UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 2)

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Carver Bancorp, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

146875604

(CUSIP Number)

Gregory Lewis

Dream Chasers Capital Group LLC

26 Broadway, 8th Floor

New York, New York 10004

917-969-2814

With a copy to:

Drew G.L. Chapman

Hamilton Clarke LLP

48 Wall Street

New York, New York 10005

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 12, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 146875604 | | Page 1 |

| 1 |

NAME OF REPORTING PERSON

Dream Chasers Capital Group LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

150,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

150,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.9%* |

| 14 |

TYPE OF REPORTING PERSON

CO |

* All percentage calculations set forth herein

are based upon the aggregate of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s

Definitive Proxy Statement filed with the SEC on October 31, 2024.

| CUSIP No. 146875604 | | Page 2 |

| 1 |

NAME OF REPORTING PERSON

Gregory Antonius Lewis |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

150,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

150,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.9%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s

Definitive Proxy Statement filed with the SEC on October 31, 2024.

| CUSIP No. 146875604 | | Page 3 |

| 1 |

NAME OF REPORTING PERSON

Shawn Paul Herrera |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

81,100 |

| 9 |

SOLE DISPOSITIVE POWER

81,100 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

81,100 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.6%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s

Definitive Proxy Statement filed with the SEC on October 31, 2024.

| CUSIP No. 146875604 | | Page 4 |

| 1 |

NAME OF REPORTING PERSON

Kevin Scott Winters |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

69,000 |

| 9 |

SOLE DISPOSITIVE POWER

69,000 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

69,000 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.3%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s

Definitive Proxy Statement filed with the SEC on October 31, 2024.

| CUSIP No. 146875604 | | Page 5 |

| 1 |

NAME OF REPORTING PERSON

Jeffrey John Bailey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

98,274 |

| 8 |

SHARED VOTING POWER

161,2001 |

| 9 |

SOLE DISPOSITIVE POWER

98,274 |

| 10 |

SHARED DISPOSITIVE POWER

161,200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

259,4742 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.0%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein

are based upon the aggregate of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s

Definitive Proxy Statement filed with the SEC on October 31, 2024.

1 Jointly owned with

wife, Michelle Bailey.

2 Includes 161,200

shares owned jointly with wife, Michelle Bailey.

| CUSIP No. 146875604 | | Page 6 |

The following constitutes Amendment No. 2 (“Amendment

No. 2”) to the Schedule 13D originally filed by the Reporting Persons on October 22, 2024, as amended by Amendment No. 1 that was

filed with the SEC on November 4, 2024 (together, the “Original Schedule 13D”). Capitalized terms used but not defined herein

shall have the meanings ascribed to such terms in the Original Schedule 13D.

ITEM 1. SECURITY AND

ISSUER

Item 1 is hereby amended and

restated to read as follows:

This statement on Schedule

13D (“Schedule 13D”) relates to the common stock, par value $0.01 per share (the “Common Stock”),

of Carver Bancorp, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located

at 75 West 125th Street, New York, NY 10027. This Schedule 13D amends, supersedes and replaces entirely any and all Schedule

13Ds previously filed by any of the Reporting Persons with respect to the Issuer.

The Reporting Persons (as

defined below) each beneficially owns an aggregate of 409,774 shares of Common Stock. These shares represent approximately 7.97% of the

outstanding shares of Common Stock.

ITEM 5. INTEREST IN SECURITIES OF

THE ISSUER

Item 5 is hereby amended and restated to

read as follows:

The aggregate percentage of

Shares reported as beneficially owned by each person named herein is based upon 5,140,872 Shares issued and outstanding as of October

15, 2024, which is the total number of Shares outstanding as reported in the Issuer’s Definitive Proxy Statement filed with the

Securities and Exchange Commission on October 31, 2024.

| |

(a) |

Dream Chasers beneficially owns 150,300 Shares. |

Percentage: Approximately

2.9%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 150,300 |

| |

3. |

Sole power to dispose or direct the disposition: 0 |

| |

4. |

Shared power to dispose or direct the disposition: 200 |

| |

(c) |

Dream Chasers has not entered into any transactions in Shares during the past 60 days. |

Mr. Lewis, as the sole manager of Dream Chasers, may be deemed to have

the shared power to vote or direct the vote of all of the Shares of Dream Chasers, Mr. Herrera and Mr. Winters.

| |

(a) |

Herrera beneficially owns 81,100 Shares. |

Percentage: Approximately

1.6%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 0 |

| CUSIP No. 146875604 | | Page 7 |

| |

3. |

Sole power to dispose or direct the disposition: 81,100 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| |

(c) |

Herrera purchased 4,000 in open market transactions during the past 60 days on September 11, 2024 for an average price per Share of $1.90. |

| |

(a) |

Winters beneficially owns 69,000 Shares. |

Percentage: Approximately

1.3%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 69,000 |

| |

3. |

Sole power to dispose or direct the disposition: 69,000 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| |

(c) |

Winters sold a total of 88,000 Shares during the past 60 days on December 10, 2024 for a purchase price of $1.82 per Share plus an amount equal to 50% of the net proceeds derived from any sale or other transfer above $1.82 per Share, payable upon the sale of those Shares by the transferee. |

| |

(a) |

Bailey beneficially owns 259,474 Shares3, of which 161,200 Shares are jointly owned with his wife. |

Percentage: Approximately

5.0%

| |

(b) |

1. |

Sole power to vote or direct vote: 98,274 |

| |

2. |

Shared power to vote or direct vote: 161,200 |

| |

3. |

Sole power to dispose or direct the disposition: 98,274 |

| |

4. |

Shared power to dispose or direct the disposition: 161,200 |

| |

(c) |

Bailey has not entered into any transactions in Shares during the past 60 days. |

The

Reporting Persons, as members of a “group” for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed the

beneficial owner of the Shares directly owned by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of

such Shares except to the extent of his or its pecuniary interest therein.

3 Bailey has

entered into a Proxy and Power of Attorney that grants full voting and investment discretion over 98,800 Shares to Garrett Kyle Bailey.

In total, Bailey owns an aggregate of 358,274 Shares, however beneficially owns for purposes of Section 13(d) 259,474 Shares.

| CUSIP No. 146875604 | | Page 8 |

| |

(d) |

Other than as set forth in Item 3, no person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, Shares. |

Each of the Reporting Persons specifically disclaims beneficial ownership

of the securities reported herein except to the extent of such Reporting Person’s pecuniary interest therein.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Item 6 is hereby amended and restated to read by

inserting the following paragraph as a new paragraph five, as follows:

Winters entered into a Stock Transfer Agreement dated

December 10, 2024 with Mathew Bradbury pursuant to which he transferred 88,000 shares of Common Stock. The purchase price payable thereunder

is payable upon the sale of any of those shares by the transferee in the amount of $1.82 per share plus an amount equal to 50% of the

net proceeds derived from any sale or other transfer above $1.82 per share.

ITEM 7. MATERIAL TO BE FILED AS AN

EXHIBIT

Item 7 is hereby amended and restated to read as follows:

| CUSIP No. 146875604 | | Page 9 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certify that the information set forth in this statement is true,

complete and correct.

Date: December 12, 2024

| |

|

|

| |

DREAM CHASERS CAPITAL GROUP LLC |

| |

|

|

| |

By: |

/s/ Gregory Antonius Lewis |

| |

|

Name: Gregory Lewis |

| |

|

Title: Managing Member |

| |

GREGORY ANTONIUS LEWIS |

| |

|

| |

|

| |

By: |

/s/ Gregory Antonius Lewis |

| |

Name: Gregory Antonius Lewis |

| |

SHAWN PAUL HERRERA |

| |

|

| |

|

| |

By: |

/s/ Shawn Paul Herrera |

| |

Name: Shawn Paul Herrera |

| |

|

|

| |

KEVIN SCOTT WINTERS |

| |

|

| |

|

| |

By: |

/s/ Kevin Scott Winters |

| |

Name: Kevin Scott Winters |

| |

JEFFREY JOHN BAILEY

|

| |

|

| |

By: |

/s/ Jeffrey John Bailey |

| |

Name: Jeffrey John Bailey |

| CUSIP No. 146875604 | | Page 10 |

| CUSIP No. 146875604 | | Page 11 |

Exhibit 99.5

STOCK

TRANSFER AGREEMENT

THIS STOCK TRANSFER AGREEMENT

(the “Agreement”) is made and entered into this 10th day of December, 2024, by and among MATHEW J. BRADBURY

(“Transferee”) and KEVIN SCOTT WINTERS (“Transferor”).

W I T N E S S E T H :

WHEREAS, Transferor desire

to transfer to Transferee and Transferee desires to receive from Transferor 88,000 shares (each, a “Share” and collectively,

the “Shares”) of common stock of Carver Bancorp, Inc. (“Company”), under the terms and conditions set forth herein.

NOW, THEREFORE, in consideration

of the foregoing, the mutual covenants and conditions contained herein and for other good and valuable consideration, the receipt and

sufficiency of which is hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

1. Transfer

and Purchase Price. (a) Transferor hereby transfers to Transferee and Transferee hereby agrees to receive from Transferor all of Transferor’s

right, title and interest in and to the Shares for the purchase price set forth below (the “Purchase Price”) and other good

and valuable consideration.

(b) The

Purchase Price per Share payable by the Transferee to the Transferor, which shall be payable solely upon and no later than five (5) days

following the sale or other transfer of any of the Shares by Transferee, by wire transfer of immediately available funds to an account

designated by Transferor, shall be an amount equal to the sum of:

(i) $1.82 per Share; and

(ii) 50% of the net amount

(after reasonable commissions) derived by the Transferee on the sale or other transfer of a Share in excess of $1.82 per Share.

2. Closing.

The closing (the “Closing”) will take place through delivery of the Shares via a DTC-book entry transfer from the account

of Transferor to the account of Transferee in a transaction initiated on December 10, 2024.

3. Representations

and Warranties of Transferor. Transferor hereby represents and warrants to Transferee as follows:

(a) Authority.

Transferor has all necessary power and authority to enter into this Agreement and to transfer the Shares to the Transferee, to consummate

the transactions contemplated hereby and to perform their obligations hereunder. This Agreement has been duly and validly executed and

delivered by Transferor and constitutes a legal, valid and binding obligation of Transferor enforceable against Transferor in accordance

with its terms.

(b) Title.

Transferor is the lawful record and beneficial owner of the Shares to be sold hereunder, free and clear of any security interest, claim,

lien, pledge, option, encumbrance or restriction (on transferability or otherwise) whatsoever in law or in equity, and the delivery of

the Shares in the manner set forth in Section 2 above will convey to Transferee lawful, valid and indefeasible title thereto, free and

clear of any security interest, claim, lien, pledge, option, encumbrance or restriction whatsoever.

(c) Approval

of Company; Consent. To the best of Transferor’s knowledge, no consent, waivers, approval, registration or authorization

of the Company or any governmental authority is required in connection with the execution and delivery of this Agreement or the Shares

or the consummation of the transactions contemplated hereby.

6. Representation

and Warranties of Transferee. Transferee represents and warrants that it has full right and authority to purchase the Shares from

Transferor.

7. Indemnity.

From and after the Closing, Transferor shall indemnify and hold harmless, Transferee in respect to any and all Damages that Transferee

may incur by reason of a breach or alleged breach by Transferor of any representation, warranty, covenant or agreement of Transferor contained

herein. As used in this Section, the term “Damages” means any loss, expense, liability or other damage, including, without

limitation, reasonable attorneys’ fees, accountant’s fees, and all other reasonable costs and expenses of litigation, investigation,

defense or settlement of claims (including costs of all appeals related thereto), or threats thereof in amounts paid in settlement.

8. Survival

of Representations. All representations, warranties, agreements, covenants and obligations herein are material, and shall be deemed

to have been relied upon by the other party, and shall, for a period of one year, survive the Closing and continue in full force and effect

following the Closing and not merge in the performance of any obligation by any party hereto.

9. Entire

Agreement. This Agreement (together with any other documents and instruments referred to herein) constitutes the entire agreement

among the parties hereto with respect to the transactions contemplated and supersedes all prior agreements, understandings, and negotiations,

both written and oral, among the parties with respect thereto.

10. Controlling

Law. This Agreement shall be construed and enforced in accordance with the laws of the State of New York without reference to its

conflict-of-laws rules.

11. Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, and it shall not be necessary in

making proof of this Agreement or the terms of this Agreement to produce or account for more than one of such counterparts.

12. Amendments.

No amendment, supplement, modification, waiver or termination of this Agreement shall be implied or be binding unless executed in writing

by the party to be bound thereby.

13. Third

Parties. Nothing herein expressed or implied is intended or shall be construed to confer upon or give to any person or entity other

than the parties hereto and their affiliates, successors or assigns, any rights or remedies under or by reason of this Agreement.

[Signature Page Follows]

Signature Page for Stock Transfer Agreement

IN WITNESS WHEREOF, this Agreement

has been duly executed as of the day and year first above written.

| |

TRANSFEREE: |

| |

|

| |

/s/ |

| |

|

| |

MATHEW BRADBURY, an individual |

| |

|

| |

|

| |

TRANSFEROR: |

| |

|

| |

/s/ |

| |

|

| |

KEVIN SCOTT WINTERS, an individual |

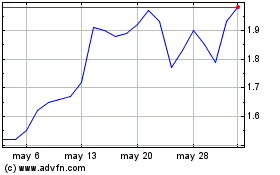

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Carver Bancorp (NASDAQ:CARV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025