iPhone drives record September quarter revenue

Services revenue reaches new all-time high

Apple® today announced financial results for its fiscal 2024

fourth quarter ended September 28, 2024. The Company posted

quarterly revenue of $94.9 billion, up 6 percent year over year,

and quarterly diluted earnings per share of $0.97. Diluted earnings

per share was $1.64,1 up 12 percent year over year when excluding

the one-time charge recognized during the fourth quarter of 2024

related to the impact of the reversal of the European General

Court’s State Aid decision.

“Today Apple is reporting a new September quarter revenue record

of $94.9 billion, up 6 percent from a year ago,” said Tim Cook,

Apple’s CEO. “During the quarter, we were excited to announce our

best products yet, with the all-new iPhone 16 lineup, Apple Watch

Series 10, AirPods 4, and remarkable features for hearing health

and sleep apnea detection. And this week, we released our first set

of features for Apple Intelligence, which sets a new standard for

privacy in AI and supercharges our lineup heading into the holiday

season.”

“Our record business performance during the September quarter

drove nearly $27 billion in operating cash flow, allowing us to

return over $29 billion to our shareholders,” said Luca Maestri,

Apple’s CFO. “We are very pleased that our active installed base of

devices reached a new all-time high across all products and all

geographic segments, thanks to our high levels of customer

satisfaction and loyalty.”

Apple’s board of directors has declared a cash dividend of $0.25

per share of the Company’s common stock. The dividend is payable on

November 14, 2024 to shareholders of record as of the close of

business on November 11, 2024.

Apple will provide live streaming of its Q4 2024 financial

results conference call beginning at 2:00 p.m. PT on October 31,

2024 at apple.com/investor/earnings-call. The webcast will be

available for replay for approximately two weeks thereafter.

1. Non-GAAP measure. See the section

titled “Reconciliation of Non-GAAP to GAAP Results of Operations”

at the end of the accompanying financial statements.

Apple periodically provides information for investors on its

corporate website, apple.com, and its investor relations website,

investor.apple.com. This includes press releases and other

information about financial performance, reports filed or furnished

with the SEC, information on corporate governance, and details

related to its annual meeting of shareholders.

This press release contains forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements include without limitation

those about payment of the Company’s quarterly dividend and future

business plans. These statements involve risks and uncertainties,

and actual results may differ materially from any future results

expressed or implied by the forward-looking statements. Risks and

uncertainties include without limitation: effects of global and

regional economic conditions, including as a result of government

policies, geopolitical tensions, conflict, terrorism, natural

disasters, and public health issues; risks relating to the design,

manufacture, introduction, and transition of products and services

in highly competitive and rapidly changing markets, including from

reliance on third parties for components, technology,

manufacturing, applications, support, and content; risks relating

to information technology system failures, network disruptions, and

failure to protect, loss of, or unauthorized access to, or release

of, data; and effects of unfavorable legal proceedings, government

investigations, and complex and changing laws and regulations. More

information on these risks and other potential factors that could

affect the Company’s business, reputation, results of operations,

financial condition, and stock price is included in the Company’s

filings with the SEC, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the Company’s most recently

filed periodic reports on Form 10-K and Form 10-Q and subsequent

filings. The Company assumes no obligation to update any

forward-looking statements, which speak only as of the date they

are made.

Apple revolutionized personal technology with the introduction

of the Macintosh in 1984. Today, Apple leads the world in

innovation with iPhone, iPad, Mac, AirPods, Apple Watch, and Apple

Vision Pro. Apple’s six software platforms — iOS, iPadOS, macOS,

watchOS, visionOS, and tvOS — provide seamless experiences across

all Apple devices and empower people with breakthrough services

including the App Store, Apple Music, Apple Pay, iCloud, and Apple

TV+. Apple’s more than 150,000 employees are dedicated to making

the best products on earth and to leaving the world better than we

found it.

NOTE TO EDITORS: For additional information visit Apple Newsroom

(www.apple.com/newsroom), or email Apple’s Media Helpline at

media.help@apple.com.

© 2024 Apple Inc. All rights reserved. Apple and the Apple logo

are trademarks of Apple. Other company and product names may be

trademarks of their respective owners.

Apple Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited)

(In millions, except number of

shares, which are reflected in thousands, and per-share

amounts)

Three Months Ended

Twelve Months Ended

September 28,

2024

September 30,

2023

September 28,

2024

September 30,

2023

Net sales:

Products

$

69,958

$

67,184

$

294,866

$

298,085

Services

24,972

22,314

96,169

85,200

Total net sales (1)

94,930

89,498

391,035

383,285

Cost of sales:

Products

44,566

42,586

185,233

189,282

Services

6,485

6,485

25,119

24,855

Total cost of sales

51,051

49,071

210,352

214,137

Gross margin

43,879

40,427

180,683

169,148

Operating expenses:

Research and development

7,765

7,307

31,370

29,915

Selling, general and administrative

6,523

6,151

26,097

24,932

Total operating expenses

14,288

13,458

57,467

54,847

Operating income

29,591

26,969

123,216

114,301

Other income/(expense), net

19

29

269

(565

)

Income before provision for income

taxes

29,610

26,998

123,485

113,736

Provision for income taxes

14,874

4,042

29,749

16,741

Net income

$

14,736

$

22,956

$

93,736

$

96,995

Earnings per share:

Basic

$

0.97

$

1.47

$

6.11

$

6.16

Diluted

$

0.97

$

1.46

$

6.08

$

6.13

Shares used in computing earnings per

share:

Basic

15,171,990

15,599,434

15,343,783

15,744,231

Diluted

15,242,853

15,672,400

15,408,095

15,812,547

(1) Net sales by reportable segment:

Americas

$

41,664

$

40,115

$

167,045

$

162,560

Europe

24,924

22,463

101,328

94,294

Greater China

15,033

15,084

66,952

72,559

Japan

5,926

5,505

25,052

24,257

Rest of Asia Pacific

7,383

6,331

30,658

29,615

Total net sales

$

94,930

$

89,498

$

391,035

$

383,285

(1) Net sales by category:

iPhone

$

46,222

$

43,805

$

201,183

$

200,583

Mac

7,744

7,614

29,984

29,357

iPad

6,950

6,443

26,694

28,300

Wearables, Home and Accessories

9,042

9,322

37,005

39,845

Services

24,972

22,314

96,169

85,200

Total net sales

$

94,930

$

89,498

$

391,035

$

383,285

Apple Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(In millions, except number of

shares, which are reflected in thousands, and par value)

September 28,

2024

September 30,

2023

ASSETS:

Current assets:

Cash and cash equivalents

$

29,943

$

29,965

Marketable securities

35,228

31,590

Accounts receivable, net

33,410

29,508

Vendor non-trade receivables

32,833

31,477

Inventories

7,286

6,331

Other current assets

14,287

14,695

Total current assets

152,987

143,566

Non-current assets:

Marketable securities

91,479

100,544

Property, plant and equipment, net

45,680

43,715

Other non-current assets

74,834

64,758

Total non-current assets

211,993

209,017

Total assets

$

364,980

$

352,583

LIABILITIES AND SHAREHOLDERS’

EQUITY:

Current liabilities:

Accounts payable

$

68,960

$

62,611

Other current liabilities

78,304

58,829

Deferred revenue

8,249

8,061

Commercial paper

9,967

5,985

Term debt

10,912

9,822

Total current liabilities

176,392

145,308

Non-current liabilities:

Term debt

85,750

95,281

Other non-current liabilities

45,888

49,848

Total non-current liabilities

131,638

145,129

Total liabilities

308,030

290,437

Commitments and contingencies

Shareholders’ equity:

Common stock and additional paid-in

capital, $0.00001 par value: 50,400,000 shares authorized;

15,116,786 and 15,550,061 shares issued and outstanding,

respectively

83,276

73,812

Accumulated deficit

(19,154

)

(214

)

Accumulated other comprehensive loss

(7,172

)

(11,452

)

Total shareholders’ equity

56,950

62,146

Total liabilities and shareholders’

equity

$

364,980

$

352,583

Apple Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

Twelve Months Ended

September 28,

2024

September 30,

2023

Cash, cash equivalents, and restricted

cash and cash equivalents, beginning balances

$

30,737

$

24,977

Operating activities:

Net income

93,736

96,995

Adjustments to reconcile net income to

cash generated by operating activities:

Depreciation and amortization

11,445

11,519

Share-based compensation expense

11,688

10,833

Other

(2,266

)

(2,227

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(3,788

)

(1,688

)

Vendor non-trade receivables

(1,356

)

1,271

Inventories

(1,046

)

(1,618

)

Other current and non-current assets

(11,731

)

(5,684

)

Accounts payable

6,020

(1,889

)

Other current and non-current

liabilities

15,552

3,031

Cash generated by operating activities

118,254

110,543

Investing activities:

Purchases of marketable securities

(48,656

)

(29,513

)

Proceeds from maturities of marketable

securities

51,211

39,686

Proceeds from sales of marketable

securities

11,135

5,828

Payments for acquisition of property,

plant and equipment

(9,447

)

(10,959

)

Other

(1,308

)

(1,337

)

Cash generated by investing activities

2,935

3,705

Financing activities:

Payments for taxes related to net share

settlement of equity awards

(5,441

)

(5,431

)

Payments for dividends and dividend

equivalents

(15,234

)

(15,025

)

Repurchases of common stock

(94,949

)

(77,550

)

Proceeds from issuance of term debt,

net

—

5,228

Repayments of term debt

(9,958

)

(11,151

)

Proceeds from/(Repayments of) commercial

paper, net

3,960

(3,978

)

Other

(361

)

(581

)

Cash used in financing activities

(121,983

)

(108,488

)

Increase/(Decrease) in cash, cash

equivalents, and restricted cash and cash equivalents

(794

)

5,760

Cash, cash equivalents, and restricted

cash and cash equivalents, ending balances

$

29,943

$

30,737

Supplemental cash flow disclosure:

Cash paid for income taxes, net

$

26,102

$

18,679

Apple Inc.

RECONCILIATION OF NON-GAAP TO

GAAP RESULTS OF OPERATIONS (Unaudited)

(In millions, except number of

shares, which are reflected in thousands, and per-share

amounts)

Three Months Ended

Twelve Months Ended

September 28, 2024

September 28, 2024

As Reported (GAAP)

Non-GAAP Adjustments

(a)

As Adjusted (Non-GAAP)

As Reported (GAAP)

Non-GAAP Adjustments

(a)

As Adjusted (Non-GAAP)

Income before provision for income

taxes

$

29,610

$

—

$

29,610

$

123,485

$

—

$

123,485

Provision for income taxes

14,874

(10,246

)

(b)

4,628

29,749

(10,246

)

(b)

19,503

Net income

$

14,736

$

10,246

(b)

$

24,982

$

93,736

$

10,246

(b)

$

103,982

Diluted earnings per share

$

0.97

$

0.67

(c)

$

1.64

$

6.08

$

0.67

(c)

$

6.75

Shares used in computing diluted earnings

per share

15,242,853

—

15,242,853

15,408,095

—

15,408,095

(a)

These adjustments reconcile certain of the

Company’s GAAP results of operations to its non-GAAP results of

operations. The Company believes that the presentation of results

excluding the impact of the reversal of the European General

Court’s State Aid decision provides meaningful supplemental

information to both management and investors that is indicative of

the Company’s core operating results and facilitates comparison of

operating results across reporting periods. The Company uses these

non-GAAP measures when evaluating its financial results as well as

for internal planning and forecasting purposes. These non-GAAP

measures should not be viewed as a substitute for the Company’s

GAAP results.

(b)

Non-GAAP adjustments to provision for

income taxes and net income to reflect the impact of the reversal

of the European General Court’s State Aid decision recognized

during the fourth quarter of 2024. On September 10, 2024, the

European Court of Justice announced that it had set aside the 2020

judgment of the European General Court and confirmed the European

Commission’s 2016 State Aid decision. As a result, during the

fourth quarter of 2024 the Company recorded a one-time income tax

charge of $10.2 billion, net, which represents $15.8 billion

payable to Ireland via release of restricted funds held in escrow,

partially offset by a U.S. foreign tax credit of $4.8 billion and a

decrease in unrecognized tax benefits of $823 million. For

additional information, refer to Note 7, “Income Taxes” of the

Notes to Consolidated Financial Statements that will be included in

Part II, Item 8 of the Company's fiscal 2024 Annual Report on Form

10-K.

(c)

Represents the per-share impact of the

non-GAAP adjustments to net income.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031454158/en/

Press Contact: Josh Rosenstock Apple

jrosenstock@apple.com (408) 862-1142

Investor Relations Contact: Suhasini Chandramouli Apple

suhasini@apple.com (408) 974-3123

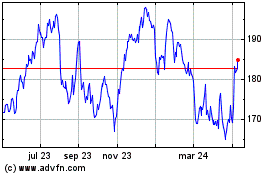

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

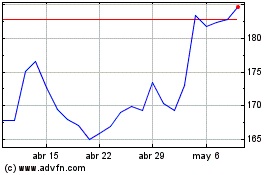

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024