TIDMPFD TIDMIRSH

RNS Number : 6199R

Premier Foods plc

30 October 2023

30 October 2023

Premier Foods plc (the "Company" or the "Group")

Acquisition of FUEL10K, accelerating expansion into Breakfast

Premier Foods today announces it has acquired FUEL10K, a vibrant

Breakfast brand, with a portfolio of granola, oats and drinks

products, as the Group significantly expands its presence in the

Breakfast meal occasion.

Strategic highlights & opportunities

-- FUEL10K is a differentiated, protein enriched Breakfast brand

-- On-trend proposition which attracts a predominantly young

consumer demographic

-- Track record of strong double-digit revenue growth over the

last three years

-- Substantially increases Group's position in the Breakfast

category, building on success of Ambrosia porridge pots

-- The Group expects to unlock significant future value through

leveraging its proven branded growth model

-- FUEL10K's commitment to sustainability supports the Group's

purpose of Enriching Life Through Food

Alex Whitehouse, Chief Executive Officer

"The acquisition of FUEL10K follows on from our successful

integration of The Spice Tailor, where we have increased revenue

and profit through the application of our branded growth model.

FUEL10K provides us with an ideal platform to accelerate our

expansion into the Breakfast category, building on our recent

successful launch of Ambrosia porridge pots. Possessing a

differentiated category position, with its protein enriched product

range and appealing to a younger demographic, we expect to deliver

significant further profitable growth of FUEL10K through the

deployment of our successful branded growth model."

,

Barney Mauleverer, co-founder, FUEL10K

"We are very excited to be passing the reigns on to the owner of

such a great stable of UK brands. Having built the foundations from

start-up, the FUEL10K brand is now primed to accelerate into the

future and achieve even more great things. I could not think of a

better custodian of our brand than Premier Foods to entrust what we

have begun and make the most of such a great opportunity."

Transaction details

-- Premier Foods has acquired 100% of FUEL10K(,1) for an Enterprise

Value of GBP34.0m, equivalent to an EV/sales multiple of c.1.6x

on revenues(2) of c.GBP21m

-- Initial consideration of GBP29.6m funded through available

cash reserves

-- A minimum further deferred consideration of GBP4.0m will be

payable in FY26/27, with any increment to this dependent upon

certain growth targets(3)

-- Earnings accretive(6) in first full year

-- Post acquisition, the Group's FY23/24 Net debt/EBITDA is expected

to be lower than FY22/23

-- The transaction completed on 29 October 2023

Further information on the transaction can be found in an

investor presentation on our website at

https://www.premierfoods.co.uk/Investors/Results-Centre/2023-2024.aspx

Ends

About Premier Foods

As one of the UK's largest food businesses, we're passionate

about food and believe each and every day we have the opportunity

to enrich life for everyone. Premier Foods employs over 4,000

people operating from 15 sites across the country, supplying a

range of retail, wholesale, foodservice and other customers with

our iconic brands which feature in millions of homes every day.

Through some of the nation's best-loved brands, including

Ambrosia, Batchelors, Bisto , Loyd Grossman, Mr. Kipling, Oxo and

Sharwood's, we're creating great tasting products that contribute

to healthy and balanced diets, while committing to nurturing our

people and our local communities, and going further in the pursuit

of a healthier planet , in line with our Purpose of 'Enriching Life

Through Food'.

About FUEL10K

FUEL10K make fuel for busy people, with a protein enriched

Breakfast range which make mornings easier, tastier and more

nutritious. The portfolio includes a range of granola, oats and

drinks products which can be eaten at the Breakfast table or on the

go. FUEL10K is sold in the UK in all major retailers, convenience

channels and online and attracts a young demographic who need fuel

to power them through the day. A fast growing Breakfast brand,

FUEL10K was acquired by Premier Foods on 29 October 2023.

Contacts:

Institutional investors and analysts:

Duncan Leggett, Chief Financial Officer

Richard Godden, Director of Investor Relations

Investor.relations@premier foods.co.uk

Media enquiries:

Sarah Henderson, Director of Communications

Headland

+44 (0) 7884

Ed Young 666830

+44 (0) 7799

Jack Gault 089357

- Ends -

This announcement may contain "forward-looking statements" that

are based on estimates and assumptions and are subject to risks and

uncertainties. Forward-looking statements are all statements other

than statements of historical fact or statements in the present

tense, and can be identified by words such as "targets", "aims",

"aspires", "assumes", "believes", "estimates", "anticipates",

"expects", "intends", "hopes", "may", "would", "should", "could",

"will", "plans", "predicts" and "potential", as well as the

negatives of these terms and other words of similar meaning. Any

forward-looking statements in this announcement are made based upon

Premier Foods' estimates, expectations and beliefs concerning

future events affecting the Group and subject to a number of known

and unknown risks and uncertainties. Such forward-looking

statements are based on numerous assumptions regarding the Premier

Foods Group's present and future business strategies and the

environment in which it will operate, which may prove not to be

accurate. Premier Foods cautions that these forward-looking

statements are not guarantees and that actual results could differ

materially from those expressed or implied in these forward-looking

statements. Undue reliance should, therefore, not be placed on such

forward-looking statements. Any forward-looking statements

contained in this announcement apply only as at the date of this

announcement and are not intended to give any assurance as to

future results. Premier Foods will update this announcement as

required by applicable law, including the Prospectus Rules, the

Listing Rules, the Disclosure and Transparency Rules, London Stock

Exchange and any other applicable law or regulations, but otherwise

expressly disclaims any obligation or undertaking to update or

revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.

Notes to editors:

1. The Group has acquired 100% of the shares of FUEL10K Limited

on a cash and debt free basis

2. Projected revenue to the year ended 31 March 2024

3. Additional consideration above the Enterprise value of GBP34.0m

is dependent on future sales growth to FY25/26 and subject

to a maximum cap of total consideration (comprising initial

consideration and additional consideration) of GBP55.0m. The

maximum cap reflects a stretching revenue target.

4. For year ended 31 March 2023, FUEL10K reported Profit before

tax of GBP0.5m; as at 31 March 2023, Gross Assets were GBP5.1m

5. There are no further conditions to be fulfilled post completion

of the transaction

6. Expected to be Adjusted earnings per share ("eps") accretive

in year one. Adjusted eps is defined as Adjusted profit after

tax divided by the weighted average number of shares in the

period. Adjusted profit after tax is defined as Adjusted profit

before tax less a notional tax charge of 25.0%. Adjusted profit

before tax is defined as Trading profit less net regular interest.

Trading profit is defined as profit/(loss) before tax, before

net finance costs, amortisation of acquired intangibles, fair

value movements on foreign exchange and other derivative contracts,

net interest on pensions and administration expenses. Net regular

interest is defined as net finance cost after excluding write-off

of financing costs, early redemption fees, other interest payable

and other finance income.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEADENAAXDFFA

(END) Dow Jones Newswires

October 30, 2023 03:00 ET (07:00 GMT)

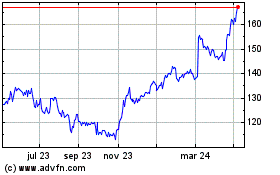

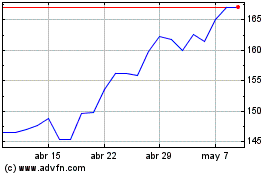

Premier Foods (LSE:PFD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Premier Foods (LSE:PFD)

Gráfica de Acción Histórica

De May 2023 a May 2024