UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to Section 240.14a-12 |

AIMEI

HEALTH TECHNOLOGY CO., LTD

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

|

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AIMEI

HEALTH TECHNOLOGY CO., LTD

10

East 53rd Street, Suite 3001

New

York, NY 10022

+34

678 035200

NOTICE

OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO

BE HELD ON DECEMBER 23, 2024

TO

THE SHAREHOLDERS OF AIMEI HEALTH TECHNOLOGY CO., LTD:

You

are cordially invited to attend the extraordinary general meeting of shareholders of Aimei Health Technology Co., Ltd (“Aimei Health,”

“Company,” “we,” “us” or “our”) to be held on December 23, 2024 in person in the

offices of the Company’s counsel, Hunter Taubman Fischer & Li LLC, at 950 Third Avenue, 19th Floor, New York, NY 10022 and

virtually at 11:00 a.m. Eastern Time (the “Extraordinary General Meeting”), or at such other time, on such other date and

at such other place at which the meeting may be adjourned.

If

you plan on attending the Extraordinary General Meeting in person please email xiejunheng@aimeihealth.com at least one day

prior to the Extraordinary General Meeting. If you plan on attending the Extraordinary General Meeting online, you will be able to vote

and submit your questions during the Extraordinary General Meeting by visiting https://www.virtualshareholdermeeting.com/AFJKU2024

shortly prior to the start of the meeting and entering the 16-digit control number found on the proxy card or voting instruction

form. A person participating in the Extraordinary General Meeting in the virtual meeting format is deemed to be present in person at

the meeting.

The

purpose of the Extraordinary General Meeting will be to consider and vote on the following proposals:

| 1. | Proposal

1 – To approve an amendment to the Investment Management Trust Agreement dated December

1, 2023 (the “Trust Agreement”), entered into by and between Continental Stock

Transfer & Trust Company, as trustee (the “Trustee”) and the Company governing

the trust account established in connection with the Company’s initial public offering

(“IPO”), to amend the amount of funds to be deposited by our sponsor, Aimei

Investment Ltd (the “Sponsor”) into the Trust Account (as defined below)

in connection with extending the timeframe within which the Company must consummate its initial

business combination, from $0.033 per Public Share (as defined below) (for each monthly extension)

to an amount equal to the lesser of (i) $50,000 for all outstanding Public Shares and (ii)

$0.033 for each outstanding Public Share (for each monthly extension) (the “Trust Agreement

Amendment Proposal” or “Proposal 1”); and |

| | | |

| 2. | Proposal

2 – To approve, by ordinary resolution, to direct the chairman of the Extraordinary

General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if

necessary, to permit further solicitation and vote of proxies in the event there are not

sufficient votes for, or otherwise in connection with, the approval of Proposal 1(the “Adjournment

Proposal” or “Proposal 2”). |

Each

of the Trust Agreement Amendment Proposal and the Adjournment Proposal (together the “Proposals”) is more fully described

in the accompanying proxy statement. Please take the time to read carefully each of the Proposals in the accompanying proxy statement

before you vote.

The

Amended and Restated Articles of Association of the Company (the “Articles”) and the Trust Agreement provide that the Company

has until 12 months from the closing of its IPO (“Combination Period”) to consummate its initial business combination (namely,

until December 6, 2024). The Articles and the Trust Agreement also provide that if the board of directors (the “Board”) anticipates

that we may not be able to consummate our initial business combination within the Combination Period, we may, by resolution of the Board

if requested by our Sponsor, extend the Combination Period up to twelve (12) times each for an additional one month (each, a “Monthly

Extension”) from December 6, 2024 (i.e., 12 months after the consummation of the IPO) up to December 6, 2025 (i.e., 24 months after

the consummation of the IPO) subject to the Sponsor depositing additional funds into the trust account (the “Trust Account”)

established pursuant to the Trust Agreement, in accordance with the terms set out in that agreement. The first monthly extension fee

(namely, $0.033 per Public Share) will be deposited into the Trust Account (“Initial Contribution”) prior to December 6,

2024, in accordance with the current terms of the Trust Agreement, to extend the Combination Period by an additional month (i.e., from

December 6, 2024 to January 6, 2025). If the Trust Agreement Amendment Proposal is approved by the shareholders, to effectuate each of

the subsequent eleven (11) Monthly Extensions, the Sponsor will be required to deposit the lesser of (i) $50,000 for all remaining Public

Shares and (ii) $0.033 for each remaining Public Share into the Trust Account, for each Monthly Extension (the “Amended Monthly

Extension Fee”). Each subsequent Amended Monthly Extension Fee, if and to the extent approved at the Extraordinary General

Meeting, must be deposited into the Trust Account by the sixth of each succeeding month until November 6, 2025 (the Initial Contribution

and each deposited Amended Monthly Extension Fee, together “Contributions”). The amount of the Contributions will not

bear interest and will be repayable by us to our Sponsor upon consummation of an initial business combination.

The

Company’s Board believes that the approval of Proposal 1 will provide the Sponsor with an incentive to fund the Amended Monthly

Extension Fees required for each Monthly Extension that may be required for the Company to complete an initial business combination.

Accordingly, the Board believes that Proposal 1 is necessary in order to be able to consummate an initial business combination within

the Combination Period. Therefore, the Board has determined that it is in the best interests of the Company to give effect to the Contributions

and recommends our shareholders approve and adopt Proposal 1. This is to incentivize our Sponsor to fund such Amended Monthly Extension

Fees and provide such Monthly Extensions as may be required for us to complete an initial business combination by or before December

6, 2025 which will provide our shareholders with the opportunity to participate in an initial business combination. The funding by our

Sponsor of one or more Monthly Extensions will be required in order for us to have the opportunity to complete the initial business combination

disclosed in our current filings with the U.S. Securities and Exchange Commission (“SEC”).

The

purpose of the Adjournment Proposal is to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General

Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of Proposal 1.

Holders

(“Public Shareholders”) of Aimei Health’s ordinary shares (“Public Shares”) sold in our IPO may elect to

redeem their Public Shares for their pro rata portion of the funds available in the Trust Account in connection with the Trust Agreement

Amendment Proposal (the “Election”) regardless of how such Public Shareholders vote in regard to the Proposals, or whether

they were holders of Aimei Health’s ordinary shares on the record date or acquired such shares after such date. Aimei Health believes

that the redemption right provided for by way of this proxy statement protects Aimei Health’s Public Shareholders from having to

maintain their investments for an unreasonably long period if Aimei Health fails to find a suitable acquisition in the Combination Period

initially contemplated by its Articles and set forth in the Trust Agreement. If the Trust Agreement Amendment Proposal is approved by

the requisite vote of shareholders (and not abandoned), the remaining Public Shareholders will retain their right to redeem their Public

Shares for their pro rata portion of the funds available in the Trust Account upon consummation of a business combination.

To

exercise your redemption rights, you must tender your shares to the Company’s transfer agent at least two business days prior to

the Extraordinary General Meeting (or December 19, 2024). You may tender your shares by either delivering your share certificates

to the transfer agent or by delivering your shares electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal

At Custodian) system. If you hold your shares in street name, you will need to instruct your bank, broker or other nominee to withdraw

the shares from your account in order to exercise your redemption rights.

The

per-share pro rata portion of the Trust Account was approximately $[●] as of [●]. The closing price of Aimei Health’s

shares on [●] was $[●]. Aimei Health cannot assure shareholders that they will be able to sell their shares of Aimei Health

in the open market, as there may not be sufficient liquidity in its securities when shareholders wish to sell their shares.

The

approval of the Trust Agreement Amendment Proposal requires the affirmative vote of the holders of at least 50% or more of the outstanding

ordinary shares entitled to vote at the Extraordinary General Meeting, whether represented in person or by proxy.

The

approval of the Adjournment Proposal requires a resolution passed by a simple majority of the votes cast by the shareholders who, being

present in person or by proxy and entitled to vote at the Extraordinary General Meeting, vote at the Extraordinary General Meeting.

The

Board has fixed the close of business on November 8, 2024 as the record date (“Record Date”) for the determination of shareholders

entitled to notice of and to vote at the Extraordinary General Meeting or at any adjournment thereof. Only holders of record of Aimei

Health’s ordinary shares on that date are entitled to notice of and to have their votes counted at the Extraordinary General Meeting

or any adjournments thereof.

After

careful consideration of all relevant factors, the Board has determined that the Trust Agreement Amendment Proposal and the Adjournment

Proposal are fair to and in the best interests of Aimei Health and its shareholders, has declared them advisable and recommends that

you vote or give instruction to vote “FOR” all the foregoing Proposals.

Enclosed

is the proxy statement containing detailed information concerning the Proposals and Extraordinary General Meeting. Whether or not you

plan to attend the Extraordinary General Meeting, we urge you to read this material carefully and vote your shares.

We

look forward to seeing you at the Extraordinary General Meeting.

Dated:

[●], 2024

| |

|

By

Order of the Board, |

| |

|

|

| |

|

/s/

Junheng Xie |

| |

|

Junheng

Xie |

| |

|

Chief

Executive Officer

|

| |

|

Aimei

Health Technology Co., Ltd |

Your

vote is important. Each shareholder who is entitled to attend and vote at the Extraordinary General Meeting is entitled to appoint one

or more proxies to attend and vote instead of that shareholder, and a proxyholder need not be a shareholder. Please sign, date, and return

your proxy card as soon as possible to make sure that your shares are represented at the Extraordinary General Meeting. Your proxy card

must be received by the Company not less than 48 hours before the time for holding the Extraordinary General Meeting or any adjournment

thereof. If you are a shareholder of record, you may also cast your vote in person or online at the Extraordinary General Meeting. If

your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you

may cast your vote in person or online at the Extraordinary General Meeting by obtaining a proxy from your brokerage firm or bank.

Important

Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting of Shareholders to be held on December 23,

2024: This Notice of Extraordinary General Meeting and the accompanying proxy statement are available at https://www.proxyvote.com

by entering your unique 16-digit control number found in your proxy materials.

How

to Vote

| ● | By

Internet: During the Extraordinary General Meeting, you may vote online at www.virtualshareholdermeeting.com/AFJKU2024. |

| | | |

| ● | By

Mail: You may vote by completing and returning the enclosed proxy card. |

| | | |

| ● | In

Person: All shareholders are cordially invited to attend the Extraordinary General Meeting. |

This

communication is not a form for voting and presents only an overview of the more complete proxy materials. The Company encourages you

to review the complete proxy materials before voting. You will receive paper copies of all of our proxy materials by mail and can also

access our proxy materials online at www.proxyvote.com. The paper copies of all of our proxy materials are first being distributed or

made available, as the case may be, to our shareholders on or about [ ], 2024.

PROXY

STATEMENT FOR THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO

BE HELD ON DECEMBER 23, 2024

This

proxy statement, along with the accompanying Notice of Extraordinary General Meeting of Shareholders, contains information about the

Extraordinary General Meeting of the Company, including any adjournments of the Extraordinary General Meeting. We are holding the Extraordinary

General Meeting in person at the offices of Hunter Taubman Fischer & Li LLC at 950 Third Avenue, 19th Floor, New York, NY 10022 and

virtually online at www.virtualshareholdermeeting.com/AFJKU2024, on Monday, December 23, 2024, at 11:00 a.m., Eastern

Time.

Capitalized

terms used but not defined in this proxy statement have the meaning given to them in the accompanying Notice of Extraordinary General

Meeting of Shareholders.

This

proxy statement relates to the solicitation of proxies by the Board for use at the Extraordinary General Meeting.

This

Notice of Extraordinary General Meeting and proxy statement are first being distributed or made available, as the case may be, to our

shareholders on or about [ ], 2024.

QUESTIONS

AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL MEETING

These

questions and answers are only summaries of the matters they discuss. They do not contain all of the information that may be important

to you. You should read carefully this entire proxy statement.

| Why

am I receiving this proxy statement? |

|

This

proxy statement and the accompanying materials are being sent to you in connection with the solicitation of proxies by the Board,

for use at the Extraordinary General Meeting to be held in person at the offices of Hunter Taubman Fischer & Li LLC, at 950 Third

Avenue, 19th Floor, New York, NY 10022 and virtually online at www.virtualshareholdermeeting.com/AFJKU2024, on December 23,

2024 at 11:00 a.m., Eastern Time, or at any adjournments thereof. This proxy statement summarizes the information that you need to

make an informed decision on the Proposals to be considered at the Extraordinary General Meeting. |

|

|

| What

is being voted on? |

|

You are being asked to consider and vote on the following

Proposals: |

| |

|

|

|

|

| |

|

|

● |

a

proposal to approve the amendment to the Trust Agreement entered into by and between Continental Stock Transfer & Trust Company

and the Company governing the trust account established in connection with the Company’s IPO, to amend the amount of funds

to be deposited by the Sponsor into the Trust Account in connection with extending the timeframe within which the Company must consummate

its initial business combination, from $0.033 per Public Share (for each monthly extension) to an amount equal to the lesser of (i)

$50,000 for all outstanding Public Shares and (ii) $0.033 for each outstanding Public Share (for each monthly extension); |

| |

|

|

|

|

| |

|

|

● |

a

proposal to approve to direct the chairman of the Extraordinary General Meeting to adjourn the Extraordinary General Meeting to a

later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes

for, or otherwise in connection with, the approval of the foregoing proposal. |

| How

does the Board recommend I vote? |

|

After

careful consideration of all relevant factors, the Board recommends that you vote or give

instruction to vote “FOR” the Trust Agreement Amendment Proposal and “FOR”

the Adjournment Proposal.

|

| Why

is the Company proposing the Trust Agreement Amendment Proposal? |

|

The

Articles and the Trust Agreement provide that the Company has until 12 months from the closing of its IPO to consummate our initial

business combination (i.e., until December 6, 2024). The Articles and the Trust Agreement also provide that if the Board anticipates

that we may not be able to consummate our initial business combination within the Combination Period, we may, by resolution of the

Board if requested by our Sponsor, extend the Combination Period up to twelve (12) times each for an additional one month from December

6, 2024 (i.e., 12 months after the consummation of the IPO) up to December 6, 2025 (i.e., 24 months after the consummation of the

IPO), subject to the Sponsor depositing additional funds into the Trust Account established pursuant to the Trust Agreement, in

accordance with the terms set out in that agreement. The Initial Contribution, namely, $0.033 per Public Share, will be deposited

into the Trust Account prior to December 6, 2024, in accordance with the current terms of the Trust Agreement, to extend the Combination

Period by an additional month (i.e., from December 6, 2024 to January 6, 2025). If the Trust Agreement Amendment Proposal is approved

by the shareholders, to effectuate each of the subsequent eleven (11) Monthly Extensions, the Sponsor will be required to deposit

the lesser of (i) $50,000 for all remaining Public Shares and (ii) $0.033 for each remaining Public Share into the Trust Account,

for each Monthly Extension. Each subsequent Amended Monthly Extension Fee, if and to the extent approved at the Extraordinary General

Meeting, must be deposited into the Trust Account by the sixth of each succeeding month until November 6, 2025. The amount of the

Contributions will not bear interest and will be repayable by us to our Sponsor upon consummation of an initial business combination. |

| Why

should I vote for the Trust Agreement Amendment Proposal? |

|

The

Company’s Board believes that the approval of Proposal 1 will provide the Sponsor with an incentive to fund the Amended Monthly

Extension Fees required for each Monthly Extension that may be required for the Company to complete an initial business combination.

Accordingly, the Board believes that Proposal 1 is necessary in order to be able to consummate an initial business combination within

the Combination Period. Therefore, the Board has determined that it is in the best interests of the Company to give effect to the

Contributions and recommends our shareholders approve and adopt Proposal 1. This is to incentivize our Sponsor to fund such Amended

Monthly Extension Fees and provide such Monthly Extensions as may be required for us to complete an initial business combination

by or before December 6, 2025 which will provide our shareholders with the opportunity to participate in an initial business combination.

The funding by our Sponsor of one or more Monthly Extensions will be required in order for us to have the opportunity to complete

the initial business combination disclosed in our current filings with the SEC. |

| |

|

|

| How

do the Aimei Health insiders intend to vote their shares? |

|

All

of Aimei Health’s directors and officers, its Sponsor and their respective affiliates

are expected to vote any ordinary shares over which they have voting control (including any

Public Shares owned by them) in favor of the Trust Agreement Amendment Proposal and the Adjournment

Proposal.

Aimei

Health’s directors and officers, its Sponsor, and their respective affiliates have waived their redemption rights with respect

to the Trust Agreement Amendment Proposal and accordingly are not entitled to redeem the founder shares which include 1,725,000 ordinary

shares initially issued to Aimei Investment Ltd for an aggregate purchase price of $25,000 (the “Founder Shares”) or

the ordinary shares underlying the Private Units (as defined below). On the Record Date, Aimei Health’s directors, executive

officers, its Sponsor and their respective affiliates beneficially owned and were entitled to vote 1,725,000 Founder Shares and 332,000

Private Units, representing approximately 22.79% of Aimei Health’s issued and outstanding ordinary shares.

Aimei

Health’s directors, executive officers, its Sponsor and their respective affiliates may choose to buy Public Shares in the

open market and/or through negotiated private purchases. In the event that purchases do occur, the purchasers may seek to purchase

shares from shareholders who would otherwise have voted against the Trust Agreement Amendment Proposal. Any Public Shares held by

or subsequently purchased by affiliates of Aimei Health may be voted in favor of the Trust Agreement Amendment Proposal. |

| What

vote is required to adopt the Trust Agreement Amendment Proposal? |

|

The

approval of the Trust Agreement Amendment Proposal requires the affirmative vote of the holders of at least 50% or more of the outstanding

ordinary shares entitled to vote at the Extraordinary General Meeting, whether represented in person or by proxy. |

| |

|

|

| Why

is the Company proposing the Adjournment Proposal? |

|

To

allow the Company more time to solicit additional proxies in favor of the Trust Agreement Amendment Proposal, in the event there

are not sufficient votes for, or otherwise in connection with, the approval of Trust Agreement Amendment Proposal. |

| |

|

|

| Why

should I vote “FOR” the Adjournment Proposal? |

|

If

the Adjournment Proposal is not approved by the Company’s shareholders, the chairman will not be able to adjourn the Shareholder

Meeting to a later date or dates to approve the Trust Agreement Amendment Proposal. |

| |

|

|

| What

if I do not want to vote “FOR” the Trust Agreement Amendment Proposal or the Adjournment Proposal? |

|

If

you do not want the Trust Agreement Amendment Proposal or the Adjournment Proposal to be

approved, you may “ABSTAIN,” not vote, or vote “AGAINST” such proposal.

If

you attend the Extraordinary General Meeting in person or by proxy, you may vote “AGAINST” any of the Proposals, and

your ordinary shares will be counted for the purposes of determining whether the Proposals are approved.

However,

if you fail to attend the Extraordinary General Meeting in person or by proxy, or if you do attend the Extraordinary General Meeting

in person or by proxy but you “ABSTAIN” or otherwise fail to vote at the Extraordinary General Meeting, your ordinary

shares will not be counted for the purposes of determining whether the Trust Agreement Amendment Proposal or the Adjournment Proposal

is approved, and your ordinary shares which are not voted at the Extraordinary General Meeting will have no effect on the outcome

of such vote. |

| |

|

|

| How

do I change my vote? |

|

If

you have submitted a proxy to vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy

card to Aimei Health’s Secretary so as to be received at least 48 hours prior to the time for holding the Extraordinary General

Meeting or any adjournment thereof, or by voting in person or online at the Extraordinary General Meeting. Attendance at the Extraordinary

General Meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to 10 East 53rd

Street, Suite 3001, New York, NY 10022, Attention - Secretary. |

| If

my shares are held in “street name,” will my broker automatically vote them for me? |

|

No.

Broker non-votes occur when beneficial owners do not give voting instructions to their brokers

and the brokers lack the discretionary authority to vote on the proposal. If you are a beneficial

owner and do not give instructions to your broker, the broker will determine if it has the

discretionary authority to vote on the particular matter.

Under

the rules of the New York Stock Exchange, which are also applicable to companies listed on the Nasdaq Global Market (“Nasdaq”),

brokers have the discretion to vote on routine matters such as ratifying the appointment of external auditors, but do not have discretion

to vote on non-routine matters such as the election of directors and approving equity awards plans. We believe that Proposal 1 and

Proposal 2 are “non-routine” items. Your broker can vote your shares with respect to “non-routine items”

only if you provide instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how

to provide these instructions. If you do not give your broker instructions, your shares will be treated as broker non-votes, which

will be counted for purposes of calculating whether a quorum is present at the meeting but will not be treated as votes cast and

will have no effect on Proposal 1 and Proposal 2. |

| What

is a quorum requirement? |

|

A

quorum of shareholders is necessary to hold a valid Extraordinary General Meeting. A quorum

will be present for the Extraordinary General Meeting if the holders of a majority of the

issued and outstanding shares are present in person or by proxy (or if a shareholder is a

corporation or other non-natural person, by its duly authorized representative or proxy)

at the Extraordinary General Meeting.

We

will include abstentions and broker non-votes to determine whether a quorum is present at the Extraordinary General Meeting. If a

quorum is not present within 15 minutes of the time appointed for the Extraordinary General Meeting, or if at any time during the

meeting it becomes inquorate, then the meeting will automatically be adjourned to the same time and place seven days hence, or to

such other time or place as is determined by the directors. If a quorum is not present within 15 minutes of the time appointed for

the adjourned meeting, then the meeting shall be dissolved. |

| |

|

|

| How

are votes counted? |

|

The

approval of the Trust Agreement Amendment Proposal requires the affirmative vote of the holders

of at least 50% or more of the outstanding ordinary shares entitled to vote at the Extraordinary

General Meeting, whether represented in person or by proxy.

The

approval of the Adjournment Proposal a resolution passed by a simple majority of the votes cast by the shareholders who, being present

in person or by proxy and entitled to vote at the Extraordinary General Meeting, vote at the Extraordinary General Meeting. The Adjournment

Proposal will only be put forth for a vote if there are not sufficient votes for, or otherwise in connection with, the approval of

the Trust Agreement Amendment Proposal at the Extraordinary General Meeting.

For

purposes of the Trust Agreement Amendment Proposal and the Adjournment Proposal, abstentions (but not broker non-votes), while considered

present for the purposes of establishing a quorum, will not count as a vote cast at the Extraordinary General Meeting and will have

no effect on the outcome of any vote on such Proposals. |

| Who

can vote at the Extraordinary General Meeting? |

|

Only

holders of record of Aimei Health’s ordinary shares at the close of business on the

Record Date are entitled to have their vote counted at the Extraordinary General Meeting

and any adjournments thereof. On the Record Date, 9,026,000 ordinary shares were issued and

outstanding and entitled to vote.

Shareholder

of Record: Shares Registered in Your Name. If on the Record Date, your shares were registered directly in your name with Aimei

Health’s Transfer Agent, Continental Stock Transfer & Trust Company, then you are a shareholder of record. As a shareholder

of record, you may vote in person or online at the Extraordinary General Meeting or vote by proxy. Whether or not you plan to attend

the Extraordinary General Meeting, we urge you to fill out and return the enclosed proxy card as soon as possible but in any event

so that it is received by the Company not less than 48 hours before the time for holding the Extraordinary General Meeting or any

adjournment thereof to ensure your vote is counted.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank. If on the Record Date, your shares were held, not in your name, but

rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares

held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner,

you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend

the Extraordinary General Meeting in person. However, since you are not the shareholder of record, you may not vote your shares online

or in person at the Extraordinary General Meeting unless you request and obtain a valid proxy from your broker or other agent. |

| Does

the Board recommend voting for the approval of the Trust Agreement Amendment Proposal and the Adjournment Proposal? |

|

Yes.

After careful consideration of the terms and conditions of these Proposals, the Board has

determined that Proposal 1 and Proposal 2 are in the best commercial interests of Aimei Health.

The Board recommends that Aimei Health’s shareholders vote “FOR” for Proposal

1 and Proposal 2.

|

| |

|

|

| What

interests do the Company’s sponsor, directors and officers have in the approval of the proposals? |

|

Aimei

Health’s directors, officers, its Sponsor and their respective affiliates have interests in the Proposals that may be different

from, or in addition to, your interests as a shareholder. These interests include direct or indirect ownership of certain securities

of the Company. See the section entitled “The Trust Agreement Amendment Proposal — Interests of Aimei Health’s

Sponsor, Directors and Officers.” |

| |

|

|

| If

the Trust Agreement Amendment Proposal is not approved, what happens next? |

|

If

the Trust Agreement Amendment Proposal is not approved, the ability to extend the time frame to consummate the initial business combination

is contingent upon our Sponsor depositing into the Trust Account the required amount of funds for each Monthly Extension ($227,700,

or $0.033 per Public Share) in accordance with the current terms of the Trust Agreement. |

| If

the Trust Agreement Amendment Proposal is approved, what happens next? |

|

If

the Trust Agreement Amendment Proposal is approved, our Sponsor will be required to deposit the Amended Monthly Extension Fee, equal

to the lesser of (i) $50,000 for all remaining Public Shares and (ii) $0.033 for each remaining Public Share into the Trust Account,

for each Monthly Extension, to extend the date which the Company must consummate its initial business combination. |

| |

|

|

| What

do I need to do now? |

|

Aimei

Health urges you to read carefully and consider the information contained in this proxy statement and to consider how the Proposals

will affect you as a Aimei Health shareholder. You should then vote as soon as possible in accordance with the instructions provided

in this proxy statement and on the enclosed proxy card. |

| |

|

|

| How

do I vote? |

|

If

you are a holder of record of Aimei Health’s ordinary shares, you may vote in person or online at the Extraordinary General

Meeting or by submitting a proxy for the Extraordinary General Meeting. Whether or not you plan to attend the Extraordinary General

Meeting in person or online, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing,

signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage-paid envelope so that it is received

by the Company not less than 48 hours before the time for holding the Extraordinary General Meeting or any adjournment thereof. You

may still attend the Extraordinary General Meeting and vote in person or online if you have already voted by proxy. If your ordinary

shares of Aimei Health are held in “street name” by a broker or other agent, you have the right to direct your broker

or other agent on how to vote the shares in your account. You are also invited to attend the Extraordinary General Meeting in person

or online. However, since you are not the shareholder of record, you may not vote your shares in person or online at the Extraordinary

General Meeting unless you request and obtain a valid proxy from your broker or other agent. |

| How

do I exercise my redemption rights? |

|

If

the Trust Agreement is amended, each Public Shareholder may seek to redeem all or a portion

of its Public Shares at a per-share price, payable in cash, equal to the aggregate amount

then on deposit in the Trust Account, including interest (which interest shall be net of

taxes payable), divided by the number of then outstanding Public Shares. You will also be

able to redeem your Public Shares in connection with any shareholder vote to approve a proposed

business combination, or if the Company has not consummated a business combination by December

6, 2025. In order to exercise your redemption rights, you must, prior to 5:00 p.m. Eastern

time on December 19, 2024 (two business days before the Extraordinary General Meeting)

tender your shares physically or electronically and submit a request in writing that we redeem

your Public Shares for cash to Continental Stock Transfer & Trust Company, our transfer

agent, at the following address:

Continental

Stock Transfer & Trust Company

1

State Street Plaza, 30th Floor

New

York, New York 10004

Attn:

SPAC Redemption Team

E-mail:

spacredemptions@continentalstock.com

The

redemption rights include the requirement that a shareholder must identify itself in writing as a beneficial holder and provide its

legal name, phone number and address in order to validly redeem its Public Shares. |

| |

|

|

| What

should I do if I receive more than one set of voting materials? |

|

You

may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or

voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example,

if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage

account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive

so that it is received by the Company not less than 48 hours before the time for holding the Extraordinary General Meeting or any

adjournment thereof, in order to cast a vote with respect to all of your ordinary shares of Aimei Health. |

| |

|

|

| Who

can help answer my questions? |

|

If

you have questions about the Proposals or if you need additional copies of the proxy statement

or the enclosed proxy card you should contact:

Aimei

Health Acquisition Corporation

10

East 53rd Street, Suite 3001

New

York, NY 10022

+34

678 035200

You

may also obtain additional information about the Company from documents filed with the SEC by following the instructions in the section

entitled “Where You Can Find More Information.” |

FORWARD-LOOKING

STATEMENTS

We

believe that some of the information in this proxy statement constitutes forward-looking statements. You can identify these statements

by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,”

“estimate,” “intends,” and “continue” or similar words. You should read statements that contain these

words carefully because they:

| |

● |

discuss

future expectations; |

| |

● |

contain

projections of future results of operations or financial condition; or |

| |

● |

state

other “forward-looking” information. |

We

believe it is important to communicate our expectations to our shareholders. However, there may be events in the future that we are not

able to predict accurately or over which we have no control. The cautionary language discussed in this proxy statement provides examples

of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking

statements, including, among other things, claims by third parties against the trust account, unanticipated delays in the distribution

of the funds from the trust account and Aimei Health’s ability to finance and consummate any proposed business combination. You

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement.

All

forward-looking statements included herein attributable to Aimei Health or any person acting on Aimei Health’s behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable

laws and regulations, Aimei Health undertakes no obligation to update these forward-looking statements to reflect events or circumstances

after the date of this proxy statement or to reflect the occurrence of unanticipated events.

BACKGROUND

We

are a blank check company incorporated as a Cayman Islands exempted company with limited liability for the purpose of entering into a

merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one

or more businesses or entities, which we refer to throughout this document as our initial business combination.

On

December 6, 2023, we consummated our IPO of 6,000,000 units (the “Public Units”). Each Public Unit consists of one ordinary

share, $0.0001 par value, and one right (“Public Right”) to receive one-fifth (1/5) of one ordinary share upon the consummation

of an initial business combination. The Public Units were sold at an offering price of $10.00 per Unit, generating gross proceeds of

$60,000,000. Pursuant to that certain underwriting agreement, dated December 1, 2023, we granted Spartan Capital Securities, LLC, the

representative of the underwriters, a 45-day option to purchase up to an additional 900,000 Public Units (over and above the 6,000,000

units referred to above) solely to cover over-allotments, if any (the “Over-Allotment Option”). Simultaneously with the consummation

of our IPO, the underwriters exercised the Over-Allotment Option in full, generating total proceeds of $9,000,000.

Simultaneously

with the closing of the IPO on December 6, 2023, we consummated the private placement (“Private Placement”) with our Sponsor,

Aimei Investment Ltd, of 332,000 units (the “Private Units”), generating total proceeds of $3,320,000. The Private Units

are identical to the Public Units sold in our IPO, except that the Private Units (including the underlying securities) may not, subject

to certain limited exceptions, be transferred, assigned, or sold by it until six months after the completion of our initial business

combination.

On

December 6, 2023, a total of $69,690,000 of the net proceeds from the sale of Units in the IPO and the Private Placement, were placed

in a U.S.-based trust account at Continental Stock Transfer & Trust Company, as trustee. This amount was comprised of proceeds of

$69,000,000 in gross proceeds (which amount includes $690,000 of the underwriters’ deferred discount) from the IPO (including the

proceeds received from the exercise by the underwriters of the over-allotment option), and a total of $3,320,000 in gross proceeds for

the sale of the Private Units, offset by $1,930,000 in total offering expenses and $700,000 in use of proceeds not held in the Trust

Account, which became available to be used to provide for business, legal and accounting due diligence on prospective business combinations,

and continuing general and administrative expenses.

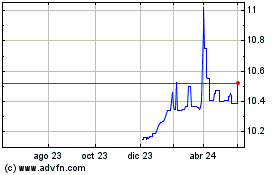

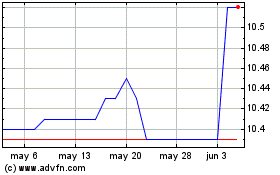

On

December 3, 2023, the Units commenced trading on Nasdaq under the symbol “AFJKU”. Commencing January 22, 2024, the Company’s

ordinary shares and Rights are separately traded on Nasdaq under the symbols “AFJK” and “AFJKR,” respectively.

On

June 19, 2024, Aimei Health entered into a definitive Business Combination Agreement (the “Merger Agreement”) for a business

combination with (i) United Hydrogen Group Inc., an exempted company incorporated with limited liability in the Cayman Islands (“United

Hydrogen”), (ii) United Hydrogen Global Inc., an exempted company incorporated with limited liability in the Cayman Islands (“Pubco”),

(iii) United Hydrogen Victor Limited, an exempted company incorporated with limited liability in the Cayman Islands and a wholly-owned

subsidiary of Pubco; (iv) United Hydrogen Worldwide Limited, an exempted company incorporated with limited liability in the Cayman Islands

and a wholly-owned subsidiary of Pubco; and (v) Aimei Investment Ltd, a Cayman Islands exempted

company, in the capacity as, from and after the closing of the transactions contemplated by the Merger Agreement (the “Closing”),

the representative for Aimei Health and its shareholders (the “Sponsor”). The merger involves multiple steps and will result

in the cancellation and conversion of various shares into Pubco’s Class A and Class B ordinary shares. After the Closing, Aimei

Health will become a wholly owned subsidiary of Pubco. The deal is expected to close in early 2025, subject to various conditions, including

shareholder approvals and regulatory clearances. A press release announcing the merger agreement was also issued.

The

mailing address of Aimei Health’s principal executive office is 10 East 53rd Street, Suite 3001, New York, NY 10022, and its telephone

number is +34 678 035200.

You

are not being asked to vote on a business combination at this time. If the Trust Agreement Amendment Proposal is approved and you do

not elect to redeem your Public Shares, you will retain the right to vote on any proposed business combination if and when it is submitted

to shareholders and the right to redeem your Public Shares for a pro rata portion of the trust account in the event such business

combination is approved and completed or the Company has not consummated a business combination by the end of the Combination Period.

RISK

FACTORS

You

should consider carefully all of the risks described in our final prospectus for our IPO as filed with the SEC on December 5, 2023, and

in the other reports we file with the SEC before making a decision to invest in our securities. Furthermore, if any of the events described

in our final prospectus or other reports filed with the SEC occur, our business, financial condition and operating results may be materially

adversely affected or we could face liquidation. In that event, the trading price of our securities could decline, and you could lose

all or part of your investment. The risks and uncertainties described in our final prospectus and other reports are not the only ones

we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important

factors that adversely affect our business, financial condition and operating results or result in our liquidation.

PROPOSAL

1 — THE TRUST AGREEMENT AMENDMENT PROPOSAL

Aimei

Health is proposing to approve an amendment to the Trust Agreement by and between the Company and Continental Stock Transfer & Trust

Company governing the trust account established in connection with the Company’s IPO, to amend the amount of funds to be deposited

by the Sponsor into the Trust Account in connection with extending the timeframe within which the Company must consummate its initial

business combination (the “Trust Amendment”). A copy of the proposed Trust Amendment is attached to this proxy statement

as Annex A. All shareholders are encouraged to read the proposed amendment in its entirety for a more complete description

of its terms.

The

purpose of the Trust Amendment is to provide the Company and the Sponsor with an incentive to agree to extend the period of time within

which the Company must complete its initial business combination. The Company believes that it is necessary to provide the Sponsor with

an incentive to fund the Amended Monthly Extension Fees required for each Monthly Extension that may be required for the Company to complete

an initial business combination. Accordingly, the Board believes that this Proposal 1 is necessary in order to be able to consummate

an initial business combination.

Currently,

under the Company’s Articles, the Company has until 12 months from the closing of its IPO to consummate an initial business combination.

The Articles and the Trust Agreement also provide that if the Board anticipates that we may not be able to consummate our initial business

combination within the Combination Period, we may, by resolution of the Board if requested by our Sponsor, extend the Combination Period

up to twelve (12) times each for an additional one month from December 6, 2024 (i.e., 12 months after the consummation of the IPO) up

to December 6, 2025 (i.e., 24 months after the consummation of the IPO), subject to the Sponsor depositing additional funds into the

Trust Account as set out below. Currently, to effectuate each Monthly Extension, the Sponsor must deposit an amount equal to $0.033 per

Public Share into the Trust Account. The Initial Contribution, namely, $0.033 per Public Share, will be deposited into the Trust Account

prior to December 6, 2024, in accordance with the current terms of the Trust Agreement, to extend the Combination Period by an additional

month (i.e., from December 6, 2024 to January 6, 2025).

Through

this Trust Agreement Amendment Proposal, Aimei Health is proposing that its shareholders approve that the Sponsor will be required to

deposit the lesser of (i) $50,000 for all remaining Public Shares and (ii) $0.033 for each remaining Public Share into the Trust Account,

for each of the subsequent eleven (11) Monthly Extensions. Each subsequent Amended Monthly Extension Fee, if and to the extent approved

at the Extraordinary General Meeting, must be deposited into the Trust Account by the sixth of each succeeding month until November 6,

2025. The amount of the Contributions will not bear interest and will be repayable by us to our Sponsor upon consummation of an initial

business combination.

If

our Sponsor advises us that it does not intend to make the Contributions (other than the Initial Contribution, which will be made prior

to the date of the Extraordinary General Meeting), then the Trust Agreement Amendment Proposal, will not be put before the shareholders

at the Extraordinary General Meeting and, unless we can complete an initial business combination by January 6, 2025, we will dissolve

and liquidate the Company.

If

Proposal 1 is approved, to effectuate each of the subsequent eleven (11) Monthly Extensions, the Sponsor will be required to deposit

the Amended Monthly Extension Fee, equal to the lesser of (i) $50,000 for all remaining Public Shares and (ii) $0.033 for each remaining

Public Share into the Trust Account. If the Trust Agreement Amendment Proposal is not approved, the ability to extend the timeframe is

contingent upon our Sponsor depositing the required amount of funds for each Monthly Extension ($227,700, or $0.033 per Public Share)

in accordance with the current terms of the Trust Agreement.

The

Board’s Reasons for the Trust Agreement Amendment Proposal

Under

the Trust Agreement Amendment Proposal, the Company is seeking the approval of its shareholders of an amendment to the Trust Agreement

that reduces the amount it must deposit into the Trust Account to be equal to the lesser of (i) $50,000 for all remaining Public Shares

and (ii) $0.033 for each remaining Public Share, for each of the subsequent eleven (11) Monthly Extensions. The Company’s Board

believes that the approval of Proposal 1 will provide the Sponsor with an incentive to fund the Amended Monthly Extension Fees required

for the Monthly Extension that may be required for the Company to complete an initial business combination. Accordingly, the Board believes

that Proposal 1 is necessary in order to be able to consummate an initial business combination. Therefore, the Board has determined that

it is in the best interests of the Company to give effect to the Contributions and recommends our shareholders approve and adopt Proposal

1. This is to incentivize our Sponsor to fund such Amended Monthly Extension Fees and provide such Monthly Extensions as may be required

for us to complete an initial business combination by or before December 6, 2025 which will provide our shareholders with the opportunity

to participate in an initial business combination. The funding by our Sponsor of one or more Monthly Extensions will be required in order

for us to have the opportunity to complete the initial business combination disclosed in our current filings with the SEC.

As

discussed above, after careful consideration of all relevant factors, the Board has determined that the Trust Agreement Amendment Proposal

is fair to, and in the best interests of, Aimei Health and its shareholders. The Board has approved and declared advisable adoption of

the Trust Agreement Amendment Proposal and recommends that you vote “FOR” such adoption. The Board expresses no opinion as

to whether you should redeem your Public Shares.

If

the Trust Agreement Amendment Proposal is Not Approved

The

Company is seeking the approval of its shareholders in order to implement the Trust Agreement Amendment Proposal. Approval of the Trust

Agreement Amendment Proposal in required for the implementation of the Board’s plan to increase the likelihood that the Company

will be able to extend the date by which it must complete an initial business combination. Therefore, the Board will abandon and not

implement the Trust Agreement Amendment Proposal unless our shareholders approve the Trust Agreement Amendment Proposal.

If

the Trust Agreement Amendment Proposal is not approved, the ability of the Company to extend the time frame of the Combination Period

will be contingent upon our Sponsor depositing into the Trust Account the required amount of funds for each Monthly Extension (being

$227,700, or $0.033 per Public Share) in accordance with the current terms of the Trust Agreement. In the event that the Company would

require all eleven (11) subsequent Monthly Extensions to complete an initial business combination, this amount would aggregate to approximately

$2,504,700 (or $0.033 per Public Share).

If

the Trust Agreement Amendment Proposal is not approved and the Sponsor does not agree to implement any of the eleven (11) additional

Monthly Extensions in accordance with the current terms of the Trust Agreement, the Board will take all such action necessary to (i)

cease all operations except for the purpose of winding up (ii) as promptly as reasonably possible but not more than five (5) Business

Days (as that term is defined in the Articles) thereafter to redeem the Public Shares to the holders of the Public Shares, on a pro rata

basis, in cash at a per-share amount equal to the aggregate amount then on deposit in the Trust Account (including interest not previously

released to the Company, which shall be net of taxes payable, and less interest to pay dissolution expenses) divided by the number of

then outstanding Public Shares and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our

remaining shareholders and the Board, liquidate and dissolve the Company, subject to the Company’s obligations under the Companies

Act (Revised) of the Cayman Islands, including any statutory modification or re-enactment thereof for the time being in force, to provide

for claims of creditors and the requirements of other applicable law. In the event of such redemption, only the holders of the Public

Shares shall be entitled to receive pro rata redeeming provisions from the Trust Account with respect to their Public Shares).

The

holders of the Founder Shares and Private Units will not participate in any redemption distribution with respect to their Founder Shares

or Private Units, until all of the claims of any redeeming shareholders and creditors are fully satisfied (and then only from funds held

outside the trust account). The Company will pay the costs of liquidating the trust account from the up to $50,000 of interest earned

on the funds held in the trust account that is available to us for liquidation expenses.

If

the Trust Agreement Amendment Proposal is Approved

The

Initial Contribution (namely, $0.033 per Public Share) will be deposited into the Trust Account prior to December 6, 2024, in accordance

with the current terms of the Trust Agreement, to extend the Combination Period by an additional month (i.e., from December 6, 2024 to

January 6, 2025). If the Trust Agreement Amendment Proposal is approved by the shareholders, to effectuate each of the eleven (11) subsequent

Monthly Extensions, the Sponsor will be required to deposit the lesser of (i) $50,000 for all remaining Public Shares and (ii) $0.033

for each remaining Public Share into the Trust Account, for each Monthly Extension. Each subsequent Amended Monthly Extension Fee, if

and to the extent approved at the Extraordinary General Meeting, must be deposited into the Trust Account by the sixth of each succeeding

month until November 6, 2025. The Company will then continue to work to consummating its initial business combination.

You

are not being asked to vote on a business combination at this time. If the Trust Agreement Amendment Proposal is approved and you do

not elect to redeem your Public Shares, you will retain the right to vote on any proposed business combination when it is submitted to

shareholders (provided that you are a shareholder on the record date for a meeting to consider a business combination) and the right

to redeem your Public Shares for a pro rata portion of the Trust Account in the event such business combination is approved and

completed or the Company has not consummated a business combination by the end of the Combination Period.

If

the Trust Agreement Amendment Proposal is approved and implemented, the removal of the funds from the Trust Account in connection with

the Election will reduce the amount held in the Trust Account following the Election. The Company cannot predict the amount that will

remain in the Trust Account after such withdrawal if the Trust Agreement Amendment Proposal is approved and the amount remaining in the

Trust Account may be only a fraction of the amount of $____________ (including interest but less the funds used to pay taxes) that was

in the Trust Account as of the Record Date. In such event, the Company may require additional funds to complete a business combination,

and there can be no assurance that such funds will be available on terms acceptable to the parties or at all.

Interests

of our Sponsor, Directors, and Officers

When

you consider the recommendation of the Board, you should keep in mind that our Sponsor, executive officers and members of the Board have

interests that may be different from, or in addition to, your interests as a shareholder. These interests include, among other things:

| |

● |

The

fact that our initial shareholders, including the Sponsor and our directors and officers, hold 1,725,000 Founder Shares and 332,000

Private Units that would expire worthless if a business combination is not consummated. The Founder Shares had an aggregate market

value of approximately $____________ based on the closing price for the Company’s Public Shares of $____________ on the Nasdaq

on ____________, 2024 and the Private Units had an aggregate market value (assuming they have the same value per Unit as the Public

Units) of $____________ based on the closing price for the Public Units of $____________ on the Nasdaq on ____________, 2024; |

| |

|

|

| |

● |

Even

if the trading price of our ordinary shares lost substantial value prior to the consummation of a business combination, due to the

low amount of the initial investment in the Company made by the Sponsor, if an initial business combination is completed, the initial

shareholders are likely to be able to make a substantial profit on their investment in us even if the ordinary shares have lost significant

value. On the other hand, if the Trust Agreement Amendment Proposal is not approved and the Company liquidates without completing

its initial business combination before December 6, 2025, the initial shareholders will lose their entire investment in us; |

| |

|

|

| |

● |

In

order to finance transaction costs in connection with an intended initial business combination,

our Sponsor, affiliates of the Sponsor, officers, and directors may, but are not obligated

to, make loans from time to time to us to fund certain capital requirements (“Working

Capital Loans”). Such Working Capital Loans would be evidenced by promissory notes.

The notes would either be repaid upon consummation of a business combination, without interest,

or, at the lender’s discretion, up to $1,500,000 of notes may be converted upon consummation

of a business combination into additional Private Units at a price of $10.00 per Unit. As

of June 30, 2024, there were no amounts outstanding under any Working Capital Loan.

|

| |

● |

The

Sponsor, and our officers and directors are entitled to reimbursement of out-of-pocket expenses incurred by them in connection with

certain activities on our behalf, such as identifying and investigating possible business targets and business combinations. However,

if the Company fails to consummate a business combination within the Combination Period, they will not have any claim against the

Trust Account for reimbursement. Accordingly, Aimei Health may not be able to reimburse these expenses if the Company liquidates

without completing its initial business combination before December 6, 2025 (i.e., 24 months from the closing of the IPO assuming

that all 12 Monthly Extensions are exercised). As of the Record Date, the Sponsor, and our officers and directors did not incur any

unpaid reimbursable expenses; and |

| |

● |

The

Sponsor agreed, commencing from the date that the Company’s securities were first listed on Nasdaq, through the earlier of

the Company’s consummation of a business combination and its liquidation, to make available to the Company certain general

and administrative services, including office space, utilities, and administrative services, as the Company may require from time

to time. The Company agreed to pay to the Sponsor, $10,000 per month, for up to 12 months, subject to extension to up to 24 months.

As of September 30, 2024, the unpaid balance was $[], which was included in amount due to related party balance. |

Additionally,

if the Trust Agreement Amendment Proposal is approved and we consummate an initial business combination, the Sponsor, and our officers

and directors may have additional interests as will be described in the proxy statement for the business combination.

The

Company’s directors, executive officers, its Sponsor, and their respective affiliates have waived their redemption rights with

respect to the Trust Agreement Amendment Proposal and accordingly are not entitled to redeem the Founder Shares or ordinary shares underlying

the Private Units. In addition, Aimei Health’s directors, executive officers and their affiliates may choose to buy Units or ordinary

shares of Aimei Health in the open market and/or through negotiated private purchases. In the event that purchases do occur, the purchasers

may seek to purchase shares from shareholders who would otherwise have voted against the Trust Agreement Amendment Proposal and elected

to redeem their shares for a portion of the trust account. Any shares of Aimei Health held by our Sponsor and its affiliates will be

voted in favor of the Trust Agreement Amendment Proposal.

Resolution

to be Voted Upon - Trust Agreement Amendment Proposal

The

full text of the resolution to be passed is as follows:

“RESOLVED,

that, the Trust Agreement be amended to adjust the amount of funds to be deposited into the Trust Account in connection with extending

the timeframe within which the Company must consummate its initial business combination, from $0.033 per Public Share (for each monthly

extension) to an amount equal to the lesser of (i) $50,000 for all outstanding Public Shares and (ii) $0.033 for each outstanding Public

Share (for each monthly extension), be confirmed, adopted, approved and ratified in all respects.”

Required

Vote

Approval

of the Trust Agreement Amendment Proposal requires the affirmative vote of the holders of 50% or more of the outstanding ordinary shares

entitled to vote at the Extraordinary General Meeting, whether represented in person or by proxy at the Extraordinary General Meeting.

Abstentions, which are not votes cast, will have no effect with respect to approval of this Proposal.

All

of Aimei Health’s directors, executive officers and their affiliates are expected to vote any shares owned by them in favor of

the Trust Agreement Amendment Proposal. On the Record Date, our Sponsor and the directors and executive officers of Aimei Health and

their affiliates beneficially owned and were entitled to vote 2,057,000 ordinary shares of Aimei Health representing approximately 22.79%

of Aimei Health’s issued and outstanding ordinary shares. As the Trust Agreement Amendment Proposal is not a “routine”

matter, brokers will not be permitted to exercise discretionary voting on this proposal.

Recommendation

of the Board

THE

BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE TRUST AGREEMENT AMENDMENT PROPOSAL. THE BOARD EXPRESSES NO OPINION AS

TO WHETHER YOU SHOULD ELECT TO REDEEM YOUR PUBLIC SHARES.

PROPOSAL

2 — THE ADJOURNMENT PROPOSAL

The

Adjournment Proposal, if adopted, will request the chairman of the Extraordinary General Meeting (who has agreed to act accordingly)

to adjourn the Extraordinary General Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal

will only be presented to our shareholders in the event, based on the tabulated votes, there are not sufficient votes at the time of

the Extraordinary General Meeting for, or otherwise in connection with, the approval of the Trust Agreement Amendment Proposal . If the

Adjournment Proposal is not approved by our shareholders, it is agreed that the chairman of the Extraordinary General Meeting shall not

adjourn the Extraordinary General Meeting to a later date in the event, based on the tabulated votes, there are not sufficient votes

at the time of the Extraordinary General Meeting for, or otherwise in connection with, the approval of the Trust Agreement Amendment

Proposal .

Resolution

to be Voted Upon

The

full text of the resolution to be passed is as follows:

“RESOLVED,

as an ordinary resolution that, the chairman may adjourn the Extraordinary General Meeting to a later date or dates to permit further

solicitation of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Trust

Agreement Amendment Proposal, to be determined by the chairman of the Extraordinary General Meeting, be confirmed, adopted, approved

and ratified in all respects.”

Required

Vote

The

approval of a simple majority of the votes cast by the shareholders who, being present in person or by proxy and entitled to vote at

the Extraordinary General Meeting, vote at the Extraordinary General Meeting will be required to direct the chairman of the Extraordinary

General Meeting to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and

vote of proxies if, based upon the tabulated vote at the time of the Extraordinary General Meeting, there are not sufficient votes for,

or otherwise in connection with, the approval of the Trust Agreement Amendment Proposal. Abstentions will have no effect with respect

to approval of this Adjournment Proposal. As this proposal is not a “routine” matter, brokers will not be permitted to exercise

discretionary voting on this proposal.

Recommendation

THE

BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ADJOURNMENT PROPOSAL.

MANAGEMENT

Directors

and Executive Officers

Our

executive officers and directors are as follows:

| Name | |

Age | | |

Title |

| Junheng Xie | |

| 35 | | |

Chief Executive Officer and Director |

| Heung Ming Henry Wong | |

| 55 | | |

Chief Financial Officer and Director |

| Lin Bao | |

| 50 | | |

Independent Director |

| Dr. Julianne Huh | |

| 55 | | |

Independent Director |

| Robin Hoksnes Karlsen | |

| 31 | | |

Independent Director |

Junheng

Xie, CEO, Secretary, and Director

Junheng

Xie has served as our chief executive officer, secretary, and director since April 2024. Since 2017, Mr. Xie has served as the CEO of

Hangzhou Aiwoba Network Technology Co., Ltd., a health and wellness enterprise integrating medical moxibustion, Internet of Things, artificial

intelligence and shared technology. In his role as CEO, he is responsible for the management of the company, including developing business

plans and policies, overseeing shareholder and director meetings, supervising product development, sales and marketing, reviewing company

financial statements, and executing contracts. Since June 2014, Mr. Xie has also been the founder of Hangzhou Junlin Health Management

Consulting Co., Ltd., a company that offers a health moxibustion service platform with web-based and mobile applications. In his role

as founder, Mr. Xie manages the daily operations of the company, including setting the company’s mission and vision, raising funds,

developing strategies, and recruiting and overseeing management teams. Mr. Xie received his diploma from Zhejiang Vocational College

of Art in Hangzhou, China, in 2008. We believe that Mr. Xie is qualified to serve on the Board due to his experience in managing an operating

company as its CEO, as well as his experience in developing business plans and policies, raising capital, and reviewing company financial

statements.

Heung

Ming Henry Wong, CFO, and Director

Heung

Ming Henry Wong has served as our Chief Financial Officer and Director since May 2023. Mr. Wong has also served as an independent non-executive

director of six other listed companies, including (i) Nature Wood Group Limited (Nasdaq: NWGL) since September 2023; (ii) E-Home Household

Service Holdings Ltd. (Nasdaq: EJH) since March 2023; (iii) Ostin Technology Group Co., Ltd. (Nasdaq: OST) since April 2022; (iv) Helens

International Holdings Company Limited (HKG: 9869) since August 2021; (v) Baiyu Holdings Inc. (formerly known as TD Holdings, Inc.) (Nasdaq:

BYU) since April 2021; and (vi) Raffles Interior Limited (HKG: 1376) since March 2020. In addition, Mr. Wong served as an independent

non-executive director of Sansheng Holdings (Group) Co. Ltd. (HKG: 2183) from August 2022 to December 2023. From November 2010 to April

2023, Mr. Wong was an independent non-executive director of Shifang Holding Limited (HKG: 1831). From July 2022 to November 2023, Mr.

Wong was the independent non-executive director of REDEX Pte. Ltd. Mr. Wong has over 29 years of experience in finance, accounting, internal

controls, and corporate governance in Singapore, China, and Hong Kong. In the PRC and Hong Kong, Mr. Wong has helped a number of companies

listed in overseas stock exchanges, including those in the United States and Hong Kong. From May 2020 to March 2021, Mr. Wong served

as the chief financial officer of Meten Holding Group Ltd. (Nasdaq: METX). Mr. Wong has also served as chief financial officer and senior

finance executive of various companies, including Frontier Services Group Limited (HKG: 0500) from April 2017 to September 2018, and

Beijing Oriental Yuhong Waterproof Technology Co., Ltd., a leading waterproof materials manufacturer in the PRC and a company listed

on China’s Shenzhen Stock Exchange (SHE: 2271) from May 2014 to August 2015. Mr. Wong began his career in an international accounting

firm and moved along in audit fields by taking some senior positions both in internal and external audits including being a senior manager

and a manager in PricewaterhouseCoopers, Beijing office and Deloitte Touche Tohmatsu, Hong Kong, respectively. Mr. Wong graduated from

the City University of Hong Kong in 1993 with a bachelor’s degree in Accounting and obtained a master’s degree in Electronic

Commerce from the Open University of Hong Kong in 2003. He is a fellow member of the association of Chartered Certified Accountants and

the Hong Kong institute of Certified Public Accountants and a member of the Hong Kong Institute of Certified Internal Auditor. We believe

that Mr. Wong is qualified to serve on the Board due to his extensive experience as an independent non-executive director as well as

his more than 29 years of experience in finance, accounting, internal control, and corporate governance.

Lin

Bao, Independent Director

Lin

Bao has served as one of our independent directors since November 2023. Ms. Bao is a citizen of Canada and a resident of the PRC. Ms.

Bao has over 15 years of experience in accounting and auditing. She has served as the chief financial officer of Jayud Global Logistics

Limited, a China-based end-to-end supply chain solution provider with a focus on providing cross-border logistics services, since October

2022. She has served as an independent director of SunCar Technology Group Inc. since May 2023 and as an independent director of Cetus

Capital Acquisition Corp. since February 2023. From April 2020 to September 2022, she served as the chief financial officer of Eagsen,

Inc., a vehicle communication and entertainment system provider. Before Eagsen, Inc. was established, Ms. Bao served as Chief Financial

Officer of Shanghai Eagsen Intelligent Co., Ltd. from November 2019 to March 2020. From February 2018 to August 2019, Ms. Bao served

as chief financial officer of Jufeel International Group., a biotech company that cultivates, produces, develops, and sells raw aloe

vera and aloe vera based consumer products in China. From October 2015 to January 2018, Ms. Bao worked as an independent consultant to

provide accounting advisory services for China-based companies. Ms. Bao began her career in accounting at Ernst & Young LLP Toronto,

where she served from January 2005 to May 2008 as a senior accountant. Ms. Bao received a bachelor’s degree in Accountancy from

Concordia University in 2004, and a bachelor’s degree in Japanese from the Beijing Second Foreign Language Institute in 1994. Ms.

Bao is a Certified Public Accountant in the United States, and she is also a Canadian Chartered Professional Accountant and a Hong Kong

Certified Public Accountant. We believe that Ms. Bao is qualified to serve on the Board due to her experience as an independent director

for a special purpose acquisition company, her extensive experience as a chief financial officer for several companies, as well as her

more than 15 years of experience in accounting and auditing.

Dr.

Julianne Huh, Independent Director

Dr.

Julianne Huh has served as one of our independent directors since November 2023. Dr. Huh is a citizen of Korea and resident of Malaysia.

Since November 2023, Dr. Huh has been serving as an independent director of OneMedNet Corporation (formerly known as Data Knights Acquisition

Corp). From October 2017 to June 2022, Dr. Huh served as the Director of S&I F&B Management Sdn, Bhd based in Kuala Lumpur, Malaysia,

where she managed the overall business, operations and marketing of 2 Ox French Bistro. From June 2016 to August 2017, Dr. Huh served

as the Vice President of The Mall of Korea based in Bangkok, Thailand, where she managed projects for business set-up, construction of

department stores and nine restaurants. Dr. Huh also managed the overall business, operations and marketing while serving as the Vice

President during this time. From November 2013 to June 2016, Dr. Huh served as the director of business development of Juna International

Ltd based in Shanghai, China and Seoul, Korea, where she oversaw China Business Development in the entertainment and music industry.

From August 2006 to June 2016, Dr. Huh founded the Wonderful World of Learning (WWL) and served as its general manager based in Shanghai,

where she managed the overall business and operations of the preschool, curriculum development and teacher training. From October 2011