SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ______)

Filed by the Registrant x

Filed by

a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Carver

Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Dear shareholders,

We are pleased to share with you that Institutional

Shareholder Services (ISS), a leading independent proxy advisory service, recently announced its support for our two highly

qualified director nominees, Jillian E. Joseph and Kenneth J. Knuckles, at the upcoming Annual Meeting of Stockholders scheduled

for Thursday, December 12, 2024. The ISS recommendation was made several days after our presentation to the proxy advisory firm

and included several key points for your consideration:

| ü | "The recent appointment

of [Donald] Felix as CEO appears to be a step in the right direction. He appears to have relevant experience and an understanding of the

issues facing the bank, and despite his short tenure, he has developed what appears to be a logical go-forward plan. Moreover, Felix has

seemingly been endorsed by the dissident." |

| ü | "Moreover, the dissident

is advocating for a dramatically different (and seemingly riskier) strategy than that now in progress under Felix. The addition of nominees

associated with this perspective could introduce disruption that CARV cannot afford at this stage (there are also credible reputational

concerns)." |

| ü | "Ultimately, the company's

go-forward plan is appropriately focused on restoring profitability to the core banking franchise, whereas the dissident has called for

a radically different and inherently riskier plan." |

ISS Endorsement: Attached is a copy

of our presentation to ISS dated November 21, 2024. We encourage you to review the presentation before the upcoming meeting of shareholders

to make a fully informed decision with your vote that will help shape the future direction of Carver — a community bank dedicated

to building wealth in New York's neighborhoods block-by-block since 1948. ISS was clear in its recognition of our plans to restore long-term

profitability and in its acknowledgment that Dream Chasers did not present a compelling alternative to move Carver forward.

Improving Profitability: Our presentation

highlights the strategic initiatives and operational goals in place to improve top-line performance and reduce risks and expenses at Carver,

including (1) our commitment to growing the business; (2) our dedication to building capacity and increasing performance; (3) our focus

on investing in tested technologies to make the bank more efficient, enhance customer service, and reduce risk; and (4) our emphasis on

investing in the future to attract and retain top talent at the executive, branch, and staff levels.

American Banker Article: The American

Banker published a profile of Carver on December 5, 2024, that includes additional information on our new CEO, Don Felix, and his plans

for Carver. A copy of that story may be found by clicking on the link: www.americanbanker.com/news/new-ceo-of-carver-in-new-york-working-on-a-fix-amid-proxy-clash.

We believe ISS' support for our director nominees

is a testament to our ongoing efforts to achieve sustainable growth and operational resilience. Please don't hesitate to contact us with

any questions before the shareholder meeting on December 12, 2024.

Very truly yours,

Lewis P. Jones, Chairman of the Board / Donald Felix, President and

CEO

| Our commitment to Investors – Institutional Shareholder Services

November 21, 2024

NASDAQ: CARV

CELEBRATING

75 YEARS OF SERVICE

TO THE COMMUNITY

1

NASDAQ: CARV

Executing on our Turnaround:

Building Forward for Value Creation |

| What is this Proxy Contest About?

• At this year’s Annual Shareholders Meeting, you will make a significant decision

regarding the future strategy and direction of Carver Bancorp that either propels us

further forward for the turnaround underway or sets us back by adding two

unqualified directors, whose affiliation with Dream Chasers is not aligned with

Carver’s mission, or the best interests of its shareholders or community stakeholders

• This proxy contest is about whether the Dream Chasers Capital Group LLC (“DC”), led

by Mr. Greg A. Lewis – who earlier this year were rejected by the Carver Board of

Directors for posing disqualifying reputational risk and lacking demonstrated banking

experience and leadership and a credible plan – will be allowed to place two Board

members as part of a longer-term campaign to take ill-conceived control of Carver:

o As a federally chartered institution with access to the Federal Reserve window,

DC’s motivation is to “farm” the Bank’s ~25K customers as prospective/captive

brokerage customers

2 |

| Table of Contents

3

I Executive Summary 5

II Carver Overview and Turnaround Underway 7

III Carver’s Strategy and Roadmap for Value and Impact Creation 10

IV Our Dedicated Board and Governance is Driving Change 13

V Dream Chasers Poses Unacceptable Risk and No Viable Plan 16

VI Conclusion 19 |

| Section I

Executive Summary

4 |

| Change was needed and is accelerating

5

Executive Summary

Turnaround and

transformation are in progress

Carver is successfully

overcoming past challenges

Carver’s Strategy and

Roadmap Lead to Impact

and Value Creation

The Board has overseen

decisive strategic

repositioning & early success

Our Dedicated Board and

Governance Culture is Driving

Change

Our Board is best positioned

to continue delivering on our

strategy

Dream Chasers (“DC”) Poses

Unacceptable Risks and No

Viable Plan

No experience & knowledge

of community banking, and

noncredible candidates

• As regulators noted, due to

the ongoing efforts and

progress of the Board and

respective Management,

Carver successfully exited a

Formal Agreement (“FA”)

with the Office of the

Comptroller of the Currency

(“OCC”) in 2023

• Our Board and

Management had to

undertake a significant

transformation in the last 8

years – over 75% of

Management and over 40%

of the Board turned over

since the FA in 2016

• New oversight and

reinvestment was

responsible for the 1)

recovery, 2) stabilization,

and 3) growth & transition

• We are deliberately

continuing to build on

strengths for proof points

towards long-term

sustainability based on

portfolio diversification and

capital adequacy

• Carver’s evolving business

model is strengthened by a

platform infrastructure

accommodating greater

scale supported by

enhanced risk

management

• Carver continues to multiply

impact & value to the

communities it serves by

advancing relationships

with a broad set of mission-aligned partners

• Carver’s experienced,

independent Board has

demonstrated strong

governance and been

effective, steady, and duly

committed team of

engaged stewards through

industry challenges

• The complement of our

Board has extensive

credibility given their senior

operating and corporate

experience, tenure as

public company directors,

relevant industry expertise,

and deep community

connections

• Our Board has provided

rigorous oversight and

leadership continuity

• DC, collectively and

individually, critically lack

the requisite leadership,

skills, and a feasible plan

with structural details, and

will derail active progress

• Not a match to the Board’s

established caliber or ability

to deliver, DC’s noncredible

candidates will subvert the

Board, governance, and

the organization

• The adverse publicly

disclosed regulatory history

of DC’s leadership, and by

extension it’s nominees,

poses unacceptable

reputational risks to Carver’s

standing and mission

credibility |

| Section II

Carver Overview and Turnaround

Underway

6 |

| Stabile foundation for forward progress

7

Carver Overview and Turnaround

Overview:

Carver Bancorp, Inc. (NASDAQ: CARV)

Headquarters: Harlem, NYC

Employees: ~105

Founded: 1948

History: Founded with a mission of “providing

local residents with a place to save, grow

businesses and build wealth, block by block,

and generation to generation”

Community Focused: One of 22 Black-Owned/Operated banks, Carver is one of

the nation’s largest and few remaining

publicly-traded Minority Depository

Institutions (“MDI”) and certified Community

Development Financial Institutions (“CDFI”)

Total Assets: $749MM

Net Loans: $613MM

Deposits: $651MM

Branches: 7 - Manhattan, Brooklyn, Queens

*Figures as of 9/30/24

• Placed under Formal Agreement (“FA”) by the OCC in 2016

• Carver has been executing a deliberate transformation

process to reshape its Board, Management, and execution

• Repositioned, after 7 years of diligence and focus, the Bank

successfully emerged from the FA in early 2023

• In response to federal regulation at the time, over 30% of CRE

earning assets needed to be reduced, decreasing profitability

From Challenge…

…To Resiliency

Recovery

Stabilization

Growth and

Transition

• Gain on sale from our HQ building funded

critical investments in technology and

talent, and increased the capital base

• Made targeted hires in key areas, e.g.,

BSA, Operations, Fraud, Risk Management

• Rationalized the branch network and

strategically invested in tech/delivery

platforms and capabilities

• Modernizing our infrastructure allowed us

to 1) enhance delivery channels and

customer experience, 2) broaden

partnership opportunities, 3) diversify

product offerings for increased scale |

| Industry expertise enhances execution

8

Carver Overview and Turnaround

Today, Carver is conducting business, responding to competition, capitalizing on opportunities, and growing (gathering deposits

and making loans) in a manner that was simply not previously possible. Achievements in the past 18 months include:

Carver Today

Grow the business Build capacity &

Increase performance

Disciplined consistency,

Expand capabilities Evolve & Transform

Core Franchise Capital & Earnings Operating Model Leadership

For the 18 months from Mar-23

to Sep-24 (since exiting the

FA):

Loans: Portfolio increased

by $21.3MM or 3.6%, and

diversified earning assets

into consumer loans,

commercial loan

participations with

institutional partners,

bespoke commercial

lending to professional

niches, and committed

auto loan exposure

Deposits: Raised over

$50.4MM or 8.4% of new

retail & institutional deposits

Capital: Notwithstanding

operating losses, the Bank

remains well capitalized

and in compliance with

regulatory and self-imposed

thresholds. The Bank’s

strategic plan, submitted to

regulators in early 2024,

includes a commitment to

raise additional capital as

needed to support Carver’s

growth ambitions and to

maintain its safety and

soundness as a well-capitalized institution

Technology: We have

made advances to make

the Bank more efficient,

enhance customer service,

and mitigate risk, including

but not limited to:

o LoanVantage

(automated loan

platform),

o MANTL (online banking

account opening

process),

o RAROE (Risk Adjusted

Return on Equity loan

pricing model

platform) and

o ACH origination

(enhanced cash

management services)

Talent: the Bank has made

the strategic decision to

invest in the future by

onboarding new and

experienced leadership:

New permanent CEO

with significant

expansive and deep

senior executive

financial services

experience

Retail Branch

Management,

Institutional and Private

Banking,

Fraud Risk

Management

New staff hires have made

tangible improvement in

funding, client acquisition &

operating loss mitigation |

| Section III

Carver Strategy and Roadmap for

Value and Impact Creation

9 |

| Forward planning for profitability

10

Carver Strategy and Roadmap

Loans: Disciplined lending

growth, e.g., syndicated loan

purchases, targeted

consumer loan conduit, for

greater yield & diversification

Deposits: Increasingly secure

low-cost core deposits and

diversify mix and stable

balances

NIM: Continue on strong

positive trend

Non-interest income: Seek

and increase recurring non-interest income from various

sources, e.g., JPMC Empower

Efficiency Ratio: Reduce

operating expenses (forensic

exercise underway)

Customer Acquisition: Drive

new low cost-to-acquire

customers, drive primacy

Capital: Resume capital-raising initiatives impeded

by lack of a permanent

CEO

Interest Rate Risk

Management: In partnership

with capital market

consultants, employ

volatility mitigation

strategies to better protect

asset value and quality of

earnings

Portfolio Diversification:

Accelerate diversification of

lending strategies to

increase high-quality, low

risk earning assets

Credit Quality: Continue to

invest in our risk

management to maintain

minimal charge-offs/losses

Technology: Continue to

reengineer processes and

accelerate the scalability

and modernization of our

infrastructure across the

Bank with a relentless

emphasis on rationalizing

cost vs. return (efficiency,

productivity, and forecast

achievement)

Fraud/Risk: Continue to

enhance from a strong base

Customer Experience: Focus

on delivery of a

differentiated, high NPS CX

that responds to our

communities’ specific needs

Strategic Partnerships: Forge

new partnerships, e.g., to

expand deposit base and

community impact

Culture: Continue to curate

a winning culture and

motivated workforce

through recognition and

career development that

retains (and attracts) top

talent

Talent: Bolster our efforts to

attract top talent through

greater outreach,

increasing our profile, and

driving on performance that

can deliver immediate

results

Governance: Continue to

complement Board and

Management with high-caliber, senior, experienced

and notable industry

executives with specific and

relevant expertise

At an inflection point with a newly installed permanent CEO, our Board, Management, and Staff, in unison, are singularly focused

on increasing our margin to further our mission, generating sustainable profitability, and returning value for shareholders

Grow the business Build capacity &

Increase performance

Disciplined consistency,

Expand capabilities Evolve & transform

Carver Tomorrow

Core Franchise Capital & Earnings Operating Model Leadership

Note: Items above are select representations from our internal prioritized focused list |

| Delivering impact and value

11

Carver Strategy and Roadmap

• PPP: Carver was a financial first responder to small

businesses that were impacted by the Covid-19 Pandemic

o The Bank created a team to support small businesses

with the Paycheck Protection Program, providing $50

million in loans to more than 400 businesses and

supporting the preservation of more than 5,000 jobs

o Additionally, we partnered with fintech companies

and the Federal Reserve Bank to provide Paycheck

Protection Program Liquidity Funding that supported

more than 16,000 small businesses nationally

• Reinvestment: Carver reinvests over 80 cents of every

deposit dollar back into the communities that we serve

• Microloans: Leading Microloan program, providing loans

up to $50,000 to growing local businesses

• MWBEs: Carver has maintained its mission of providing

access to capital and banking solutions to MWBEs and

consumers across the Greater New York City region

o Sponsorship of the Minority Women Business Pitch

Competition in partnership with The Greater Harlem

Chamber of Commerce to support energy efficiency

and address the negative impact of climate change

offering $50K total in grant giveaways

Customers Communities

• CRA: Awarded “Outstanding” CRA ratings for 20

consecutive years

• Financial Education: Developer and host of financial

education / literacy, wealth-building skills and small business

empowerment programming

• Non-Profits: Supporter of local non-profit organizations,

workforce development and home ownership programs

• HBCUs: Major supporter of Historically Black Colleges and

Universities

• Wellness: Food distribution and wellness events in low-to

moderate income communities

• Always on programming, including:

o Branch Customer appreciation days

o Participated and provided back packs in the NYC

Parks Brooklyn recreation summer camp

o Held Financial Workshop for Moms

In leading a community bank with our history and mission, how we show up, where we show up, and how often matters. Our

consistency & the integrity of our Bank are material to our standing and credibility with partners, stakeholders, and communities

Carver in the Community |

| Section IV

Our Dedicated Board and

Governance Driving Change

12 |

| Right plan needs key expertise, purpose-driven leaders

Dedicated Board Driving Change

Audit / Compliance (2 separate cttees)

Banking / Financial Services

Comms / Branding / Marketing

Community Development

Compensation / HR

Economic Development

Finance / Investing / Asset & Liability

Government, Public Policy, Regulatory

Legal / Contract Negotiations

Nominating / Governance

Real Estate

Risk Management

Strategic Planning / M&A

Technology, Cyber & Info Security

Committees (CH = Chair, * = Exec Ctte) 2*(1 CH) 6* (1 CH) 7* (1 CH) 4 5* (2 CH) 3* (1 CH) 3 N/A

Financial Services / Community Dev:

Skills & Experience Lewis Jones,

Chair,

2013

Colvin

Grannum,

2013

Pazel

Jackson(1),

1997

Jillian

Joseph,

2019

Kenneth

Knuckles,

Vice Chair, 2013

Craig

MacKay(2),

2017

Robin

Nunn,

2022

Donald

Felix(3), CEO

2024

Board Characteristics: 100% NY rep

Avg. 66 y.o.

Avg. tenure: 11 yrs 29% gender diverse

100% diverse

100% Independent

Avg. 4 Committees 3 QFEs

(1) Dr. Jackson was interim CEO from 4/99 to 9/99

(2) Mr. MacKay was Interim CEO from 9/23 to 10/24 and is heading transitioning for CEO leadership continuity

(3) Mr. Felix is the new CEO as of 11/24 and brings substantial financial services / operational acumen

(4) Board and Management capital raise underway for >$200K

Rigorous oversight

Increasing investment(4)

= Committee Assignments

13 |

| Based in NYC, Ms. Joseph is an accomplished

transactional attorney with over 20 years in the complex

real estate, finance, and asset management industry

Ms. Joseph’s professional work is directly correlated to the

work of Carver

• Supports Nuveen Real Estate Debt with approximately

$10 Billion of loan originations each year in mortgage

financing, mezzanine lending, and structured debt

offering

• Ms. Joseph is also a market leader in managing debt

portfolios through financial crises including extensive

work on restructures, modifications, workouts, and

foreclosures

Ms. Joseph is a long-standing pillar in the community

sitting on boards supporting urban innovation and

affordable housing development

Committed in service to Carver since 2019 and serves on

the Asset Liability and Interest Rate Risk, the Institutional

Strategy, and the Compliance Committees

Our Nominees are aligned to Stakeholders

Dedicated Board Driving Change

Jillian E. Joseph

Managing Director and

Associate General Counsel,

Nuveen (a TIAA company)

Based in NYC, Mr. Knuckles has more than 40 years of

experience in economic development and urban

planning. Most recently, Mr. Knuckles was the President

and CEO of the Upper Manhattan Empowerment Zone

Development Corporation

During his tenure as Chief Executive Officer, Mr. Knuckles

led the investment of more than $240 million in capital in

mixed-use and retail development projects in Northern

Manhattan, leveraging over $2 billion in private

investment, and the creation of 10,000 jobs

Mr. Knuckles’ deep ties to the community and experience

in NYC community development and land use issues

significantly contributes to and advances Carver’s

fulfillment of its mission

Dedicated in service to Carver since 2013 and serves as

the Vice Chair of the Carver Board of Directors and Chair

of the Carver Compensation and Human Resources

Committee

Kenneth J. Knuckles

Prominent Community Leader

(member NYC Planning

Commission); former President

and CEO

Key Board Expertise: Economic

Development and Commercial

Lending

Key Board Expertise: Community

Development and Economic

Empowerment

14 |

| Section V

Dream Chasers Poses Unacceptable

Risk and No Viable Plan

15 |

| DC points are misguided & misleading

Dream Chasers is NOT the answer

`

DC Points Raised Facts

• Carver Financial

Health and

Share Price over

the last 10 Years

• Context matters when evaluating historical information and forming definitive conclusions

• DC applies a 10-year evaluation timeframe to the evaluation of Carver’s leadership team, 100% of whom, and

over 40% of the Board, were not leading the Bank 10-years ago

• In fact, the overwhelming majority of the current executive team (over 75%) joined the Bank after it was placed

under the OCC formal agreement, with the expressed intention to improve the Bank and successfully exit the FA

• In early 2023 they did just that, and if not for the leadership of Carver’s Management team and Board oversight,

the Bank would not have successfully exited the OCC formal agreement

• DC’s Plan for

Growth

• DC’s plan for growth is:

o “simple: adopt a strategy similar to … JPMorgan” and

o “take Carver’s existing consumer banking services and establish a broker dealer”

• Given the lack of specificity and naïve simplicity of DC’s plan, it demonstrates a clear lack of sophistication,

expertise, and necessary preparation and experience for managing and operating a highly regulated financial

services institution

• Notwithstanding their ambitions or seemingly good intentions, the DC team has not demonstrated any of the

attributes or characteristics or knowledge of the research, the investment, the skill, and the timing that it takes to be

“JPMorgan”, nor are they demonstrating an understanding of the difference in managing a large money center

vs. a community bank

• This simplistic approach without critical diligence and relevant experience is what could set Carver back from the

progress it is currently making

• DC’s plan is also predicated on what they gain and how they benefit vs. leading with what’s in the long-term

interest of shareholders, and the customers and communities Carver serves

• CEO KPIs • DC stated the compensation for the new CEO is not tied to shareholder value or performance measures and is only

tied to qualitative factors. That is in fact, categorically false, disingenuous to investors. and in conflict with the

public record. Carver’s filed 8-K includes both qualitative and quantitative measures.

• Mr. Felix’s contract in the 8-K specifies the incentive compensation is not guaranteed and that the amount of

incentive compensation shall be determined in the Compensation Committee’s sole discretion: both qualitative

and quantitative KPIs are intended to complement each other. Qualitative KPIs measure progress against critical

foundation-building business, financial and compliance objectives, e.g., business development, regulatory

compliance, improvement in peer rankings, etc. Quantitative KPIs validate operating and financial progress, e.g.,

capital raising, NIM, profitability/MRA satisfaction, etc.

• As a newly installed CEO, as of Nov. 1, Mr. Felix will be completing an assessment to create a strategic plan. The

KPIs will be published upon completing the strategic plan which Mr. Felix and Management will have prepared for

Board review by 3/31/25 16 |

| CEO of a small investment management

fund who has a history of being fined

and suspended by FINRA for making

false statements to investors (CRD

#2793976):

• FINRA sanctions against Mr. Lewis and

broker-dealer StockKings Capital LLC:

$85K fine and 7-month suspension

• FINRA asserted Mr. Lewis made

unwarranted and unsupported claims

about his fintech platform valuation

and on the potential revenue it could

generate

• Mr. Lewis was also cited for

misclassifying ~$40K of personal

expenses as business expenses

Mr. Lewis’ baseless plan highlights his

stark lack of experience for operating

and growing a community bank; DC’s

plan for growth?: “Adopt a strategy

similar to JPMorgan”

DC and their Nominees will not add value(1)

Dream Chasers is NOT the answer

Greg A. Lewis

CEO, Dream

Chaser’s

Capital Group,

LLC

Based in CA, not NY, CEO of privately

held specialized metal parts

manufacturing company

Mr. Bailey is not remotely qualified for

public company Board level

experience for a regulated financial

services institution

Mr. Bailey has no ties to the local

communities Carver serves, shocking

lack of expertise in banking, no industry

stature or profile, and would be joining

an oversight body, tasked with

fiduciary responsibility, with less

relevant experience than most entry-level bank employees

Mr. Bailey has been recruited by DC

under the false premise that success in

any line of business is transferable to

the highly regulated, highly specialized

mission-driven community banking

industry

Jeffrey J. Bailey(1)

CEO, Dunham Metal

Processing

While Mr. Anderson retired after a

career in banking, his experience is not

fungible and does not translate to a

public company Board level, and is not

additive at the senior level that is

required

Mr. Anderson has never served in the

senior-most executive role of Managing

Director in any of his positions, was not

the strategic decision maker, and his

experience is limited to the G-SIB banks

vs. at least some regional or community

banking

Mr. Anderson has been unfortunately

recruited by DC and is now party to

fulfill on Mr. Lewis’ 1) ill-conceived lack

of an executable strategy and 2) his

progress derailing plans that will

negatively impact Carver and the

communities it serves

Jeffrey W. Anderson(1)

Retired, Executive

Director

(1) A vote for Mr. Bailey &/or Mr. Anderson is effectively a vote for Mr. Lewis

17 |

| Section VI

Conclusion

18 |

| Support Carver’s Nominees & Turnaround

19

Conclusion

Protect Your Investment and Carver’s Future :

Vote on the WHITE proxy card FOR Carver’s slate of directors

Jillian Joseph Kenneth Knuckles

Recognizing that Carver was not in a position to succeed, our Board has proactively and effectively

taken decisive actions to protect the safety & soundness of the Bank through periods of challenge

Dutifully protecting the Bank and all of its stakeholders

Our experienced, engaged, and highly qualified Board, and new CEO leadership, are well-suited to

continue overseeing and leading the deliberate execution of our strategy to drive value creation

Accountability for the future

Carver continues to evolve and deliver on its operating plan on a steady path to profitability, long-term sustainability, and consistent community impact

Maintaining our forward progress

DC would set us back: DC lacks the experience and qualifications for a publicly-traded, highly

regulated community financial services institution; they have no credible and achievable plan or

direct senior / public board experience; the reputational risk challenges are outright disqualifiers

Dream Chasers is NOT the answer and would reverse hard-earned progress & planning |

| THANK YOU

Accelerating Our Progress

20 |

| Forward Looking Statements & Additional Information

Forward-Looking Statements

Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements

regarding Carver Bancorp, Inc.’s (the “Company”) expectations; beliefs; plans; strategies; business or financial prospects or outlook; future shareholder value; expected growth and value

creation; profitability; investments; capital allocation; earnings expectations; expected drivers and guidance; expected benefits of new initiatives; cost reductions and efficiencies; priorities

or performance; and other statements that are not historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and

business performance and plans as of the time the statements are made. The Company does not undertake any obligation to update these statements unless required by applicable laws

or regulations, and you should not place undue reliance on forward-looking statements.

Various factors could cause actual results to differ materially from those expressed or implied. These factors include but are not limited to the following: changes in interest rates, which may

reduce net interest margin and net interest income; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal

Reserve System; the ability of the Company to obtain approval from the Federal Reserve Bank of Philadelphia (the "Federal Reserve Bank") to distribute interest payments owed to the

holders of the Company's subordinated debt securities; the limitations imposed on the Company which require, among other things, written approval of the Federal Reserve Bank prior to

the declaration or payment of dividends, any increase in debt by the Company, or the redemption of Company common stock, and the effect on operations resulting from such limitations;

the impact of bank closings and the risks related to disruption in the banking industry and financial markets; the market price and trading volume of our shares of common stock has been

and may continue to be volatile, and purchasers of our securities could incur substantial losses; changes in the level of trends of delinquencies and write-offs and in our allowance and

provision for credit losses; the results of examinations by our regulators, including the possibility that our regulators may, among other things, require us to increase our reserve for credit losses,

write down assets, change our regulatory capital position, limit our ability to borrow funds or maintain or increase deposits; national and/or local changes in economic conditions, which

could occur from numerous causes, including political changes, domestic and international policy changes, unrest, war and weather, inflation or deflation conditions in the real estate,

securities markets or the banking industry, which could affect liquidity in the capital markets, the volume of loan originations, deposit flows, real estate values, the levels of non-interest

income and the amount of credit losses; adverse changes in the financial industry and the securities, credit, national and local real estate markets (including real estate values); changes in

our existing loan portfolio composition (including reduction in commercial real estate loan concentration) and credit quality or changes in credit loss requirements; legislative or regulatory

changes that may adversely affect the Company’s business, including but not limited to new capital regulations, which could result in, among other things, increased deposit insurance

premiums and assessments, capital requirements, regulatory fees and compliance costs, and the resources we have available to address such changes; changes in the level of government

support of housing finance; changes to state rent control laws, which may impact the credit quality of multifamily housing loans; our ability to control costs and expenses; the impairment of

our investment securities; risks related to a high concentration of loans to borrowers secured by property located in our market area; increases in competitive pressure among financial

institutions or non-financial institutions; unexpected outflows of uninsured deposits could require us to sell investment securities at a loss; changes in consumer spending, borrowing and

savings habits; technological changes that may be more difficult to implement or more costly than anticipated; changes in deposit flows, loan demand, real estate values, borrowing

facilities, capital markets and investment opportunities, which may adversely affect our business; changes in accounting standards, policies and practices, as may be adopted or

established by the regulatory agencies or the Financial Accounting Standards Board could negatively impact the Company's financial results; litigation or regulatory actions, whether

currently existing or commencing in the future, which may restrict our operations or strategic business plan; the ability to originate and purchase loans with attractive terms and acceptable

credit quality; and the ability to attract and retain key members of management, and to address staffing needs in response to product demand or to implement business initiatives.

21 |

| Forward Looking Statements & Additional Information, cont’d

Additional Information and Where to Find it

The Company has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for the Company’s 2024

Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY THE

COMPANY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY

SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by the Company free of charge through the website

maintained by the SEC at www.sec.gov. Copies of the documents filed by the Company are also available free of charge by accessing the Company’s website at www.carverbank.com.

Participants

The Company, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by the

Company. Information about the Company’s executive officers and directors is available in the Company’s definitive proxy statement for its 2024 Annual Meeting, which was filed with the

SEC on October 31, 2024. To the extent holdings by our directors and executive officers of the Company’s securities reported in the proxy statement for the 2024 Annual Meeting have

changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge

at the SEC’s website at www.sec.gov.

22 |

New CEO sets path for Carver

amid proxy clash

By John

Reosti

Carver Bancorp's new CEO,

Donald Felix, is managing through a proxy contest as he devises a plan to return the Black-operated bank to profitability.

Carver Bancorp

Donald Felix, who took

the helm at Carver Bancorp as president and CEO on Nov. 1, is no stranger to troubled banks.

Felix, 50, served as chief

of staff for Citigroup Chairman Richard Parsons from 2009 into 2010, during the bank's painful recovery from near collapse during

the financial crisis. It was "a challenging moment for the institution," Felix said in an interview. "It gave me first-hand

witness and experience on managing relationships with regulators, particularly for an institution that was struggling at the time."

The $749 million-asset, New

York-based Carver is far from the brink of failure. Capital ratios remain in excess of regulatory minimums, even after a string of annual

losses. Felix pointed to several other positive signs, including a linked-quarter spike in net interest income, which rose 9% to $6 million

for the three months ended Sept. 30.

"We've got some good

wind in the sails, now it's about how do we continue moving forward with a more robust strategic plan," Felix said. "For us,

the opportunity is how do we do more and do better."

Still, Carver's struggles

have prompted renewed attention from activists. Dream Chasers Capital Group, led by veteran securities executive Greg Lewis, sought last

year to acquire a 35% stake in Carver, an offer the company rejected. Now, Dream Chasers, which says it represents shareholders

with 9.7% stake in the bank, is seeking to elect two members to Carver's board. The controversy has added another layer of complexity

to Felix's task but hasn't dimmed his enthusiasm for the job.

"This is a good opportunity,"

Felix said. "It's meaningful for the future. With so few Black-operated banks remaining, Carver … is too important not to

succeed."

Felix' most recent job prior

to joining Carver was a two-year stint at the Providence, Rhode Island-based Citizens Financial Group, where he served as head of national

banking, in charge of the $220 billion-asset company's digital national bank, Citizens Access. His 25-year banking career includes three

years at Chase as chief of staff for Thasunda Duckett, CEO of the consumer bank. "I got recruited from Citi to Chase and another

phenomenal opportunity," Felix said. "I went from crisis management to large-scale business transformation."

Felix said his experience

working at three of the biggest financial institutions in the country "has led to my being where I am today." He is convinced

that his background will prove invaluable leading Carver, which he acknowledged needs a turnaround. "So much of my experience absolutely

lines up with what's needed at this particular moment, this inflection point for the bank, raising capital, returning to profitability

and growing the business," Felix said.

Past as prologue

Carver was founded in 1948

in Harlem by a group of 14 African- and Caribbean-American activists and entrepreneurs, including Joseph Davis, a real estate agent and

property appraiser, and M. Moran Weston, a social worker who was later ordained an Episcopal priest and served as the longtime rector

of St. Phillip's Church in Harlem. Davis became Carver's first CEO.

Created with a mission to

serve communities that traditional banks largely ignored, Carver evolved into a fixture in New York and one of the nation's largest Black-operated

banks. After 75 years, its brand equity remains strong, Felix said. "The excitement, the passion, the commitment by our employees,

by our board and by our customers to the mission Carver serves is extremely high," he said. "I can't tell you the number of

reach-outs I've received from people who are attracted to this bank. I fall into the same category."

Despite his big-bank background,

Felix said he never hesitated seeking the Carver job following former CEO Michael Pugh's resignation in August 2023. Pugh left

Carver to head the Local Initiatives Support Corp. A native New Yorker born to parents who emigrated from Grenada, Felix has been aware

of Carver's presence throughout his life. "I am who the bank was founded to serve," he said. "I'm a first-generation American.

Interestingly or anecdotally, I have lived or gone to school or commuted around each of the seven branches that Carver has, so I'm intimately

familiar with who the bank is and who they serve."

While Felix went to work at

Citi immediately after graduating Howard University, it was his older sister, Gemma, who sparked his interest in banking. Gemma got a

job as a teller at Chase in the late 1980s. "I watched her progress," Felix said. "They needed new help at a major branch

at 14th Street and 7th Avenue. It was a big deal. They asked her to go there and help grow that branch. She continued to progress

to the point where she became assistant branchmanager at the flagship branch at 270 Park Avenue."

Gemma's success "made

banking interesting to me," he said. "Everyone knew her. I could go to any of her branches. Her customers knew her and she knew

them by name. That's where a lot of the inspiration came from."

Work cut out

While Carver's legacy resonates

with many, its financial performance since going public in 1994 has been uneven, creating frustration for investors. An earlier string

of annual losses in the mid-to-late 1990s led to a hostile takeover attempt by Kevin Cohee, CEO of the $614 million-asset OneUnited Bank.

Carver beat back the bid and, under the leadership of CEO Deborah Wright, was able to turn things around. The bank enjoyed a six-year

run of strong profitability in the early and mid-2000s.

Carver's fortunes deteriorated

as a result of the Great Recession of 2007 to 2009. A major jump in nonperforming construction and commercial real estate loans resulted

in more than $30 million of losses in 2010. Losses continued into 2011 and led to a $55 million recapitalization. Carver has never fully

regained its footing. In May 2016, Carver entered into a formal agreement with the Office of the Comptroller of the Currency

focused on CRE lending practices and the Bank Secrecy Act. The agreement remained in effect until January 2023, boosting regulatory compliance

costs. And like other banks, the sharp increase in interest rates in 2022 and 2023 buffeted Carver, making funding more expensive. The

result has been fresh losses, $4.4 million in its 2023 fiscal year and $3 million in fiscal 2024, which ended March 31. Losses through

the first six months of fiscal 2025 totaled $4.3 million, up 44% from the same period the previous fiscal year.

In a letter to shareholders

Monday, Dream Chasers' Lewis blasted the board's performance, writing "it does the community and Carver no good to back a Board that

has overseen operating losses, share price declines, and poor performance for such a long period of time."

"No bank or investment

fund would tolerate such prolonged poor performance in their own organizations, and we shouldn't accept it from Carver," Lewis wrote.

Getting started

Felix parachuted into the

middle of the situation, starting work just six weeks before Carver's annual meeting, scheduled for Dec. 12. At the moment, Felix is completing

an assessment of the business and is clear on his top priorities. "First and foremost, we've got to grow the bank, drive new deposits,

focus on incremental loans, acquire new customers, particularly the next generation of customers," Felix said.

Raising capital to upgrade

technology, strengthen risk management and attract talent is "also on the docket," Felix said.

Carver disclosed plans to

increase its Small Business Administration lending last year, under interim CEO Craig MacKay. Felix likes the initiative and plans to

expand it. "It is definitely something I want to grow," Felix said. "If you think about the community impact, helping businesses

start, helping them stay in business, helping them grow, the jobs created as a result, that is certainly squarely in our target."

Institutional Shareholder

Services, widely considered the leading proxy advisory firm, endorsed Carver in its contest with Dream Chasers. It did so largely on the

strength of Felix's appointment, which it termed "a step in the right direction" in a Nov. 29 press release. Felix "appears

to have relevant experience and an understanding of the issues facing the bank, and despite his short tenure, he has developed what appears

to be a logical go-forward plan," ISS stated.

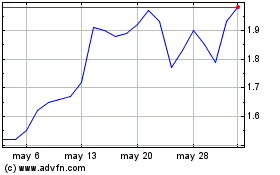

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025