TIDMKDNC

RNS Number : 3492U

Cadence Minerals PLC

22 November 2023

Cadence Minerals Plc

("Cadence Minerals", "Cadence", or "the Company")

Corporate Update - Hastings Technology Metals

Cadence Minerals (AIM/NEX: KDNC; OTC: KDNCY) is pleased to note

the announcement by Hastings Technology Metals (ASX: HAS)

("Hastings") regarding the project financing process for the

Yangibana Rare Earths Project ("Yangibana Project") . Hastings has

agreed an at-the-market equity financing facility for up to $50

million with Alpha Investment Partners ("AIP").

Highlights:

-- At-the-Market equity financing facility for up to $50 million

established with AIP to provide working capital funding flexibility

as project financing process is advanced

-- Project financing process for Yangibana Project advancing

through first stage financiers' investment and credit committee

approvals

-- Multiple non-binding financing proposals received from global

mining funds and debt capital market investors to fund the

Yangibana Project debt size in the order of the target gearing

ratio of 60%

-- Discussions ongoing with Federal Government, following recent

announcement of $2 billion expansion in critical minerals

financing

-- Strategic partner and joint venture indicative proposals received from global mining funds

-- Certification of Green Financing Framework to enable issue of

green finance instruments, accredited

by Second Party Opinion ("SPO") provider, Det Norske Veritas

("DNV") Business Assurance Australia

-- Next steps include shortlisting preferred

financier(s)/syndicated lender group to conduct final due

diligence, long form term sheet, intercreditor terms (if required)

and site visits.

During the September quarter, Hastings completed early

infrastructure works at the Yangibana Project, including the

Kurrbili Accommodation Village, Yangibana Airstrip, access roads,

production borefields, water pipelines and clearing and grubbing of

the entire plant site.

Link here to view the full Hastings announcement

Hastings Executive Chairman Charles Lew commented: "Securing

multiple indicative funding proposals is a significant milestone.

We are pleased by the strong response we have received from various

potential financiers validating the economic and technical

viability of the Yangibana Project."

"As we evaluate each option, we are focused on choosing the path

that best aligns with our strategic objectives and drives the best

economics for the business. As we work towards finalising the

funding stack, we will continue to look at opportunities to

optimise our working capital and operating efficiencies to deliver

value for our shareholders."

Cadence shareholding in Hastings

On 25 January 2023, Cadence completed the sale of its 30% stake

in several mineral concessions forming part of the Yangibana Rare

Earths project for a consideration of 2.45 million Hastings shares.

This consideration was a premium over the Net Present Value ("NPV")

of the Cadence portion of the mineable material, based on the

definitive feasibility ("DFS") updated by Hastings on 21 February

2022. Currently Cadence holds approximately 1.4% of Hastings issued

share capital.

The full announcement concerning the Yangibana sale is available

here .

For further information contact:

Cadence Minerals plc +44 (0) 20 3582 6636

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 20 7220 1666

James Joyce

Darshan Patel

Fortified Securities - Joint

Broker +44 (0) 20 3411 7773

Guy Wheatley

Brand Communications +44 (0) 7976 431608

Public & Investor Relations

Alan Green

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Cautionary and Forward-Looking Statements

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"will", or the negative of those variations or comparable

expressions including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the company's future growth results of operations

performance , future capital, and other expenditures (including the

amount, nature, and sources of funding thereof) competitive

advantages business prospects and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. Many factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including risks associated with vulnerability to

general economic and business conditions, competition,

environmental and other regulatory changes actions by governmental

authorities, the availability of capital markets reliance on key

personnel uninsured and underinsured losses and other factors many

of which are beyond the control of the company. Although any

forward-looking statements contained in this announcement are based

upon what the Directors believe to be reasonable assumptions. The

company cannot assure investors that actual results will be

consistent with such forward-looking statements.

The information contained within this announcement is deemed by

the company to constitute Inside Information as stipulated under

the Market Abuse Regulation (E.U.) No. 596/2014, as it forms part

of U.K. domestic law under the European Union (Withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBBBDBIXDDGXD

(END) Dow Jones Newswires

November 22, 2023 06:39 ET (11:39 GMT)

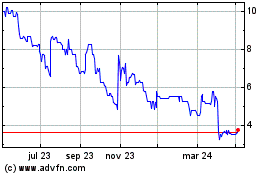

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

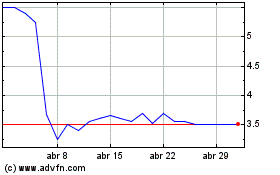

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025