UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a‑16 OR 15d‑16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2023

COMMISSION FILE NUMBER 001-39081

BioNTech SE

(Translation of registrant’s name into English)

An der Goldgrube 12

D-55131 Mainz

Germany

+49 6131-9084-0

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20‑F or Form 40‑F: Form 20‑F ☒ Form 40‑F ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(7): ☐

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

On November 6, 2023, BioNTech SE (the “Company”) issued a press release announcing its third quarter 2023 financial results and corporate update and details of a conference call to be held at 8:00 am EST on November 6, 2023 to discuss the results. The press release and the conference call presentation are attached as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein.

The information contained in Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, unless expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| BioNTech SE |

| | |

| | |

| By: | /s/ Jens Holstein |

| | Name: Jens Holstein |

| | Title: Chief Financial Officer |

Date: November 6, 2023

EXHIBIT INDEX

| | | | | |

| |

| Exhibit | Description of Exhibit |

| |

| 99.1 | |

| |

| 99.2 | |

| |

BioNTech Announces Third Quarter 2023 Financial Results

and Corporate Update

•Positive clinical data updates across multiple drug classes including antibody-drug conjugate (ADC) candidates BNT323/DB-1303, BNT325/DB-1305, CAR-T candidate BNT211, T cell therapy candidate BNT221 and mRNA cancer vaccine candidate BNT116

•Progress across the oncology pipeline with multiple late-stage trials initiated since third quarter start

•New and expanded strategic collaborations reflect BioNTech's commitment to delivering transformational therapies for oncology and infectious diseases

•Successful launches of Omicron XBB.1.5-adapted monovalent COVID-19 vaccine in markets worldwide

•Updated 2023 COVID-19 vaccine revenue guidance of around €4 billion

•Guidance reduction of planned 2023 R&D expenses to €1.8-2.0 billion and SG&A expenses to €600-650 million

•First nine months of 20231 revenues of €2.3 billion2, net profit of €472 million and diluted earnings per share of €1.94 ($2.113)

Conference call and webcast scheduled for November 6, 2023, at 8:00 am ET (2:00 pm CET)

MAINZ, Germany, November 6, 2023 (GLOBE NEWSWIRE) -- BioNTech SE (Nasdaq: BNTX, “BioNTech” or “the Company”) today reported financial results for the three and nine months ended September 30, 2023, and provided an update on its corporate progress.

“Over the last quarter, we complemented our investigational pipeline with ADC candidates, initiated later-stage clinical trials and presented significant data across modalities including cancer vaccines, cell therapies, ADCs and immune checkpoint modulators. Our strategy focuses on assembling a diverse toolbox of complementary technologies to deliver novel therapies, aiming to improve the standard-of-care for cancer patients,” said Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech. “We combine our internal innovation engine with a high-performance partnership model to transform healthcare and improve patients' quality of life.”

Financial Review for the Third Quarter and First Nine Months of 2023

| | | | | | | | | | | | | | |

| in millions €, except per share data | Third Quarter 2023 | Third Quarter 2022 | Nine Months 2023 | Nine Months 2022 |

Total Revenues2 | 895.3 | 3,461.2 | 2,340.0 | 13,032.3 |

| Net Profit | 160.6 | 1,784.9 | 472.4 | 7,155.7 |

Diluted Earnings per Share | 0.67 | 6.98 | 1.94 | 27.70 |

Total revenues reported were €895.3 million2 for the three months ended September 30, 2023, compared to €3,461.2 million for the comparative prior year period. For the nine months ended September 30, 2023, total revenues were €2,340.0 million2, compared to €13,032.3 million for the comparative prior year period. Inventory write-downs by BioNTech's collaboration partner Pfizer, Inc. ("Pfizer") reduced BioNTech's revenues by €507.9 million and €615.4 million for the three and nine months ended September 30, 2023, respectively.

Cost of sales were €161.8 million for the three months ended September 30, 2023, compared to €752.8 million for the comparative prior year period. For the nine months ended September 30, 2023, cost of sales were €420.7 million, compared to €2,811.5 million for the comparative prior year period. The change was in line with decreasing COVID-19 vaccine revenues.

Research and development (R&D) expenses were €497.9 million for the three months ended September 30, 2023, compared to €341.8 million for the comparative prior year period. For the nine months ended September 30, 2023, research and development expenses were €1,205.3 million, compared to €1,027.2 million for the comparative prior year period. Research and Development expenses are mainly influenced by progressing clinical studies for pipeline candidates, the development of variant adapted as well as next generation COVID-19 vaccines and expanding R&D headcount.

General and administrative (G&A) expenses were €144.5 million for the three months ended September 30, 2023, compared to €141.0 million for the comparative prior year period. For the nine months ended September 30, 2023, G&A expenses were €386.6 million, compared to €361.8 million for the comparative prior year period. G&A expenses were mainly influenced by increased expenses for IT services as well as expanding the G&A headcount.

Income taxes were accrued in an amount of €66.8 million for the three months ended September 30, 2023, compared to €659.2 million accrued for the comparative prior year period. For the nine months ended September 30, 2023, income taxes were accrued with an amount of €50.5 million, compared to €2,625.8 million accrued for the comparative prior year period. The derived annual effective income tax rate for the nine months ended September 30, 2023, was 9.7% which is expected to change over the 2023 financial year to be in line with the updated estimated annual cash effective income tax rate of somewhere around 21% for the BioNTech Group.

Net profit was €160.6 million for the three months ended September 30, 2023, compared to €1,784.9 million for the comparative prior year period. For the nine months ended September 30, 2023, net profit was €472.4 million, compared to €7,155.7 million net profit for the comparative prior year period.

Cash and cash equivalents as well as security investments were €16,967.6 million, comprising €13,495.8 million cash and cash equivalents and €3,471.8 million security investments, respectively, as of September 30, 2023. Subsequent to the end of the reporting period, as of October 16, 2023, a payment of €565.0 million was received from BioNTech's collaboration partner, settling BioNTech’s gross profit share for the second quarter of 2023 (as defined by the contract with Pfizer).

Diluted earnings per share was €0.67 for the three months ended September 30, 2023, compared to a diluted earnings per share €6.98 for the comparative prior year period. For the nine months ended September 30, 2023, diluted earnings per share was €1.94, compared to €27.70 diluted earnings per share for the comparative prior year period.

Shares outstanding as of September 30, 2023, were 237,715,500, excluding 10,836,700 shares in treasury.

In March 2023, BioNTech initiated a new share repurchase program pursuant to which the Company was able to purchase American Depositary Shares, or ADSs, each representing one ordinary share of the Company, in the amount of up to $0.5 billion during the remainder of 2023. During the three months ended September 30, 2023, 3,114,280 ADSs were repurchased under the share repurchase program at an average price of €97.15 ($106.923), for total consideration of €302.5 million ($333.1 million3). The trading plan for BioNTech's 2023 program concluded on September 18, 2023.

“In the third quarter, we continued to invest in our capabilities and our portfolio of innovative product candidates while strengthening the financial position of BioNTech. About €17 billion in cash and security investments provide strategic flexibility and is a major strength, especially in these days, where financial stability is key,” said Jens Holstein, CFO of BioNTech. “We updated our financial guidance for the full year 2023. In line with anticipated revenues of around €4 billion, we reduced relevant cost drivers for 2023 as we effectively manage our expenditures.”

Outlook updated for the 2023 Financial Year

The Company updated its COVID-19 vaccine revenue guidance and updates its previous expense and capex guidance for the 2023 financial year:

BioNTech COVID-19 Vaccine Revenues for the 2023 Financial Year:

| | | | | | | | |

| Initial Guidance Mar 2023 | Updated Guidance Nov 2023 |

| Estimated BioNTech COVID-19 vaccine revenues for the full 2023 financial year | ~ €5 billion | ~ €4 billion |

The revenues estimate reflects expected revenues related to BioNTech’s share of gross profit from COVID-19 vaccine sales in the collaboration partners’ territories, from direct COVID-19 vaccine sales to customers in BioNTech’s territory and expected revenues generated from products manufactured by BioNTech and sold to collaboration partners.

Revenue guidance is based on various assumptions. These include, but are not limited to, expectations regarding: transitions in the purchasing environment; the timing and receipt of regulatory approvals and recommendations; the progress of vaccination campaigns; and seasonal variations in SARS-CoV-2 circulation and vaccination uptake.

Several factors drive the Company’s adjusted revenue guidance. Such factors include BioNTech’s and Pfizer’s lower than previously forecast revenue expectations for the full 2023 financial year, which take into account delays in the expected timing of regulatory approvals, as well as the effects of Pfizer’s recently-announced write-downs and other charges.

While fewer primary vaccinations and lower population-wide levels of boosting are anticipated overall compared to the same period in prior years, vaccine adaptation and seasonal trends are expected to lead to demand peaks in the autumn and winter compared to other seasons. As a result of later-than-anticipated regulatory approvals and their effect on national vaccination campaign timelines, expected sales have shifted to future periods. In general, the Company continues to remain largely dependent on revenues generated in its collaboration partner’s territories.

In addition, BioNTech's revenues have been affected by the inventory write-downs and other charges related to COMIRNATY that were previously announced by the Company’s collaboration partner Pfizer. As a result of the Company’s continued assessment of these write-downs and other charges, the Company has determined that the charges originating on BioNTech’s end had largely already been reflected in the Company’s financial results for the 2022 financial year, and to a smaller extent, continued to be reflected during 2023. Ultimately, the initial estimate of “up to €0.9 billion” impact has been refined by the Company. The impact from the collaboration partner's charges onto the Company's revenues has been identified to be €0.6 billion for the nine months ended September 30, 2023 and €0.5 billion for the three months ended September 30, 2023, which is reflected in the revised revenues guidance.

Planned 2023 Financial Year Expenses and Capex4:

| | | | | | | | |

| Initial Guidance Mar 2023 | Updated Guidance Nov 2023 |

R&D expenses5 | €2,400m - €2,600m | €1,800m - €2,000m |

| SG&A expenses | €650m - €750m | €600m - €650m |

Capital expenditures for operating activities6 | €500m - €600m | €200m - €300m |

Estimated 2023 Financial Year Tax Assumptions:

| | | | | | | | |

| Initial Guidance Mar 2023 | Updated Guidance Nov 2023 |

BioNTech Group estimated annual cash effective income tax rate7 | ~ 27% | ~ 21% |

The full interim unaudited condensed consolidated financial statements can be found in BioNTech's Report on Form 6-K for the period ended September 30, 2023, filed today with the United States Securities and Exchange Commission ("SEC") and available at https://www.sec.gov/.

Endnotes

1Financial information is prepared and presented in Euros and numbers are rounded to millions and billions of Euros in accordance with standard commercial practice.

2BioNTech’s profit share is estimated based on preliminary data shared between Pfizer and BioNTech as further described in the Annual Report. Any changes in the estimated share of the collaboration partner’s gross profit will be recognized prospectively.

3Calculated applying the average foreign exchange rate for the nine months ended September 30, 2023, as published by the German Central Bank (Deutsche Bundesbank).

4Numbers reflect current base case projections and are calculated based on constant currency rates. Excluding external risks that are not yet known and/or quantifiable, including, but not limited to, the effects of ongoing and/or future legal disputes or related activity.

5Numbers include effects identified from additional collaborations or potential M&A transactions to the extent disclosed and will be updated as needed.

6Numbers exclude potential effects caused by or driven from collaborations or M&A transactions.

7Numbers exclude potential effects caused by or driven from share-based payment settlements in the course of 2023.

Operational Review and Pipeline Update for the Third Quarter 2023 and Key Post Period-End Events

COVID-19 Vaccine Marketed Products

•In August, BioNTech and Pfizer received a positive opinion from the European Medicines Agency (EMA) Committee for Medicinal Products for Human Use (CHMP) recommending marketing authorization for the companies' Omicron XBB.1.5-adapted monovalent COVID-19 vaccine for individuals 6 months of age and older.

•In September, BioNTech and Pfizer received approval of their supplemental Biologics License Application by the U.S. Food and Drug Administration (FDA) for their Omicron XBB.1.5-adapted monovalent COVID-19 vaccine for individuals 12 years and older, and emergency use authorization for individuals 6 months through 11 years of age.

•Several other national healthcare regulatory bodies, including in the United Kingdom (UK), Japan, Canada and South Korea, have approved BioNTech and Pfizer's monovalent XBB.1.5-adapted vaccine.

•In October, BioNTech and Pfizer announced an agreement between the Japanese government and Pfizer Japan Co., Ltd. to supply an additional 9 million doses of the Omicron XBB.1.5-adapted COVID-19 vaccine for the special vaccination program in Japan which started this

autumn. This follows an agreement between the Japanese government and Pfizer Inc. in July to supply 20 million doses and additional supplies as needed, and an agreement announced in September to provide additional 10 million doses of the companies’ Omicron XBB.1.5-adapted COVID-19 vaccine for the special vaccination program in Japan.

Select Oncology Pipeline Highlights - Recent and upcoming trial starts and data readouts

Antibody-Drug Conjugate (ADC) Pipeline

BioNTech's pipeline comprises several ADCs that are based on a topoisomerase I inhibitor as payload.

BNT323/DB-1303 is an HER2-targeted ADC candidate being developed in collaboration with Duality Biologics (Suzhou) Co. Ltd. (“DualityBio”).

•An open-label, multi-center, randomized Phase 3 clinical trial (NCT06018337) is planned to evaluate BNT323/DB-1303 versus investigator's choice of chemotherapy in advanced or metastatic Hormone Receptor (HR)+, HER2-low breast cancer subjects whose disease has progressed on at least two lines of prior endocrine therapy (ET) or within six months of first line ET plus CDK4/6 inhibitor in the metastatic setting, and no prior chemotherapy. The study aims to enroll approximately 532 patients.

•In September, clinical data from the ongoing Phase 1/2 clinical trial (NCT05150691) evaluating BNT323/DB-1303 in patients with advanced/unresectable, recurrent, or metastatic HER2-expressing solid tumors were presented at the 2023 European Congress on Gynaecological Oncology Annual Meeting. BNT323/DB-1303 showed a manageable safety profile and no new safety signals were observed. BNT323/DB-1303 demonstrated encouraging antitumor activity in patients (n=17) with advanced, recurrent or metastatic HER2-expressing endometrial cancer with an objective response rate (“ORR”; confirmed and unconfirmed) of 58.8% and disease control rate (“DCR”) of 94.1%.

BNT324/DB-1311 is an ADC candidate being developed in collaboration with DualityBio.

•In September, the first patient was dosed in a first-in-human, open-label Phase 1/2 clinical trial (NCT05914116) evaluating BNT324/DB-1311 in multiple advanced solid tumors.

BNT325/DB-1305 is a TROP2-targeted ADC candidate being developed in collaboration with DualityBio.

•In October, clinical data from the ongoing Phase 1/2 clinical trial (NCT05438329) in patients with advanced solid tumors were presented at the 2023 European Society of Medical Oncology (ESMO) Annual Meeting suggesting a manageable safety profile at lower dose levels. Encouraging preliminary activity of BNT325/DB-1305 was observed with an ORR of 30.4% (7/23), and DCR of 87.0% (20/23) (both unconfirmed) across overall study population. Encouraging efficacy signals were observed in non-small cell lung cancer (NSCLC) patients with an ORR of 46.2% (6/13) and an DCR of 92.3% (12/13) (both unconfirmed).

BNT326/YL202 is a HER3-targeted ADC candidate being developed in collaboration with MediLink Therapeutics (Suzhou) Co., Ltd. (“MediLink”).

•A multicenter, open-label, first-in-human Phase 1 clinical trial (NCT05653752) evaluating YL202 as a later-line treatment in patients with locally advanced or metastatic epidermal growth factor receptor (EGFR)-mutated NSCLC or HR-positive and HER2-negative breast cancer is ongoing.

Next-Generation Immune Checkpoint Immunomodulator Pipeline

BNT316/ONC-392 (gotistobart) is an anti-CTLA-4 monoclonal antibody candidate being developed in collaboration with OncoC4, Inc. (“OncoC4”). BNT316/ONC-392 (gotistobart) is designed to offer a differentiated safety profile that may allow for higher dosing and longer duration of treatment both as monotherapy and in combination with other therapies.

•In November, clinical data were presented at the 2023 Society for Immunotherapy of Cancer (SITC) Annual Meeting from the ongoing Phase 1/2 trial (NCT04140526) showing that BNT316/ONC-392 (gotistobart) monotherapy has a manageable safety profile. Early readout of the expansion cohort showed encouraging clinical activity in patients with immunotherapy-resistant NSCLC. A Phase 3 trial evaluating BNT316/ONC-392 (gotistobart) monotherapy in this patient population is ongoing.

•A Phase 2 clinical trial (NCT05682443) is planned to evaluate the safety and efficacy of BNT316/ONC-392 in combination with lutetium Lu-177 vipivotide tetraxetan in metastatic castration resistant prostate cancer patients who have disease progressed on androgen receptor pathway inhibition.

BNT312/GEN1042 is a bispecific antibody candidate based on Genmab A/S (“Genmab”)'s DuoBody technology and designed to induce conditional immune activation by crosslinking CD40 and 4-1BB positive cells.

•In November, preclinical data demonstrating in vivo antitumor activity and peripheral immune modulation of a chimeric variant of BNT312/GEN1042 were presented at the 2023 SITC Annual Meeting. These data support ongoing Phase 1/2 clinical studies evaluating the combination of BNT312/GEN1042 with pembrolizumab and chemotherapy in patients with advanced solid tumors (NCT04083599, NCT05491317).

BNT314/GEN1059 is a bispecific antibody candidate designed to boost antitumor immune responses through EpCAM-dependent 4-1BB agonistic activity. This is the fifth drug candidate under BioNTech's collaboration with Genmab where the development costs and potential future profits will be shared equally.

•In October, preclinical data characterizing the mechanism of action of BNT314/GEN1059 were presented at the 2023 ESMO Annual Meeting.

•A first-in-human trial sponsored by BioNTech is planned to investigate the clinical safety and preliminary antitumor activity of BNT314/GEN1059 in patients with solid tumors.

Cancer Vaccines Pipeline

BNT116 is based on BioNTech’s FixVac platform, and is a wholly owned, systemically administered, off-the-shelf mRNA-based cancer vaccine candidate. This candidate is being evaluated for the treatment of advanced NSCLC.

•In July, BioNTech and Regeneron Pharmaceuticals Inc. (“Regeneron”) initiated a randomized, controlled Phase 2 clinical trial (NCT05557591) to evaluate BNT116 in combination with cemiplimab (Regeneron’s Libtayo) and cemiplimab alone as first-line treatment in patients with advanced NSCLC whose tumors express PD-L1 in ≥ 50% of tumor cells.

•In November, clinical data from the ongoing Phase 1 clinical trial (NCT05142189) evaluating the safety, tolerability and preliminary efficacy of BNT116 alone and in combination with cemiplimab (Regeneron’s Libtayo) or chemotherapy across various cohorts of patients were presented at the 2023 SITC Annual Meeting. BNT116 was generally well tolerated with an expected safety profile

as monotherapy and in combination with cemiplimab. In heavily pretreated NSCLC patients, treatment with BNT116 with cemiplimab from cycle 3 onwards showed early clinical activity.

BNT122 (Autogene cevumeran) is an mRNA cancer vaccine candidate based on an individualized neoantigen-specific immunotherapy (iNeST) approach being developed in collaboration with Genentech, Inc. (“Genentech”), a member of the Roche Group (“Roche”).

•In October, the first patient was dosed in a randomized Phase 2 clinical trial (NCT05968326) evaluating the safety and efficacy of BNT122 in combination with atezolizumab (Roche’s Tecentriq) followed by adjuvant standard-of-care chemotherapy (mFOLFIRINOX) in patients with resected pancreatic ductal adenocarcinoma (PDAC) compared to chemotherapy alone. The Phase 2 study is expected to enroll 260 patients with resected PDAC, who have not received prior systemic anti-cancer treatment and showed no evidence of disease after surgery.

Cell Therapy Pipeline

BNT211 is an autologous Claudin-6 (CLDN6)-targeting chimeric antigen receptor (CAR) T cell therapy candidate that is being tested alone and in combination with a CAR-T cell Amplifying RNA Vaccine (“CARVac”), encoding CLDN6.

•In October, clinical data from the ongoing Phase 1/2 clinical trial (NCT04503278) were presented at the 2023 ESMO Annual Meeting detailing the new dose escalation of CLDN6 CAR-T cells with and without a CLDN6-encoding mRNA vaccine for the treatment of CLDN6-positive relapsed/refractory solid tumors using an automated manufacturing process. CLDN6 CAR-T cells ± CLDN6 CARVac demonstrated encouraging signs of clinical activity. In several patients treated with CARVac, an increased persistence of cancer-specific CAR-T cells was observed. The rate of treatment-dependent adverse events was dose-dependent. After determination of the recommended Phase 2 dose, BioNTech plans to initiate a pivotal trial in germ cell tumors.

BNT221 is an autologous, fully personalized, polyspecific T-cell therapy candidate directed against selected sets of individual neoantigens. BNT221 is based on expanded neoantigen-specific memory T cells and induced naive T cells.

•In October and November, first monotherapy clinical data from the ongoing first-in-human Phase 1 dose escalation clinical trial (NCT04625205) in patients with checkpoint inhibitor unresponsive or refractory metastatic melanoma were presented at the 2023 ESMO and SITC Annual Meetings. These initial results showed a manageable safety profile and encouraging activity signs of tumor regression in several patients with anti-PD-1/anti-CTLA-4 pretreated advanced or metastatic melanoma.

Select Infectious Pipeline Highlights - Recent trial starts and data readouts

COVID-19-Influenza Combination mRNA Vaccine Program – BNT162b2 + BNT161

•In October, BioNTech and Pfizer announced top-line results from a Phase 1/2 clinical trial (NCT05596734) evaluating the safety, tolerability and immunogenicity of mRNA-based combination vaccine candidates for influenza and COVID-19 in healthy adults 18 to 64 years of age. In the clinical trial, the vaccine candidates were compared to licensed influenza vaccines and the Pfizer-BioNTech COVID-19 Omicron BA.4/BA.5 adapted bivalent vaccine given separately at the same visit. The data from the trial demonstrated robust immune responses to influenza A, influenza B, and SARS-CoV-2 strains, as well as a safety profile consistent with the safety profile of the companies’ COVID-19 vaccine. A pivotal Phase 3 trial is expected to be initiated in the coming months.

Mpox Program - BNT166

The BNT166 vaccine candidates encode surface antigens that are expressed in the two infectious forms of the mpox virus (MPXV) with the aim to efficiently fight virus replication and infectivity. In partnership with the Coalition for Epidemic Preparedness Innovations (CEPI), BNT166 is part of BioNTech’s infectious disease vaccine programs aiming to help provide equitable access to effective and well-tolerated vaccines for high medical need indications.

•In October, the first patient was dosed in a Phase 1/2 clinical trial (NCT05988203) evaluating the safety, tolerability, reactogenicity and immunogenicity of two mRNA-based multivalent vaccine candidates against mpox. The trial aims to enroll 96 healthy participants with and without prior history of known or suspected smallpox vaccination.

Corporate Update for the Third Quarter 2023 and Key Post Period-End Events

•In July, BioNTech successfully completed its previously announced acquisition of InstaDeep Ltd. (“InstaDeep”), following the satisfaction of all customary closing conditions. The acquisition supports the Company’s strategy to build world-leading capabilities in Artificial Intelligence (“AI”)-driven drug discovery and development. InstaDeep will operate as a UK-based global subsidiary of BioNTech. The transaction adds approximately 290 highly skilled professionals to BioNTech’s existing bioinformatics and data science workforce, including teams in AI, machine learning, bioengineering, data science, and software development.

•In September, BioNTech and CEPI announced a strategic partnership to advance mRNA-based vaccine candidates with the development of BNT166 for the prevention of mpox, an infectious disease that can lead to severe, life-threatening complications. The strategic partnership aims to contribute to CEPI’s 100 Days Mission, a goal to accelerate development of well-tolerated and effective vaccines against a potential future pandemic virus so that a vaccine can be ready for regulatory authorization and manufacturing at scale within 100 days of recognition of a pandemic pathogen. This mission is spearheaded by CEPI and embraced by the G7, G20, and industry leaders. The partnership between BioNTech and CEPI could help accelerate responses to future outbreaks caused by viruses of the Orthopoxvirus viral family. CEPI will provide funding of up to $90 million to support the development of mRNA-based vaccine candidates.

•Post period-end, in October, BioNTech and MediLink entered into a strategic research collaboration and worldwide license agreement to develop a next-generation ADC candidate against Human Epidermal Growth Factor Receptor 3 (HER3). Under the terms of the agreement, MediLink will grant BioNTech exclusive global rights, excluding Mainland China, Hong Kong Special Administrative Region, and Macau Special Administrative Region, for the development, manufacturing, and commercialization of one of MediLink's ADC assets. In exchange, BioNTech will provide MediLink with an upfront payment totaling of $70 million and additional development, regulatory and commercial milestone payments potentially totaling over $1 billion. The completion of the agreement is subject to customary closing conditions.

•Also, post period-end in November, BioNTech and Biotheus Inc. (“Biotheus”), announced an exclusive license and collaboration agreement under which BioNTech will have the rights to develop, manufacture and commercialize PM8002, a bispecific antibody candidate targeting PD-L1 and VEGF, globally except in Greater China, where Biotheus retains the rights to PM8002. PM8002 is currently being tested in a Phase 2/3 study in China to evaluate the efficacy and safety of the candidate as a monotherapy or in combination with chemotherapy in patients with NSCLC.

Upcoming Investor and Analyst Events

•BioNTech’s Innovation Series Day will take place tomorrow, Tuesday, November 7, 2023, from 9.00 a.m. ET (3.00 p.m. CET) in Boston, USA. The event will provide an update on BioNTech’s clinical progress across its pipeline and provide a deep dive into scientific and technological

innovations from its research engine. The slide presentation and audio of the webcast will be available via this link.

•BioNTech's fourth quarter and full year 2023 financial results and corporate update are scheduled for Wednesday, March 20, 2024.

Conference Call and Webcast Information

BioNTech invites investors and the general public to join a conference call and webcast with investment analysts today, November 6, 2023, at 8.00 a.m. ET (2.00 p.m. CET) to report its financial results and provide a corporate update for the third quarter of 2023.

To access the live conference call via telephone, please register via this link. Once registered, dial-in numbers and a pin number will be provided.

The slide presentation and audio of the webcast will be available via this link.

Participants may also access the slides and the webcast of the conference call via the “Events & Presentations” page of the Investor Relations section of the Company’s website at https://biontech.com. A replay of the webcast will be available shortly after the conclusion of the call and archived on the Company’s website for 30 days following the call.

About BioNTech

Biopharmaceutical New Technologies (BioNTech) is a next generation immunotherapy company pioneering novel therapies for cancer and other serious diseases. The Company exploits a wide array of computational discovery and therapeutic drug platforms for the rapid development of novel biopharmaceuticals. Its broad portfolio of oncology product candidates includes individualized and off-the-shelf mRNA-based therapies, innovative chimeric antigen receptor (CAR) T cells, several protein-based therapeutics, including bispecific immune checkpoint modulators, targeted cancer antibodies and antibody-drug conjugate (ADC) therapeutics, as well as small molecules. Based on its deep expertise in mRNA vaccine development and in-house manufacturing capabilities, BioNTech and its collaborators are developing multiple mRNA vaccine candidates for a range of infectious diseases alongside its diverse oncology pipeline. BioNTech has established a broad set of relationships with multiple global pharmaceutical collaborators, including Duality Biologics, Fosun Pharma, Genentech, a member of the Roche Group, Genevant, Genmab, OncoC4, Regeneron, Sanofi and Pfizer.

For more information, please visit www.BioNTech.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech's expected revenues and net profit related to sales of BioNTech's COVID-19 vaccine, referred to as COMIRNATY where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech's collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech's partners; the rate and degree of market acceptance of BioNTech's COVID-19 vaccine and, if approved, BioNTech's investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech's research and development programs, including those relating to additional formulations of BioNTech's COVID-19 vaccine, and BioNTech's current and future preclinical studies and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work and the availability of results; our expectations with respect to our intellectual property; the impact of the Company’s acquisition of InstaDeep Ltd. and the Company's collaboration and licensing agreements;

the development of sustainable vaccine production and supply solutions, and the nature and feasibility of these solutions; and BioNTech's estimates of commercial and other revenues, cost of sales, research and development expenses, sales and marketing expenses, general and administrative expenses, capital expenditures, income taxes, net profit, cash, cash equivalents and security investments, shares outstanding and cash outflows and share consideration. In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: BioNTech's pricing and coverage negotiations with governmental authorities, private health insurers and other third-party payors after BioNTech's initial sales to national governments; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech's other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side-effect profile and durability of immune response; the timing of and BioNTech's ability to obtain and maintain regulatory approval for BioNTech's product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech's and its counterparties’ ability to manage and source necessary energy resources; BioNTech's ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech's third-party collaborators to continue research and development activities relating to BioNTech's development candidates and investigational medicines; the impact of the COVID-19 pandemic on BioNTech's development programs, supply chain, collaborators and financial performance; unforeseen safety issues and potential claims that are alleged to arise from the use of BioNTech's COVID-19 vaccine and other products and product candidates developed or manufactured by BioNTech; BioNTech's and its collaborators’ ability to commercialize and market BioNTech's COVID-19 vaccine and, if approved, its product candidates; BioNTech's ability to manage its development and expansion; regulatory developments in the United States and other countries; BioNTech's ability to effectively scale BioNTech's production capabilities and manufacture BioNTech's products, including BioNTech's target COVID-19 vaccine production levels, and BioNTech's product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech's Report on Form 6-K for the period ended September 30, 2023 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at https://www.sec.gov/. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on BioNTech’s current expectations and speak only as of the date hereof.

CONTACTS

Investor Relations

Victoria Meissner, M.D.

+1 617 528 8293

Investors@biontech.de

Media Relations

Jasmina Alatovic

+49 (0)6131 9084 1513

Media@biontech.de

Interim Consolidated Statements of Profit or Loss

| | | | | | | | | | | | | | |

| Three months ended September 30, | Nine months ended September 30, |

| 2023 | 2022 | 2023 | 2022 |

| (in millions €, except per share data) | (unaudited) | (unaudited) | (unaudited) | (unaudited) |

| Revenues | | | | |

| Commercial revenues | 893.7 | 3,394.8 | 2,336.6 | 12,923.3 |

| Research & development revenues | 1.6 | 66.4 | 3.4 | 109.0 |

| Total revenues | 895.3 | 3,461.2 | 2,340.0 | 13,032.3 |

| | | | |

| Cost of sales | (161.8) | (752.8) | (420.7) | (2,811.5) |

| Research and development expenses | (497.9) | (341.8) | (1,205.3) | (1,027.2) |

| Sales and marketing expenses | (14.4) | (12.8) | (44.7) | (44.9) |

| General and administrative expenses | (144.5) | (141.0) | (386.6) | (361.8) |

| Other operating expenses | (31.4) | (285.1) | (223.7) | (594.6) |

| Other operating income | 27.8 | 459.8 | 105.2 | 1,157.5 |

| Operating income | 73.1 | 2,387.5 | 164.2 | 9,349.8 |

| | | | |

| Finance income | 156.3 | 60.9 | 363.2 | 448.5 |

| Finance expenses | (2.0) | (4.3) | (4.5) | (16.8) |

| Profit before tax | 227.4 | 2,444.1 | 522.9 | 9,781.5 |

| | | | |

| Income taxes | (66.8) | (659.2) | (50.5) | (2,625.8) |

| Profit for the period | 160.6 | 1,784.9 | 472.4 | 7,155.7 |

| | | | |

| Earnings per share | | | | |

| Basic earnings for the period per share | 0.67 | 7.43 | 1.96 | 29.47 |

| Diluted earnings for the period per share | 0.67 | 6.98 | 1.94 | 27.70 |

Interim Consolidated Statements of Financial Position

| | | | | | | | | | | |

| | September 30, | December 31, |

| (in millions €) | | 2023 | 2022 |

| Assets | | (unaudited) | |

| Non-current assets | | | |

| Intangible assets | | 665.5 | 158.5 |

| Goodwill | | 365.6 | 61.2 |

| Property, plant and equipment | | 728.9 | 609.2 |

| Right-of-use assets | | 197.0 | 211.9 |

| Other financial assets | | 1,292.7 | 80.2 |

| Other non-financial assets | | 0.3 | 6.5 |

| Deferred tax assets | | 208.1 | 229.6 |

| Total non-current assets | | 3,458.1 | 1,357.1 |

| Current assets | | | |

| Inventories | | 415.7 | 439.6 |

| Trade and other receivables | | 2,002.0 | 7,145.6 |

| Contract assets | | 6.8 | — |

| Other financial assets | | 2,253.3 | 189.4 |

| Other non-financial assets | | 286.2 | 271.9 |

| Income tax assets | | 289.3 | 0.4 |

| Cash and cash equivalents | | 13,495.8 | 13,875.1 |

| Total current assets | | 18,749.1 | 21,922.0 |

| Total assets | | 22,207.2 | 23,279.1 |

| | | |

| Equity and liabilities | | | |

| Equity | | | |

| Share capital | | 248.6 | 248.6 |

| Capital reserve | | 1,228.4 | 1,828.2 |

| Treasury shares | | (10.8) | (5.3) |

| Retained earnings | | 19,305.4 | 18,833.0 |

| Other reserves | | (904.8) | (848.9) |

| Total equity | | 19,866.8 | 20,055.6 |

| Non-current liabilities | | | |

| Lease liabilities, loans and borrowings | | 161.9 | 176.2 |

| Other financial liabilities | | 38.5 | 6.1 |

| Income tax liabilities | | — | 10.4 |

| Provisions | | 8.6 | 8.6 |

| Contract liabilities | | 268.0 | 48.4 |

| Other non-financial liabilities | | 13.1 | 17.0 |

| Deferred tax liabilities | | 43.1 | 6.2 |

| Total non-current liabilities | | 533.2 | 272.9 |

| Current liabilities | | | |

| Lease liabilities, loans and borrowings | | 40.0 | 36.0 |

| Trade payables and other payables | | 222.7 | 204.1 |

| Other financial liabilities | | 321.6 | 785.1 |

| Refund liabilities | | — | 24.4 |

| Income tax liabilities | | 545.2 | 595.9 |

| Provisions | | 318.0 | 367.2 |

| Contract liabilities | | 167.1 | 77.1 |

| Other non-financial liabilities | | 192.6 | 860.8 |

| Total current liabilities | | 1,807.2 | 2,950.6 |

| Total liabilities | | 2,340.4 | 3,223.5 |

| Total equity and liabilities | | 22,207.2 | 23,279.1 |

Interim Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | Nine months ended September 30, |

| | 2023 | 2022 | 2023 | 2022 |

| (in millions €) | | (unaudited) | (unaudited) | (unaudited) | (unaudited) |

| Operating activities | | | | | |

| Profit for the period | | 160.6 | 1,784.9 | 472.4 | 7,155.7 |

| Income taxes | | 66.8 | 659.2 | 50.5 | 2,625.8 |

| Profit before tax | | 227.4 | 2,444.1 | 522.9 | 9,781.5 |

| Adjustments to reconcile profit before tax to net cash flows: | | | | | |

| Depreciation and amortization of property, plant, equipment, intangible assets and right-of-use assets | | 41.3 | 33.5 | 104.6 | 94.3 |

| Share-based payment expenses | | 15.5 | 61.4 | 37.2 | 86.4 |

| Net foreign exchange differences | | (20.4) | 116.2 | (364.3) | (222.3) |

| Loss on disposal of property, plant and equipment | | 3.3 | 0.2 | 3.6 | 0.4 |

| Finance income excluding foreign exchange differences | | (148.5) | (7.7) | (357.4) | (226.5) |

| Finance expense excluding foreign exchange differences | | 2.0 | 4.3 | 4.5 | 16.8 |

| Movements in government grants | | — | — | (3.0) | — |

| Unrealized net (gain) / loss on derivative instruments at fair value through profit or loss | | (3.5) | (2.3) | 84.7 | 82.3 |

| Working capital adjustments: | | | | | |

| Decrease in trade and other receivables, contract assets and other assets | | 631.2 | 2,245.4 | 6,648.6 | 5,016.7 |

| Decrease in inventories | | 33.2 | 72.9 | 23.9 | 207.7 |

| (Decrease) / increase in trade payables, other financial liabilities, other liabilities, contract liabilities, refund liabilities and provisions | | (25.0) | 565.9 | (293.9) | 760.3 |

| Interest received | | 70.3 | 4.3 | 166.4 | 6.5 |

| Interest paid | | (1.2) | (4.3) | (3.7) | (16.5) |

| Income tax paid | | (10.2) | (753.3) | (1,292.4) | (2,834.7) |

| Share-based payments | | (4.2) | (1.7) | (761.2) | (4.7) |

| Net cash flows from operating activities | | 811.2 | 4,778.9 | 4,520.5 | 12,748.2 |

| | | | | |

| Investing activities | | | | | |

| Purchase of property, plant and equipment | | (53.2) | (77.9) | (165.6) | (192.6) |

| Proceeds from sale of property, plant and equipment | | (0.8) | 0.4 | (0.8) | 0.4 |

| Purchase of intangible assets and right-of-use assets | | (97.2) | (4.7) | (348.9) | (26.2) |

| Acquisition of subsidiaries and businesses, net of cash acquired | | (336.9) | — | (336.9) | — |

| Investment in other financial assets | | (744.1) | (1.1) | (3,407.2) | (31.1) |

| Proceeds from maturity of other financial assets | | — | — | — | 375.2 |

| Net cash flows from / (used in) investing activities | | (1,232.2) | (83.3) | (4,259.4) | 125.7 |

| | | | | |

| Financing activities | | | | | |

| Proceeds from issuance of share capital and treasury shares, net of costs | | — | — | — | 110.5 |

| Proceeds from loans and borrowings | | 0.1 | 0.4 | 0.1 | 0.6 |

| Repayment of loans and borrowings | | (0.1) | — | (0.1) | (18.8) |

| Payments related to lease liabilities | | (9.3) | (10.0) | (28.0) | (31.9) |

| Share repurchase program | | (301.7) | (643.8) | (737.7) | (930.7) |

| Dividends | | — | — | — | (484.3) |

| Net cash flows used in financing activities | | (311.0) | (653.4) | (765.7) | (1,354.6) |

| | | | | |

| Net increase / (decrease) in cash and cash equivalents | | (732.0) | 4,042.2 | (504.6) | 11,519.3 |

| | | | | | | | | | | | | | | | | |

| Change in cash and cash equivalents resulting from exchange rate differences and other valuation effects | | 61.2 | 46.7 | 125.3 | 211.7 |

| Cash and cash equivalents at the beginning of the period | | 14,166.6 | 9,334.8 | 13,875.1 | 1,692.7 |

| Cash and cash equivalents as of September 30 | | 13,495.8 | 13,423.7 | 13,495.8 | 13,423.7 |

3rd Quarter 2023 Financial Results & Corporate Update November 6, 2023

This Slide Presentation Includes Forward-Looking Statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech's expected revenues and net profit related to sales of BioNTech's COVID-19 vaccine, referred to as COMIRNATY® where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech's collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech's partners; the rate and degree of market acceptance of BioNTech's COVID-19 vaccine and, if approved, BioNTech's investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment, seasonality and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech's research and development programs, including those relating to additional formulations of BioNTech's COVID-19 vaccine, and BioNTech's current and future preclinical studies and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work and the availability of results; our expectations with respect to our intellectual property; the impact of the Company’s collaboration and licensing agreements; the development of sustainable vaccine production and supply solutions and the nature and feasibility of these solutions; and BioNTech's estimates of commercial and other revenues, cost of sales, research and development expenses, sales and marketing expenses, general and administrative expenses, capital expenditures, income taxes, net profit, cash, cash equivalents and security investments, shares outstanding and cash outflows and share consideration. In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. The forward-looking statements in this presentation are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control, and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: BioNTech's pricing and coverage negotiations with governmental authorities, private health insurers and other third-party payors after BioNTech's initial sales to national governments; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech's other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side-effect profile and durability of immune response; the timing of and BioNTech's ability to obtain and maintain regulatory approval for BioNTech's product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech's and its counterparties’ ability to manage and source necessary energy resources; BioNTech's ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech's third-party collaborators to continue research and development activities relating to BioNTech's development candidates and investigational medicines; the impact of the COVID-19 pandemic on BioNTech's development programs, supply chain, collaborators and financial performance; unforeseen safety issues and claims for potential personal injury or death arising from the use of BioNTech's COVID-19 vaccine and other products and product candidates developed or manufactured by BioNTech; BioNTech's and its collaborators’ ability to commercialize and market BioNTech's COVID-19 vaccine and, if approved, its product candidates; BioNTech's ability to manage its development and expansion; regulatory developments in the United States and other countries; BioNTech's ability to effectively scale BioNTech's production capabilities and manufacture BioNTech's products, including BioNTech's target COVID-19 vaccine production levels, and BioNTech's product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech’s Report on Form 6-K for the period ended September 30, 2023 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at https://www.sec.gov/. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation in the event of new information, future developments or otherwise. These forward-looking statements are based on BioNTech’s current expectations and speak only as of the date hereof.

Financial Results Jens Holstein, Chief Financial Officer3 Strategic Outlook Ryan Richardson, Chief Strategy Officer4 Pipeline Update Özlem Türeci, Chief Medical Officer2 3rd Quarter 2023 Highlights Ugur Sahin, Chief Executive Officer1

1 3rd Quarter 2023 Highlights Ugur Sahin, Chief Executive Officer

Clinical data updates Strategic Priorities and Achievements in Q3 2023 and Post Period 5 1. Partnered with Pfizer; 2. Partnered with DualityBio; 3. Partnered with Genmab; 4. Partnered with OncoC4; 5. Partnered with Regeneron; 6. Partnered with CEPI. Initiated Trial COVID-19 franchise1 Infectious diseases Sustain leadership in COVID-19 vaccines Advance next-gen vaccines Initiate and accelerate clinical programs for diseases of unmet medical need Q3 Achievements Successful launch of XBB.1.5-adapted monovalent COVID-19 vaccine for 2023/2024 season 2023 Strategic Priorities Immuno-oncology Advance oncology pipeline across multiple solid tumors Initiate multiple trials with registrational potential Clinical data updates BNT1666 (Mpox): First-in-humanESMO BNT325/DB-13052 BNT314/GEN10593 BNT211 BNT221 SITC BNT316/ONC-3924 (gotistobart) BNT221 BNT116 ESGO BNT323/DB-13032 Initiated trials BNT323/DB-13032: Ph3 BNT324/DB-13112: Ph1/2 BNT311/GEN10463: Ph2 BNT314//GEN10593: First-in-human BNT1165: Ph2 Partnerships DualityBio MediLink Biotheus COVID-19-Influenza combo Partnership Coalition for Epidemic Preparedness Innovations Peer reviewed papers Murdoch et al, Infect Dis Ther 2023 Muik et al, Cell Rep 2023 Arieta et al, Cell 2023 Beguir et al, Comput Biol Med 2023 Peer reviewed papers Mackensen et al, Nature Med 2023 Bähr-Mahmud et al, Oncoimmunol 2023 Simon et al, J. Transl Med 2023

Strong Global Distribution COMIRNATY1 Q3 Highlights 1. Partnered with Pfizer. 2.COMIRNATY approved for prevention of COVID-19 as a single dose for individuals 5 years of age and older and as a 3-dose series in individuals 6 months through 4 years of age. 3. COMIRNATY may be administered as a booster in people aged 12 years and older who have received at least a primary vaccination course against COVID-19. EMA = European Medicines Agency; FDA = Food and Drug Administration; sBLA = supplemental Biologics License Application; EUA = Emergency Use Authorization. First-to-market Omicron XBB.1.5-adapted monovalent vaccine Distributed to over 40 countries and regions worldwide EU: EMA Full Marketing Authorization for ages 6 months and older2 US: FDA sBLA for individuals 12+ years and EUA for ages 6 months to 11 years old3 Other select regions with approval: UK, Japan, Canada, Australia, Singapore and South Korea Rapid Regulatory Advancement 6

0 20k 40k 60k 80k 0 20k 40k 60k 80k 0 20k 40k 60k 80k Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 Apr 2025 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 Apr 2025 Hospitalizations Likely to Increase this Winter and Stay Within Last Year’s Range1 7 1. ACIP Meeting September 12, 2023: Evidence to Recommendations Framework: 2023 – 2024 (Monovalent, XBB Containing) COVID-19 Vaccine; Modeling by Covid19 Scenario Modeling Hub. 2. High threshold assumption defined as approximately 65746 hospitalizations; 3. Medium threshold assumption defined as approximately 32872 hospitalizations. In ci de nt H os pi ta liz at io n N o bo os te r A ll bo os te r 65 + bo os te r High immune escapeLow immune escape High threshold2 Medium threshold3 High threshold2 Medium threshold3 High threshold2 Medium threshold3

Probability of developing long COVID in vaccinated vs non-vaccinated individuals Statistically Significant Reduction in Developing Long COVID after mRNA Vaccination 8 Prevalence of ongoing symptoms lasting at least 3 months after COVID-19 infection by age, regardless of COVID status, U.S. 1 0.8 1.9 6.8 9 7.4 4.2 0.2 0.3 0.8 2.7 4.7 3.8 2.3 0 2 4 6 8 10 0 - 5 years 6 - 11 years 12 - 17 years 18 - 34 years 35 - 49 years 50 - 64 years ≥ 65 years Ever Current Pr ev al en ce (% ) Vaccinated Non-vaccinated 1 – Pr ob ab ili ty o f L C D ia gn os is 10–20% of SARS-CoV-2 infected people may develop long COVID1,2 Long COVID also affects children and may lead to long term effects on development3 Post COVID-19 conditions are associated with increased healthcare utilization4 COVID-19 vaccination reduces post COVID-19 conditions among children and adults5,6 0.96 0.97 0.98 0.99 1.00 45 100 150 200 250 300 Time from COVID index, day Inverse probability of treatment weighting adjusted Kaplan–Meier Curves Brannock et al, Nature Comm. 2023CDC ACIP September 12, 2023 1. Davis, H.E., et al. Nat Rev Microbiol 2023; 2. Editorial, The Lancet Vol 401 2023; 3. Villapol, S. et al Sci Rep Nat Res 2022; 4. Katz GM et al. JAMA Health Forum 2023; 5. Saydah, Centers for Disease Control Advisory Committee on Immunization Practices, September 12, 2023; 6. Brannock et al, Nature Comm. 2023. LC: Long Covid.

XBB.1.5-adapted vaccine Effective against multiple variants of concern5 Long-term health consequences Accumulating evidence demonstrates that COVID-19 vaccination may reduce long COVID conditions4 Continuous evolution Ongoing antigenic evolution of SARS-CoV-21,2 Risk remains high For severe COVID-19 in vulnerable populations3 Long-Term Need for Annually Adapted Vaccines Anticipated 9 1. World Health Organization tracking SARS-CoV-2 variant www.who.int/en/activities/tracking-SARS-CoV-2-variants accessed October 30, 2023; 2. GISAID https://gisaid.org/ accessed October 30, 2023; 3. FDA Briefing Document Vaccines and Related Biological Products Advisory Committee Meeting June 15, 2023; 4 Brannock et al, Nature Comm. 2023; 5. Stankov M. V. et al., medRxiv pre-print, accessed October 5, 2023. Annual and/or SEASONAL VACCINATION with variant-adapted vaccines expected for the foreseeable future

Pipeline Update Özlem Türeci, Chief Medical Officer

Infectious Disease Pipeline: Achievements in Q3 2023 and Post Period 11 1. Partnered with Pfizer; 2. Collaboration with University of Pennsylvania; 3. Collaboration with Bill & Melinda Gates Foundation; 4. Partnered with CEPI; HSV = herpes simplex virus; qFlu = quadrivalent influenza. Please find current product information for Comirnaty at https://www.ema.europa.eu/en/documents/product-information/comirnaty-epar-product-information_en.pdf and https://www.fda.gov/media/151707/download. CommercialPhase 3Phase 2Phase 1/2Phase 1Product CandidateIndication COMIRNATY® COVID-191 BNT162b2 Original/Omicron BA.4/5-adapted bivalent BNT162b2 Original/Omicron BA.1-adapted bivalent LaunchedBNT162b2 Omicron XBB.1.5. BNT162b2 + BNT162b4 T-cell string BNT162b6/7 Stabilized spike antigen DataBNT162b2 BA.4/5-adapted bivalent + BNT161qFlu COVID-19 - Influenza combination1 PlannedBNT162b2 BA.4/5-adapted bivalent + BNT161 qFlu BNT161Influenza1 BNT167Shingles1 BNT163HSV2 BNT164Tuberculosis3 BNT165Malaria NewBNT166Mpox4 Infectious Disease programs partnered with Pfizer Other Infectious Disease programs ✓ ✓ ✓

XBB Sublineages Continue to Dominate the Epidemiologic Landscape Despite the Emergence of New Lineages 12 Source: GISAID - gisaid.org, data accessed on September 08, 2023. Growing dominance of the XBB-descendent EG.5.1 In the US, EG.5 is one of the three most prevalent variants and is a descendent lineage of XBB.1.9.2 BA.2.86 remains low worldwide April 2023 100% 0%Pe rc en ta ge o f s eq ue nc es s ub m itt ed to G IS A ID 90% 80% 70% 60% 50% 40% 30% 20% 10% May 2023 June 2023 July 2023 Aug 2023 Sep 2023 Oct 2023 EG.5 XBB.1.16 XBB.1.9.2 XBB.1.9.1 XBB.2.3 XBB.1.5 XBB Other variants

Monovalent XBB.1.5 Adapted Vaccine Elicits Higher nAbs Responses against VoCs Compared to the Bivalent BA.4/5 Adapted Vaccine in Preclinical Models 13 Source: Data were generated by the same pseudovirus neutralization assay and from sera of same mouse study that generated data that were presented at VRBPAC (Vaccines and Related Biological Products Advisory Committee) June 15, 2023 Meeting, https://www.fda.gov/media/169541/download). NAbs = neutralizing antibodies; VOCs= variants of concern. XBB.1.5-adapted monovalent vaccine elicits potent neutralization against various sublineages: XBB.1.5, EG.5.1, BA.2.86, XBB.1.16 and XBB.2.3 Pre-treatment: Primary series of monovalent BNT162b2 Original vaccine and a 3rd dose of Original + BA 4/5 bivalent vaccine. 4th dose: Original+BA.4/5 bivalent vaccine or a monovalent XBB.1.5 vaccine. Experimental design (mice) 3-fold increase 5-fold increase 7-fold increase 50 % N eu tr al iz at io n tit er 105 104 103 102 101 Vaccine group LOD Original + BA.4/5 XBB.1.5 XBB.1.5 EG.5.1 BA.2.86 440 572 422 2043 4069 1249 ~5-fold increase ~4-fold increase ~5-fold increase 50 % N eu tr al iz at io n tit er 106 104 103 102 101 Vaccine group LOD Original + BA.4/5 XBB.1.5 XBB.1.5 XBB.1.16 XBB.2.3 444 733 621 1800 3766 3020 105 Modjarrad, CDC ACIP September 12, 2023 Swanson, CDC VRPAC June 15, 2023

Phase 2/3 Clinical Trial Evaluating XBB.1.5 Monovalent COVID-19 Vaccine 14 mRNA = messenger ribonucleic acid; IM = intramuscular. Sponsor: BioNTech Collaborator: Pfizer BNT162b2 (OmiXBB.1.5) (NCT05997290) Phase 2/3, open label, controlled safety and efficacy study Inclusion criteria Healthy participants, 12 years of age or older Cohort A: 3 prior doses of a US- authorized mRNA COVID-19 vaccine, with most recent dose being a US-authorized Omicron BA.4/5-adapted bivalent vaccine >150 days prior day 1 Cohort B: Vaccination naïve participants BNT162b2 (OmiXBB.1.5) single 30µg dose Each participant will have at least 5 clinic visits for blood sample collection ( )N = 700 Key endpoints Primary: Safety, tolerability and immunogenicity Day 1 Day 7 1 month 3 months 6 months Status Trial ongoing Data update planned in 2024

Clinical Study Demonstrated Monovalent XBB.1.5 BNT162b2 Effectively Neutralizes EG.5.1, XBB.1.5 and BA.2.86 in Adults 15 Source: Stankov M. V. et al., medRxiv preprint, October 5, 2023, doi: https://doi.org/10.1101/2023.10.04.23296545; NT50 = 50% neutralizing titer. N T5 0 [R ec ip r. di lu tio n fa ct or ] 105 104 103 102 101 100 pre post pre post pre post pre post pre post p < 0.0001 p < 0.0001 p < 0.0001 p < 0.0001 p < 0.0001 Median fold change: Geometric mean titer: Response rate [%]: EG.5.1 43 98 20 691 … +34x XBB.1.5 55 100 27 967 … XBB.1.16 53 98 28 906 … +32x XBB.2.3 49 98 22 1031 … +48x BA.2.86 77 100 70 993 … +17x+44xClinical Study N = 53 adults Median time since last vaccination 14.6 months Immunogenicity analysis 8-10 days post vaccination Immunogenicity data suggest the monovalent XBB.1.5 vaccine increases protection against currently circulating strains

Oncology Pipeline: Achievements in Q3 2023 and Post Period Events 16 1. Partnered with Genentech, member of Roche Group; 2. Partnered with Regeneron; 3. Partnered with Genmab; 4. Partnered with OncoC4; 5. Partnered with DualityBio; 6. Partnered with MediLink Therapeutics. *Two phase 1/2 clinical trials in patients with solid tumors are ongoing in combination with immune checkpoint inhibitor +/- chemotherapy. NSCLC = non-small cell lung cancer; mCRPC = metastatic castration resistant prostate cancer; LPC = localized prostate cancer; HPV = human papillomavirus; PDAC = pancreatic ductal adenocarcinoma; CRC = colorectal cancer; CLDN = claudin; IL = interleukin; 1L = first line; R/R = relapsed/refractory; HER2/HER3 = human epidermal growth factor 2/3; sLeA = sialyl-Lewis A antigen; TROP2 = tumor-associated calcium transducer 2. BNT211 (CLDN6) Multiple solid tumors BNT311/GEN10463 (PD-L1x4-1BB) Multiple solid tumors BNT411 (TLR7) Multiple solid tumors BNT311/GEN10463 (PD-L1x4-1BB) R/R met. NSCLC, +/- pembrolizumab BNT312/GEN10423 * (CD40x4-1BB) Multiple solid tumors BNT313/GEN10533 (CD27) Multiple solid tumors BNT316/ONC-392 (gotistobart)4 (CTLA-4) Multiple solid tumors BNT1122 mCRPC & high risk LPC BNT151 (IL-2 variant) Multiple solid tumors BNT142 Multiple CLDN6-pos. adv. solid tumors BNT325/DB-13055 (TROP2) Multiple solid tumors BNT316/ONC-392 (gotistobart)4 (CTLA-4) anti-PD-1/PD-L1 experienced NSCLC BNT323/DB-13035 (HER2) Multiple solid tumors BNT1112 aPD(L)1-R/R melanoma, + cemiplimab BNT113 1L rec./met. HPV16+ PDL1+ head and neck cancer, + pembrolizumab Autogene cevumeran/BNT1221 1L adv. melanoma, + pembrolizumab Autogene cevumeran/BNT1221 Adj. ctDNA+ Stage II or III CRC BNT1162 1L adv. PD-L1 50% NSCLC, + cemiplimab Autogene cevumeran/BNT1221 Adj. PDAC, + atezolizumab + mFOLFIRINOX BNT324/DB-13115 Multiple solid tumors Phase 1 Phase 1/2 Phase 2 Phase 3 NEW BNT323/DB-13035 (HER2) HR+, HER2 low met. breast cancer PLANNED BNT116 Adv. NSCLC BNT152 + BNT153 (IL-7, IL-2) Multiple solid tumors BNT221 Refractory metastatic melanoma BNT321 (sLeA) Metastatic PDAC BNT322/GEN10563 Multiple solid tumors Autogene cevumeran/BNT1221 Multiple solid tumors NEW BNT314//GEN10593 (EpCAMx4-1BB) Multiple solid tumors PLANNED BNT316/ONC-392 (gotistobart)4 (CTLA-4) Plat.-R. ovarian cancer, + pembrolizumab Clinical data announced in Q3 and subsequently BNT326/YL2026 (HER3) Multiple solid tumors NEW BNT316/ONC-392 (gotistobart)4 mCRPC, + radiotherapy PLANNED BNT311/GEN10463 (PD-L1x4-1BB) 2L endometrial cancer, + pembrolizumab NEW

Multiple Clinical Data Readouts at Major Medical Conferences in 2H 2023 17 1. Partnered with DualityBio. ADC = antibody drug conjugate; HER2 = human epidermal growth factor 2; EC = endometrial cancer; TEAE = treatment emergent adverse event; ILD = interstitial lung disease; NSCLC = non-small cell lung cancer; ORR = objective response rate, DCR = disease control rate, DL2 = dose level 2; r/r met: resistant/refractory metastatic DLT = dose limiting toxicities. Cancer vaccine (FixVac)NEO-STIM Cell therapyCAR T-cell therapyADCADCPlatform BNT116 Advanced NSCLC BNT221 r/r met Melanoma BNT211 CLDN6+ Solid Tumors BNT325/DB-13051 Multiple Solid Tumors BNT323/DB-13031 Multiple Solid TumorsProgram FIH Ph1 • Tolerable safety profile both in monotherapy or combination • No DLTs • BNT116 + cemiplimab active in heavily pre- treated lung cancer patients Ph1 • Tumor shrinkage for 4/9 patients • Manageable safety profile with no DLTs • Polyclonal neoantigen-specific T cells response detected post-infusion Ph1/2 • Encouraging signs of activity in 13 / 22 patients at DL2: • ORR 59% • DCR 95% • Patients with CARVac improved CAR-T persistence in higher dose group • Dose-dependent increase in adverse events Ph1/2 • Encouraging efficacy signals in metastatic NSCLC patients: • unconfirmed ORR 46.2% • unconfirmed DCR 92.3% • TEAEs were manageable in lower dose levels Ph1/2 • Antitumor activity in heavily pretreated HER2-expressing EC patients: • unconfirmed ORR 58.8% • unconfirmed DCR 94.1% • No TEAEs leading to dose discontinuation • No ILD occurred Data update

3 Financial Results Jens Holstein, Chief Financial Officer

YTD 2023 Key Financial Highlights1 19 1. Financial information is prepared and presented in Euros and numbers are rounded to millions and billions of Euros in accordance with standard commercial practice. Inventory write-downs and other charges from Pfizer reduced BioNTech’s revenues by €615.4 million for the nine months ended September 30, 2023. 2. BioNTech’s profit share is estimated based on preliminary data shared between Pfizer and BioNTech as further described in the Annual Report on Form 20-F for the year ended December 31, 2022 as well as the Quarterly Report as of and for the three and nine months ended September 30, 2023, filed as an exhibit to BioNTech’s Current Report on Form 6-K filed on November 6, 2023. 3. Consists of cash and cash equivalents of €13,495.8 million and security investments of €3,471.8 million, as of September 30, 2023. The payment settling our gross profit share for the second quarter of 2023 (as defined by the contract) in the amount of €565.0 million was received from our collaboration partner subsequent to the end of the reporting period as of October 16, 2023. Profit before tax €1.94 €0.5bn €2.3 bn €17.0 bn Total revenues2 Diluted EPS Total cash plus security investments3

Q3 and YTD 2023 Financial Results: Profit or Loss 20 1. Numbers have been rounded; numbers presented may not add up precisely to the totals and may have been adjusted in the table context. Presentation of the unaudited interim consolidated statements of profit or loss has been condensed. 2. BioNTech’s profit share is estimated based on preliminary data shared between Pfizer and BioNTech as further described in the Annual Report on Form 20-F for the year ended December 31, 2022, as well as the Quarterly Report as of and for the three and nine months ended September 30, 2023, filed as an exhibit to BioNTech’s Current Report on Form 6-K filed on November 6, 2023. Any changes in the estimated share of the collaboration partner's gross profit will be recognized prospectively. Nine months ended September 30Three months ended September 30(in millions €, except per share data)1 2022202320222023 12,923.32,336.63,394.8893.7Commercial revenues2 109.03.466.41.6Research & development revenues 13,032.32,340.03,461.2895.3Total revenues (2,811.5)(420.7)(752.8)(161.8)Cost of sales (1,027.2)(1,205.3)(341.8)(497.9)Research and development expenses (44.9)(44.7)(12.8)(14.4)Sales and marketing expenses (361.8)(386.6)(141.0)(144.5)General and administrative expenses 562.9(118.5)174.7(3.6)Other operating income less expenses 9,349.8164.22,387.573.1Operating income 431.7358.756.6154.3Finance income less expenses 9,781.5522.92,444.1227.4Profit before tax (2,625.8)(50.5)(659.2)(66.8)Income taxes 7,155.7472.41,784.9160.6Profit for the period Earnings per share 29.471.967.430.67Basic profit for the period per share 27.701.946.980.67Diluted profit for the period per share

Implications of Inventory Write-Downs and Other Charges related to COMIRNATY 21 1. Inventory write-downs and other charges, jointly referred to as charges, were mainly triggered by market demand shifting from pandemic into endemic setting as well as the companies following the guidance from regulatory authorities on strain changes leading to the introduction and marketing of updated COVID-19 vaccines better matched to circulating sublineages. 2. Including all effects derived from the information received from BioNTech’s collaboration partner. 3. Inventories and provisions for production capacities derived from contracts with Contract Manufacturing Organizations (CMOs) that became redundant are measured reflecting contractual compensation payments under the collaboration agreements. Manufacturing variances are reflected as transfer price adjustment impacting sales to the collaboration partner and the share of the collaboration partner’s gross profit respectively once assessed as highly probable to occur. Amounts are only cash-effectively shared with the partner once materialized. Please refer to the Annual Report on Form 20-F for the year ended December 31, 2022, as well as the Quarterly Report as of and for the three and nine months ended September 30, 2023, filed as an exhibit to BioNTech’s Current Report on Form 6-K filed on November 6, 2023. Any changes to the assessment will be recognized prospectively. Write-downs / other charges by Pfizer Identified on the collaboration partner’s side Write-downs / other charges by BioNTech Identified on BioNTech’s side Initially announced estimate Up to €0.9 bn Actual YTD 2023 effect recorded €0.6 bn2 (thereof €0.5 bn in Q3 2023) BioNTech already reflected a large portion of write-downs / other charges in 2022 financial results and a smaller portion in 2023 Charges1 mainly reflect that market demand has shifted from pandemic to endemic, flu-like setting; Under the gross profit-sharing agreement charges are borne by both collaboration partners Reducing Pfizer’s gross profit, hence BioNTech’s revenues Reducing BioNTech’s gross profit3

2023 Financial Year Guidance Updated1 22 ~ €1 bn*~ €4 bn~ €5 bnEstimated BioNTech COVID-19 vaccine revenuesCOVID-19 vaccine revenues for FY 2023 ~ €600 m€1,800 – 2,000 m€2,400 – 2,600 mR&D expenses2 Planned FY 2023 expenses and capex ~ €75 m€600 – 650 m€650 – 750 mSG&A expenses ~ €300 m€200 – 300 m€500 – 600 mCapital expenditure for operating activities3 ~ 6 %points~ 21%~ 27%BioNTech Group estimated annual cash effective income tax rate4 Estimated FY 2023 tax assumptions Updated guidance Nov 2023 Initial guidance Mar 2023 Delta midpoint illustration5 1. Numbers reflect current base case projections and are calculated based on constant currency rates. Excluding external risks that are not yet known and/or quantifiable, including, but not limited to, the effects of ongoing and/or future legal disputes or related activity. 2. Numbers include effects identified from additional in-licensing arrangements, collaborations or potential M&A transactions to the extent disclosed and will be updated as needed. 3. Numbers exclude potential effects caused by or driven from in-licensing arrangements, collaborations or M&A transactions. 4. Numbers exclude potential effects caused by or driven from share-based payment settlements in the course of 2023. 5. For simplicity, midpoint in guidance ranges is applied when comparing initial 2023 guidance with Q3 2023 guidance update. 6. €0.6 billion related to Pfizer's recently-announced write-downs and other charges. Other factors influencing the COVID-19 vaccine revenues guidance include, but are not limited to, BioNTech’s and Pfizer’s lower revenue expectations for the full 2023 financial year, which take into account delays in the expected timing of regulatory approvals. * reflecting €0.6 bn6 Pfizer charges

4 Strategic Outlook Ryan Richardson, Chief Strategy Officer

Strategic Priorities and Outlook 1. Partnered with Pfizer. COVID-191 Immuno-oncology Infectious diseases Sustain market leadership in COVID-19 vaccines Advance next-gen vaccines Advance oncology pipeline across multiple solid tumors Grow pipeline of trials with registrational potential Initiate and accelerate clinical programs for high medical need indications Phase 3 COVID-19/Influenza trial due to start in the coming months Initiate trials with registrational potential New trial starts Data readouts to drive decision- making and future trial starts Continued development of next- generation vaccine constructs

Rollout Of Our XBB.1.5 Variant Adapted Vaccine1 25 1. As of October 2, 2023. 2. Company assessment 3. CDC Survey published on October 28, 2023: https://www.cdc.gov/vaccines/acip/meetings/downloads/slides-2023-10-25-26/02-COVID-Stokley-508.pdf. # of countries distributed to market share US/EU/JP (%)2 60 /90/90 40+ ~ 50retail channel in the US (%) ~30% of US population have received or plan to receive an XBB.1.5 variant-adapted vaccine3 7.1 24.6 30.6 37.6 Up to date with 2023-24 COVID-19 vaccine (%) Definitely will get vaccinated (%) Probably will get vaccinated or unsure (%) Probably or definitely will not get vaccinated (%) Maintaining COVID-19 market leadership with variant- adapted vaccine rollout Potential for continued variant-adapted vaccine uptake2

COVID-19 Vaccine Market Potential 2024 and 2025 Growth Drivers 26 • Manufacturing base reset to serve endemic market • Shift to commercialization model in some key markets • Expect continued shift to single dose vials and pre-filled syringes • Potential for increased vaccine uptake from combination and next-gen vaccines Leveraging partner’s infrastructure to maintain a lean cost base, the COVID-19 business should remain profitable for BioNTech 2024 2025 Variant adapted vaccines Combination vaccines Next-gen vaccines

Strategic Outlook for Oncology 27 1. New trial either through initiation or via in-licensing; 2. Partnered with OncoC4; 3. Partnered with DualityBio; 4. Partnered with Medilink Therapeutics; 5. Partnered with Biotheus; 6. Partnered with Regeneron; 7. Partnered with Genentech, member of Roche Group; 8. Partnered with Genmab; 9: BNT323/DB-1303 phase 3 has been initiated with First-Patient-Dosed expected soon; Ab: antibody; ADC: antibody drug conjugate; biAbs: bispecific antibodies; CLDN6 = claudin 6. New oncology clinical trials started year-to-date1: Plans to start additional late-stage trials for select assets in the next 18 months Phase 3 clinical trials initiated in 20239Currently in phase 2 clinical trials BNT326/YL2024 HER3 ADC BNT3162 anti-CTLA-4 Ab BNT3118 PD-L1x4-1BB biAbs BNT1166 FixVac BNT3128 CD40x4-1BB biAbs BNT3233 HER2 ADC BNT211 CLDN6 CAR-T PM80025 PD-L1 x VEGF biAbs BNT1227 iNest Pipeline progress achieved in 2023 Aim to deliver multiple oncology product approvals from 2026 onwards 4 Phase 2 2 Phase 3 5 Phase 1/2

Register to attend online using the QR code Tomorrow, November 7, 2023 9:00 a.m. – 1:00 p.m. ET 3:00 p.m. – 7:00 p.m. CET Innovation Series

Thank you

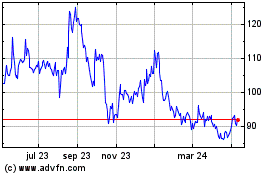

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

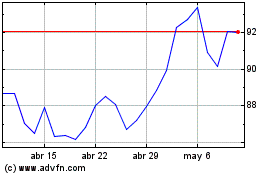

De Abr 2024 a May 2024

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

De May 2023 a May 2024