TIDMTHR

RNS Number : 1283X

Thor Energy PLC

18 December 2023

18 December 2023

Thor Energy PLC

("Thor" or the "Company")

Alligator Energy Invests into South Australian In-Situ Recovery

Copper

The directors of Thor Energy Plc ("Thor") (AIM, ASX: THR, OTCQB:

THORF) are pleased to announce a strategic investment by Alligator

Energy Limited ("Alligator") into EnviroCopper Ltd ("ECL") to

further develop In-Situ Recovery ("ISR") copper projects. Thor

currently holds a 30% equity interest in ECL.

Investment Highlights:

-- Alligator will make an initial investment of A$0.9m for 7.8%

of ECL, with the exclusive option to make further staged strategic

investments to increase its ownership in ECL to 50.1%.

-- ECL is currently advancing ISR trials for environmentally

sustainable copper extraction at its flagship Kapunda copper

project and has similar plans at its Alford West copper project to

help meet copper demand for the green energy transition ( Figure 1

).

-- BHP Ltd (previously OZ Minerals) continues to fund part of

ECL's field investigations, including a Site Environmental

Lixiviant Trial ("SELT") of Copper ISR at Kapunda (AIM/ASX: 9

August 2022).

-- ISR has been successfully (and economically) used to extract

copper in several projects both in Australia and the US. It offers

distinct economic advantages and environmental benefits over

conventional open pit/crush/heap leach for shallow oxide copper

projects.

-- ECL's experienced ISR team has undertaken significant

research and exploration funded under a Commonwealth Govt CRC-P

grant of A$2.8m, for R&D and approvals for test work into ISR

of shallow fractured rock aquifer hosted oxide copper deposits.

-- A technical advisory committee will be formed, enabling

Alligator to assist ECL with its planned In-Situ trial work across

all projects and an ability to jointly apply any intellectual

property ("IP") that is developed.

-- The South Australian Government's copper strategy of

targeting 1Mtpa of copper production per annum provides a positive

backdrop to the potential of ISR copper test work.

-- Following the initial investment by Alligator of A$0.9m, and

also taking into account the dilution deriving from the

announcement also made this morning of the agreement by ECL with

Andromeda Metals Ltd, Thor's 30% holding in ECL will be diluted to

26.5%.

Nicole Galloway Warland, Managing Director of Thor Energy,

commented:

"The A$0.9m investment by Alligator Energy into ECL justifies

the decision made by Thor in its early investment of A$1.0m in

return for the initial 30% equity stake Thor had in ECL. Thor has

every confidence that Alligator will not only provide ECL with the

financial resources to advance the Alford West copper ISR project,

but also provide some key technical support during the resource

definition and approvals process.

"Thor is looking forward to working in partnership with

Alligator Energy in developing the Alford West Copper ISR Project,

as well as investigating other potential copper ISR projects in

Australia. We look forward to updating the market and our

shareholders with further developments."

Greg Hall, CEO of Alligator Energy commented:

"Alligator has been evaluating options for potential energy

minerals opportunities both within its existing portfolio

(exploration) and externally, as a potential second future business

stream along with its significant uranium portfolio. The investment

into EnviroCopper Ltd supports this, along with significant

synergies to our existing in-house ISR uranium expertise. It

provides the opportunity for AGE to be invested in and involved in

future copper demand for the green energy transition through the

significant oxide copper resources in these projects, and with

wider potential within South Australia and Australia.

"ECL has approvals in place to proceed with initial copper ISR

trials at Kapunda, and Alligator commends ECL's strong inroads into

exploration, resource and extraction modelling, bench scale test

work, and community engagement around its trial work now underway

at Kapunda. The fact that ECL was able to attract a non-dilutive

A$2.5m funding commitment from OZ Minerals (now BHP Ltd)

demonstrates the growing interest in ISR as a credible and

environmentally friendly technique to economically extract copper

from the right geological setting.

"The ECL team's expertise augments our own, with our team also

having substantial downstream operational experience which will

complement ECL. As ECL has its own ISR technical team, this

investment will not distract from Alligator's increasing pace of

work on the Samphire ISR Uranium Project as we advance into a field

recovery trial and commence a Feasibility Study through 2024.

"Alligator views ECL as the perfect vehicle to participate in

the potential of copper ISR in Australia."

Leon Faulkner, Managing Director of EnviroCopper Limited

commented:

"EnviroCopper welcomes Alligator's investment strategy, which

further supports our growth in smarter, lower impact,

environmentally and therefore socially acceptable exploration and

mining developments. Low-footprint exploration for copper and other

energy metals is vital for the vertical integration of the green

energy transition. The synergies between both companies will

accelerate our projects with additional expertise."

Figure 1: Copper ISR Projects, South Australia

KEY COMMERCIAL TERMS

On 17 December 2023, Alligator and ECL entered into a

Subscription Agreement and Shareholders' Agreement, governing

Alligator's investment in ECL.

Alligator has committed to an initial investment of A$0.9m by

subscribing to a 7.8% shareholding in ECL and following this,

Alligator has an option to sole fund ECL over an envisaged circa

4-year period by investing a further A$10.1m to A$11.7m (in total)

across 4 additional stages to achieve a 50.1% interest in ECL. [1]

ECL's field trial results and programme progress will be a key

factor in Alligator Energy's determination of future staged

investments.

COMMITTED INVESTMENT:

-- Initial Investment: Alligator is committed to an initial

investment of A$0.9m for a 7.8% shareholding in ECL.

OPTIONAL FUTURE INVESTMENT:

-- Stage 1 Investment: Following the Initial Investment, in

mid-2024, Alligator may elect to invest a further A$1.1m to

increase its interest in ECL to 15.6%.

-- Stage 2A Investment: Following a review of the Stage 1

Investment and upon receipt of a satisfactory Stage 2A budget

programme from ECL, Alligator may elect to invest a further A$2.0m

to increase its interest in ECL to 26.7%.

-- Stage 2B & 2C Investment: Following a review of the Stage

2A Investment and upon receipt of satisfactory Stage 2B & 2C

budget programmes from ECL, Alligator may elect to invest between

A$7.0m and A$8.6m across two equal tranches (Alligator not

obligated to fund both tranches) to increase its interest in ECL to

50.1% (1) .

ELECTION NOT TO FURTHER INVEST:

-- Working Capital Facility: Should Alligator elect not to make

the Stage 1 Investment, it will offer a 6-month working capital

facility to ECL up to a maximum of A$450,000 to allow for

alternative funding sources to be pursued. Under this scenario, ECL

shares will be issued to Alligator for the amount of the working

capital facility at the same valuation as the Initial

Investment.

FURTHER ISR COPPER PROJECTS:

-- First right of refusal: ECL will have the first right of

refusal on any additional ISR copper project opportunities.

The Shareholders' Agreement contains other customary provisions

for a transaction of this nature including, but not limited to, ECL

Board observer and representation rights granted to Alligator,

budgeting requirements, and equity top up rights. ECL and Alligator

Energy will be able to share information, focused principally

around ISR, for the purposes of developing their respective

business and will grant each other a royalty free, irrevocable, and

perpetual licence to use any developed IP internally.

At the end of the sole funding period, an approach has been

agreed for either a consolidation of ECL or to pursue a process to

realise value for all ECL shareholders.

The Subscription Agreement and Shareholders' Agreement are

cross-conditional on each other as well as the completion of ECL's

Alford West consolidation transaction with Andromeda Metals

(ASX/AIM: 18 December 2023).

The Board of Thor Energy Plc has approved this announcement and

authorised its release.

For further information, please contact:

Thor Energy PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324

1935

Ray Ridge, CFO & Company Secretary

Tel: +61 (8) 7324

1935

WH Ireland Limited (Nominated Adviser and Tel: +44 (0) 207

Joint Broker) 220 1666

Antonio Bossi / Darshan Patel / Isaac Hooper

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483

413 500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Shivantha Thambirajah / Tel: +44 (0) 20

Bessie Elliot 3004 9512

Updates on the Company's activities are regularly posted on

Thor's website: https://thorenergyplc.com which includes a facility

to register to receive these updates by email, and on the Company's

X page @thorenergyplc

About Thor Energy Plc

The Company is focused on uranium and energy metals that are

crucial in the shift to a 'green' energy economy. Thor has a number

of highly prospective projects that give shareholders exposure to

uranium, nickel, copper, lithium and gold. Our projects are located

in Australia and the USA.

Thor holds 100% interest in three uranium and vanadium projects

(Wedding Bell, Radium Mountain and Vanadium King) in the Uravan

Belt in Colorado and Utah, USA with historical high-grade uranium

and vanadium drilling and production results.

At Alford East in South Australia, Thor has earnt an 80%

interest in oxide copper deposits considered amenable to extraction

via In Situ Recovery techniques (ISR). In January 2021, Thor

announced an Inferred Mineral Resource Estimate(1). Thor also holds

a 26.5% interest in Australian copper development company

EnviroCopper Limited, which in turn holds rights to earn up to a

75% interest in the mineral rights and claims over the resource on

the portion of the historic Kapunda copper mine and the Alford West

copper project, both situated in South Australia, and both

considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020. Thor

executed a A$8m Farm-in and Funding Agreement with Investigator

Resources Limited (ASX: IVR) to accelerate exploration at the

Molyhil Project on 24 November 2022.(6)

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits. Thor's interest in the

Bonya tenement EL29701 is planned to be divested as part of the

Farm-in and Funding agreement with Investigator Resources

Limited.(6)

Thor owns 100% of the Ragged Range Project, comprising 92 km(2)

of exploration licences with highly encouraging early-stage gold

and nickel results in the Pilbara region of Western Australia.

Notes

(1)

https://thorenergyplc.com/investor-updates/maiden-copper-gold-mineral-resource-estimate-alford-east-copper-gold-isr-project/

(2)

www.thorenergyplc.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thorenergyplc.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

https://thorenergyplc.com/investor-updates/molyhil-project-mineral-resource-estimate-updated/

(5)

www.thorenergyplc.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

(6)

https://thorenergyplc.com/wp-content/uploads/2022/11/20221124-8M-Farm-in-Funding-Agreement.pd

[1] In November 2022, OZ Minerals (now BHP Ltd) committed to a

non-dilutive research funding with ECL of $2.6 million over an

18-month period (funding partially complete) to pursue research

into the potential economic extraction of copper through ISR at the

Kapunda Project. As such, the total maximum potential investment

amount required by Alligator to reach 50.1% is dependent pro-rata

on how much of the remaining BHP Ltd investment is received by

ECL.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQVLBFXLLZFBL

(END) Dow Jones Newswires

December 18, 2023 02:30 ET (07:30 GMT)

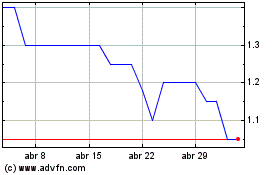

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025