TIDMEOG

RNS Number : 2172A

Europa Oil & Gas (Holdings) PLC

19 January 2024

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG /

Sector: Oil & Gas

19 January 2024

Europa Oil & Gas (Holdings) plc

("Europa" or the "Company")

Award & Concurrent Cancellation of Options

Europa Oil & Gas (Holdings) plc, the AIM quoted UK, Ireland

and West Africa focused oil and gas exploration, development, and

production company, is pleased to announce an updated enterprise

management incentive (EMI) scheme for directors and employees and

the concurrent cancellation of certain historical options.

The Board recognises the importance of share options to

appropriately incentivise and retain talent, as well as to ensure

their interests are aligned with that of the Company and its

shareholders. Following a third-party independent review of the

Company's remuneration packages by external consultants, the

Remuneration Committee of the Board agreed in full with the

review's observations that the existing long-term incentive package

for employees and directors was no longer appropriate and the board

adopted in full its recommendations that it should be replaced to

re-align the option scheme with the current strategic focus of the

Company.

Accordingly, the Company has cancelled, with mutual agreement

and immediate effect, 10,241,000 of existing EMI options over

ordinary shares of 1p each in the capital of the Company ("Ordinary

Shares") (the "Historical EMI Options") and will cancel the

2,950,000 options held by Brian O'Cathain, following which he will

no longer hold any options in the Company.

On 17 January 2024 (the "Grant Date"), under the Company's new

EMI scheme, Europa granted a total of 50,000,000 options over

Ordinary Shares (the "New EMI Options"), a portion of which are to

replace the Historical EMI Options, as detailed in the table

below.

Number of Exercise Number of Number of Resultant

New EMI Price options held options being number of

Options of New cancelled options

Granted EMI Options held

Granted

Brian O'Cathain 0 n/a 2,950,000 2,950,000 0

----------- ------------- -------------- --------------- -----------

William Holland 20,000,000 1.075 7,721,000 7,721,000 20,000,000

----------- ------------- -------------- --------------- -----------

Alastair

Stuart 15,000,000 1.075 0 0 15,000,000

----------- ------------- -------------- --------------- -----------

Other Employees 15,000,000 1.075 11,800,000 2,520,000 24,280,000

----------- ------------- -------------- --------------- -----------

Total 50,000,000 N/A 22,471,000 13,191,000 59,280,000

----------- ------------- -------------- --------------- -----------

The New EMI Options granted shall vest on the third anniversary

of the Grant Date (the "Vesting Date"), expire ten years from the

Grant Date, and are subject to a performance condition requiring

the volume weighted average share price over the last 20 trading

days prior to the Vesting Date to be greater than or equal to 1.25

times the volume weighted average share price over the last 20

trading days prior to the Grant Date.

Following the abovementioned option awards and cancellations, as

of 19 January 2024, the Company has a total of 77,609,628 options

and warrants outstanding over Ordinary Shares. Of these outstanding

options and warrants, 17,064,154 are due to expire, or otherwise be

cancelled, before the end of Q1 2024. Consequently, by end Q1 2024

the Company expects to have 60,545,474 options and warrants

outstanding, representing 5.93% of the fully diluted share

capital.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

For further information, please visit www.europaoil.com or

contact:

William Holland / Louise Europa Oil & Gas (Holdings) mail@europaoil.com

Armstrong plc

Strand Hanson Limited

James Dance / James Spinney - Nominated & Financial +44 (0) 20 7409

/ Rob Patrick Adviser 3494

+44 (0) 20 7186

Peter Krens Tennyson Securities 9033

Patrick d'Ancona / Finlay + 44 (0) 20 7390

Thomson / Kendall Hill Vigo Consulting 0230

Notes to Editors

Europa Oil & Gas (Holdings) plc has a diversified portfolio

of multi-stage hydrocarbon assets which includes production,

development and exploration interests, in countries that are

politically stable, have transparent licensing processes, and offer

attractive terms. Average net production for the financial year

ending 31 July 2023 was 265 bopd. On 21 December 2023 the Company

acquired 42.9% interest in Antler Global, which holds an 80%

interest in the EG08 PSC offshore Equatorial Guinea. EG08 contains

an estimated gross mean un-risked 1.4 trillion cubic feet ("TCF")

gas prospective resources that can be tested with a single well

with a 92% chance of success. EG08 is adjacent to the Chevron

licence that contains the Alen gas field which is connected via

pipeline to the Bioko Island LNG plant. Europa took over

operatorship of PEDL343 ("Cloughton") on 27 July 2023 in which

Europa holds a 40% interest and contains an estimated 192 billion

cubic feet "BCF") of gas in place. Europa holds a 25% interest in

P.2358, Block 13/23c ("Serenity") in the Outer Moray Firth area of

the North Sea, which the 2019 Serenity oil discovery. The Company

holds one exploration licence offshore Ireland, which has two

principal prospects, the largest of which has the potential to host

gross mean un-risked prospective resources of 1.5 TCF gas. Inishkea

West is a near field gas prospect in the Slyne Basin which the

Company classifies as lower risk due to its close proximity to the

producing Corrib gas field and associated gas processing

infrastructure.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

Details of the person discharging managerial responsibilities

1

a) Name i) William Holland

ii) Alastair Stuart

========================== ==================================================

Reason for the notification

2

==============================================================================

a) Position/status i) Chief Executive Officer

ii) Chief Operating Officer

========================== ==================================================

b) Initial notification Initial notification

/Amendment

========================== ==================================================

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

==============================================================================

a) Name EUROPA OIL & GAS (HOLDINGS) PLC

========================== ==================================================

b) LEI 213800JWTCW7TN3WRC06

========================== ==================================================

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

==============================================================================

a) Description of the Ordinary Shares of 1p each

financial instrument,

type of instrument

Identification code GB00B03CJS30

========================== ==================================================

b) Nature of the transaction Grant of Options under EMI scheme

========================== ==================================================

c) Price(s) and volume(s) Name Price(s) Volume(s)

1.075 (exercise

William Holland price) 20,000,000

1.075 (exercise

Alastair Stuart price) 15,000,000

================= ===========

========================== ==================================================

d) Aggregated information

* Aggregated volume * 35,000,000

* Price * N/A

========================== ==================================================

e) Date of the transaction 17/01/2024

========================== ==================================================

f) Place of the transaction Outside a trading venue

========================== ==================================================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHGPURGGUPCGBR

(END) Dow Jones Newswires

January 19, 2024 02:00 ET (07:00 GMT)

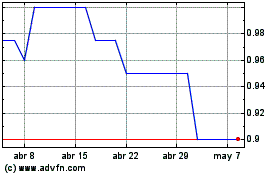

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024