TIDMSVM

SVM UK EMERGING FUND PLC

(the "Fund")

ANNUAL FINANCIAL RESULTS

FOR THE YEARED 31 MARCH 2022

The Board is pleased to announce the Annual Financial Results for the year

ended 31 March 2022. The full Annual Report and Financial Statements, Notice

of Annual General Meeting and Form of Proxy will be posted to shareholders and

be available shortly on the Manager's website at www.svmonline.co.uk

Copies of the Annual Report will be submitted to the FCA's National Storage

Mechanism and will be available for inspection at https://data.fca.org.uk/#/nsm

/nationalstoragemechanism in due course.

HIGHLIGHTS

* Over the 12 months to 31 March 2022, net asset value total return fell

10.0% to 112.51p compared to a return of 5.4% in the chosen comparator, the

IA UK All Companies Sector Average Index.

* Over the five years to 31 March 2022, net asset value has gained 19.4% and

the share price 29.6%, against the comparator index return of 24.1%.

* Portfolio emphasises exposure to scalable businesses with a competitive

edge that can protect margins and deliver growth.

* At 30 June 2022, net asset value per share had fallen to 89.68p

Financial Highlights Year to 31 March Year to 31

2022 March

2021

Total Return performance:

Net Asset Value total return* -10.0% 52.7%

Share Price total return* -12.1% 42.1%

Comparator Index (IA UK All Companies 5.4% 37.8%

Sector Average Index since 1 October

2013**)

31 March 31 March % Change

2022 2021

Capital Return performance:

Net asset value (p) 112.51 125.00 -10.0%

Share price (p) 87.50 99.50 -12.1%

MSCI All-Share Index*** 2,032.66 1,774.53 14.5%

Discount* 22.2% 20.4%

Gearing* 16.1% 16.7%

Ongoing Charges ratio:*

Investment management fees 0.86% 0.77%

Other operating expenses 1.78% 2.32%

Total Return to 1 3 5 10 Launch

31 March 2022 (%) Year Years Years Years (2000)

Net Asset Value -10.0% 2.2% 19.4% 57.4% 16.0%

Comparator Index** 5.4% 17.5% 24.1% 64.2% -11.6%

*Alternative Performance Measures (APM). For a definition of terms see Glossary

of Terms and Alternative Performance Measures in the AFS

**The comparator index for the Fund is the IA UK All Companies Sector Average.

*** A representative index of the UK Equity Market

INVESTMENT OBJECTIVE

The investment objective of the Fund is long term capital growth from

investments in smaller UK companies. Its aim is to outperform the IA UK All

Companies Sector Average Index on a total return basis.

CHAIRMAN'S STATEMENT

Over the 12 months to 31 March 2022, the Company's net asset value fell 10.0%

to 112.51p per share, compared to a return of 5.4% in the chosen comparator

index, the IA UK All Companies Sector Average Index. Over the five years to 31

March 2022, net asset value has gained 19.4% and the share price 29.6%, against

the IA UK All Companies Sector Average return of 24.1%. The portfolio

emphasises exposure to scalable businesses with a competitive edge that can

protect margins and deliver growth. The Company's net asset value decreased in

the three months since the year end to 89.68p at 30 June 2022. (total return,

FE, IA UK All Companies Sector Average for comparison purposes).

Review of the year

This has been a painful period for growth investors, with stockmarket interest

focusing on companies perceived as beneficiaries of inflation. Many growth

companies delivered good results but their shares were de-rated. The invasion

of Ukraine put upward pressure on the

prices of commodities and energy. These sectors outperformed but the Company

has low exposure to them, many of them being large businesses. This market

pattern was the primary reason for portfolio underperfomance during the year

under review.

Economic overheating seems likely to lead, in the short term, to higher UK

interest rates, but action by the Bank of England and a squeeze on real incomes

are likely in time to cool the economy. In the medium and longer term

disinflationary pressures may reassert. A recession in the UK and elsewhere is

likely to emerge in the coming year but it may be relatively short.

The Fund is focused on businesses with potential for self-help and growth,

which we believe to be well funded. Even in downturns there remain growth

sectors in the economy and business with innovative services. The need for

resilience, shorter supply chains, digital transformation and software

automation, is driving growth in businesses with those specialist services.

Labour market tightness works in favour of some business-to-business services

that improve efficiency, as well as those that can help to manage talent and

retain it.

Even amidst a squeeze on incomes, consumers change tastes and behaviours. The

pandemic has also left in its wake a continuing demand for companies that

support health, vaccines

and pets. Share prices for growth businesses have been reset, offering value to

investors.

The strongest contributions to performance over the period were from Watches of

Switzerland, Kape Technologies, Alpha FX, Kin and Carter and 4 Imprint Group.

Laggards included Ceres Power, JD Sports Fashion, Essensys, Flutter

Entertainment and ASOS.

Additional investment was made in Londonmetric, Kooth, Ideagen, Kape

Technologies and Marlowe. To fund these purchases, Ocado, Parsley Box,

Restaurant Group, The Hut Group,

Just Eat Takeaway, Molten Ventures and Moonpig were sold.

Annual General Meeting

The Annual General Meeting will be held on Friday 9 September 2022 at SVM's

offices in Edinburgh. At the last General Meeting, shareholders approved powers

for the Company to issue shares and to buy back for cancellation, or to hold in

treasury. Your Board has directed the Manager to implement this arrangement,

operating within Board guidelines and approvals. This aims is to improve

liquidity in our shares, and your Board does not expect this overall to be

dilutive to shareholders.

Following the period under review on 21 June 2022, the Manager advised the

Board that they had accepted a conditional offer to be acquired by Assetco plc,

an AIM listed asset management company. The portfolio managers of the Company

will continue in their current roles at the Managers.

Outlook

The past 12 months have seen a sharp rotation towards cyclical sectors,

combined with very negative sentiment towards growth businesses. In times of

market turmoil investors tend to focus more on macroeconomic news and

headlines, rather than company results. Yet in the recent reporting season many

growth companies reported good progress, with positive updates on current

trading and prospects. The Manager focuses on resilient growing businesses,

with low exposure to commodities, oil and banks.

The Fund remains fully invested with some additional gearing.

Peter Dicks

Chairman

20 July 2022

MANAGER'S REVIEW

Summary

Over the 12 months there were a number of challenges to the UK stockmarket; the

Russian Ukraine war, inflation and the possibility of recession. These

developments squeezed supply of energy, food and key industrial commodities at

the same time as high consumer demand came at the end of the pandemic. Investor

interest was very narrowly focused - on oil, banks and resources while most

other sectors lagged. The Fund strategy is focused on growth in medium sized

and smaller companies, with low exposure to cyclical sectors such as

commodities. Many portfolio companies are currently trading well despite all

the difficulties. There are signs that the UK economy is adapting to the

disruption in supplies, creating opportunity for new onshore suppliers

replacing risky ones overseas. The world is now much better placed to manage

changes to supply chains and build up resilience. In time, disinflationary

forces could reassert.

Portfolio review and investment strategy

The Managers investment approach involves sustainability, good stewardship and

culture. Companies with successful business models are usually transparent in

their accounting and reporting, and communicate their strategy. They have a

good sense of their key value drivers and will share that in one-to-one

meetings. Resilience in a business often comes from its strength within a

niche. Key to the opportunity that the Managers see in investment is an ability

to generate returns greater than cost of capital and to ensure that stewardship

of assets is focused on this.

Some portfolio investments assisting the drive to reduce carbon emissions are

in industrial sectors. Libertine Holdings, for example, floated on AIM in late

2021, and the Fund participated in its capital raise. Libertine has technology

for heavy duty power trains used by trucks, and enabling technology for using

fossil-free energy sources. We see opportunity for growth in applications for

clean power from renewable fuels.

Geopolitical shocks tend not to dominate investment thinking for long; markets

usually recover on an easing of tensions rather than full resolution.

Technology is a powerful force for improving services and productivity and is

likely to remain disinflationary despite some unwinding of globalisation.

The challenge for investors now is stock selection, identifying the companies

best able to deal with inflation. With skill shortages, higher energy costs,

and supply chains impacting manufacturers, the winners may be distributors,

business services and companies with unique products and services. First to

benefit will be those providing services that enhance business resilience or

sustainability, or which provide logistics support to shorten supply chains.

Growth businesses, particularly if mid-cap, typically occupy niches with wide

defensive moats. These range from food to legal services, representing

innovation in business models for which technology may be just one factor. Some

of these shares have been badly hit in the recent sell-off, but as yet have

seen little deterioration in business prospects.

Hilton Food Group, a medium sized company developing internationally, reported

increased revenue, maintaining a trend of continuous volume growth since its

float in 2007. It is growing organically and by acquisition, and now generates

more than two-thirds of its revenue outside the UK. It has a scalable business

model focused on supplying protein via supermarket chains. Pork and chicken

processor, Cranswick has a highly automated operating model, which should help

it to deal with labour shortage and wage inflation in the food sector.

Some large cap businesses are burdened by legacy structures and business models

that restrict their ability to adapt. They are also much more in the political

spotlight; exposed to intervention that restricts ability to adapt and raise

prices. Companies best placed in the current environment may be small and

medium sized, flexible and innovative.

Kainos Group provides IT services, consulting and software solutions. It has

gained from the drive to cloud and resilience. It is well positioned in the

public sector, and healthcare in particular, supporting digital transformation.

Trading this year shows good growth in sales and bookings. The Government has

steadily increased spending on digital transformation in recent years and

Kainos should participate in this. For the economy as a whole, productivity is

an important driver of GDP per capita growth, and a key enabler for this is

software and digital services. Kainos is currently a medium sized business but

is dominant in some of the segments it services.

Insurer Beazley reported a rise in gross premiums, helped by good demand in the

cyber insurance market. In cyber, Beazley, is seeing significant rate

improvement and it is continuing to invest for growth. IT service business,

Softcat, saw significant analyst upgrades as customers continued to invest in

technology. It reported growing demand in software, hardware and services.

Top 5 Contributors to Absolute Bottom Contributors to Absolute

Performance (%) Performance (%)

Company name Contribution Company name Contribution

ALPHA FX GROUP 1.84 JD SPORTS FASHION -2.26

WATCHES OF SWITZERLAND 1.68 CERES POWER -1.92

KAPE TECHNOLOGIES 0.64 ESSENSYS GROUP -1.43

KIN AND CARTA 0.61 FLUTTER ENTER -0.84

4IMPRINT GROUP 0.56 ASOS -0.81

A liquidity squeeze is underway; credit is tightening, challenging lossmaking

businesses and questionable operating models. Risks appear to be in businesses

that are not inherently generating free cash flow or where there is too much

reliance on funding from suppliers or customers. The enemy of genuine growth

has been easy money, allowing ailing incumbent businesses to borrow and acquire

as they face competition from innovative new entrants.

The Managers' approach to stockpicking emphasises strong market positions and

pricing power. Even as the economy slows, growth areas include energy

efficiency, sustainability and online security. Some disruptive new business

models in traditional sectors have a long growth runway and are not highly

rated. They are likely to continue to take market share even as the UK economy

faces the prospect of recession.

Outlook

The portfolio emphasises exposure to businesses with strong competitive

positions and potential for organic growth. It also includes investments with

recovery potential.

Your Fund remains fully invested with some additional gearing.

Market

Sector analysis* % Listing* % Capitalisation %

*

Industrials 22.8 Main Market 60.1 Small 54.9

Information 22.5 AIM 39.9 Mid 25.5

Technology 15.6 Other - Large 19.6

Consumer 10.7

Discretionary 9.9

Communication 8.1

Services 5.7

Financials 3.6

Healthcare 1.1

Real Estate

Consumer Staples

Materials

*Analysis is of gross exposure

INVESTMENT PORTFOLIO

as at 31 March 2022

Market Market

Exposure Exposure

2022 % of 2021

Stock £000 Net Assets £000

Alpha Financial 378 5.6 258

Markets

Watches of 319 4.7 185

Switzerland

Group*

4Imprint Group 266 3.9 232

Dechra 243 3.6 205

Pharmaceuticals

Unite Group 233 3.6 214

Kape 204 3.0 113

Technologies

Hilton Food 182 2.7 158

Group

FDM Group 175 2.6 166

Holdings

Kin and Carta* 163 2.4 114

Keystone Law 157 2.3 153

Group

Ten largest 2,320 34.4

investments

Experian 148 2.2 125

Gamma 147 2.2 177

Communications

Rentokil 146 2.2 135

Initial

Impax Asset 140 2.1 109

Management

Group

JD Sports 139 2.1 155

Fashion*

XP Power 138 2.0 187

Beazley Group 132 1.9 110

Jet2 131 1.9 144

Computacenter 123 1.8 99

Libertine 114 1.7 -

Twenty largest 3,678 54.5

investments

Kainos Group 113 1.7 128

LondonMetric 110 1.6 79

Property

Marlowe 109 1.6 -

Games Workshop 105 1.6 144

Group

Oxford 105 1.5 95

Instruments

Entain* 103 1.5 -

Reach 101 1.5 119

Instem 99 1.5 87

Ashtead Group 99 1.5 89

Molten Ventures 97 1.4 -

Thirty largest 4,719 69.9

investments

Other 2,825 41.9

investments (47

holdings)

Total 7,544 111.8

investments

CFD positions (1,136) (16.8)

CFD unrealised - -

gains

Net current 337 5

assets

Net assets 6,745

100.0

*Includes CFDs.

Market exposure for equity investments held is the same as fair value and for

CFDs held is the market value of the underlying shares to which the portfolio

is exposed via the contract. The investment portfolio is grossed up to include

CFDs and the net CFD position is then deducted in arriving at the net asset

total. Further information is given in note 6 to the Financial Statements. A

full portfolio listing as at 31 March 2022 is detailed on the website.

PRINCIPAL RISKS AND UNCERTAINTIES

The Directors carry out a robust assessment of the Company's emerging and

principal risks including reviewing the policies implemented for identifying

and managing the principal risks faced by the Fund.

Many of the Fund's investments are in small companies and may be seen as

carrying a higher degree of risk than their larger counterparts. These risks

are mitigated through portfolio diversification, in-depth analysis, the

experience of the Manager and a rigorous internal control culture. Further

information on the internal controls operated for the Fund is detailed in the

Report of the Directors.

The principal risks facing the Fund relate to the investment in financial

instruments and include market, liquidity, credit and interest rate risk. An

explanation of these risks and how they are mitigated is explained in note 10

to the financial statements. Additional risks faced by the Fund are summarised

below.

The Board considers the COVID-19 pandemic, the geopolitical risks associated

with the conflict between Russia and Ukraine and rising inflation to be factors

which exacerbate existing risk, rather than new emerging risks. Their impact

is considered within the relevant risks.

Investment strategy - The risk that an inappropriate investment strategy may

lead to the Fund underperforming its comparator, for example in terms of stock

selection, asset allocation or gearing. The Board has given the Manager a

clearly defined investment mandate which incorporates various risk limits

regarding levels of borrowing and the use of derivatives. The Manager invests

in a diversified portfolio of holdings and monitors performance with respect to

the comparator. The Board regularly reviews the Fund's investment mandate and

long term strategy.

Discount - The risk that a disproportionate widening of discount in comparison

to the Fund's peers may result in loss of value for shareholders. The discount

varies depending upon performance, market sentiment and investor appetite. The

Board regularly reviews the discount and the Fund operates a share buy-back

programme.

Accounting, Legal and Regulatory - Failure to comply with applicable legal and

regulatory requirements could lead to a suspension of the Fund's shares, fines

or a qualified audit report. In order to qualify as an investment trust the

Fund must comply with section 1158 of the Corporation Tax Act 2010 ("CTA").

Failure to do so may result in the Fund losing investment trust status and

being subject to Corporation Tax on realised gains within the Fund's

portfolio. The Manager monitors movements in investments, income and

expenditure to ensure compliance with the provisions contained in section 1158.

Breaches of other regulations, including the Companies Act 2006, the Listing

Rules of the UK Listing Authority or the Disclosure and Transparency Rules of

the UK Listing Authority, could lead to regulatory and reputational damage. The

Board relies on the Manager and its professional advisers to ensure compliance

with section 1158 CTA, Companies Act 2006 and United Kingdom Listing Authority

Rules.

Operational - The risk of loss resulting from inadequate or failed internal

processes, people and systems or from external events. In common with most

other Investment Trusts, the Fund has no employees and relies upon the services

provided by third parties. The Manager has comprehensive internal controls and

processes in place to mitigate operational risks. Risk controls are monitored

by their assigned owner with oversight from the Manager's risk and compliance

function as part of the Manager's risk & control framework, which is reviewed

at least annually.

Corporate Governance and Shareholder Relations - Details of the Fund's

compliance with corporate governance best practice, including information on

relations with shareholders, are set out in the Directors' Statement on

Corporate Governance.

Financial - The Fund's investment activities expose it to a variety of

financial risks including market, liquidity, credit and interest rate risk.

These risks are explained in note 10 to the financial statements. The Board

seeks to mitigate and manage these risks through continuous review, policy

setting and enforcement of contractual obligations. The Board receives both

formal and informal reports from the Manager and third party service providers

addressing these risks. The Board believes the Fund has a relatively low risk

profile as it has a simple capital structure; invests principally in UK quoted

companies; does not use derivatives other than CFDs and uses well established

and creditworthy counterparties.

The capital structure comprises only ordinary shares that rank equally. Each

share carries one vote at general meetings.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors consider that the Annual Report and Financial Statements, taken

as a whole, are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Fund's performance, business model and

strategy.

The Directors each confirm to the best of their knowledge that:

. the financial statements, prepared in accordance with the applicable

accounting standards, give a true and fair view of the assets, liabilities,

financial position and gain or loss of the Fund and;

. the Strategic Report includes a fair review of the development and

performance of the business and the position of the Fund together with a

description of the principal risks and uncertainties that it faces.

By Order of the Board

Peter Dicks

Chairman

20 July 2022

Income statement

for the year to 31 March 2022

Notes Revenue Capital Total

£000 £000 £000

Net loss on investments at fair value 6 - (641) (641)

Income 1 94 - 94

Investment management fees 2 - (61) (61)

Other expenses 3 (127) - (127)

Loss before finance costs and taxation (33) (702) (735)

Finance costs (14) - (14)

Loss on ordinary activities before taxation (47) (702) (749)

Taxation 4 - - -

Loss attributable to ordinary shareholders (47) (702) (749)

Loss per Ordinary Share 5 (0.78)p (11.71)p (12.49)p

for the year to 31 March 2021

Notes Revenue Capital Total

£000 £000 £000

Net loss on investments at fair value 6 - 2,743 2,743

Income 1 51 - 51

Investment management fees 2 - (48) (48)

Other expenses 3 (144) - (144)

(Loss)/gain before finance costs and (93) 2,695 2,602

taxation

Finance costs (17) - (17)

(Loss)/gain on ordinary activities before (110) 2,695 2,585

taxation

Taxation 4 - - -

(Loss)/gain attributable to ordinary

shareholders (110) 2,695 2,585

(Loss)/gain per Ordinary Share 5 (1.83)p 44.95p 43.12p

The Total column of this statement is the profit and loss account of the Fund.

All revenue and capital items are derived from continuing operations. No

operations were acquired or discontinued in the year. A Statement of

Comprehensive Income is not required as all gains and losses of the Fund have

been reflected in the above statement.

Balance sheet

as at 31 March 2022

Notes 2022 2021

£000 £000

Fixed Assets

Investments at fair value through profit or loss 6 6,408 7,598

Current Assets

Debtors 7 720 107

Cash at bank and on deposit 53 -

Total current assets 773 107

Creditors: amounts falling due within one year 8 (436) (211)

Net current (liabilities)/assets 337 (104)

Total assets less current liabilities 6,745 7,494

Capital and Reserves

Share capital 9 300 300

Share premium 314 314

Special reserve 5,136 5,136

Capital redemption reserve 27 27

Capital reserve 1,501 2,203

Revenue reserve (533) (486)

Equity shareholders' funds 6,745 7,494

Net asset value per Ordinary Share 5 112.51p 125.00p

Approved and authorised for issue by the Board of Directors on 20 July 2022 and

signed on its behalf

by Peter Dicks, Chairman.

Statement of Changes in Equity

for the year to 31 March 2022

Capital

Share Share Special redemption Capital Revenue

capital premium reserve reserve reserve reserve Total

£000 £000 £000* £000 £000 £000* £000

As at 1 April 300 314 5,136 27 2,203 (486) 7,494

2021

Loss attributable

to shareholders - - - - (702) (47) (749)

As at 31 March 300 314 5,136 27 1,501 (533) 6,745

2022

for the year to 31 March 2021

Capital

Share Share Special redemption Capital Revenue

capital premium reserve reserve reserve reserve Total

£000 £000 £000* £000 £000 £000* £000

As at 1 April 300 314 5,136 27 (492) (376) 4,909

2020

Loss attributable

to shareholders - - - - 2,695 (110) 2,585

As at 31 March 300 314 5,136 27 2,203 (486) 7,494

2021

*Distributable reserves at 31 March 2022 were £4,603,000 (2021: £4,650,000).

Accounting policies

Basis of preparation

The Financial Statements are prepared under the historical cost convention,

modified to include the revaluation of fixed asset investments which are

recorded at fair value, in accordance with FRS 102, the "Financial Reporting

Standard applicable in the UK and Republic of Ireland" and under the AIC's

Statement of Recommended Practice "Financial Statements of Investment Trust

Companies and Venture Capital Trusts" (SORP) issued in April 2021. The

Directors have also prepared the Financial Statements on a going concern

basis and have a reasonable expectation that the Company has adequate resources

to continue in operational existence for at least twelve months from the date

of approval of these Financial Statements. In making their assessment the

Directors have reviewed income and expenditure projections, reviewed the

liquidity of the investment portfolio and considered the Company's ability to

meet liabilities as they fall due. This conclusion also takes in to account the

Directors' assessment of the continuing risks arising from COVID-19. The

Company is exempt from presenting a Cash Flow Statement as a Statement of

Changes in Equity is presented and substantially all of the Company's

investment are highly liquid and are carried at market value.

Significant judgements and estimates

Preparation of financial statements can require management to make significant

judgements and estimates. There are no significant judgements or sources of

estimation uncertainty the Board considers need to be disclosed.

Income

Dividend income is included in the Income Statement on an ex-dividend basis and

includes dividends on both direct equity investments and synthetic equity

holdings via Contracts for Differences. Special dividends are recorded on an

ex-dividend basis and allocated to revenue or capital in line with the

underlying commercial circumstances of the dividend payment. Interest

receivable on bank balances is included in the Income Statement on an accruals

basis.

Expenses and interest

Expenses and interest payable are dealt with on an accruals basis. All expenses

other than investment management fees are charged to revenue.

Investment management fees

Investment management fees are allocated 100 per cent to capital. The

allocation is in line with the Board's expected long-term return from the

investment portfolio. The terms of the investment management agreement are

detailed in the Report of the Directors.

Taxation

Current tax is provided at the amounts expected to be paid or received.

Deferred taxation is recognised in respect of all timing differences that have

originated but not reversed at the balance sheet date where transactions or

events that result in an obligation to pay more or a right to pay less tax in

the future have occurred at the balance sheet date measured on an undiscounted

basis and based on enacted or substantively enacted tax rates. This is subject

to deferred tax assets only being recognised if it is considered probable that

there will be suitable profits from which the future reversal of the underlying

timing differences can be deducted. Timing differences are differences arising

between the taxable profits and the results as stated in the financial

statements which are capable of reversal in one or more subsequent periods.

Investments

The investments have been categorised as "fair value through profit or loss".

All investments are held at fair value. For listed investments this is deemed

to be at bid prices. A Contract for Difference (CFD) is a synthetic equity

comprising of a future contract to either purchase or sell a specific asset at

a specified future date for a specified price. The Company can hold long and

short positions in CFDs which are held at fair value, based on the bid prices

of the underlying securities in respect of long positions, and the offer prices

of the underlying securities in respect of short positions. Profits and losses

on CFDs are recognised in the Income Statement as capital gains or losses on

investments at fair value. Dividends and interest on CFDs are included in the

revenue income. The year end fair value of CFD positions which are assets is

included in fixed asset investments, whilst the year end fair value of CFD

positions which are liabilities is included within current liabilities in Note

8. Balances with brokers in respect of margin calls are included within

debtors in Note 7. Unlisted investments are valued at fair value based on the

latest available information and with reference to International Private Equity

and Venture Capital Valuation Guidelines.

All changes in fair value and transaction costs on the acquisition and disposal

of portfolio investments are included in the Income Statement as a capital

item. Purchases and sales of investments are accounted for on trade date.

Financial instruments

In addition to the investment transactions described above, basic financial

instruments are entered into that result in recognition of other financial

assets and liabilities, such as investment income due but not received, other

debtors and other creditors. These financial instruments are receivable and

payable within one year and are stated at cost less impairment.

Foreign currency translation

Transactions involving foreign currencies are converted at the rate ruling as

at the date of the transaction. Sterling is the functional currency of the Fund

and all foreign currency monetary assets and liabilities are retranslated into

Sterling at the rate ruling on the financial reporting date.

Capital reserve

Gains and losses on realisations of fixed asset investments, and transactions

costs, together with appropriate exchange differences, are dealt with in this

reserve. All investment management fees, together with any tax relief, are also

taken to this reserve. Increases and decreases in the valuation of fixed asset

investments are recognised in this reserve.

Special reserve

On 29 June 2001, the court approved the redesignation of the Share Premium

Account, at that date, as a fully distributable Special Reserve.

Capital redemption reserve.

Nominal value of own shares bought back.

Revenue reserve

Retained revenue profits and losses, being a fully distributable reserve.

Share Capital

Represents, allotted, issued and fully paid up shares of 5p each.

Share Premium

Value received for issuing shares in excess of the nominal value of 5p per

share.

Notes to the financial statements

1. Income

2022 2021

£000 £000

Income from shares and securities

- dividends 94 43

- interest - 8

94 51

2. Investment Management Fees

Investment Management Fees 61 48

3. Other expenses

Revenue

General expenses 69 82

Directors' fees 25 25

Auditor's remuneration 33 37

127 144

4. Taxation

Current taxation - -

Deferred taxation - -

Total taxation charge for the year - -

The tax assessed for the year is different from the standard small company rate

of corporation tax in the UK. The differences are noted below:

Gain/(loss) on ordinary activities before taxation (749) 2,585

Corporation tax (19%, 2021 - 19%) (142) 491

Effects of:

Non taxable UK dividends (14) (5)

Gains/Losses on CFD 60 (31)

Non taxable investment gains/(losses) in capital 62 (491)

Non taxable overseas dividends (1) -

Movement in deferred tax rate on excess management (11) -

charges

Movement in unutilised management expenses and NTLR 46 36

deficits

Total taxation charge for the year - -

At 31 March 2021, the Fund had unutilised management expenses and non trade

loan relationship ("NTLR") deficits of £1,637,000 (2021 - £1,439,000).

A deferred tax asset of £409,000 (2021 - £275,000) has not been recognised on

unutilised management expenses as it is unlikely that there would be suitable

taxable profits from which the future reversal of the deferred tax asset could

be deducted.

5. Returns per share

Returns per share are based on a weighted average of 5,995,000 (2021 -

5,999,000) ordinary shares in issue during the year.

Total return per share is based on the total loss for the year of £749,000

(2021 - gain of £2,585,000).

Capital return per share is based on the net capital loss for the year of £

702,000 (2021 - gain of £2,695,000).

Revenue return per share is based on the revenue loss after taxation for the

year of £47,000 (2021 - loss of £110,000).

The net asset value per share is based on the net assets of the Fund of £

6,745,000 (2021 - £7,494,000) divided by the number of shares in issue at the

year end as shown in note 9.

6. Investments at fair value through profit or loss

2022 2021

£000 £000

Listed investments and CFDs 6,408 7,598

Unlisted investments - -

Valuation as at end of year 6,408 7,598

Listed Unlisted Total Total

£000 £000 £000 £000

Opening book cost 4,928 140 5,068 4,041

Opening investment holding gains/(losses) 2,670 (140) 2,530 422

Opening fair value* 7,598 - 7,598 4,463

Analysis of transactions made during the

year

Purchase at cost 1,374 - 1,374 3,271

Sales proceeds received** (2,237) - (2,237) (2,716)

(Losses)/gain on investments*** (327) - (327) 2,580

Closing fair value 6,408 - 6,408 7,598

Closing book cost 4,953 140 5,093 5,068

Closing investment holding gains/(losses) 1,455 (140) 1,315 2,530

Closing fair value 6,408 - 6,408 7,598

(Losses)/gains on investments (327) - (327) 2,580

Movement in CFD current liability (314) - (314) 163

Net gains/(losses) on investments at fair (641) - (641) 2,743

value

The transaction costs in acquiring investments during the year were £2,000

(2021: £8,000). For disposals, transaction costs were £2,000 (2021: £3,000).

The company received £2,237,000 (2021 £2,716,000) from investments sold in the

year. The book cost of these investments when they were purchased was £

1,349,000 (2021 £2,244,000). These investments have been revalued over time

and, until they were sold, any unrealised gains/losses were included in the

fair value of the investments.

* Opening fair value of £7,598,000 includes £298,000 of CFD gains

** Sale proceeds received of £2,237,000 includes a balance of £586,000 in

relation to CFDs.

*** (Losses)/gains on investments of (£327,000) includes a balance of £586,000

in relation to gains on CFDs

7. Debtors

2022 2021

£000 £000

Investment income due but not received 6 8

Amounts receivable relating to CFDs - being cash held 699 1

at Broker

Prepayments 2 11

Taxation 13 5

Other debtors - 82

720 107

8. Creditors: amounts falling due within one year

2022 2021

£000 £000

Cash balances - 79

Amounts due relating to CFDs - being losses on CFD 375 61

contracts

Due to SVM Asset Management Limited 13 14

Other creditors 48 57

436 211

9. Share capital

Allotted, issued and fully paid

6,005,000 ordinary 5p shares (2021 - 6,005,000) 300 300

As at the date of publication of this document, there was no change in the

issued share capital and each ordinary share carries one vote, other than the

10,000 shares held in treasury which carry no voting rights.

During the year no Ordinary Shares were brought back.

10. Financial instruments

Risk Management

The Fund's investment policy is to hold investments, CFDs and cash balances

with gearing being provided by the use of CFDs and a bank overdraft. 100%

(2021: 99.2%) of the Fund's net asset value is held in investments that are

denominated in Sterling and are carried at fair value. Where appropriate,

gearing can be utilised in order to enhance net asset value. It does not invest

in short dated fixed rate securities other than where it has substantial cash

resources. Fixed rate securities held at 31 March 20221 were valued at £nil

(2021 - £nil). Investments, which comprise principally equity investments, are

valued as detailed in the accounting policies.

The Fund only operates short term gearing, which is limited to 30 per cent of

gross assets and is undertaken through an unsecured variable rate bank

overdraft and the use of CFDs. The comparator rate which determines the

interest received on Sterling cash balances or paid on bank overdrafts is the

bank base rate which was 0.75% as at 31 March 2022 (2021 - 0.1%). There are no

undrawn committed borrowing facilities. Short-term debtors and creditors are

excluded from disclosure.

The Fund does not hold any (2021: 0.8%) of the total net asset value in

investments with direct foreign currency exposure and is consequently not

currency hedged. Financial information on the investment portfolio is detailed

in note 6.

The major risks inherent within the Fund are market risk, liquidity risk,

credit risk and interest rate risk. It has an established environment for the

management of these risks which are continually monitored by the Manager.

Appropriate guidelines for the management of its financial instruments and

gearing have been established by the Board of Directors. It has no foreign

currency assets and therefore does not use currency hedging. It does not use

derivatives within the portfolio with the exception of CFDs.

Market risk

The risk that the Fund may suffer a loss arising from adverse movements in the

fair value or future cash flows of an investment. Market risks include changes

to market prices, interest rates and currency movements. The Fund invests in a

diversified portfolio of holdings covering a range of sectors. The Manager

conducts continuing analysis of holdings and their market prices with an

objective of maximising returns to shareholders. Asset allocation, stock

selection and market movements are reported to the Board on a regular basis.

Liquidity risk

The risk that the Fund may encounter difficultly in meeting obligations

associated with financial liabilities. The Fund is permitted to invest in

shares traded on AIM or similar markets; these tend to be in companies that are

smaller in size and by their nature less liquid than larger companies. The

Manager conducts continuing analysis of the liquidity profile of the portfolio

and the Fund maintains an overdraft facility to ensure that it is not a forced

seller of investments.

Credit risk

The risk that the counterparty to a transaction fails to discharge its

obligation or commitment to the transaction resulting in a loss to the Fund.

Investment transactions are entered into using brokers that are on the

Manager's approved list, the credit ratings of which are reviewed periodically

in addition to an annual review by the Manager's board of directors. The

Fund's principal bankers are State Street Bank & Trust Company, the main broker

for CFDs is UBS and other approved execution broker organisations authorised by

the Financial Conduct Authority.

Interest rate risk

The risk that interest rate movements may affect the level of income receivable

on cash deposits. At most times the Fund operates with relatively low levels

of bank gearing, this has and will only be increased where an opportunity

exists to substantially add to the net asset value performance.

11. Post balance sheet events

The Manager advised the Board on 21 June 2022 that they had accepted an offer,

conditional on FCA approval, to be acquired by AssetCo plc, an AIM listed asset

management company. The portfolio managers of the Company will continue in

their current roles at the Managers.

12. The financial information contained within this announcement does not

constitute statutory accounts as defined in sections 434 and 435 of the

Companies Act 2006. The results for the years ended 31 March 2022 and 2021 are

an abridged version of the statutory accounts for those years. The Auditor has

reported on the 2022 and 2021 accounts, their reports for both years were

unqualified and did not contain a statement under section 498 of the Companies

Act 2006. Statutory accounts for 2021 have been filed with the Registrar of

Companies and those for 2022 will be delivered in due course.

13. The Annual Report and Accounts for the year ended 31 March 2022 will

be mailed to shareholders shortly and copies will be available from the

Manager's website www.svmonline.co.uk and the Fund's registered office at 7

Castle Street, Edinburgh, EH2 3AH.

The Annual General Meeting of the Fund will be held at 9.00 a.m. on Friday 9

September 2022 at 7 Castle Street, Edinburgh, EH2 3AH.

For further information, please contact:

Colin McLean SVM Asset Management

0131 226 6699

Roland Cross Four

Broadgate 0207 726 6111

20 July 2022

END

(END) Dow Jones Newswires

July 22, 2022 05:51 ET (09:51 GMT)

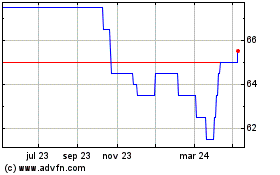

Svm Uk Emerging (LSE:SVM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Svm Uk Emerging (LSE:SVM)

Gráfica de Acción Histórica

De May 2023 a May 2024