RNS No 5978e

AMERICAN EXPRESS COMPANY

25 October 1999

PART ONE

AMERICAN EXPRESS COMPANY REPORTS RECORD

QUARTERLY NET INCOME OF $648 MILLION

(millions, except per share amounts)

Nine Months

Quarter Ended Percentage Ended Percentage

September 30 Inc/(Dec) September 30 Inc/(Dec)

------------ ---------- ------------ ----------

1999 1998 1999 1998

---- ---- ---- ----

Net Income $ 648 $ 574 13.0% $ 1,869 $ 1,611 16.0%

Net Revenues $4,879 $4,342 12.4% $14,211 $12,662 12.2%

Per Share

Net Income

Basic $ 1.45 $ 1.27 14.2% $ 4.18 $ 3.53 18.4%

Diluted $ 1.42 $ 1.25 13.6% $ 4.09 $ 3.47 17.9%

Average Common

Shares

Outstanding

Basic 446.0 451.6 (1.2%) 447.0 456.2 (2.0%)

Diluted 456.4 459.6 (0.7%) 456.4 464.9 (1.8%)

Return on

Average

Equity 25.3% 23.9% - 25.3% 23.9% -

The 1998 nine-month results include a $138 million (after-tax) credit loss

provision at American Express Bank relating to its Asia/Pacific portfolio, as

well as income of $78 million (after-tax) representing gains on the sale of

First Data Corporation shares and a preferred dividend based on Lehman Brothers

earnings. Excluding these items, income rose 11.8 percent from $1,671 million

(versus 16.0 percent from $1,611 million) and diluted earnings per share grew

13.9 percent from $3.59 (versus 17.9 percent from $3.47).

NEW YORK -- October 25, 1999 -- American Express Company today reported record

quarterly net income of $648 million, up from $574 million in the same period a

year ago. Diluted earnings per share rose 14 percent to $1.42 compared with

$1.25. Net revenues totaled $4.9 billion, up 12 percent from $4.3 billion. The

Company's return on equity was 25.3 percent.

These results met American Express' long-term targets of 12-15 percent earnings

per share growth, at least 8 percent growth in revenues and a return on equity

of 18-20 percent.

The 1999 third-quarter results reflect strong earnings and revenue growth at

Travel Related Services and American Express Financial Advisors. Due to a change

in accounting rules, the Company is required to capitalize software costs rather

than to expense them as they occur. For the third quarter of 1999, this amounted

to a pre-tax benefit of $68 million (net of amortization). As previously

announced, the benefit was offset by increased investment spending and therefore

had no material impact on net income.

Travel Related Services (TRS) reported record quarterly net income of $413

million, up 14 percent from $362 million in the third quarter a year ago.

TRS' net revenues increased 12 percent from the prior year, reflecting higher

billed business in the United States and internationally as well as strong

growth in Cardmember loans. The improvement in billed business resulted from

higher spending per Cardmember, which was based on several factors, including

the benefits of rewards programs and expanded merchant coverage. This growth

came despite the Company's decision last year to withdraw from the U.S.

Government card business, which represented approximately $3.5 billion in

annualized spending and 1.6 million cards. Excluding the loss of the Government

card business, total cards in force rose 2.3 million or 5 percent from a year

ago, with about 900,000 added in the third quarter. Other revenues also

increased, resulting principally from a higher level of securitized receivables,

acquisitions and fee income.

The provision for losses on the charge card portfolio rose as a result of higher

volume, partly offset by a continued improvement in credit quality. The

provision for losses on the lending portfolio declined as a result of

securitizing a portion of the portfolio and lower loss rates, which more than

offset the impact of higher loan volumes. Human resources expenses rose as a

result of increased business volumes and acquisitions. Other operating expenses

increased due in part to the cost of Cardmember loyalty programs, business

growth and investment spending.

The securitization of credit card receivables produced a gain of $55 million

($36 million after-tax). This gain, and the previously mentioned benefit from

software capitalization, were offset by higher spending on marketing and

promotion related to card acquisition, Internet activities and other business

building initiatives. These items had no material impact on net income or total

expenses.

American Express Financial Advisors (AEFA) reported record third quarter net

income of $240 million, up 14 percent from $211 million reported a year ago.

Net revenues and earnings growth benefited from higher fee revenues due to an

increase in managed assets, reflecting positive net sales and market

appreciation over the past twelve months, as well as wider investment margins.

AEFA reported strong increases in sales of investment certificates, annuities

and life and other insurance products, as well as continued growth in sales of

mutual funds. Human resources expenses rose, largely because of compensation

costs associated with higher sales and asset levels. Other operating expenses

rose primarily from costs related to higher business volumes and investments to

build the business.

American Express Bank/Travelers Cheque (AEB/TC) reported quarterly net income of

$38 million compared with $43 million a year ago. Travelers Cheque results were

in line with the prior year.

Net income declined as a result of lower foreign exchange trading revenues,

primarily in Asia, and higher operating expenses due to costs associated with

expanding the consumer business in new markets and realigning business

activities in certain countries.

Corporate and Other reported net expenses of $43 million, compared with $42

million a year ago.

American Express Company (http://www.americanexpress.com), founded in 1850, is a

global travel, financial and network services provider.

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarter Ended Nine Months Ended

September 30, September 30,

-------------- Percentage ------------- Percentage

1999 1998 Inc/(Dec) 1999 1998 Inc/(Dec)

---- ---- ---------- ---- ---- ----------

Net Revenues by

Segment (A)

Travel Related

Services $ 3,737 $ 3,339 11.9 % $10,836 $ 9,692 11.8 %

American Express

Financial Advisors 936 802 16.7 2,738 2,343 16.8

American Express

Bank/Travelers

Cheque 261 255 2.5 767 764 0.4

4,934 4,396 12.2 14,341 12,799 12.0

Corporate and Other,

including adjustments

and eliminations (55) (54) (1.1) (130) (137) 5.1

CONSOLIDATED NET

REVENUES (A) $ 4,879 $ 4,342 12.4 $14,211 $12,662 12.2

Pretax Income

by Segment

Travel Related

Services $ 632 $ 554 14.1 $ 1,814 $ 1,582 14.7

American Express

Financial Advisors 350 308 14.0 1,015 888 14.3

American Express

Bank/Travelers

Cheque 4 20 (78.7) 22 (131) -

986 882 11.9 2,851 2,339 21.9

Corporate and

Other (79) (83) 2.8 (258) (127) #

PRETAX INCOME $ 907 $ 799 13.4 $ 2,593 $ 2,212 17.2

Net Income by Segment

Travel Related

Services $ 413 $ 362 14.1 $ 1,187 $ 1,038 14.4

American Express

Financial Advisors 240 211 14.0 696 609 14.3

American Express

Bank/Travelers

Cheque 38 43 (13.0) 117 7 #

691 616 12.1 2,000 1,654 20.9

Corporate and Other (43) (42) (0.6) (131) (43) #

NET INCOME $ 648 $ 574 13.0 $ 1,869 $ 1,611 16.0

# Denotes variance of more than 100%.

(A) Net revenues are reported net of interest expense, where applicable, and

American Express Financial Advisors' provision for losses and benefits.

American Express Company

Financial Summary (continued)

(Unaudited)

Quarter Ended Nine Months Ended

September 30, September 30,

-------------- Percentage ------------- Percentage

1999 1998 Inc/(Dec) 1999 1998 Inc/(Dec)

EARNINGS PER SHARE

Basic

Earnings Per Common

Share $ 1.45 $ 1.27 14.2 % $ 4.18 $ 3.53 18.4 %

Average common

shares outstanding

(millions) 446.0 451.6 (1.2) 447.0 456.2 (2.0)

Diluted

Earnings Per Common

Share $ 1.42 $ 1.25 13.6 $ 4.09 $ 3.47 17.9

Average common

shares outstanding

(millions) 456.4 459.6 (0.7) 456.4 464.9 (1.8)

Cash dividends

declared per

common share $ 0.225 $ 0.225 - $ 0.675 $ 0.675 -

Selected Statistical Information

(Unaudited)

Quarter Ended Nine Months Ended

September 30, September 30,

-------------- Percentage -------------- Percentage

1999 1998 Inc/(Dec) 1999 1998 Inc/(Dec)

Return on Average

Equity* 25.3 % 23.9 % - 25.3 % 23.9 % -

Common Shares

Outstanding

(millions) 447.6 452.3 (1.0)% 447.6 452.3 (1.0)%

Book Value per

Common Share:

Actual $ 21.77 $ 20.79 4.7% $ 21.77 $ 20.79 4.7%

Pro Forma* $ 22.41 $ 19.28 16.2% $ 22.41 $ 19.28 16.2%

Shareholders'

Equity

(billions) $ 9.7 $ 9.4 3.6% $ 9.7 $ 9.4 3.6%

* Excludes the effect of SFAS No. 115.

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarter Ended

Sept 30, June 30, March 31, Dec 31, Sept 30,

1999 1999 1999 1998 1998

Net Revenues by Segment (A)

Travel Related Services $ 3,737 $ 3,678 $ 3,421 $ 3,545 $ 3,339

American Express

Financial Advisors 936 916 885 837 802

American Express Bank

/Travelers Cheque 261 259 247 239 255

4,934 4,853 4,553 4,621 4,396

Corporate and Other,

including adjustments and

eliminations (55) (33) (42) (67) (54)

CONSOLIDATED NET

REVENUES (A) $ 4,879 $ 4,820 $ 4,511 $ 4,554 $ 4,342

Pretax Income by Segment

Travel Related Services $ 632 $ 628 $ 554 $ 483 $ 554

American Express

Financial Advisors 350 353 312 304 308

American Express Bank

/Travelers Cheque 4 6 12 2 20

986 987 878 789 882

Corporate and Other (79) (92) (87) (76) (83)

PRETAX INCOME $ 907 $ 895 $ 791 $ 713 $ 799

Net Income by Segment

Travel Related Services $ 413 $ 411 $ 363 $ 326 $ 362

American Express

Financial Advisors 240 242 214 209 211

American Express Bank

/Travelers Cheque 38 38 41 36 43

691 691 618 571 616

Corporate and Other (43) (45) (43) (41) (42)

NET INCOME $ 648 $ 646 $ 575 $ 530 $ 574

(A) Net revenues are reported net of interest expense, where applicable, and

American Express Financial Advisors' provision for losses and benefits.

American Express Company

Financial Summary (continued)

(Unaudited)

Quarter Ended

September 30, June 30 March 31 December 31 September 30

1999 1999 1999 1998 1998

EARNINGS PER SHARE

Basic

Earnings Per $1.45 $1.44 $1.28 $1.18 $1.27

Common Share

Average common 446.0 447.4 447.7 448.7 451.6

shares outstanding

(millions)

Diluted

Earnings Per Common $1.42 $1.41 $1.26 $1.16 $1.25

Share

Average common 456.4 457.1 456.2 456.0 459.6

shares outstanding

(millions)

Cash dividends $0.225 $0.225 $0.225 $0.225 $0.225

declared per

common share

Selected Statistical Information

(Unaudited)

Quarter Ended

September 30, June 30 March 31 December 31 September 30

1999 1999 1999 1998 1998

Return on Average 25.3% 25.3% 25.1% 24.0% 23.9%

Equity*

Common Shares 447.6 449.0 450.0 450.5 452.3

Outstanding (millions)

Book Value per

Common Share:

Actual $21.77 $21.74 $21.74 $21.53 $20.79

Pro Forma* $22.41 $21.77 $20.92 $20.24 $19.28

Shareholders' $9.7 $9.8 $9.8 $9.7 $9.4

Equity (billions)

* Excludes the effect of SFAS No.115.

(Preliminary) Travel Related Services

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended

September 30, Percentage

1999 1998 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,700 $ 1,522 11.7 %

Net Card Fees 395 393 0.4

Travel Commissions 448 441 1.4

and Fees

Other Revenues 846 645 31.2

Lending:

Finance Charge Revenue 513 502 2.3

Interest Expense 165 164 0.9

Net Finance Charge 348 338 3.1

Revenue

Total Net Revenues 3,737 3,339 11.9

Expenses:

Marketing and Promotion 373 310 20.1

Provision for Losses

and Claims:

Charge Card 222 148 50.2

Lending 187 224 (16.6)

Other 10 17 (40.5)

Total 419 389 7.7

Charge Card Interest 208 199 4.4

Expense

Net Discount Expense 105 170 (38.7)

Human Resources 968 924 4.7

Other Operating 1,032 793 30.5

Expenses

Total Expenses 3,105 2,785 11.5

Pretax Income 632 554 14.1

Income Tax Provision 219 192 14.1

Net Income $ 413 $ 362 14.1

(Preliminary) Travel Related Services

Statement of Income

(Unaudited, Managed Asset Basis)

(Dollars in millions)

Quarter Ended

September 30, Percentage

1999 1998 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,700 $ 1,522 11.7%

Net Card Fees 399 395 1.1

Travel Commissions 448 441 1.4

and Fees

Other Revenues 730 562 29.9

Lending:

Finance Charge Revenue 747 636 17.4

Interest Expense 246 209 17.3

Net Finance Charge 501 427 17.5

Revenue

Total Net Revenues 3,778 3,347 12.9

Expenses:

Marketing and Promotion 340 310 9.4

Provision for Losses

and Claims:

Charge Card 247 224 10.5

Lending 312 263 18.5

Other 10 17 (40.5)

Total 569 504 13.0

Charge Card Interest 259 262 (1.3)

Expense

Human Resources 968 924 4.7

Other Operating 1,010 793 27.7

Expenses

Total Expenses 3,146 2,793 12.7

Pretax Income 632 554 14.1

Income Tax Provision 219 192 14.1

Net Income $ 413 $ 362 14.1

This Statement of Income is provided on a Managed Asset Basis for analytical

purposes only. It presents the income statement of TRS as if there had been no

securitization transactions. Under Statement of Financial Accounting Standards

No. 125 (SFAS No. 125), which prescribes the accounting for securitized

receivables, TRS recognized a pretax gain of $55 million ($36 million

after-tax) in the third quarter of 1999 related to the securitization of U.S.

receivables. This gain was invested in additional Marketing and Promotion

expenses and other business building initiatives and had no material impact on

Net Income or Total Expenses in the third quarter of 1999. For purposes of this

presentation such gain and a corresponding increase in Marketing and Promotion

and Other Operating Expenses have been eliminated in the third quarter of

1999.

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

September 30, Percentage

1999 1998 Inc/(Dec)

Total Cards in Force (millions):

United States 29.2 29.5 (1.0)%

Outside the United States 15.6 14.6 6.9

Total 44.8 44.1 1.6

Basic Cards in Force (millions):

United States 22.9 23.3 (1.6)

Outside the United States 12.0 11.3 5.7

Total 34.9 34.6 0.8

Card Billed Business:

United States $ 47.1 $ 41.5 13.5

Outside the United States 17.0 15.2 11.7

Total $ 64.1 $ 56.7 13.0

Average Discount Rate* 2.73% 2.72% -

Average Basic Cardmember

Spending (dollars)* $ 1,935 $ 1,704 13.6

Average Fee per Card (dollars)* $ 38 $ 37 2.7

Travel Sales $ 5.5 $ 5.1 7.0

Travel Commissions and

Fees/Sales** 8.1% 8.6% -

Total Debt $ 30.8 $ 26.9 14.5

Shareholder's Equity $ 5.4 $ 5.2 5.4

Return on Average Equity*** 29.3% 27.1% -

Return on Average Assets*** 3.3% 3.3% -

* Computed excluding Cards issued by strategic alliance partners and

independent operators as well as business billed on those Cards.

** Computed from information provided herein.

***Excluding the effect of SFAS No. 115.

(Preliminary) Travel Related Services

Selected Statistical Information Continued

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

September 30, Percentage

1999 1998 Inc/(Dec)

Owned and Managed Charge Card

Receivables:

Total Receivables $ 25.3 $ 23.3 8.8%

90 Days Past Due as a % of Total 2.5% 2.7% -

Loss Reserves (millions) $ 907 $ 961 (5.6)

% of Receivables 3.6% 4.1% -

% of 90 Days Past Due 144% 151% -

Net Loss Ratio 0.41% 0.48% -

Owned and Managed U.S. Cardmember

Lending:

Total Loans $ 20.6 $ 15.4 33.8

Past Due Loans as a % of Total:

30-89 Days 2.0% 2.2% -

90+ Days 0.8% 1.0% -

Loss Reserves (millions):

Beginning Balance $ 602 $ 577 4.3

Provision 264 236 11.9

Net Charge-Offs/Other (230) (234) (1.8)

Ending Balance $ 636 $ 579 9.9

% of Loans 3.1% 3.8% -

% of Past Due 111% 118% -

Average Loans $ 19.8 $ 15.2 30.0

Net Write-Off Rate 4.7% 6.4% -

Net Interest Yield 8.5% 9.6% -

(Preliminary) Travel Related Services

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended

September June 30, March 31, December September

30, 1999 1999 1999 31, 1998 30, 1998

Net Revenues:

Discount Revenue $ 1,700 $ 1,662 $ 1,514 $ 1,639 $ 1,522

Net Card Fees 395 393 403 398 393

Travel Commissions 448 469 426 452 441

and Fees

Other Revenues 846 845 731 687 645

Lending:

Finance Charge Revenue 513 465 503 535 502

Interest Expense 165 156 156 166 164

Net Finance Charge Revenue 348 309 347 369 338

Total Net Revenues 3,737 3,678 3,421 3,545 3,339

Expenses:

Marketing and Promotion 373 325 270 301 310

Provision for Losses

and Claims:

Charge Card 222 249 182 100 148

Lending 187 137 235 293 224

Other 10 14 14 14 17

Total 419 400 431 407 389

Charge Card Interest Expense 208 198 183 211 199

Net Discount Expense 105 131 143 185 170

Human Resources 968 968 912 990 924

Other Operating Expenses 1,032 1,028 928 968 793

Total Expenses 3,105 3,050 2,867 3,062 2,785

Pretax Income 632 628 554 483 554

Income Tax Provision 219 217 191 157 192

Net Income $ 413 $ 411 $ 363 $ 326 $ 362

MORE TO FOLLOW

QRTPBGQPUBGBUQQ

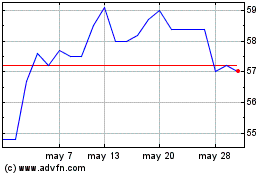

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024