ASP Isotopes Announces Pricing of Public Offering of Common Stock

01 Noviembre 2024 - 6:55AM

ASP Isotopes Inc. NASDAQ: ASPI ("ASP Isotopes” or the “Company”)

today announced the pricing of the previously announced

underwritten public offering of shares of its common stock. ASP

Isotopes has agreed to sell an aggregate of 2,395,000 shares of its

common stock at a public offering price of $6.75 per share. The

gross proceeds to ASP Isotopes from the offering, before deducting

underwriting discounts and commissions and estimated offering

expenses payable by ASP Isotopes, and without giving effect to any

exercise of the underwriters’ option to purchase additional shares,

are expected to be approximately $16.2 million. In addition,

ASP Isotopes has granted the underwriters a 30-day option to

purchase up to 359,250 additional shares of common stock at the

public offering price, less the underwriting discounts and

commissions. All of the shares in the public offering are to be

sold by ASP Isotopes. The offering is expected to close on or about

November 4, 2024, subject to the satisfaction of customary closing

conditions.

The Company currently intends to use the net proceeds from the

offering for general corporate purposes, including working capital,

operating expenses, and capital expenditures, including for the

purpose of accelerating the construction of enrichment facilities

in South Africa and Iceland.

Canaccord Genuity is acting as sole bookrunner for the offering.

Cantor Fitzgerald & Co. is acting as financial advisor.

The offering is being made pursuant to a shelf registration

statement on Form S-3 that was previously filed with and declared

effective by the Securities and Exchange Commission (“SEC”) and a

related registration statement that was filed with the SEC pursuant

to Rule 462(b) under the Securities Act of 1933 (and became

automatically effective upon filing). This offering is being made

only by means of a prospectus and a related prospectus supplement.

Copies of the preliminary prospectus supplement, dated October 31,

2024, and the accompanying prospectus, dated June 12, 2024,

relating to the offering have been filed with the SEC and made

available on the SEC’s website at www.sec.gov. Copies of the final

prospectus supplement and the accompanying prospectus relating to

the offering will be available on the SEC’s website at www.sec.gov

and may also be obtained, when available, by contacting Canaccord

Genuity LLC, Attention: Syndication Department, 1 Post Office

Square, 30th Floor, Boston, MA 02109, or by email at

prospectus@cgf.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About ASP Isotopes Inc.

ASP Isotopes Inc. is a development stage advanced materials

company dedicated to the development of technology and processes to

produce isotopes for use in multiple industries. The Company

employs proprietary technology, the Aerodynamic Separation Process

(“ASP technology”). The Company’s initial focus is on producing and

commercializing highly enriched isotopes for the healthcare and

technology industries. The Company also plans to enrich isotopes

for the nuclear energy sector using Quantum Enrichment technology

that the Company is developing. The Company has isotope enrichment

facilities in Pretoria, South Africa, dedicated to the enrichment

of isotopes of elements with a low atomic mass (light

isotopes).

Forward Looking Statements

This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to, those

regarding the expected closing of the offering and anticipated

proceeds from the offering. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “hope,” “may,”

“plan,” “possible,” “potential,” “predict,” “project,” “should,”

“target,” “would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Such statements are

subject to numerous important factors, risks and uncertainties that

may cause actual events or results to differ materially from

current expectations and beliefs, including, but not limited to:

risks and uncertainties related to the satisfaction of customary

closing conditions related to the public offering, the intended use

of net proceeds from the public offering, the impact of general

economic, industry or political conditions in the United States or

internationally and other important risk factors set forth under

the caption “Risk Factors” in the preliminary prospectus relating

to the offering, ASP Isotopes’ Annual Report on Form 10-K for the

year ended December 31, 2023, and in any other subsequent filings

made with the SEC by ASP Isotopes. Any forward-looking statements

contained in this press release speak only as of the date hereof,

and ASP Isotopes specifically disclaims any obligation to update

any forward-looking statement, whether as a result of new

information, future events or otherwise, except as required by

law.

Contacts

Jason Assad– Investor

relationsEmail: Jassad@aspisotopes.comTelephone:

561-709-3043

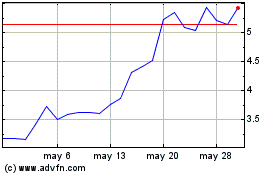

ASP Isotopes (NASDAQ:ASPI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

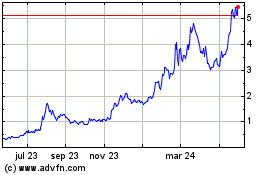

ASP Isotopes (NASDAQ:ASPI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024