UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Carver Bancorp, Inc.

(Name of Registrant as Specified in Its Charter)

Dream Chasers Capital Group LLC

Gregory Lewis

Shawn Herrera

Kevin Winters

Jeffrey Bailey

Jeffrey Anderson

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a6(i)(1) and 0-11. |

December 6, 2024

Dear Fellow Carver Shareholders:

The deadline to vote for candidates to join the Board of Directors

(the “Board”) of Carver Bancorp, Inc. (“Carver” or the “Company”) is coming up. You must vote by 11:59

PM on December 11, 2024.

Time is of the essence, and we urge you to vote for change TODAY,

using the BLUE proxy card to vote YES for Jeffrey “Jeff” Anderon and Jeffrey Bailey, and vote WITHHOLD on Carver’s under-performing

Directors.

Shareholders should vote for our nominees to protect the value of their

investment. As we have said previously, the facts are simple:

| · | Carver’s Board has presided over significant losses and shareholder

value destruction for too long. The Board continues to pay itself and management handsomely while you, the shareholder, suffers. |

| · | Shareholders need a Board focused on restoring the value of their investments

and driving growth and profitability to maintain Carver’s important community role. |

| · | Our nominees are extremely capable and aligned with shareholder interests:

Mr. Anderson is an accomplished banking and financial services executive, and Mr. Bailey is a successful businessman and Carver’s

largest individual shareholder. They will bring deep experience and the voice of the shareholder to the Board. |

| · | We love and care about Carver and its community: Mr. Anderson grew

up in Harlem and serves on three Boards of Directors of nonprofit organizations there. Mr. Bailey invested in Carver because of its opportunity

to do good business by serving its community. Dream Chasers Capital Group (“Dream Chasers”) is a minority-owned investment

firm with roots in the communities that Carver serves. |

| · | We want to see Carver do well, so that it can build on its historic

role serving customers, business and institutions in New York that have been left behind. The fundamental truth is that a Company that

loses money year after year will be unable to serve customers and its community. |

Please VOTE TODAY for Mr. Anderson and Mr. Bailey, using the

BLUE proxy card. It is time to put Carver on a path to profitability and growth, and to drive shareholder value. Thank you for

your vote. With your support, Carver’s best days are ahead.

Sincerely,

Greg Lewis

Dream Chasers Capital Group

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable

terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject

to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group

LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein may have been sourced

from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party

statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither

been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein.

Dream Chasers disclaims any obligation to update the information herein

or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect

events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated

or unanticipated events.

IMPORTANT INFORMATION AND WHERE TO FIND IT

DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY

TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY DREAM

CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE

ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI PARTNERS LLC, 1212 AVENUE

OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036-1600. STOCKHOLDERS CAN CALL TOLL-FREE: (877) 629-6356.

VOTE today using the enclosed BLUE proxy

card

Vote FOR the Dream Chasers Nominees, Mr.

Jeffrey “Jeff” Anderson and Mr. Jeffrey John Bailey

WITHOLD your vote for the Opposed Company

Nominees

Vote AGAINST Proposal 4, the nonbinding

advisory vote on executive compensation

We make no recommendation on Proposals 2 or 3

If you received a white proxy card from the Company, you may use it

to vote the above positions

|

To VOTE, follow the instructions in the

enclosed proxy materials or on the BLUE proxy card

Dream Chasers has retained Okapi Partners

LLC to assist in communicating with shareholders in connection with the proxy solicitation and to assist in efforts to obtain proxies.

If you have any questions concerning the proxy materials, or need help

voting your shares, please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Shareholders Call Toll-Free: +1 (877) 629-6356

Banks and Brokers Call Collect: +1 (212) 297-0720

Email: info@okapipartners.com

|

The following is correspondence sent to certain shareholders by Dream

Chasers today:

Q: We recognize the company has room to improve from a governance

profile standpoint (classified board, supermajority vote requirements), so we are curious to know that if Dream Chasers had their choice

of the full board, which two directors would they have wanted to target? Would it still be Mr. Knuckles and Ms. Joseph?

A: This is naturally a difficult question since we are forced to play

with the hand we are dealt. However, the stark reality is that the entire board has overseen and/or contributed to the value destruction

and lack of progress at CARV. All are accountable, and yet none have been held to account. If we were able to pick any nominee, we likely

would have focused more on the directors that have had longer tenure and have been present for more of the value destruction and poor

performance. With that said, the returns for all these non-employee directors are negative over their tenures and their ownership remains

weak. So while there may be some directors that could be seen as a “more deserving” for replacement, we believe both Mr. Knuckles

and Ms. Joseph still have shown through their tenures at CARV that they are not better positioned to create long-term value for all stakeholders

than our current highly qualified nominees. We also believe that their respective resumes do not bring the necessary experience to the

board that is needed to turn the bank around, whereas we believe Mr. Anderson’s deep banking expertise coupled with Mr. Bailey’s

hugely successful tenure as the CEO of a business that has grown exponentially under his leadership add significant value and insight

to the board.

Q2: If one or both candidates make it onto the board, can the

candidates share more about how they’d work constructively with the current board and new CEO?

Greg: If one or both candidates were to join the board they would be

coming in as a minority, only 1/8 or 2/8 of the board. They recognize they would not have the ability to unilaterally dictate strategy

changes. However, these two individuals have shown through their respective careers an ability to exercise sound business judgement and

work collaboratively. They would be independent of management and independent from Dream Chasers. They would be fiduciaries and act as

such as they evaluate the best course for shareholders.

Jeff Anderson: As noted by Greg, I would be a completely independent

director with a fresh set of eyes and a unique perspective. From the outset, I would review all the information available to better allow

myself to assess the strategy of CARV. I would also spend a substantial amount of time with the CEO and Board to get up to speed and to

gain their perspectives on the approach they have taken and the opportunities that lie ahead, including their views on expanding the services

Carver offers to its clients such as wealth management and other investment products through the establishment of a broker dealer. To

reiterate, I am independent from Dream Chasers and will remain so, committed to maximizing shareholder value and furthering Carver’s

mission. My entire career has exemplified a collaborative approach to business, and I would hope the other board members reciprocate and

be receptive to any ideas I may have as I bring my 30+ years of experience in banking and financial services to the table to help CARV

be successful. Ultimately, this is a bank in a community that is important to me and has a mission that I am completely aligned with.

I would not have taken this opportunity if I did not feel I could help CARV succeed.

Jeffrey Bailey: As Carver’s largest individual shareholder, I

too would be joining as a completely independent director. As Jeff mentioned, the first steps would really be digging into the books to

get a better grasp on the decisions that have been made, the foundation for those decisions, and what needs to be addressed on a go forward

basis in both the short and long term. While CARV has highlighted my lack of banking experience, boards should have a diverse set of skills

and experiences, I believe my experience operating Dunham and increasing revenue and operating in regulated industries puts me in a good

position to support the bank in an oversight role. With that said, with where this business is right now, it will require more time early

on with both the CEO and the Board as it formulates and executes on its strategy. I am committed to putting in that time. It is also long

overdue for a shareholder mentality to be brought to the boardroom, and I would do that as Carver’s largest individual shareholder.

Similar to Jeff, I feel I can work with this current board to generate a better outcome for all shareholders and the community in which

the bank serves.

Q3: We saw that the Dream Chasers plan includes establishing a broker

dealer and other licenses to offer wealth building services. Can Dream Chasers share more how experience of the nominees can help deliver

on the strategy, and since boosting performance is of an urgent concern, how long do they anticipate this taking the company to get off

the ground?

Firstly, we would note, again, that these directors are completely

independent from Dream Chasers. When they get into the boardroom, they would evaluate the merits of that plan as fiduciaries. If they

felt it was still appropriate to pursue that strategy, they would then be in a position to convince their fellow board members of its

merits. With that said, we do believe it is a sound strategy, and, if we are successful and our nominees are appointed and able to implement

that strategy, it would be reasonable to estimate that it could get off the ground within one year. In terms of implementing this strategy,

we would highlight Jeff Anderson’s experience at JPM. Jeff has had experience with this type of strategy, and having these offerings

available to the customers at Carver is sound strategy. Having these types of services as a broader offering are vital to allow Carver

to be more competitive in both growing and keeping its customer base. That is good for the Bank in the short- and long-term.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable

terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject

to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group

LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein may have been sourced

from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party

statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither

been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein.

Dream Chasers disclaims any obligation to update the information herein

or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect

events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated

or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Dream Chasers, Gregory Lewis, Shawn Herrera,

Kevin Winters, Jeffrey Bailey and Jeffrey Anderson (“collectively, the Participants”) are participants in the solicitation

of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”). On

November 4, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy

statement and accompanying BLUE universal proxy card or voting instruction form in connection with their solicitation of proxies from

the shareholders of the Company for the Annual Meeting.

IMPORTANT INFORMATION AND WHERE TO FIND IT

DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY

TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY DREAM

CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE

ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI

PARTNERS LLC, 1212 AVENUE OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036-1600. STOCKHOLDERS CAN CALL TOLL-FREE: (877)

629-6356.

Contacts

For Media:

Breitenbush Partners

Andrew Wilson, (773) 425-4991

awilson@breitenbushpartners.com

For Investors:

Okapi Partners

Bruce Goldfarb/Tony Vecchio

(877) 629-6356

(212) 297-0720

info@okapipartners.com

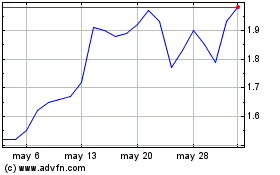

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025