TIDMCTPE

RNS Number : 3718A

CT Private Equity Trust PLC

23 May 2023

To: Stock Exchange For immediate release:

23 May 2023

CT Private Equity Trust PLC

Quarterly results for the three months ended 31 March 2023

(unaudited)

-- Share price total return for the three-month period ended 31 March 2023 of 6.8%.

-- NAV total return per share for the three-month period ended 31 March 2023 of -0.2%.

-- NAV of 702.47p per share as at 31 March 2023.

-- Quarterly dividend of 6.95p per Ordinary Share representing a yield of 6.0% .

Introduction

As at 31 March 2023 the net assets of the Company were GBP511.7

million giving a Net Asset Value ("NAV") per share of 702.47p,

which taking account of the dividend of 6.62p paid on 31 January

2023 gives a total return of -0.2% for the first quarter. This

valuation comes only a few weeks after the full year valuation and

is largely composed of 31 December 2022 valuations with c.10% of

valuations struck at 31 March 2023. This is in line with the

proportions in previous years. The pound has strengthened slightly

over the quarter and this has acted at a portfolio level to reduce

the valuation by just under 1% largely offsetting the small

underlying gain in the overall valuation before taking account of

costs.

The share price total return over the quarter was 6.8%. More

recently there has been an improvement and at the time of writing

(price 493p) the discount to NAV is 30%.

At 31 March 2023 the Company had net debt of GBP21.2 million.

The outstanding undrawn commitments are GBP189 million, of which

GBP26 million is to funds where the investment period has

expired.

A dividend of 6.79p was paid on 28 April 2023. In accordance

with the Company's dividend policy the next dividend will be 6.95p

which will be paid on 31 July 2023 to Shareholders on the register

on 7 July 2023 with an ex-dividend date of 6 July 2023.

New Investments

Three new fund commitments have been added during the quarter.

GBP8 million has been committed to Kester Capital III, a UK

focussed lower mid-market buy-out manager whom we have backed

before in two previous funds and in a number of co-investments. $8

million has been committed to MidOcean VI, a US mid-market buy-out

fund whom we have backed through one of our other funds before.

Lastly GBP8 million has been committed to Axiom I, a debut

mid-market enterprise software fund, where we know the principals

from earlier in their careers.

Two new co-investments were added. We have invested GBP2.5

million in the MVM-led life sciences company GT Medical. This

company has developed an innovative brain cancer treatment

consisting of bioresorbable tiles with embedded radioactive caesium

seeds. The tiles are placed next to the tumour cavity and are

eventually fully absorbed by the body. This is thought to extend

life and promote recovery. We have also invested GBP4.1 million

(80% of our expected investment in the business) in LeadVenture, a

leading SaaS provider of digital retailing, digital storefronts,

e-commerce, proprietary data and vertical ERP dealer management

software (DMS). The company's customers are in the non-auto sector

such as RVs, agriculture machinery and transportation. The lead for

the investment is San Francisco based Truewind Capital.

During the quarter we have made no fewer than six follow on

investments into co-investments. These are for various reasons; Med

Spa (GBP1.9 million - acquiring new clinics as part of the

roll-out), Leader 96 (GBP1.2 million - funding higher than expected

working capital), TWMA (GBP1.1 million - improving liquidity and

funding capex for major new contracts), Aurora Payments (GBP1.0

million - funding add-ons and a shortfall due to a delay in the

release of funds in escrow), Vero Biotech (GBP0.9 million - helping

fund the launch of the third generation nitric oxide gas cassette

device) and Accuvein (GBP0.8 million - junior debt issue, slightly

more than our pro-rata share).

Dealflow for both funds and co-investments remains strong and

since the quarter end we have made four commitments to funds and

five co-investments. The fund commitments and co-investments cover

Europe and North America and give diverse sectoral exposure.

We have made a $10 million commitment split evenly between Level

5 Capital Partners II and its associated co-investment vehicle

Purpose Brands. Level 5 concentrates on consumer-focussed franchise

growth investments and is based in Atlanta, Georgia. EUR5 million

has been committed to Magnesium Capital I, a European energy

transition fund. EUR5 million has been committed to Hg Mercury 4, a

lower mid-market software and services fund investing in Europe and

North America. Lastly, EUR8 million has been committed to Wise

Equity VI, the latest fund by one of the leading Italian mid-market

buy-out managers.

The new co-investments cover a range of industries and

geographies. EUR10 million has been invested in the Volpi led

co-investment in Cyclomedia. Volpi has been invested in this

Netherlands based mapping and surveying company since 2018 and we

are increasing our exposure through a continuation vehicle.

Cyclomedia's client base includes local municipalities who require

comprehensive, accessible and digitally formatted information on

properties within their areas, mainly for the purposes of local

taxation and rates. From its Northern European base, the company

has begun a process of expansion internationally and Volpi believe

that there is considerable further growth to be achieved. $8.0

million has been invested in Asbury Carbons, a Pennsylvania based

producer of milled graphite products with a diverse range of

industrial applications. The investment is led by New York based

Mill Rock Capital and Asbury is an intriguing opportunity to

revitalise a long-established company with operational improvements

and product extensions. GBP5 million has been invested in Cardo, a

Wales based provider of repair, maintenance and upgrading services

mainly to the social housing sector. Much of the impetus comes from

the transition of this housing stock to become more energy

efficient and sustainable. The deal is led by Buckthorn whom we

have coinvested with several times and who specialise in energy

transition investments. GBP2.7 million has been invested alongside

August Equity in StarTraq, a provider of software to police forces

and local authorities allowing them to efficiently issue and

process speeding tickets. The technology has an increasing range of

applications with, for example, the capability of capturing

accurately on camera drivers who are using handheld mobile phones

whilst driving. The company also has a large untapped market

opportunity internationally where it already has a small foothold.

We have also invested GBP1.2 million alongside August Equity in One

Touch, a market leading software provider serving the social care

market. This software allows carers to meet client requirements

more efficiently and the care companies themselves to manage their

staff productively in what is a closely regulated sector.

The funds in the portfolio have been active in making new

investments. SEP VI called GBP1.1 million for its first two

investments; Cresset (drug discovery software used in the design of

small molecules) and Pelion (an internet of things connectivity

business). Kester Capital has called GBP0.6 million for MAP Patient

(leader in market access consulting services to the pharmaceutical

and biotech sectors which accelerates patient access to

ground-breaking medicines, devices and diagnostics). In different

sectors, Piper Equity has called GBP0.6 million for jewellery

company Monica Vinader as it continues with this investment from

one fund to the next and GBP0.5 million for tourist excursion

company Rabbie's Trail Burners. In Germany, DBAG VIII called GBP0.5

million for Metalworks which designs and manufactures high quality

fashion accessories such as belt buckles, fasteners and studs for

luxury fashion brands. In Central Europe, Avallon III called GBP0.6

million for TES the Czech based electro-mechanical engineering

company which was acquired from fund investment ARX.

The total of drawdowns from funds and co-investments in the

quarter was GBP34.8 million (2022: GBP20.6 million). This combined

with the investments made so far this quarter is evidence of the

strong dealflow accessible to the Company in the mid-market tier of

private equity internationally. Additionally, it is a sign of

continuing confidence on the part of our investment partners.

Realisations

There have been many realisations across the portfolio this

quarter. The staged sell down of our remaining positions in the now

listed Ashtead Technology have generated GBP4.7 million. There is a

further GBP4+ million still to be realised as market conditions

allow. Kester Capital II returned GBP2.7 million (4.8x, 60% IRR)

from the sale of Vixio, the leader in the provision of regulator

and compliance intelligence to the payments market. Our

longstanding partner Inflexion have had a series of exits across

their range of funds. GBP1.6 million was returned from travel

company Scott Dunn where the holding period coincided with a crisis

for the industry due to the pandemic (1.4x, 4% IRR). GBP1.1 million

came in from the sale of software services company Mobica where

Inflexion's Partnership Capital Fund has made an excellent return

(5.6x, 29% IRR). GBP0.7 million was returned from international

foreign exchange specialist Global Reach Group (3.1x, 19% IRR).

Lastly Inflexion also exited the social media and influencer

marketing agency Goat returning GBP0.4 million (3.9x, 78% IRR). As

noted above Piper exited jewellery company Monica Vinader returning

GBP0.4 million in a sale to Bridgepoint (2.1x, 11% IRR). Piper have

continued in the investment alongside Bridgepoint in Piper VII.

The flow of realisations has continued in Continental Europe. In

Spain, Corpfin IV returned GBP4.0 million (6.1x, 51% IRR) from the

sale of care company Grupo 5. In France Chequers XVI exited Paris

based landfill site operator Environnement Conseil Travaux (ECT)

returning GBP0.8 million. Chequers XVII sold premium zips business

Riri returning GBP1.2 million (2.4x, 34% IRR). Also in France,

Ciclad 4 exited wine drums company H&A Location returning

GBP0.7 million with an excellent return of 8x cost. In Germany

DBAG's various funds have achieved a number of exits. GBP0.4

million came in from speciality chemicals producer Heytex (1.2x

cost). GBP1.0 million was returned from Italian company Pmflex a

leading European manufacturer of electrical installation conduits

(2.3x, 65% IRR). DBAG also sold prison phone communications company

Telio returning GBP0.5 million. In Central Europe ARX exited

electro-mechanical engineering company TES in the sale to a

consortium including Avallon noted above. This returned GBP1.2

million (2.7x, 40% IRR).

The total for realisations and associated income this quarter

was GBP23.9 million which compares with GBP16.2 million at the same

point in 2022.

Valuation Movements

There have been a few notable movements in valuation this

quarter, although without the 31 March reports available these have

been limited. Jollyes, the pet shop chain led by Kester is up by

GBP1.4 million reflecting strong trading performance. The combined

TDR funds were up GBP1.4 million, as the remaining holding of

shares in Target Hospitality increased in price. The Italian sub

portfolio is up by GBP1.1 million mainly due to an uplift for ultra

high-end furniture company Giorgetti. Other notable positives are

from Kester Capital II, which is up by GBP0.9 million following the

exit of Vixio noted above and Apiary I which is up by GBP0.8

million reflecting progress across the portfolio and including a

superb recovery for TAG, the travel management company to the

global live music and entertainment touring industry. TAG is now

trading strongly, well up from the nadir of the pandemic. There

were a few negative movements, with for example Agilitas 2015 down

GBP1.1 million reflecting a, hopefully, temporary portfolio company

downgrade and follow-on. Corsair VI was down by GBP0.5 million as

it experiences the J-curve effect as it builds out its portfolio.

TWMA is down GBP0.3 million as forecasts, which remain encouraging,

are taking longer to materialise. In summary, in a usually quiet

quarter for valuation movements the portfolio has held up well as

would be expected at this stage in the year.

Financing

The Company has drawn down more of its borrowing facility during

the quarter and afterwards. This has been to build up the portfolio

with new investments to provide future returns. The realisation

proceeds are ahead of last year and very healthy. There are a

number of further realisations in process which may complete during

the current quarter. The gearing level of the Company was around 4%

at the end of March and it will rise a little as the new

investments noted above are made depending on the timing of

realisation proceeds. As we expect the return on investments to

comfortably outstrip the cost of borrowing over the long term this

moderate gearing should enhance NAV. We retain most of the

revolving credit facility available to cover any difference between

realisations and new investments. Later in the year we will engage

with the bank well ahead of the expiry of the facility in June

2024.

Outlook

The economic background with high inflation and sluggish growth

internationally remains challenging. As ever the impact across the

portfolio is uneven with consumer facing businesses more affected,

although many of these have staged impressive recoveries over the

last two years. From the review of our portfolio, it is clear that

companies which offer innovative products and services and which

exhibit well defined growth trends are achieving good exits and are

unsurprisingly entering the portfolio as new investments. Whilst

our portfolio is overwhelmingly composed of buyouts many of these

companies have a technology foundation, whether in software or its

application or in the broad and innovative healthcare sectors,

underpinning their specific investment theses. Our investment

partners search energetically across Europe and further afield for

these companies which can offer excellent returns in the medium and

long term. The current flow of realisations which has continued

very well so far this year indicates underlying momentum in the

portfolio maintaining our confidence that Shareholders will

continue to benefit as the year progresses.

Hamish Mair

Investment Manager

Columbia Threadneedle Investment Business Limited

Calculated as dividends of 6.31p paid on 31 October 2022, 6.62p

paid on 31 January 2023, 6.79p paid on 28 April 2023 and 6.95p

payable on 31 July 2023 divided by the Company's share price of

445.00p as at 31 March 2023.

Portfolio Summary

Ten Largest Individual Holdings Total Valuation % of Total Portfolio

As at 31 March 2023 GBP'000

=============================== ======================== ===============================

Sigma 17,681 3.3

=============================== ======================== ===============================

Inflexion Strategic Partners 14,980 2.8

=============================== ======================== ===============================

Coretrax 14,061 2.6

=============================== ======================== ===============================

Jollyes 11,078 2.1

=============================== ======================== ===============================

TWMA 10,844 2.0

=============================== ======================== ===============================

Aurora Payment Solutions 10,442 1.9

=============================== ======================== ===============================

F&C European Capital Partners 10,117 1.9

=============================== ======================== ===============================

Bencis V 9,721 1.8

=============================== ======================== ===============================

SEP V 9,189 1.7

=============================== ======================== ===============================

Apposite Healthcare II 8,828 1.6

=============================== ======================== ===============================

116,941 21.7

========================================================= ===============================

Portfolio Holdings

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

================================== ================= ========== ==========

Buyout Funds - Pan European

F&C European Capital Partners Europe 10,117 1.9

Apposite Healthcare II Europe 8,828 1.6

Stirling Square Capital II Europe 7,766 1.4

Volpi Capital Northern Europe 6,772 1.3

Apposite Healthcare III Europe 5,986 1.1

Agilitas 2015 Fund Northern Europe 5,053 0.9

ArchiMed II Western Europe 4,509 0.8

Astorg VI Western Europe 3,189 0.6

TDR Capital II Western Europe 1,411 0.3

Silverfleet European Dev Fund Europe 1,215 0.2

TDR II Annex Fund Western Europe 1,202 0.2

Agilitas 2020 Fund Europe 743 0.1

Med Platform II Global 599 0.1

Volpi III Northern Europe 295 0.1

ArchiMed MED III Global 279 0.1

Total Buyout Funds - Pan European 57,964 10.7

===================================================== ========== ==========

Buyout Funds - UK

Inflexion Strategic Partners United Kingdom 14,980 2.8

August Equity Partners V United Kingdom 7,576 1.4

Apiary Capital Partners I United Kingdom 6,325 1.2

Axiom 1 United Kingdom 6,233 1.1

Inflexion Supplemental V United Kingdom 5,581 1.0

August Equity Partners IV United Kingdom 5,499 1.0

Inflexion Buyout Fund V United Kingdom 5,488 1.0

Piper Private Equity VI United Kingdom 4,224 0.8

Kester Capital II United Kingdom 4,007 0.7

Inflexion Buyout Fund IV United Kingdom 3,634 0.7

Inflexion Enterprise Fund IV United Kingdom 2,711 0.5

FPE Fund II United Kingdom 2,556 0.5

Inflexion Partnership Capital II United Kingdom 2,484 0.5

FPE Fund III United Kingdom 2,039 0.4

Inflexion Enterprise Fund V United Kingdom 1,983 0.4

RJD Private Equity Fund III United Kingdom 1,963 0.4

Inflexion Supplemental IV United Kingdom 1,593 0.3

GCP Europe II United Kingdom 1,433 0.3

Horizon Capital 2013 United Kingdom 1,298 0.2

Piper Private Equity VII United Kingdom 1,280 0.2

Primary Capital IV United Kingdom 1,195 0.2

Inflexion Buyout Fund VI United Kingdom 1,123 0.2

Inflexion Partnership Capital I United Kingdom 935 0.2

Dunedin Buyout Fund II United Kingdom 925 0.2

Inflexion 2012 Co-Invest Fund United Kingdom 836 0.1

Kester Capital III United Kingdom 756 0.1

Inflexion 2010 Fund United Kingdom 504 0.1

Piper Private Equity V United Kingdom 405 0.1

August Equity Partners III United Kingdom 2 -

Total Buyout Funds - UK 89,568 16.6

===================================================== ========== ==========

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

================================== ================= ========== ==========

Buyout Funds - Continental Europe

Bencis V Benelux 9,721 1.8

Aliante Equity 3 Italy 8,518 1.6

DBAG VII DACH 5,912 1.1

Vaaka III Finland 5,449 1.0

Capvis III CV DACH 5,105 0.9

Italian Portfolio Italy 4,967 0.9

Summa II Nordic 4,888 0.9

Montefiore IV France 4,314 0.8

Chequers Capital XVII France 4,058 0.7

Procuritas VI Nordic 4,018 0.7

DBAG VIII DACH 3,562 0.7

Verdane Edda Nordic 3,333 0.6

Avallon MBO Fund III Poland 3,317 0.6

Procuritas Capital IV Nordic 3,143 0.6

ARX CEE IV Eastern Europe 3,008 0.6

Corpfin Capital Fund IV Spain 2,720 0.5

Capvis IV DACH 2,532 0.5

NEM Imprese III Italy 2,368 0.4

Summa I Nordic 2,233 0.4

Montefiore V France 2,142 0.4

Vaaka II Finland 1,767 0.3

DBAG Fund VI DACH 1,539 0.3

Corpfin V Spain 1,521 0.3

Vaaka IV Finland 1,318 0.2

Chequers Capital XVI France 1,206 0.2

Portobello Fund III Spain 1,107 0.2

Ciclad 5 France 1,054 0.2

DBAG VIIB DACH 884 0.2

Avallon MBO Fund II Poland 831 0.2

Procuritas VII Nordic 621 0.1

DBAG VIIIB DACH 588 0.1

Verdane XI Northern Europe 463 0.1

PineBridge New Europe II Eastern Europe 433 0.1

Summa III Northern Europe 315 0.1

Procuritas Capital V Nordic 295 0.1

Gilde Buyout Fund III Benelux 92 -

Capvis III DACH 51 -

N+1 Private Equity Fund II Iberia 43 -

DBAG Fund V DACH 31 -

Total Buyout Funds - Continental

Europe 99,467 18.4

===================================================== ========== ==========

Private Equity Funds - USA

Blue Point Capital IV North America 7,922 1.5

Camden Partners IV United States 3,484 0.6

Graycliff III United States 3,013 0.6

Stellex Capital Partners North America 2,967 0.6

Blue Point Capital III North America 2,844 0.5

Graycliff IV North America 2,650 0.5

MidOcean VI United States 1,031 0.2

Blue Point Capital II North America 156 -

HealthpointCapital Partners III United States 135 -

================================== ================= ========== ==========

Total Private Equity Funds - USA 24,202 4.5

===================================================== ========== ==========

Investment Geographic Total % of

Focus Valuation Total

GBP'000 Portfolio

======================================== =============== ========== ==========

Private Equity Funds - Global

Corsair VI Global 3,777 0.7

PineBridge GEM II Global 947 0.2

F&C Climate Opportunity Partners Global 859 0.2

AIF Capital Asia III Asia 69 -

PineBridge Latin America II South America 57 -

Hg Saturn 3 Global 14 -

Warburg Pincus IX Global 3 -

Total Private Equity Funds - Global 5,726 1.1

========================================================= ========== ==========

Venture Capital Funds

SEP V United Kingdom 9,189 1.7

MVM V Global 4,151 0.8

Kurma Biofund II Europe 2,642 0.5

SEP IV United Kingdom 1,669 0.3

SEP VI Europe 1,135 0.2

Northern Gritstone United Kingdom 1,050 0.2

Pentech Fund II United Kingdom 393 0.1

SEP II United Kingdom 275 0.1

Life Sciences Partners III Western Europe 250 -

MVM VI Global 130 -

Environmental Technologies Fund Europe 64 -

SEP III United Kingdom 43 -

Total Venture Capital Funds 20,991 3.9

========================================================= ========== ==========

Direct - Quoted

Ashtead United Kingdom 4,673 0.9

Total Direct - Quoted 4,673 0.9

========================================================= ========== ==========

Secondary Funds

The Aurora Fund Europe 805 0.1

======================================== =============== ========== ==========

Total Secondary Funds 805 0.1

========================================================= ========== ==========

Direct Investments/Co-investments

Sigma United States 17,681 3.3

Coretrax United Kingdom 14,061 2.6

Jollyes United Kingdom 11,078 2.1

TWMA United Kingdom 10,844 2.0

Aurora Payment Solutions United States 10,442 1.9

San Siro Italy 8,787 1.6

ATEC (CETA) United Kingdom 8,644 1.6

AccuVein United States 8,346 1.5

Weird Fish United Kingdom 7,535 1.4

Amethyst Radiotherapy Europe 7,300 1.4

Velos IoT (JT IoT) United Kingdom 7,250 1.3

Leader96 Bulgaria 7,223 1.3

Swanton United Kingdom 6,837 1.3

Prollenium North America 6,821 1.3

Rosa Mexicano United States 6,580 1.2

Ambio Holdings United States 6,402 1.2

Orbis United Kingdom 5,600 1.0

Cybit (Perfect Image) United Kingdom 5,439 1.0

Walkers Transport United Kingdom 5,162 1.0

Cyberhawk United Kingdom 5,045 0.9

Family First United Kingdom 5,045 0.9

Omlet United Kingdom 5,027 0.9

123Dentist Canada 4,781 0.9

1Med Switzerland 4,499 0.8

Dotmatics United Kingdom 4,497 0.8

Agilico (DMC Canotec) United Kingdom 4,008 0.7

Contained Air Solutions United Kingdom 3,949 0.7

LeadVenture United States 3,882 0.7

Habitus Denmark 3,543 0.7

Alessa (Tier1 CRM) Canada 3,496 0.7

MedSpa Partners Canada 3,412 0.6

Avalon United Kingdom 3,315 0.6

PathFactory Canada 3,216 0.6

Bomaki Italy 2,978 0.6

Collingwood Insurance Group United Kingdom 2,977 0.6

Vero Biotech United States 2,456 0.5

GT Medical United States 2,426 0.5

Neurolens United States 2,218 0.4

Ashtead United Kingdom 1,622 0.3

Rephine United Kingdom 1,248 0.2

Babington United Kingdom 771 0.1

TDR Algeco/Scotsman Europe 298 0.1

Total Direct Investments/Co-investments 236,741 43.8

========================================================= ========== ==========

Total Portfolio 540,137 100.0

========================================================= ========== ==========

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

three months ended 31 March 2023 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------- --------------- --------------

Income

Losses on investments held at fair value - (68) (68)

Exchange gains - 237 237

Investment income 724 - 724

Other income 220 - 220

----------------------------------------------- --------- --------------- --------------

Total income 944 169 1,113

----------------------------------------------- --------- --------------- --------------

Expenditure

Investment management fee - basic fee (118) (1,065) (1,183)

Investment management fee - performance - - -

fee

Other expenses (284) - (284)

----------------------------------------------- --------- --------------- --------------

Total expenditure (402) (1,065) (1,467)

----------------------------------------------- --------- --------------- --------------

Profit/(loss) before finance costs and

taxation 542 (896) (354)

Finance costs (79) (709) (788)

----------------------------------------------- --------- --------------- --------------

Profit/(loss) before taxation 463 (1,605) (1,142)

Taxation - - -

Profit/(loss) for period/ total comprehensive

income 463 (1,605) (1,142)

Return per Ordinary Share 0.63p (2.20p) (1.57p)

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

three months ended 31 March 2022 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------ --------- ----------------- --------------

Income

Gains on investments held at fair value - 8,143 8,143

Exchange losses - (249) (249)

Investment income 1,332 - 1,332

Other income 17 - 17

------------------------------------------ --------- ----------------- --------------

Total income 1,349 7,894 9,243

------------------------------------------ --------- ----------------- --------------

Expenditure

Investment management fee - basic fee (110) (994) (1,104)

Investment management fee - performance

fee - (5,245) (5,245)

Other expenses (274) - (274)

------------------------------------------ --------- ----------------- --------------

Total expenditure (384) (6,239) (6,623)

------------------------------------------ --------- ----------------- --------------

Profit before finance costs and taxation 965 1,655 2,620

Finance costs (59) (534) (593)

------------------------------------------ --------- ----------------- --------------

Profit before taxation 906 1,121 2,027

Taxation 6 - 6

Profit for period/ total comprehensive

income 912 1,121 2,033

Return per Ordinary Share 1.23p 1.52p 2.75p

CT PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

year ended 31 December 2022 (audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 77,330 77,330

Exchange losses - (2,083) (2,083)

Investment income 4,550 - 4,550

Other income 186 - 186

-------------------------------------------- --------- --------- ---------

Total income 4,736 75,247 79,983

-------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (464) (4,172) (4,636)

Investment management fee - performance

fee - (5,402) (5,402)

Other expenses (1,077) - (1,077)

-------------------------------------------- --------- --------- ---------

Total expenditure (1,541) (9,574) (11,115)

-------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 3,195 65,673 68,868

Finance costs (254) (2,294) (2,548)

-------------------------------------------- --------- --------- ---------

Profit before taxation 2,941 63,379 66,320

Taxation - - -

Profit for year/total comprehensive income 2,941 63,379 66,320

Return per Ordinary Share 4.01p 86.42p 90.43p

CT PRIVATE EQUITY TRUST PLC

Balance Sheet

As at 31 As at 31 As at 31

March 2023 March 2022 December 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ ---------------

Non-current assets

Investments at fair value through

profit or loss 540,137 496,873 528,557

--------------------------------------- ------------ ------------ ---------------

Current assets

Other receivables 1,441 249 389

Cash and cash equivalents 15,305 23,986 34,460

--------------------------------------- ------------ ------------ ---------------

16,746 24,235 34,849

Current liabilities

Other payables (8,688) (13,312) (7,411)

Interest-bearing bank loan (14,937) (15,828) (16,618)

--------------------------------------- ------------ ------------ ---------------

(23,625) (29,140) (24,029)

Net current (liabilities)/assets (6,879) (4,905) 10,820

Total assets less current liabilities 533,258 491,968 539,377

--------------------------------------- ------------ ------------ ---------------

Non-current liabilities

Interest-bearing bank loan (21,547) (20,385) (21,702)

--------------------------------------- ------------ ------------ ---------------

Net assets 511,711 471,583 517,675

--------------------------------------- ------------ ------------ ---------------

Equity

Called-up ordinary share capital 739 739 739

Share premium account 2,527 2,527 2,527

Special distributable capital

reserve 10,026 15,040 10,026

Special distributable revenue

reserve 31,403 31,403 31,403

Capital redemption reserve 1,335 1,335 1,335

Capital reserve 465,681 420,539 471,645

Shareholders' funds 511,711 471,583 517,675

--------------------------------------- ------------ ------------ ---------------

Net asset value per Ordinary

Share 702.47p 637.78p 710.65p

CT PRIVATE EQUITY TRUST PLC

Reconciliation of Movements in Shareholders' Funds

Three months Three months Year ended

ended 31 March ended 31 31 December

2023 March 2022 2022

(unaudited) (unaudited) (audited)

------------------------------------ ---------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Opening shareholders' funds 517,675 473,447 473,447

Buyback of ordinary shares - - (5,014)

(Loss)/profit for the period/total

comprehensive income (1,142) 2,033 66,320

Dividends paid (4,822) (3,897) (17,078)

------------------------------------ ---------------- ------------- -------------

Closing shareholders' funds 511,711 471,583 517,675

------------------------------------ ---------------- ------------- -------------

Notes (unaudited)

1. The unaudited quarterly results have been prepared on the

basis of the accounting policies set out in the statutory accounts

of the Company for the year ended 31 December 2022. Earnings for

the three months to 31 March 2023 should not be taken as a guide to

the results for the year to 31 December 2023.

2. Investment management fee:

Three months ended Three months ended Year ended 31 December

31 March 2023 31 March 2022 2022

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Investment

management

fee - basic fee 118 1,065 1,183 110 994 1,104 464 4,172 4,636

Investment

management

fee - performance

fee - - - - 5,245 5,245 - 5,402 5,402

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

118 1,065 1,183 110 6,239 6,349 464 9,574 10,038

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

3. Finance costs:

Three months ended Three months ended Year ended 31 December

31 March 2023 31 March 2022 2022

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- --------- --------- --------- --------- --------- ---------

Interest payable

on bank loans 79 709 788 59 534 593 254 2,294 2,548

4. Returns and net asset values

Three months ended Three months Year ended 31

31 March 2023 ended 31 March December 2022

2022

(unaudited) (unaudited) (audited)

The returns and net asset

values per share are based

on the following figures:

Revenue Return GBP463,000 GBP912,000 GBP2,941,000

Capital Return (GBP1,605,000) GBP1,121,000 GBP63,379,000

Net assets attributable GBP511,711,000 GBP471,583,000 GBP517,675,000

to shareholders

Number of shares in issue

at the period end 72,844,938 73,941,429 72,844,938

Weighted average number

of shares in issue during

the period 72,844,938 73,941,429 73,342,303

5. The financial information for the three months ended 31 March

2023, which has not been audited or reviewed by the Company's

auditor, comprises non-statutory accounts within the meaning of

Section 434 of the Companies Act 2006. Statutory accounts for the

year ended 31 December 2022, on which the auditor issued an

unqualified report, will be lodged shortly with the Registrar of

Companies. The quarterly report will be available shortly on the

Company's website www.ctprivateequitytrust.com

Legal Entity Identifier: 2138009FW98WZFCGRN66

For more information, please contact:

Hamish Mair (Investment Manager) 0131 718 1184

Scott McEllen (Company Secretary) 0131 718 1137

hamish.mair@columbiathreadneedle.com

/ scott.mcellen@columbiathreadneedle.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFZZGZKGFVGFZM

(END) Dow Jones Newswires

May 23, 2023 06:30 ET (10:30 GMT)

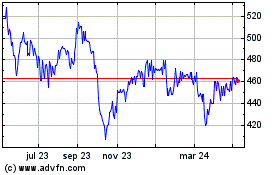

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

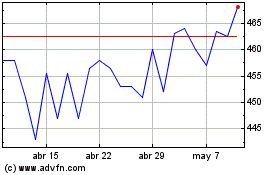

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De May 2023 a May 2024