false

0001859199

0001859199

2024-07-24

2024-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): July 24, 2024

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

On

July 24, 2024, reAlpha Tech Corp. (the “Company”) entered into a Membership Interest Purchase Agreement (the “Purchase

Agreement”), with David R. Breschi and Kristen Britton (the “Sellers”), pursuant to which the Company acquired from

the Sellers 85% of the outstanding membership interests of Hyperfast Title LLC (“Hyperfast”), a Florida limited liability

company, which provides real estate closings and title insurances in Florida that was founded by the owners of Madison Settlement Services,

LLC, a national title agency (the “Acquisition”). The Purchase Agreement contained certain representations, warranties and

covenants of the parties customary for a transaction of this nature.

In

connection with the Acquisition, the Company, the Sellers and Hyperfast entered into an Amended and Restated Operating Agreement (as may

be amended from time to time, the “Operating Agreement”). The Operating Agreement provides for, among other things, annual

license fees to be paid to each of the Sellers, subject to certain conditions set forth therein, including their continued service in

providing services on behalf of Hyperfast; annual management fees payable to the Sellers based on Hyperfast’s operating margin,

if any; a right of first refusal to each of Hyperfast’s members to purchase the other member’s interest in Hyperfast if any

member receives an offer for or desires to sell its interests in Hyperfast; and certain rights to both the Company, as managing member,

to purchase each of the Sellers’ membership interests, and to the Sellers to sell each of their respective membership interests

in Hyperfast, each in accordance with the terms set forth in the Operating Agreement.

On

July 29, 2024, the Company issued a press release announcing the Acquisition. A copy of the press release is furnished as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein by reference.

The press release being furnished

pursuant to Item 8.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended,

or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings,

except to the extent expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

* Filed herewith.

** Furnished herewith.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: July 29, 2024 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

reAlpha Completes Strategic Acquisition of Controlling

Interest of Hyperfast Title, Unlocking Title

Capabilities and New Growth Opportunities

Strategic purchase serves to vertically integrate

the homebuying process

Dublin, Ohio, July 29, 2024 – reAlpha

Tech Corp. (“reAlpha” or the “Company”) (Nasdaq: AIRE), a real estate technology company developing

and commercializing artificial intelligence (“AI”) technologies, today announced the acquisition of 85% of the outstanding

membership interests of Hyperfast Title, LLC (“Hyperfast” or “Hyperfast Title”), a title company

licensed to operate in Florida, Virginia and Tennessee, from the owners of Madison Settlement Services, LLC, a national title agency (“Madison

Settlement Services”).

This strategic acquisition adds title and settlement

services under the reAlpha umbrella of real estate services and enhances the capabilities of Claire, its generative AI-powered, commission-free

homebuying platform, powered through reAlpha Realty, LLC. Specifically, Hyperfast will enable reAlpha to provide title services to consumers

who utilize Claire to purchase homes.

“We are thrilled to welcome Hyperfast to

the reAlpha family,” said Mike Logozzo, President and Chief Operating Officer of reAlpha. “This acquisition underscores our

commitment to creating an integrated, easy-to-use full-service homebuying solution powered by our proprietary AI technology and talented

professionals. We believe what we are building at reAlpha is truly unique and that this acquisition positions us for meaningful growth.”

Acquiring title services aligns with reAlpha’s

goal of vertically integrating the homebuying process, which we anticipate will result in a more seamless customer experience and increased

revenue opportunities. reAlpha is also partnering with Madison Settlement Services to expand Claire into new geographic markets, leveraging

their network of offices serving 33 U.S. states to offer real estate services nationwide.

Hyperfast will continue to operate under its brand

by co-founders David Breschi and Kristen Britton while benefiting from reAlpha’s resources and generative AI platform.

“The purchase of Hyperfast Title aligns

with our strategy of integrating highly complementary businesses into reAlpha to support our long-term growth,” said Sureet Pabbi,

Associate Vice President of M&A at reAlpha. “Title services alone is a $23 billion industry1,

and we will continue to diligently search for strategic acquisition opportunities and prudently deploy capital into companies we believe

can help take reAlpha to the next level.”

David Breschi, Chief Executive Officer of Madison

Settlement Services added: “We believe that Claire marks the natural evolution of real estate transactions into the digital age

– taking a process that for decades has been centered upon real estate agents and expensive real estate agent commissions to an

online buyer-centered experience empowered through AI technology. We’re confident reAlpha is the future of real estate transactions,

and we are honored to be part of the team.”

About reAlpha Tech Corp.

reAlpha Tech Corp. (NASDAQ: AIRE) is a real estate

technology company developing an end-to-end commission-free homebuying platform. Utilizing the power of AI and an acquisition-led growth

strategy, reAlpha’s goal is to offer a more affordable, streamlined experience for those on the journey to homeownership. For more

information, visit www.realpha.com.

About Claire

Claire, announced on April 24, 2024, is reAlpha’s

generative AI-powered, zero-commission homebuying platform. The tagline: No fees. Just keys.TM – reflects reAlpha’s

dedication to eliminating traditional barriers and making homebuying more accessible and transparent.

Claire’s introduction aligns with major shifts

in the real estate sector2 after the National Association

of Realtors (“NAR”) agreed to settle certain lawsuits upon being found to have violated antitrust laws, resulting in

inflated fees paid to buy-side agents. This development is expected to result in the end of the standard six percent sales commission,

which equates to approximately $100 billion in realtor fees paid annually. Claire offers a cost-free alternative for homebuyers by utilizing

an AI-driven workflow that assists them through the home buying process.

Homebuyers can use Claire’s conversational

interface to guide them through every step of their journeys, from property search to closing the deal. By offering support 24/7, Claire

is poised to make the homebuying process more efficient, enjoyable and cost-efficient. Claire matches buyers with their dream homes using

over 400 data attributes and provides insights into market trends and property values. Additionally, Claire can assist with questions,

booking property tours, submitting offers, and negotiations.

Currently, Claire is under limited availability

for homebuyers located in Palm Beach, Miami-Dade and Broward counties in South Florida, but reAlpha is actively seeking new MLS and brokerage

licenses that will enable expansion into more U.S. states.

For more information on Claire, please visit www.reAlpha.com.

About Hyperfast

Hyperfast was originally founded as a subsidiary

of Madison Settlement Services, a 30-year-old real estate title company licensed in over 30 states that has served over 80,000 customers.

Forward-Looking Statements

The information in this press release includes

“forward-looking statements”. Forward-looking statements include, among other things, statements about the Hyperfast acquisition;

the anticipated benefits of the Hyperfast acquisition, reAlpha’s ability to anticipate the future needs of the short-term rental

market; future trends in the real estate, technology and artificial intelligence industries, generally; and reAlpha’s future growth

strategy and growth rate. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”,

“could”, “might”, “plan”, “possible”, “project”, “strive”, “budget”,

“forecast”, “expect”, “intend”, “will”, “estimate”, “anticipate”,

“believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations

of them or similar terminology. Factors that may cause actual results to differ materially from current expectations include, but are

not limited to: reAlpha’s limited operating history and that reAlpha has not yet fully developed its AI-based technologies; reAlpha’s

ability to commercialize its developing AI-based technologies; whether reAlpha’s technology and products will be accepted and adopted

by its customers and intended users; reAlpha’s ability to integrate the business of Hyperfast into its existing business and the

anticipated demand for Hyperfast services; the inability to maintain and strengthen reAlpha’s brand and reputation; the inability

to accurately forecast demand for short-term rentals and AI-based real estate focused products; the inability to execute business objectives

and growth strategies successfully or sustain reAlpha’s growth; the inability of reAlpha’s customers to pay for reAlpha’s

services; changes in applicable laws or regulations, and the impact of the regulatory environment and complexities with compliance related

to such environment; and other risks and uncertainties indicated in reAlpha’s U.S. Securities and Exchange Commission (“SEC”)

filings. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are

subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from

those anticipated in the forward-looking statements. Although reAlpha believes that the expectations reflected in the forward-looking

statements are reasonable, there can be no assurance that such expectations will prove to be correct. reAlpha’s future results,

level of activity, performance or achievements may differ materially from those contemplated, expressed or implied by the forward-looking

statements, and there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in

the forward-looking statements. For more information about the factors that could cause such differences, please refer to reAlpha’s

filings with the SEC. Readers are cautioned not to put undue reliance on forward-looking statements, and reAlpha does not undertake any

obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by law.

Media

irLabs on behalf of reAlpha

Fatema Bhabrawala

fatema@irlabs.ca

| 1 | https://www.ibisworld.com/united-states/market-research-reports/title-insurance-industry/ |

| 2 | https://www.nar.realtor/magazine/real-estate-news/nar-practice-changes-to-take-effect-august-17 |

3

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

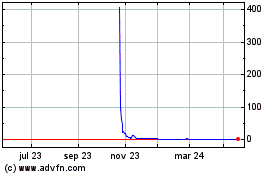

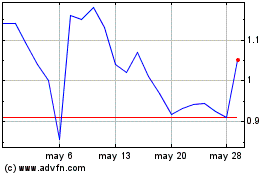

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024