TIDMFLK

RNS Number : 5653W

Fletcher King PLC

23 December 2021

FLETCHER KING PLC

Interim Results for the 6 months ended 31 October 2021

Financial Highlights

Turnover: GBP1,426,000 (2020 restated: GBP909,000)

Earnings before tax: GBP11,000 (2020: GBP477,000 loss)

Basic EPS: 0.12p per share (2020: 4.47p loss per share)

Dividend proposed: nil (2020: nil)

Operational Highlights

-- Performance was significantly improved on the comparative

period last year, reflecting a return to more stable market

conditions.

-- Steady and predictable revenue from asset management and fund

management clients was supplemented by an improvement in

transaction-based fee income.

-- Post period end, the Company has signed a lease on

alternative office premises that are expected to provide a material

reduction in fixed overheads.

Commenting on the results David Fletcher, Chairman of Fletcher

King said:

"After a very difficult trading period last year, it is pleasing

to report a return to profitability for the first half of this

year, albeit a modest one. In normal circumstances we would be

hopeful for the trend to continue, but with the emergence of a new

covid strain, and potential adverse impact on society and the wider

economy, it remains to be seen how our markets will be

affected".

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

ENQUIRIES:

Fletcher King Plc

David Fletcher / Peter Bailey

Tel: 020 7493 8400

Cairn Financial Advisers LLP (Nomad)

James Caithie / Liam Murray

Tel: 020 7213 0880

The interim results are available on the Company's website:

www.fletcherking.co.uk

CHAIRMAN'S STATEMENT

Results

Turnover for the period was GBP1,426,000 (2020 restated:

GBP909,000) with a profit before tax of GBP11,000 (2020: loss of

GBP447,000).

Dividend

In view of the continued uncertainty and the low level of profit

the Board is not declaring an interim dividend. (2020: no

dividend).

The Commercial Property Market

Although a degree of uncertainty continued throughout the

period, both the letting and capital markets were considerably more

buoyant compared to the corresponding period last year and this is

reflected in our improved results.

The general improvement in the letting markets however was not

across all segments and retail in particular remained generally

subdued. Offices were more in demand, particularly in Central

London and other major city centres, and industrials continued

their upward trajectory.

The capital markets also saw a significant increase in the

volume of transactions with investors having substantial funds to

deploy seeking suitable property to purchase.

Business Overview

It was pleasing to see the Investment Department return to

greater activity and it had a significantly better first half than

the corresponding period last year.

Property Management and Fund Management continued its steady

performance and added instructions from new clients.

The volume of bank valuation instructions increased and this

trend continues. Regrettably the settlement of rating appeals

continue to be slow and the timing of negotiations with the

Valuation Office are impossible to predict.

We continue to restrict discretionary expenditure where

possible. The lease on our current offices expires in May next year

and we will be moving to new space which will provide a material

reduction in fixed office overheads.

On 4 October we announced that Mr Elliott Bernerd was indirectly

acquiring 29.99% of the shares in the Company via a Placing and a

purchase of shares from the three largest shareholders which

includes myself. The three shareholders will be selling 50% of

their holding. The transaction is subject to FCA controller

approval which has yet to be received. An announcement will be made

as soon as it has, which is now expected in early 2022.

Outlook

Just when we thought the worst of the pandemic was coming to an

end we have been hit by a new strain. We are once again in a period

of uncertainty and it remains to be seen how our markets will be

affected and the duration and severity of any downturn.

In the current circumstances, it continues to be difficult to

assess our future trading performance but we are encouraged by the

return to profitability in the first half of the year, albeit a

modest one, and hopefully in due course we will be able to return

to a dividend payment.

We have some good investment sales instructions in the pipeline

and there are positive signs of increasing numbers of bank

valuations. Rating appeals will remain slow but we are hopeful that

at least one of our larger appeals will be agreed.

Our Fund and Property Management mandates will continue to

provide a secure income stream with opportunities for growth.

As we have previously announced, and subject to FCA approval,

the Board is delighted to welcome Elliott Bernerd as a substantial

shareholder in the Company. It has been our wish for some time to

have a significant shareholder who would help the expansion of our

business and assist us in acquiring new clients and projects.

Elliott and I have known each other since the early years of our

careers. His expertise, vast experience and contacts throughout the

property world will be, I am sure, of great value to the Company

and its shareholders.

I am pleased to report that we continue to be securely financed

with a strong balance sheet and cash reserves. This is important

not only for shareholders but also it gives confidence to our

valued clients and hard working and talented staff who I thank for

their valuable contribution.

DAVID FLETCHER

CHAIRMAN

23 December 2021

Fletcher King Plc

Consolidated Interim Statement of Comprehensive Income

for the 6 months ended 31 October 2021

Restated*

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2021 2020

(Unaudited) (Unaudited) 2021 (Audited)

GBP000 GBP000 GBP000

------------------------------------- ------------- --- ------------- --- ---------------

Revenue 1,426 909 2,264

Employee benefits expense (642) (637) (1,262)

Depreciation expense (140) (140) (281)

Other operating expenses (643) (584) (1,566)

(1,425) (1,361) (3,109)

Other operating income 13 12 25

Investment income - - -

Finance income - 2 2

Finance expense (3) (9) (16)

------------- --- ------------- --- ---------------

Profit/(loss) before taxation 11 (447) (834)

Taxation - 35 146

------------- --- ------------- --- ---------------

Profit/(loss) for the period 11 (412) (688)

------------- --- ------------- --- ---------------

Other comprehensive income

Fair value gain on financial

assets through other comprehensive

income - - (101)

Total comprehensive income for

the period 11 (412) (789)

------------- --- ------------- --- ---------------

Earnings per share (note 4)

- Basic 0.12p (4.47p) (7.47p)

- Diluted 0.12p (4.47p) (7.47p)

Dividends per share

Interim dividend proposed - - -

Dividends paid - 0.50p 0.50p

* Prior period restatement relates to the realignment of the

Group's revenue recognition policy to the principal versus agent

requirements of IFRS 15. As a result, revenue has been presented

gross of fees shared with third parties, with the related costs now

included within other operating expenses. The impact on revenue and

costs is GBP0.04m. The restatement has no impact on the Group's

profit for the period, earnings per share or net asset

position.

Fletcher King Plc

Consolidated Interim Statement of Financial Position

as at 31 October 2021

31 October 31 October 30 April

2021 2020 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

-------------------------------- ------------- ------------- -----------

Assets

Non-current assets

Property, plant and equipment 8 16 12

Right-of-use asset 136 408 272

Financial assets 529 630 529

673 1,054 813

Current Assets

Trade and other receivables 837 501 1,148

Corporation tax debtor 111 - 111

Cash and cash equivalents 3,096 3,113 2,892

4,044 3,614 4,151

Total assets 4,717 4,668 4,964

Liabilities

Current liabilities

Trade and other payables 647 499 908

Provisions 100 - 100

Current taxation liabilities - - -

Lease liabilities 580 299 577

Total current liabilities 1,327 798 1,585

Non current liabilities

Lease liabilities - 114 -

Shareholders' equity

Share capital 921 921 921

Share premium 140 140 140

Investment revaluation reserve (101) - (101)

Reserves 2,430 2,695 2,419

Total shareholders' equity 3,390 3,756 3,379

Total equity and liabilities 4,717 4,668 4,964

Fletcher King Plc

Consolidated Interim Statement of Changes in Equity

for the 6 months ended 31 October 2021

Investment Profit

Share Share revaluation and TOTAL

capital premium reserve loss EQUITY

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ------------- ------------- ------------ ------- -------

Balance at 1 May 2021 921 140 (101) 2,419 3,379

Profit for the period - - - 11 11

Equity dividends paid - - - - -

------------------------------ ------------- ------------- ------------ ------- -------

Balance at 31 October

2021 (Unaudited) 921 140 (101) 2,430 3,390

=============================== ============= ============= ============ ======= =======

Balance as at 1 May 2020 921 140 - 3,153 4,214

Loss for the period - - - (412) (412)

Equity dividends paid - - - (46) (46)

------------------------------- ------------- ------------- ------------ ------- -------

Balance at 31 October

2020 (Unaudited) 921 140 95 2,695 3,756

=============================== ============= ============= ============ ======= =======

Balance as at 1 May 2020 921 140 - 3,153 4,214

Loss for the year - - - (688) (688)

Equity dividends paid - - - (46) (46)

Fair value loss on financial

assets through other

comprehensive income - - (101) - (101)

Balance at 30 April 2021

(Audited) 921 140 (101) 2,419 3,379

=============================== ============= ============= ============ ======= =======

Fletcher King Plc

Consolidated Interim Statement of Cash Flows

for the 6 months ended 31 October 2021

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2021

2021 (Unaudited) 2020 (Unaudited) (Audited)

GBP000 GBP000 GBP000

------------------------------------- ----------------- ----------------- -----------

Cash flows from operating

activities

Profit/(loss) before taxation

from continuing operations 11 (447) (834)

Adjustments for:

Movement in provision - - 100

Depreciation expense 140 140 281

Investment income - - -

Finance income - (2) (2)

Finance expense 3 9 16

Cash flows from operating

activities

before movement in working

capital 154 (300) (439)

Decrease/(increase) in trade

and other receivables 311 179 (468)

(Decrease)/increase in trade

and other payables (261) (190) 219

----------------- ----------------- -----------

Cash generated from/(absorbed

by) operations 204 (311) (688)

Taxation paid - - -

----------------- ----------------- -----------

Net cash flows generated from/(used

in) operating activities 204 (311) (688)

------------------------------------------- ----------------- ----------------- -----------

Cash flows from investing

activities

Investment income - - -

Finance income - 2 2

Net cash flows from investing

activities - 2 2

------------------------------------------- ----------------- ----------------- -----------

Cash flows from financing

activities

Lease payments - (156) -

Dividends paid to shareholders - (46) (46)

----------------- ----------------- -----------

Net cash flows from financing

activities - (202) (46)

------------------------------------------- ----------------- ----------------- -----------

Net increase/(decrease) in

cash and cash equivalents 204 (511) (732)

Cash and cash equivalents

at start of period 2,892 3,624 3,624

----------------- ----------------- -----------

Cash and cash equivalents

at end of period 3,096 3,113 2,892

Fletcher King Plc

Explanatory Notes

1. General information

The Company is a public limited company incorporated and

domiciled in England and Wales. The address of its registered

office is 61 Conduit Street, London W1S 2GB.

These interim financial statements were approved by the Board of

Directors on 22 December 2021.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the European Union. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the International Financial Reporting Standards

Interpretations Committee and there is an ongoing process of review

and endorsement by the European Commission. The financial

information has been prepared on the basis of IFRS that the

Directors expect to apply for the year ended 30 April 2022.

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the

consolidated financial statements for the year ended 30 April 2021.

There are no new standards, interpretations and amendments,

effective for the first time from 1 May 2021, that have had a

material effect on the financial statements of the Group.

3. Non Statutory Accounts

The financial information for the period ended 31 October 2021

set out in this interim report does not constitute the Group's

statutory accounts for that period. Whilst the financial figures

included in this interim report have been computed in accordance

with IFRS, this interim report does not contain sufficient

information to constitute an interim financial report as that term

is defined in IAS34. The statutory accounts for the year ended 30

April 2021 have been delivered to the Registrar of Companies. The

auditors reported on those accounts; their report was unqualified,

did not contain a statement under either Section 498(2) or Section

498(3) of the Companies Act 2006 and did not include references to

any matters to which the auditor drew attention by way of

emphasis.

The financial information for the 6 months ended 31 October 2021

and 31 October 2020 is unaudited.

Fletcher King Plc

Explanatory Notes

4. Earnings per share

6 months 6 months Year ended

to 31 October to 31 October 30 April

2021 2020 2021

Number Number Number

Weighted average number of shares

for basic earnings per share 9,209,779 9,209,779 9,209,779

Share options - - -

--------------- --------------- ------------

Weighted average number of shares

for diluted earnings per share 9,209,779 9,209,779 9,209,779

=============== =============== ============

GBP000 GBP000 GBP000

--------------- --------------- ------------

Earnings for basic and diluted earnings

per share: 11 (412) (688)

=============== =============== ============

Basic earnings per share 0.12p (4.47p) (7.47p)

Diluted earnings per share 0.12p (4.47p) (7.47p)

=============== =============== ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEUEDEEFSELE

(END) Dow Jones Newswires

December 23, 2021 02:00 ET (07:00 GMT)

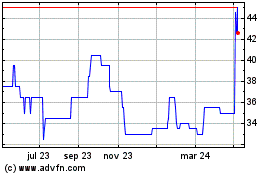

Fletcher King (LSE:FLK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

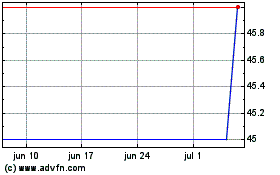

Fletcher King (LSE:FLK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025