Strategic Minerals PLC Director/PDMR Shareholding (8551Z)

27 Enero 2022 - 4:03AM

UK Regulatory

TIDMSML

RNS Number : 8551Z

Strategic Minerals PLC

27 January 2022

27 January 2022

Strategic Minerals plc

("Strategic Minerals", "SML" or the "Company")

Director Dealing

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a producing

mineral company actively developing projects prospective for

battery materials, announces that it was informed today by John

Peters (Managing Director), of his purchase of 2,000,000 ordinary

shares of 0.1p each in the Company ("Ordinary Shares") at a price

of 0.2975p per share.

Following these transactions, Mr Peters interest in Ordinary

Shares is as follows:

Director Ordinary Shares Resultant Shareholding % of Issued

Purchased Share Capital

John Peters (Managing

Director) 2,000,000 76,000,000 3.76%

---------------- ----------------------- ---------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name John Peters

----------------------------------- -------------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------------

a) Position/status

1. Managing Director

----------------------------------- -------------------------------------------

b) Initial notification

/Amendment Initial Notification

----------------------------------- -------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------------

a) Name

Strategic Minerals Plc

----------------------------------- -------------------------------------------

b) LEI

213800DICA5NPVOJT776

----------------------------------- -------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

--------------------------------------------------------------------------------

a) Description of the ordinary shares of 0.1p each

financial instrument,

type of instrument

Identification code ISIN: GB00B4W8PD74

b) Nature of the transaction

Purchase of Ordinary Shares

----------------------------------- -------------------------------------------

c) Price(s) and volume(s)

----------------------- ---------------

Price(s) Volume(s)

----------------------- ---------------

0.2975 pence 2,000,000

---------------------------------------------------------------- ---------------

d) Aggregated information

- Aggregated volume Price(s) Volume(s)

0.2975 pence 2,000,000

----------

- Price

e) Date of the transaction 26 January 2022

----------------------------------- -------------------------------------------

f) Place of the transaction XLON

----------------------------------- -------------------------------------------

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole drilling programme and the resource update that resulted

was announced in February 2019. In March 2019, the Company entered

into arrangements to acquire the balance of the Redmoor

Tin/Tungsten project which was settled on 24 July 2019 by way of a

vendor loan which was fully repaid on 26 June 2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Austra lia and brought the project temporarily into production in

April 2019. The project has been granted a conditional approval by

the South Australian Government for a Program for Environmental

Protection and Rehabilitation (PEPR) in relation to mining of its

Paltridge North deposit and processing at the Mountain of Light

installation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHFIFEALDIDFIF

(END) Dow Jones Newswires

January 27, 2022 05:03 ET (10:03 GMT)

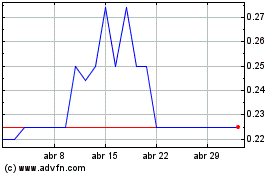

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024