TIDMWRKS

RNS Number : 8618S

TheWorks.co.uk PLC

09 November 2023

9 November 2023

TheWorks.co.uk plc

("The Works", the "Company" or the "Group")

Half-year trading update for the 26 weeks ended 29 October

2023

The Works, the multi-channel value retailer of arts, crafts,

toys, books and stationery, announces an update on trading for the

26 weeks ended 29 October 2023 (the "Period" or "H1 FY24").

Trading update

In the first half of FY24 The Works delivered total sales growth

of 3.4% and a total LFL sales increase of 1.6%. Store LFLs

increased by 3.5%, whilst online sales declined by 12.2%.

The macro-economic environment was challenging throughout the

period, characterised by high inflation and low consumer

confidence. In the nine weeks since our previous update, consumer

demand has softened further and, combined with unseasonable weather

conditions, this has caused reduced footfall.(1) We have seen a

slowdown in the rate of store LFL sales growth as a result,

particularly in October although, conversely, the online LFL has

improved.

Mindful of this trading environment, we have reviewed all areas

of activity, including implementing additional promotions and

taking mitigating action to reduce costs where we can, whilst also

gearing up to deliver excellent value for customers this

Christmas.

Outlook

As always, trading in the six weeks between now and Christmas

will have a significant bearing on the overall result for the

financial year. Last year, consumers left Christmas shopping until

very late in the season, and we expect that sales may follow a

similar pattern this year. As such, any forecast prepared at this

stage includes a high degree of uncertainty.

We anticipate that trading conditions during H2 FY24 will remain

challenging and consumer spend will be subdued , resulting in the

continuation of the increased levels of discounting recently seen

across the sector. To ensure that we offer the best value to our

customers, we expect to maintain a higher level of promotional

activity than envisaged at the outset of the year. We will also

continue to take action to reduce costs.

Taking into account the level of uncertainty with regard to

sales, and our expectation that it will be necessary to continue to

maintain a higher than planned level of discounting to remain

competitive, we have revised our estimate of the likely full year

result for FY24, and now expect that the pre IFRS 16 Adjusted

EBITDA will be approximately GBP6.0m . (2)

Financial position

The Group had net bank borrowings of GBP2.5m at the Period end,

reflecting the build of stock prior to the peak trading season, and

the corresponding low point in cash levels. There was GBP17.5m of

headroom within our GBP20.0m bank facility.

CFO succession

It was announced at the Preliminary results on 30 August 2023

that Rosie Fordham, Head of Finance at The Works, would succeed

Steve Alldridge as CFO by the end of December 2023 following an

orderly handover process. We confirm that Rosie will assume the

position of CFO and join the Board of Directors on 31 December

2023.

Gavin Peck, Chief Executive Officer of The Works, commented:

"The first half of the year has been challenging for the retail

sector as cost-of-living pressures continued to weigh on

households. We have focused on delivering excellent value for our

customers, adapting as best we can to the tough trading conditions,

and I am proud of the way our colleagues have rallied together and

responded.

"Consumer sentiment softened towards the end of the period,

which resulted in early discounting across the sector and increased

uncertainty as we head into the Christmas period. Recognising the

competitiveness of the market we have responded with more

promotional activity, which we expect to continue as we approach

Christmas. Families will want to celebrate Christmas affordably and

our value proposition makes us an ideal choice for them.

"Market conditions remain challenging and given the level of

uncertainty in trading and forecasting we believe it is now prudent

to moderate our expectations for FY24. Despite this short-term

volatility, we believe that our 'better, not just bigger' strategy

has the potential to deliver profitable growth in the medium and

long-term."

Interim results notification

The results for H1 FY24 and an update on Christmas trading will

be announced on Thursday, 18 January 2024.

Enquiries: via Sanctuary

Counsel

The Works

Gavin Peck CEO

Steve Alldridge

CFO

Sanctuary Counsel | 020 7340 0395

Ben Ullmann | theworks@sanctuarycounsel.com

Rachel Miller |

Kitty Ryder

Footnotes

(1) For example, the BRC (British Retail Consortium) footfall

data for October, which reported a 5.7% year on year decline

in footfall, compared with a 2.9% year on year decline

in September ( link ).

(2) The Company compiled estimate of the market's expectation

for the FY24 pre IFRS 16 Adjusted EBITDA result prior to

this announcement was approximately GBP10.0m.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKFBNKBDBDDK

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

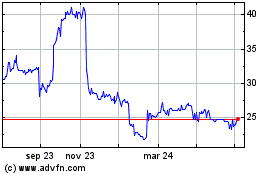

Theworks.co.uk (LSE:WRKS)

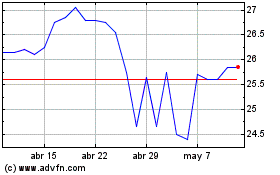

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Theworks.co.uk (LSE:WRKS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024