Hunting PLC (LSE: HTG), the precision engineering group, today

issues a year-end trading update ahead of announcing its 2024 Final

Results on Thursday 6 March 2025.

All financial data noted below remains subject to audit.

Highlights

- Solid strategic progress in respect of the Hunting 2030

Strategy, with key milestones delivered within OCTG and Subsea

product groups.

- 2024 trading and financial outturn in line with previous

guidance and market expectations, with EBITDA in the range of

$123-$126m.. Group revenue is expected to be in the range of

$1,040-$1,050m.

- EBITDA margin of c.12% is likely to be reported for the year,

up from 11% in 2023, as anticipated.

- Strong cash generation delivered in Q4 2024, with total cash

and bank / (borrowings)1 at the year-end expected to be $100-$105m,

ahead of the guidance provided in October 2024.

- Following a record order book performance in H1 2024, Hunting’s

sales order book closed the year at c.$500m following the

conversion of large orders into revenue throughout H2 2024. This

order book will be completed through 2025 and into 2026 and

supports the Group’s anticipated continued EBITDA growth.

- Market conditions, while volatile through Q4 2024, appear more

stable in the US with the Henry Hub natural gas price nearing $4

per mmBtu at the close of the year, further underpinned by likely

improvements to industry support with the newly elected US

administration.

- Continued growth in 2025 with EBITDA expectations being in the

range of c.$135-$145m, driven by the Group’s strong order book, and

a material cost savings programme, with the higher end of range

coming from the expected more positive market conditions in North

America.

- 2025 guidance does not include any earnings accretive

acquisitions, for which we are in active discussions, nor does it

reflect an active tender pipeline, which may contribute further to

full year 2025 performance.

Jim Johnson, Chief Executive of Hunting, commented:

“I would like to thank the Hunting team for delivering another

year of strong growth, with firm progress towards a number of the

key 2030 strategic objectives that we identified at our Capital

Markets Day, namely positive growth of revenue, EBITDA, margins,

cash and bank and continued diversification of our service offering

and revenue streams.

“This growth has been delivered against a challenging industry

backdrop through 2024, particularly in North America, which saw

lower than expected activity due to depressed gas prices.

Pleasingly, these challenges are beginning to subside with the

natural gas price in the US ending the year strongly, which will

likely lead to more drilling in the US and Canada, which will be

further supported by the new US administration.

“2025 should, therefore, deliver a further year of growth and

with strong acquisition opportunities, a healthy balance sheet, and

a robust cost cutting programme that includes the consolidation of

our EMEA operations, our profits and returns should continue to

advance in the year ahead.”

2024 Full Year Trading Summary

Trading in Q4 2024 remained in line with management’s

expectations and with the guidance issued in October 2024, with

EBITDA anticipated to be in the range of $123-$126m for the full

year. EBITDA margin is likely to be c.12%.

Working capital has reduced since Q3 2024, to close the year at

c.$360m driven by lower inventory and improved receivables

collections. Capital investment will total c.$32m for the full

year.

EBITDA to Free Cash Flow conversion is likely to be c.110% for

2024, with year-end total cash and bank / (borrowings)1 now

anticipated to be above the previous guidance at $100-$105m,

supported by the accelerated receivables programmes and discounted

letters of credit used during H2 2024.

As noted in October 2024, the carrying values of the Hunting

Titan operating segment are being assessed for impairment, with

management expecting to book a reduction in carrying value as an

adjusting item.

Delivery of Hunting 2030 Strategic Milestones

Hunting has delivered a number of strategic milestones during

the year, with a strong operational performance from the Group’s

OCTG and Subsea product groups, and further growth from the

Advanced Manufacturing and Other Manufacturing product groups. As

noted in the Q3 2024 Trading Update, the operating performance of

the Perforating Systems product group has been below 2023 during

the year due to the lower US onshore rig count and average price

for natural gas.

Management notes that the OCTG and Subsea product groups have

delivered EBITDA margins well in excess of the target of 15%

published at the Company’s Capital Markets Day (“CMD”) in September

2023. The Advanced Manufacturing product group has reported further

progress in margin during 2024, while the Perforating Systems

product group will likely report low-single digit margin.

Free Cash Flow has improved significantly in the year, with a

c.110% conversion to EBITDA. The working capital to revenue ratio

is also likely to be c.30%, which is better than the CMD

target.

Capital Allocation

The Group has considerable balance sheet strength, and we

continue to pursue value accretive opportunities to grow and

diversify our portfolio in line with the strategic goals outlined

at Hunting’s CMD.

When assessing any opportunity, the Group has a disciplined

capital allocation policy. In line with this policy, the Group also

regularly considers if additional shareholder returns are

appropriate.

The Group’s dividend distribution ambitions remain on track.

EMEA Restructuring and Cost Savings

As announced separately today, the Directors have taken the

decision to restructure the Group’s EMEA operating segment, given

the low levels of future drilling activity anticipated in the North

Sea.

The Directors reiterate the strong outlook for the global oil

and gas industry; and recognise that its operating footprint needs

to align with future activity, which will likely focus on North and

South America, the Middle East, Africa and Asia Pacific out to

2030.

A review of sales, general and administration costs is also

underway.

In total, management plans to eliminate up to c.$10m of costs in

the year, the majority of which being from the restructuring of the

EMEA operating segment, noted above.

Further information on this initiative will be reported at the

Company’s 2024 Final Results, on Thursday 6 March 2025.

2025 Full Year Trading Guidance

Following a record order book in H1 2024, the Group’s sales

order book continued to be strong with a year-end position of

c.$500m following the conversion of large orders into revenue in H2

2024. Tendering activity continues to be positive across our key

regions of operation with opportunities in North and South America,

the Middle East, and Asia Pacific.

Management continues to pursue earnings accretive bolt-on

acquisitions that are focused on subsea opportunities, which

remains a robust end-market to the end of the decade. Active

discussions are underway with a number of targets, in line with the

Hunting 2030 Strategic ambitions. Following the securing of the new

banking facilities, as detailed in the October 2024 update, the

Company has total liquidity2 of c.$400m, as of today’s date,

available to pursue this focused growth initiative.

As noted above, in addition to the organic growth in the

business, a programme of cost savings and restructuring is underway

underpinning the EBITDA guidance for the full year 2025 of

$135-$145m.

Free Cash Flow conversion continues to be an area of focus for

the Group, with management anticipating an EBITDA to free cash flow

conversion of c.50%. Year-end total cash and bank / (borrowings)1

are targeted to be $135-$145m.

Investor Presentation via Investor Meet Company

The Company will be giving an investor presentation hosted by

Investor Meet Company covering its Trading Update for the financial

year ended 31 December 2024.

The online event will take place at 10:00 a.m. GMT today with

Jim Johnson (Chief Executive) and Bruce Ferguson (Finance Director)

presenting from the Company.

Investors can sign up to Investor Meet Company for free and add

to meet Hunting via:

https://www.investormeetcompany.com/hunting-plc/register-investor

Investors who already follow Hunting on the Investor Meet

Company platform will automatically be invited.

About Hunting PLC

Hunting is a global, precision engineering group that provides

precision-manufactured equipment and premium services, which add

value for our customers. Established in 1874, it is a listed public

company, quoted on the London Stock Exchange in the Equity Shares

in Commercial Companies (“ESCC”) category. The Company maintains a

corporate office in Houston and is headquartered in London. As well

as the United Kingdom, the Company has operations in China, India,

Indonesia, Mexico, Netherlands, Norway, Saudi Arabia, Singapore,

United Arab Emirates and the United States of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; North America; Subsea Technologies; Europe, Middle

East and Africa (“EMEA”), and Asia Pacific.

The Group also reports revenue and EBITDA financial metrics

based on five product groups: OCTG, Perforating Systems, Subsea,

Advanced Manufacturing and Other Manufacturing.

Hunting PLC’s Legal Entity Identifier is

2138008S5FL78ITZRN66.

Note 1 - Total cash and bank /

(borrowings) comprises cash and cash equivalents less bank debt and

excludes the long-term shareholder loan of $3.9 million and IFRS 16

lease liabilities.

Note 2 – Total liquidity comprises secured

committed facilities (the RCF and term loan) and unsecured

uncommitted facilities, including the four facilities available to

our Chinese subsidiary, combined with our year end cash and bank /

(borrowings).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113382898/en/

Hunting PLC Jim Johnson, Chief Executive Bruce Ferguson,

Finance Director Tel: +44 (0) 20 7321 0123

Buchanan Ben Romney Barry Archer Tel: +44 (0) 20 7466

5000

or

lon.IR@hunting-intl.com

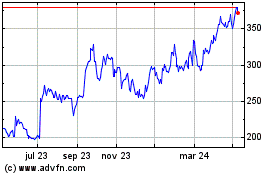

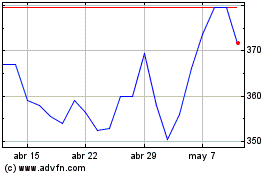

Hunting (LSE:HTG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Hunting (LSE:HTG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025