Future Biogas is exposed to a degree of gas price volatility through its existing management

contracts. However, new AD plants are core to our investment thesis and will be underpinned

by long-term offtake agreements with corporates.

---------------------------------------------------------------------------------------------------

Sustainable farming practices

By promoting a regenerative farming approach, feedstock from energy crops can be sustainably

integrated into agricultural systems. The circular process of returning digestate back to

land can help replenish soil nutrients and carbon, and displaces demand for carbon-intensive

artificial fertilisers.

---------------------------------------------------------------------------------------------------

Opportunities for growth

The investment in Future Biogas, whilst modest today, creates an opportunity for significant

follow-on investment in new AD plant at attractive returns.

---------------------------------------------------------------------------------------------------

Portfolio review

The portfolio is generating strong growth momentum supported by

long-term tailwinds. We are confident that it will continue to

generate attractive further investment opportunities and is well

positioned to deliver our target returns.

The Company's portfolio was valued at GBP3,641 million at 31

March 2023 (2022: GBP2,873 million) and delivered a total portfolio

return in the year of GBP501 million, including income and

allocated foreign exchange hedging (2022: GBP509 million).

Table 1 summarises the valuations and movements in the

portfolio, as well as the return for each investment, for the

year.

Table 1: Portfolio summary (31 March 2023, GBPm)

================================================

Portfolio

Directors' Directors' Allocated Underlying total

valuation Investment Accrued Foreign valuation foreign portfolio return

31 March in the Divestment income Value exchange 31 March exchange income in in the

Portfolio 2022 year in the movement movement translation 2023 hedging the year year(1)

assets year

--------------- ---------- ---------- ---------- -------- -------- ----------- ---------- --------- ---------- ---------

TCR 279 352(2,4) (190)(3) 4 86 6 537 (2) 18 108

ESVAGT 548 44(2) (87)(3) (2) 7 (25) 485 22 46 50

Infinis 332 30(5) (9)(6) 2 52 - 407 - 16 68

GCX - 318(4) - 19 - (14) 323 15 18 19

Ionisos 237 - - 9 43 9 298 (7) 9 54

Tampnet 241 6(2) - - 52 (7) 292 13 6 64

Joulz 241 6(2) - - 30 10 287 (7) 6 39

Oystercatcher 230 - (12)(6) - 17 19 254 (14) 4 26

SRL 200 18(2) (1)(6) - 2 - 219 - 19 21

Valorem 144 - - - 38 6 188 (4) 4 44

DNS:NET 202 22(2,5) - - (54) 9 179 (6) 8 (43)

Attero 116 - (23)(6) - 47 4 144 (3) 1 49

Future Biogas - 28(4) - - - - 28 - - -

--------------- ---------- ---------- ---------- -------- -------- ----------- ---------- --------- ---------- ---------

Economic

infrastructure

portfolio 2,770 824 (322) 32 320 17 3,641 7 155 499

--------------- ---------- ---------- ---------- -------- -------- ----------- ---------- --------- ---------- ---------

Projects 103 - (104) (1) - 2 - (1) 1 2

Total portfolio

reported in

the Financial

statements 2,873 824 (426) 31 320 19 3,641 6 156 501

--------------- ---------- ---------- ---------- -------- -------- ----------- ---------- --------- ---------- ---------

This comprises the aggregate of value movement, foreign exchange translation,

1 allocated foreign exchange hedging and underlying portfolio income

in the year.

Capitalised interest totalling GBP95 million across the portfolio.

2

Syndication of investments in ESVAGT (GBP87 million) and TCR (GBP190

3 million).

New acquisitions of GCX (GBP318 million), Future Biogas (GBP28 million)

4 and further stake in TCR (GBP338 million).

Follow-on investments in Infinis (GBP30 million) and DNS:NET (GBP15

5 million).

Shareholder loan/share premium repayment (non-income cash).

6

The total portfolio return in the year of GBP501 million was

15.1% (2022: GBP509 million, 19.8%) of the aggregate of the opening

value of the portfolio and investments less amounts syndicated in

the year (excluding capitalised interest), which totalled GBP3,325

million.

Performance was strong across the portfolio, driven by

outperformance from a number of portfolio companies, but

particularly TCR, Tampnet, Ionisos, Attero and Valorem, each of

which continues to benefit from positive underlying growth trends.

The other portfolio companies performed in line with expectations,

with the exception of DNS:NET, which continues to face challenges

with its fibre network roll out.

Table 2 shows the portfolio return in the year for each asset as

a percentage of the aggregate of the opening value of the asset and

investments in, and syndication of, the asset in the year

(excluding capitalised interest). Note that this measure does not

time-weight for investments and syndications in the year and

includes foreign exchange movements net of hedging.

Table 2: Portfolio return by asset (year to 31 March 2023,

%)

Total portfolio

return 15.1

TCR 25.3

-------

ESVAGT 10.9

-------

Infinis 18.9

-------

GCX* 6.0

-------

Ionisos 22.8

-------

Tampnet 26.4

-------

Joulz 16.4

-------

Oystercatcher 11.1

-------

SRL 10.3

-------

DNS:NET (19.6)

-------

Valorem 30.5

-------

Attero 42.1

-------

Future Biogas* 0.6

-------

Projects** 1.9

-------

* GCX acquired in August 2022 and Future Biogas acquired in

February 2023 and return not annualised.

** Divested in June 2022 and return not annualised.

Movements in portfolio value

The movements in portfolio value were driven principally by the

delivery of planned cash flows and other asset outperformance as

well as new and follow-on investments and syndications made during

the year. A reconciliation of the movement in portfolio value is

shown in Table 3 below. The portfolio summary shown in Table 1

details the analysis of these movements by asset. Changes to

portfolio valuations arise due to several factors, as shown in

Table 4.

The portfolio generated a value gain of GBP320 million in the

year, alongside income of GBP156 million.

Table 3: Reconciliation of the movement in portfolio value (year

to 31 March 2023, GBPm)

Opening portfolio value at 1 April 2022 2,873

Investment(1) 824

Divestment/capital repaid (426)

Value movement 320

Exchange movement(2) 19

Accrued income movement 31

------------------------------------------ ------

Closing portfolio value at 31 March 2023 3,641

------------------------------------------ ------

1 Includes capitalised interest.

2 Excludes movement in the foreign exchange hedging programme (see

Table 12 in the Financial review).

Portfolio activity

Our renewable energy generating companies, Infinis, Valorem and

Attero, performed strongly in the year and have made substantial

progress in developing their pipelines of new projects towards and

into operation. This is reflected in an overall increase in

installed capacity from 898MW to 979MW over the year, as shown in

the Sustainability report in the Annual report and accounts

2023.

Infinis had a very strong year, generating a value gain of GBP52

million driven by higher forecast future power prices and price

volatility which benefitted the power response assets in

particular. Its power response assets experienced higher running

hours driven by the UK's power generation capacity constraints.

Infinis made significant progress in further establishing a

1.5GW solar energy generation and battery storage pipeline across

various stages of development.

In March 2023, we invested a further GBP30 million of equity to

support the development of this pipeline, with the remainder of the

funding coming from the company's own cash generation and debt

facilities.

Valorem materially outperformed the prior year despite the

French government's 90% windfall tax. Its closed capacity now

totals 778MW of wind and solar projects including new projects in

France and Finland and its first project in Greece. It has a

healthy 5.7GW pipeline of wind and solar projects in Europe as well

as long-term feed-in tariffs unaffected by the windfall tax. The

market fundamentals in France and the EU for renewable developers

remains strong, particularly due to recent availability issues

experienced by the French nuclear power sector and France's

renewables development targets. French solar and wind auction

tariffs increased by c.25% in 2022 versus 2021.

Attero also benefitted from high power prices although its

hedging strategy insulates it from short-term price volatility.

Despite waste supply volumes being slightly lower than expectations

due to lower economic activity, the company outperformed the prior

year due to the higher electricity price outlook and good

availability at its EfW plants.

The GBP47 million value increase in Attero is due to several

waste supply contracts recontracted at increased gate fees and for

longer periods, as well as the higher longer-term electricity price

outlook.

Preparations for a potential divestment of Attero are at an

advanced stage. Any sale proceeds are expected to contribute

towards partially repaying drawings on the Company's RCF.

TCR materially outperformed expectations, increasing in value by

GBP86 million, due to a number of significant contract wins and

extensions, higher utilisation rates of the fleet, and stronger

than expected repair and maintenance activity.

This outperformance reflects a sustained rebound of air traffic

levels as well as an increased post-pandemic demand for its

full-service rental model globally. TCR added over 35 airports to

its portfolio in 2022 and its off-lease rate has reverted to

pre-Covid-19 levels.

In November 2022, TCR completed the bolt-on acquisition of

Adaptalift, an Australian-headquartered ground service equipment

lessor, adding incremental contracted EBITDA at an attractive

valuation with strong expected synergies.

TCR successfully raised additional debt from existing and new

lenders to support its next growth phase.

ESVAGT and Joulz, which indirectly contribute to the energy

transition, have performed well and are benefitting from the

tailwinds in this sector.

ESVAGT had a good year, benefitting from contract rates in

excess of our expectations and high utilisation levels. Inflation

is generally positive for ESVAGT due to its index-linked contracts,

although cost inflation, in particular fuel costs, accelerated in

the year.

In January 2023, ESVAGT's joint venture in the United States,

CREST, won its first SOV contract in the US offshore wind market.

The 15-year SOV contract is with Siemens Gamesa, servicing the

Coastal Virginia Offshore Windfarm, the largest offshore wind

project in the US (2.6GW), and was an important milestone in

ESVAGT's growth ambitions, representing an incremental step up in

earnings.

The pipeline for further new SOVs in the North Sea and the

rapidly accelerating US wind market is strong and we expect a

number of tenders will take place over the next 12 months.

ESVAGT's ERRV segment continued to see good momentum due to the

improved oil and gas markets, attractive supply/demand dynamics and

an increased focus on security of supply in Europe.

Joulz performed ahead of expectations due to strong growth in

the order book, including for its large integrated Energy

Transition Solutions. The business made considerable progress

diversifying its supplier base to mitigate the risk of delays

previously experienced in completing new installations, primarily

due to key hardware suppliers struggling to keep up with rising

demand.

The company's long-term contracts are directly linked to

inflation, and this provided good protection for higher operating

and capital costs.

In December 2022, Joulz successfully raised debt financing,

which was utilised to replenish its revolving credit facility,

supporting the funding of further growth opportunities. As part of

a planned transition, a new CEO joined the business in March

2023.

Our communications infrastructure investments, Tampnet, GCX and

DNS:NET, are taking advantage of the acceleration in digitalisation

trends.

Tampnet performed well in the year, increasing in value by GBP52

million, driven by higher forecast revenues due to the signing of

new private network contracts, identification of new potential

growth opportunities and extended life assumptions resulting from

higher energy prices and the increased focus on security of energy

supply by governments in Europe and the US. It exceeded budgeted

revenue and EBITDA targets due to increased offshore activity on

the back of improved sentiment in the energy markets and stronger

demand for bandwidth upgrades.

Tampnet is progressing a number of new fibre projects in the

North Sea and the Gulf of Mexico and signed a number of important

new contracts in both regions. The company is also in discussions

with several carbon capture and storage projects in the North Sea

which are located within Tampnet's existing network. The

digitisation proposition offered by Tampnet (combining low-latency

connectivity with services such as Private Networks) is continuing

to prove popular with customers, and we expect to see an

acceleration of the short-term penetration of digitisation

projects.

GCX had a good year with strong growth in lease revenues,

although indefeasible right of use sales are behind schedule. The

business secured a significant managed services contract during the

year and is experiencing increasing demand for bandwidth capacity

across its network. The business is evaluating a number of

opportunities to expand its subsea network as well as the

development of terrestrial assets. GCX and Tampnet announced a

strategically important partnership which supports the increasing

network connectivity demands of the data centre market in the

Nordics.

DNS:NET continues to experience delays in the roll out of its

fibre network in the Berlin area and specifically in connecting and

activating customers. We have updated the forecasts to reflect more

conservative roll-out assumptions, which has led to a GBP54 million

value decrease in the year.

Operational performance was below expectations as delays to

connect and activate new homes persist, which we see as an

industry-wide challenge. The delivery of a network built by a local

authority to be transferred to DNS:NET under concession contract is

also running behind schedule.

During the year, we invested a further GBP15 million to support

the business's roll out and have worked with the company to

optimise its business model and strengthen the management team in

order to minimise and recover the roll out delays. A new CFO was

appointed in January 2023. He is overseeing the implementation of a

new ERP system and other initiatives. Hiring to further strengthen

the management team is also underway, aimed at providing the

bandwidth and experience to accelerate the network roll out.

Ionisos delivered meaningful growth against prior year due to

strong volume growth, notably in the medical and pharmaceutical

segments, resulting in a GBP43 million gain in value.

In order to meet growing demand, Ionisos progressed various

expansion opportunities, including extending existing sterilisation

facilities, acquiring the Daniken E-Beam plant in Switzerland, and

a new greenfield EO plant in Kleve, Germany, which became

operational in January 2023. In a capacity constrained market,

these initiatives will increase Ionisos's ability to address and

meet strong underlying demand growth for sterilisation, whilst

diversifying its technology mix and expanding the geographic

footprint from which it will service its medical and pharmaceutical

client base.

Oystercatcher performed well in the year. Advario Singapore

Limited's ('ADS') customer activity levels were high and all

available capacity was let. This was despite a backdrop of a

backwardation market structure for petroleum products. Our positive

medium-term outlook remains unchanged given the terminal is the

premier gasoline blending terminal in Singapore and the wider

region.

A strategic transition to some green fuel storage is progressing

well. In 2022, a first agreement was signed with a customer to

start storing and blending sustainable aviation fuel ('SAF') at

ADS. The project to convert existing storage to accommodate SAF is

on track and is expected to be operational in mid-2023. We believe

this gives ADS a first mover advantage for SAF-related business in

Singapore.

SRL performed broadly in line with plan during the financial

year. Whilst higher than in the previous year, activity levels were

slightly lower than expected due to delays in capital expenditure

programmes in the public sector and construction sectors resulting

in fewer days on hire than forecast. The Investment Manager is

working closely with management to professionalise account

management processes and optimise fleet utilisation and build.

Summary of portfolio valuation methodology

Investment valuations are calculated at the half-year and at the

financial year end by the Investment Manager and then reviewed by

the Board. Investments are reported at the Directors' estimate of

fair value at the relevant reporting date.

The valuation principles used are based on International Private

Equity and Venture Capital ('IPEV') valuation guidelines, generally

using a discounted cash flow ('DCF') methodology (except where a

market quote is available), which the Investment Manager considers

to be the most appropriate valuation methodology for unquoted

infrastructure equity investments.

Where the DCF methodology is used, the resulting valuation is

checked against other valuation benchmarks relevant to the

particular investment, including, for example:

-- earnings multiples;

-- recent transactions; and

-- quoted market comparables.

In determining a DCF valuation, we consider and reflect changes

to the two principal inputs, being forecast cash flows from the

investment and discount rates.

We consider both the macroeconomic environment and

investment-specific value drivers when deriving a balanced base

case of cash flows and selecting an appropriate discount rate.

Inflation in the UK and Europe has risen sharply which has put

pressure on supply chain and employee costs.

The portfolio is positively correlated to inflation, but the

ability to pass cost inflation to customers varies by portfolio

company so we take a granular approach to modelling the effects of

inflation.

Higher longer-term power prices have positively affected the

valuation of our energy generating portfolio companies, although

the majority of our power price exposure was hedged in the short to

medium term.

Future power price projections are taken from independent

forecasters and changes in these assumptions will affect the future

value of these investments. Recently introduced taxes on renewable

electricity generators vary in their applicability and we have

considered their impact on each company individually, based on

their circumstances.

Table 4: Components of value movement (year to 31 March 2023, GBPm)

----------------------------------------------------------------------------------------------------------------------

Value movement component Value movement Description

in the year

------------------------------------- -------------- ---------------------------------------------------------------

Planned growth 175 Net value movement resulting from the passage of time,

consistent with the discount rate and

cash flow assumptions at the beginning of the year less

distributions received and capitalised

interest in the year.

------------------------------------- -------------- ---------------------------------------------------------------

Other asset performance 99 Net value movement arising from actual performance in the year

and changes to future cash

flow projections, including financing assumptions and changes

to regulatory assumptions.

------------------------------------- -------------- ---------------------------------------------------------------

Discount rate movement (6) Value movement relating to changes in the discount rate applied

to the portfolio cash flows.

------------------------------------- -------------- ---------------------------------------------------------------

Macroeconomic assumptions 52 Value movement relating to changes to macroeconomic out-turn or

assumptions, eg. power prices,

inflation, interest rates and taxation rates. This includes

changes to regulatory returns

that are directly linked to macroeconomic variables.

------------------------------------- -------------- ---------------------------------------------------------------

Total value movement before exchange 320

------------------------------------- -------------- ---------------------------------------------------------------

Foreign exchange retranslation 19 Movement in value due to currency translation to year-end date.

------------------------------------- -------------- ---------------------------------------------------------------

Total value movement 339

------------------------------------- -------------- ---------------------------------------------------------------

TCR operates in the aviation sector, which has been severely

affected by travel restrictions over the past three years.

The value of TCR assumes a full recovery in air traffic to

pre-Covid-19 levels in 2024, consistent with the assumptions made

in the prior year.

As a 'through-the-cycle' investor with a strong balance sheet,

we consider valuations in the context of the longer-term value of

the investments. This includes consideration of climate change risk

and stranded asset risk. Factors considered include physical risk,

litigation risk linked to climate change and transition risk (for

example, assumptions on the timing and extent of decommissioning of

North Sea oil fields, which affects Tampnet and ESVAGT).

We take a granular approach to these risks, for example each

relevant offshore oil and gas field has been assessed individually

to forecast the market over the long term and a low terminal value

has been assumed at the end of the forecast period.

In the case of stranded asset risk, we consider long-term

threats that may impact value materially over our investment

horizon, for example, technological evolution, climate change, or

societal change.

For ESVAGT, which operates ERRVs in the North Sea servicing

sectors, including the oil and gas market, we do not assume any new

vessels or replacement vessels in our valuation for that segment of

the business.

A number of our portfolio companies are set to benefit from

these long-term megatrends and, in the base case for each of our

valuations, we take a balanced view of potential factors that we

estimate are as likely to result in underperformance as

outperformance.

Discount rate

Table 5 shows the movement in the weighted average discount rate

applied to the portfolio at the end of each year since the

Company's inception and the position as at March 2023. The weighted

average discount rate increased over the course of FY23 due to the

evolution of the portfolio mix following the realisation of the

European Projects portfolio and the completion of the GCX and

Future Biogas acquisitions.

The range of discount rates used in individual valuations at 31

March 2023 is also shown, which is broadly consistent with the

prior year.

During the year, we witnessed an increase in risk-free rates

across Europe as central banks took action in response to higher

inflation. Given the significant risk premium included in our

long-term discount rates and the continued appetite for

high-quality infrastructure businesses, rising risk-free rates did

not impact the discount rates used to value our portfolio companies

at 31 March 2023.

Table 5: Portfolio weighted average discount rate (31 March,

%)

March 08 12.4

March 09 13.8

============

March 10 12.5

============

March 11 13.2

============

March 12 12.6

============

March 13 12.0

============

March 14 11.8

============

March 15 10.2

============

March 16 9.9

============

March 17 10.0

============

March 18 10.5

============

March 19 10.8

============

March 20 11.3

============

March 21 10.8

============

March 22 10.9

============

March 23 11.3

============

March 23 range 10.0 to 13.2

============

Portfolio company debt

Our portfolio companies are funded by long-term senior-secured

debt alongside equity from the Company and other shareholders.

Valorem also uses project financing in its portfolio of renewable

energy projects. There were no mezzanine or junior debt structures

within our portfolio at 31 March 2023 (2022: none).

In recent years, the Investment Manager proactively refinanced

facilities across the portfolio, extending the term of the debt and

securing low fixed rates or hedged interest rates.